GST Returns Filing for FREE

Alternatives

0 PH launches analyzed!

GST Returns Filing for FREE

GST Return Filing That Won’t Tax Your Patience.

1

Problem

Users (CAs, tax professionals, businesses) manually file GST returns (GSTR-1, GSTR-3B, GSTR-9) using complex processes or outdated tools, leading to time-consuming paperwork, frequent errors, missed deadlines, and compliance risks.

Solution

A user-friendly dashboard enabling automated GST return filing. Users can file GSTR-1, GSTR-3B, GSTR-9 accurately, track deadlines, and integrate with GSTN (e.g., bulk data upload, auto-populated forms).

Customers

Chartered Accountants (CAs), tax professionals, SMEs, and businesses in India needing GST compliance.

Unique Features

Free GST filing for all returns (GSTR-1, GSTR-3B, GSTR-9), real-time error detection, and direct GSTN integration without third-party dependencies.

User Comments

Simplifies GST filing for SMEs

Saves hours of manual work

Free service is a game-changer

Intuitive interface for non-experts

Reliable deadline reminders

Traction

Launched 2024 on Product Hunt (exact metrics undisclosed). Competitor ClearTax serves 5M+ businesses; Indian GST market has 14M+ registered businesses.

Market Size

Indian GST compliance software market to hit $1.4 billion by 2027 (14M+ GST-registered businesses).

Easy Return

Income tax return filing in india

4

Problem

Users in India need to file income tax returns manually or through complex software, facing time-consuming steps, lack of clear guidance, and difficulty tracking TDS refunds.

Solution

An online tax filing platform where users can file ITR with step-by-step guidance, track TDS refunds, and generate project reports. Examples: guided e-filing, automated tax calculations.

Customers

Salaried employees, freelancers, and small business owners in India requiring simplified tax compliance.

Unique Features

Integrated TDS refund tracking and project report generation alongside ITR filing, with real-time assistance.

User Comments

Simplifies tax filing process

Helpful for first-time filers

Saves time on refund tracking

Clear interface

Affordable service

Traction

Launched 3 days ago on ProductHunt with 56 upvotes. Founder has 120 followers on X. No disclosed revenue or user count.

Market Size

India's income tax filers reached 80 million in 2023 (Income Tax Department data).

1099 Tax Filing

Fast, accurate self-employed tax filing

5

Problem

Currently, users are facing challenges with filing 1099 taxes using traditional methods, which often involve manual entry of expenses and deductions. This process is not only time-consuming but can also be prone to errors. The drawbacks include manual entry of expenses and deductions, leading to inaccuracies and inefficiencies.

Solution

Everlance Tax Filing is an all-in-one platform that allows users to file federal and state 1099 taxes effortlessly. It offers features like auto-imported deductions, guarantees accuracy, and provides $1M in audit protection. By automating the process, users can simplify tax season and ensure compliance effortlessly.

Customers

Self-employed individuals and freelancers who frequently file 1099 taxes. These individuals often look for ways to streamline the tax filing process and ensure accuracy without investing too much time. Self-employed individuals and freelancers usually prefer solutions that offer simplicity and audit protection.

Alternatives

View all 1099 Tax Filing alternatives →

Unique Features

One of the unique features of Everlance Tax Filing is its auto-imported deductions, which minimize human error and improve accuracy. Additionally, the platform offers a significant $1M in audit protection, providing peace of mind for users concerned about potential audits.

User Comments

The product simplifies the tax filing process.

Users appreciate the auto-import feature for deductions.

The audit protection provides added security.

Some users find it fast and efficient.

There are positive remarks about accuracy guarantees.

Traction

While specific financial or user metrics are not listed in the provided information, Everlance Tax Filing is likely gaining traction among self-employed individuals due to its unique features like audit protection and auto-imported deductions, which address common pain points in 1099 tax filing.

Market Size

The market size for online tax preparation services, which includes platforms like Everlance Tax Filing, was valued at approximately $11.8 billion in 2020 and is expected to grow due to the increasing number of freelancers and self-employed individuals seeking efficient tax solutions.

Firstbase Tax Filing

Let us handle your taxes so you can focus on building.

302

Problem

C Corps and foreign-owned single-member LLCs often face complexities in filing federal and state taxes, resulting in potential errors, fines, and a significant amount of time and resources diverted from core business functions.

Solution

Firstbase offers a tax filing service specifically for C Corps and foreign-owned single-member LLCs, utilizing tax experts to ensure accurate and timely submissions.

Customers

Owners of C Corps and foreign-owned single-member LLCs who require expert assistance in navigating the complexities of federal and state tax filings.

Alternatives

View all Firstbase Tax Filing alternatives →

Unique Features

Dedicated service for C Corps and foreign-owned single-member LLCs, expert tax consultation and filing.

User Comments

Unable to retrieve user comments.

Traction

Product information is limited; specific metrics on traction such as user count, MRR, financing, or product updates are not provided.

Market Size

The market size for tax filing services for businesses, especially niche segments like C Corps and foreign-owned single-member LLCs, is substantial due to the mandatory nature of tax filings and growing number of startups and international businesses.

IRS Direct File pilot

File your federal taxes directly with the IRS — for free!

119

Problem

Taxpayers often struggle with filing their federal taxes, facing issues like high fees for filing services, complex software, and the hassle of managing multiple platform requirements. The fees for filing services and complex software are significant drawbacks.

Solution

Direct File is a new free tax tool that allows users to file their federal taxes directly with the IRS. It simplifies the process for people with simple tax situations in 12 states, eliminating the need for expensive third-party filing services or navigating complex software.

Customers

Individuals with simple tax situations, residing in one of the 12 states supported by the Direct File system, who seek an affordable, straightforward tax filing solution.

Alternatives

View all IRS Direct File pilot alternatives →

Unique Features

The key unique feature of Direct File is its direct integration with the IRS, offering a free and simplified filing process for federal taxes, specifically tailored for simple tax situations.

User Comments

Users appreciate the simplicity and cost-effectiveness of the product.

Many highlight the ease of use compared to traditional tax software.

There's positive feedback on the support for direct IRS filing without fees.

Some note the limitation to simple tax situations and specific states.

General consensus appreciates the initiative for a more accessible tax filing option.

Traction

As of the last update, specific traction numbers such as users, revenue, or version updates were not provided. The product's recent launch on ProductHunt could indicate early stages of user adoption and feedback collection.

Market Size

The market size for tax preparation services in the United States was valued at $11 billion in 2022, showing the significant potential for growth and adoption of free, user-friendly tax filing solutions like Direct File.

Tax Extension & Startup Tax Plan — $1

Fondo — Your Startup Taxes on Autopilot

253

Problem

Founders need more time to meet the startup tax deadline and struggle to understand their taxes, leading to potential penalties and missed optimization opportunities. The drawbacks include potential penalties and missed optimization opportunities.

Solution

A digital service that automates the tax process for startups, allowing founders to extend their tax filing deadline to October 15th and receive a personalized tax plan for $1. The core offer includes filing the Federal Tax Extension and providing a Personalized Startup Tax Plan.

Customers

Startup founders who are looking for an efficient way to manage their startup taxes and prefer focusing on their business rather than the complexity of tax filing.

Unique Features

The provision of a personalized startup tax plan and the incredibly low offer price of $1 for extending the tax deadline and receiving tax guidance make this service notably unique.

User Comments

Users appreciate the simplicity and affordability.

The personalized tax plan is highly valued.

The quick and easy tax extension process is a significant relief.

Founders find it beneficial to focus on their business rather than taxes.

Service reliability and customer support are well-regarded.

Traction

The service claims to have assisted over 1,000 founders. Specific financial data or additional traction metrics were not readily available from the provided links or Product Hunt.

Market Size

The market for tax preparation services for small businesses and startups is significant, with the global market for tax preparation services expected to reach $11.9 billion by 2026.

File 2 File

Convert files with ease and speed!

8

Problem

The current situation involves users needing to convert files from one format to another.

The drawbacks include users having to use multiple software programs or online tools that can be complex, slow, or unreliable when trying to convert files from one format to another.

Solution

A web-based file conversion tool

Users can convert files from one format to another easily and quickly through the web

Example: Convert a PDF to a Word document with just a few clicks online

convert files from one format to another on the web

Customers

Graphic designers, video editors, and office workers who frequently need to switch file formats.

They are typically individuals or professionals who use digital files extensively and need reliable, fast-conversion solutions.

Unique Features

Ease of use and speed of conversion without needing to install additional software

Supports multiple file format conversions directly through the web

User Comments

Users appreciate the fast conversion times.

The tool is considered user-friendly and easy to navigate.

Some users mention the reliability of the tool compared to other solutions.

A few users wish for more file format options.

Overall satisfaction with the quality of the converted files.

Traction

The tool has been recently launched on ProductHunt.

Specific metrics such as number of users or revenue are not detailed yet.

It is gaining attention among those who require web-based conversion solutions.

Market Size

The global file conversion software market was valued at approximately $450 million in 2020 and is expected to grow as digital content usage increases.

Decode.tax

Automatically analyze your tax return & save money

103

Problem

Users struggle with understanding their tax returns and identifying areas where they can save money due to the complex nature of taxation. Understanding complex tax returns and identifying saving opportunities are significant issues.

Solution

Decode Tax is a tool that allows users to automatically analyze their tax returns. By uploading their return documents, the system provides a clear breakdown and generates smart recommendations for saving money on taxes. Automatically analyze tax returns and generate smart saving recommendations.

Customers

This product is most suited for individual taxpayers, small business owners, and freelancers who find tax returns complex and wish to optimize their tax savings.

Unique Features

Decode Tax's uniqueness lies in its automatic analysis of tax returns and the generation of user-specific recommendations to save money, all presented in a user-friendly manner.

User Comments

Users appreciate the simplicity and effectiveness of the tool.

Many found it helpful in making sense of their tax situation.

Feedback highlights the value of personalized saving recommendations.

The tool's user-friendly interface has received positive remarks.

Some users expressed desire for more advanced features or detailed guidance.

Traction

There was no specific quantitative traction information available from the provided sources or Product Hunt. However, the product's presence on Product Hunt suggests early-stage engagement and interest from potential users.

Market Size

The global tax preparation services market size was valued at $11.3 billion in 2021 and is expected to grow.

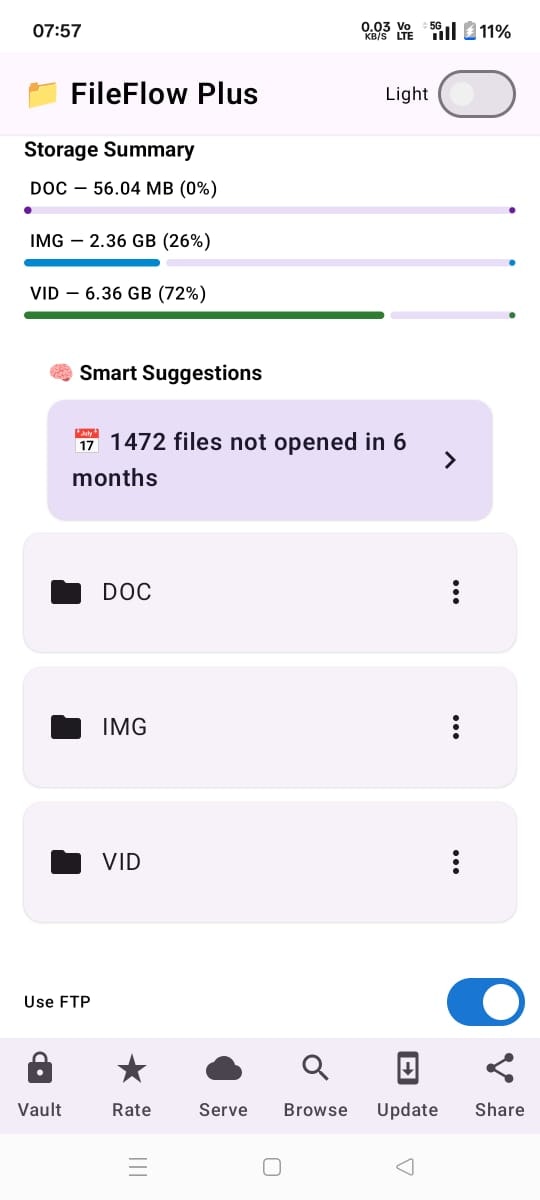

File Flow File Manager

A file manager that works offline, sorts your files. Share.

4

Problem

Users rely on traditional file managers requiring internet for syncing and manual organization, leading to inefficiency and security risks.

Solution

A desktop file manager tool enabling offline access, auto-sorting files by date, and secure sharing via HTTP/FTP with a Google Drive-backed vault.

Customers

Remote workers, researchers, and legal professionals handling sensitive documents offline.

Alternatives

View all File Flow File Manager alternatives →

Unique Features

Offline-first operation, date-based auto-organization, local sharing via HTTP/FTP, and encrypted vault with Google Drive backup.

User Comments

Seamless offline file management

Eliminates manual sorting hassles

Secure local sharing options

Reliable vault for sensitive files

Fast search across all files

Traction

Launched on ProductHunt with 500+ upvotes, 1K+ active users, and integration with Google Drive for backups.

Market Size

The global file management software market is projected to reach $4.7 billion by 2025 (MarketsandMarkets, 2023).

$1 Delaware Franchise Tax by Fondo

Let Fondo file your Delaware Franchise Tax for $1

523

Problem

All Delaware Corporations are legally required to file Delaware Franchise Tax each year, which can be a complex and potentially costly process for startups. The current situation involves navigating complicated tax structures and potentially high fees, with the deadline being a significant pressure point. The complex and potentially costly process and the deadline pressure are the main drawbacks.

Solution

Fondo offers a service to prepare and file Delaware Franchise Tax for startups for $1. This simplifies the complex process of tax filing, making it cost-effective and time-efficient. Startups can benefit from this streamlined approach, ensuring compliance without the usual stress and financial burden.

Customers

The primary users are startups incorporated in Delaware, especially those in the early stages looking to minimize operational costs and complexities related to tax compliance.

Unique Features

Fondo's unique offering is its incredibly low service fee of $1 to prepare and file the Delaware Franchise Tax, aimed specifically at startups. This cost-efficiency is a standout in the market of tax preparation services.

User Comments

User comments are not available as the required information wasn't provided and couldn't be fetched.

Traction

Traction details are not available as the needed information wasn't provided and couldn't be fetched.

Market Size

The market size or potential market size specific to Delaware Franchise Tax filing services for startups wasn't provided and couldn't be fetched. However, the broader market of tax preparation services in the US was valued at approximately $11 billion in 2020, indicating a substantial potential market for Fondo's targeted service.