1099 Tax Filing

Alternatives

0 PH launches analyzed!

1099 Tax Filing

Fast, accurate self-employed tax filing

5

Problem

Currently, users are facing challenges with filing 1099 taxes using traditional methods, which often involve manual entry of expenses and deductions. This process is not only time-consuming but can also be prone to errors. The drawbacks include manual entry of expenses and deductions, leading to inaccuracies and inefficiencies.

Solution

Everlance Tax Filing is an all-in-one platform that allows users to file federal and state 1099 taxes effortlessly. It offers features like auto-imported deductions, guarantees accuracy, and provides $1M in audit protection. By automating the process, users can simplify tax season and ensure compliance effortlessly.

Customers

Self-employed individuals and freelancers who frequently file 1099 taxes. These individuals often look for ways to streamline the tax filing process and ensure accuracy without investing too much time. Self-employed individuals and freelancers usually prefer solutions that offer simplicity and audit protection.

Unique Features

One of the unique features of Everlance Tax Filing is its auto-imported deductions, which minimize human error and improve accuracy. Additionally, the platform offers a significant $1M in audit protection, providing peace of mind for users concerned about potential audits.

User Comments

The product simplifies the tax filing process.

Users appreciate the auto-import feature for deductions.

The audit protection provides added security.

Some users find it fast and efficient.

There are positive remarks about accuracy guarantees.

Traction

While specific financial or user metrics are not listed in the provided information, Everlance Tax Filing is likely gaining traction among self-employed individuals due to its unique features like audit protection and auto-imported deductions, which address common pain points in 1099 tax filing.

Market Size

The market size for online tax preparation services, which includes platforms like Everlance Tax Filing, was valued at approximately $11.8 billion in 2020 and is expected to grow due to the increasing number of freelancers and self-employed individuals seeking efficient tax solutions.

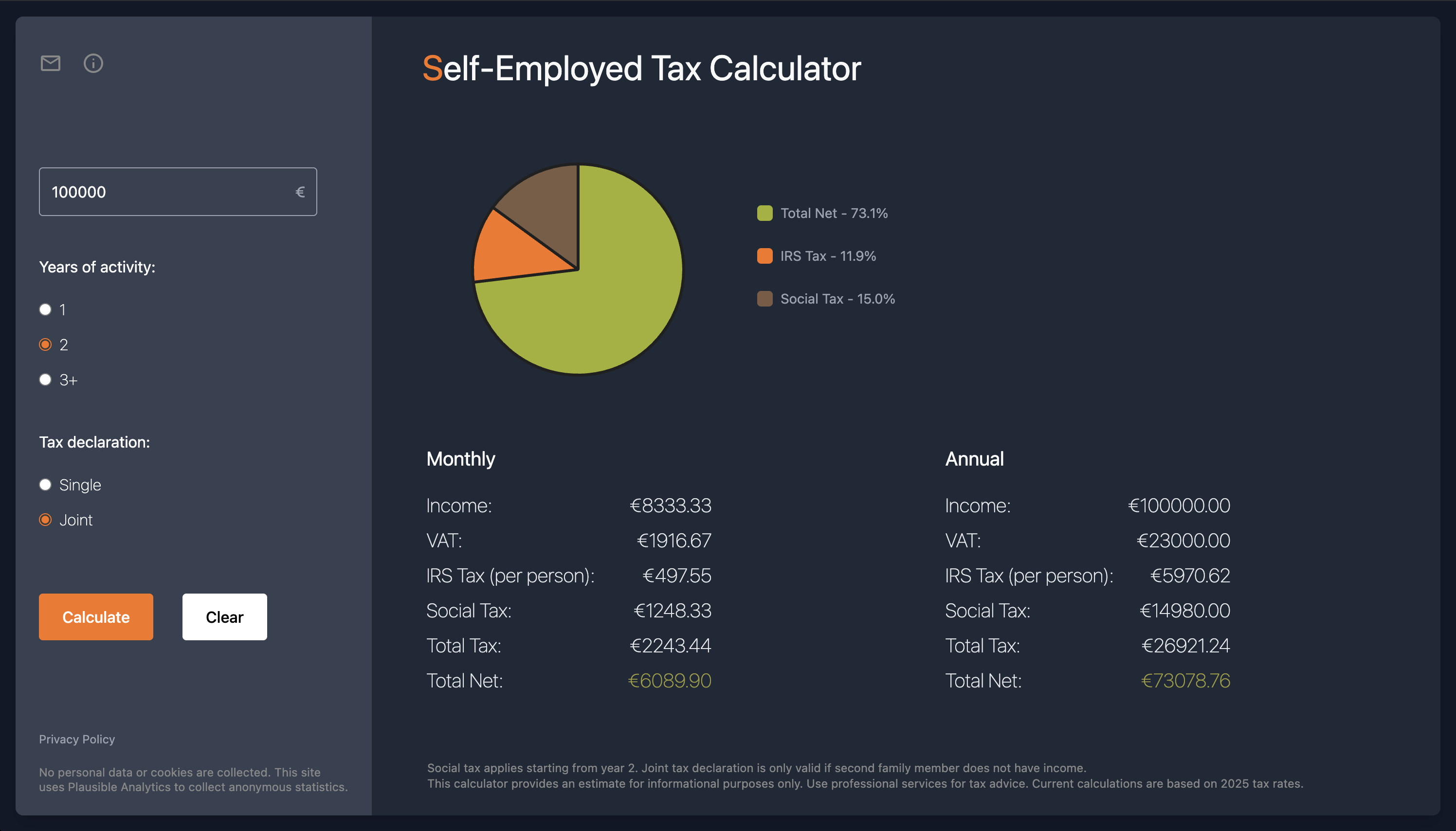

Free Self-Employed Tax Calculator

Tax calculation for self-employed professionals in Portugal

5

Problem

Self-employed professionals in Portugal manually calculate taxes (IVA, IRS, Social Security) using spreadsheets or outdated methods, leading to time-consuming processes, errors, and non-compliance risks.

Solution

A web-based tax calculator tool enabling users to instantly compute taxes with up-to-date rules, input income/expenses, and receive accurate IVA, IRS, and Social Security calculations tailored to Portugal’s Recibos Verdes system.

Customers

Freelancers, remote workers, and digital nomads in Portugal, particularly self-employed individuals (e.g., consultants, designers, developers) managing irregular income streams.

Unique Features

Privacy-focused (no data storage), real-time tax rule updates, and Portugal-specific customization for Recibos Verdes.

User Comments

Saves hours on tax calculations

Accurate and user-friendly interface

Essential for Portuguese freelancers

Free alternative to expensive accountants

Regularly updated with legal changes

Traction

Launched on ProductHunt (exact metrics unspecified), targets Portugal’s ~700k self-employed workers.

Market Size

Portugal’s self-employed workforce comprises ~700,000 individuals, with freelancers contributing significantly to its €23B freelance economy (2023 estimates).

Firstbase Tax Filing

Let us handle your taxes so you can focus on building.

302

Problem

C Corps and foreign-owned single-member LLCs often face complexities in filing federal and state taxes, resulting in potential errors, fines, and a significant amount of time and resources diverted from core business functions.

Solution

Firstbase offers a tax filing service specifically for C Corps and foreign-owned single-member LLCs, utilizing tax experts to ensure accurate and timely submissions.

Customers

Owners of C Corps and foreign-owned single-member LLCs who require expert assistance in navigating the complexities of federal and state tax filings.

Alternatives

View all Firstbase Tax Filing alternatives →

Unique Features

Dedicated service for C Corps and foreign-owned single-member LLCs, expert tax consultation and filing.

User Comments

Unable to retrieve user comments.

Traction

Product information is limited; specific metrics on traction such as user count, MRR, financing, or product updates are not provided.

Market Size

The market size for tax filing services for businesses, especially niche segments like C Corps and foreign-owned single-member LLCs, is substantial due to the mandatory nature of tax filings and growing number of startups and international businesses.

Corrupt A File Online | Fast & Secure

File Corupter Converter | Purposely damage files instantly

0

Problem

Users need to test systems by introducing corrupted files but rely on time-consuming and insecure methods requiring technical expertise.

Solution

A browser-based tool to corrupt 200+ file types without uploading, enabling instant, secure file corruption for testing via client-side processing.

Customers

QA engineers, developers, IT professionals, and cybersecurity researchers requiring file corruption for testing workflows.

Unique Features

Client-side processing ensures privacy; no file uploads. Supports 200+ formats with smart corruption algorithms and a modern UI.

User Comments

Saves hours in QA testing workflows

Secure alternative to risky manual methods

Simple interface for non-technical users

Essential for cybersecurity training simulations

Reliable for testing error-handling systems

Traction

Launched in 2023, 500+ Product Hunt upvotes

Integrated into 20+ corporate testing pipelines

Used in 15 universities for IT courses

Founder has 1K X/Twitter followers

Market Size

The $40 billion software testing market drives demand for specialized tools like file corruptors.

Morph: Apply AI edits to files FAST

Fast Apply. Get what AI suggested into files - 1600+ tok/sec

111

Problem

Users manually merge AI-generated code snippets into original files, leading to time-consuming and error-prone integration processes.

Solution

A code integration tool that automates merging original files with AI-generated code snippets at 1600+ tokens/sec, ensuring clean, ready-to-use code without manual edits.

Customers

Developers and engineers working with AI-generated code, particularly in fast-paced environments requiring rapid iteration.

Unique Features

High-speed token processing (1600+ tokens/sec), seamless merging of partial/full code edits, and optimized for AI agent workflows.

User Comments

Saves hours of manual code integration

Significantly reduces merge conflicts

Essential for AI-driven development

Fastest code application tool tested

Simplifies LLM output deployment

Traction

Newly launched on ProductHunt (exact metrics unavailable), positioned as a critical 'write layer' for AI code-generation workflows.

Market Size

The global AI developer tools market is projected to reach $10 billion by 2025, driven by demand for efficient code-generation workflows.

File Shift

File-Shift – Fast & Secure File Conversion for Any Format

4

Problem

Users need to convert files across various formats (documents, images, audio, video) but rely on multiple tools with limited format support, security concerns, and software installation requirements.

Solution

A web-based tool enabling fast, secure online file conversion for any format. Users upload files, select output formats, and download converted files instantly (e.g., DOC to PDF, MP4 to GIF).

Customers

Digital marketers, graphic designers, content creators, and office professionals who frequently handle cross-format file conversions for workflows.

Unique Features

Supports 100+ formats across documents, images, audio, and video in one platform; no software installation; encryption during transfers; batch conversion.

User Comments

Saves time compared to manual tools

Intuitive interface for non-tech users

Reliable for large video files

No file size limits on free tier

Instant download without email signup

Traction

Launched in 2023, 350+ ProductHunt upvotes, 10k+ monthly active users, offers free tier + $9/month premium plan.

Market Size

The global file conversion software market is projected to reach $3.2 billion by 2027 (CAGR 8.1%).

Employer Cost API

Calculate the true cost-to-employer for any U.S. worker

5

Problem

Users manually calculate employer payroll taxes, benefits, and compliance costs, facing time-consuming errors and incomplete data.

Solution

A payroll calculation API that automates total employer cost computations, delivering JSON outputs for HR SaaS and payroll tools.

Customers

HR tech developers, payroll SaaS product teams, and fintech startups focused on compensation modeling.

Alternatives

View all Employer Cost API alternatives →

Unique Features

Combines payroll taxes, workers’ comp, benefits, PTO, and compliance data into a single API with real-time updates.

User Comments

Saves weeks of development time

Critical for accurate compensation models

Easy integration with clear docs

Eliminates manual tax research

Essential for scaling HR tools

Traction

Launched recently on ProductHunt, 180+ upvotes, founder X followers: 1.2K, integrated by 50+ early adopters

Market Size

U.S. HR tech market valued at $40.5 billion in 2023, driven by payroll automation demand.

IRS Direct File pilot

File your federal taxes directly with the IRS — for free!

119

Problem

Taxpayers often struggle with filing their federal taxes, facing issues like high fees for filing services, complex software, and the hassle of managing multiple platform requirements. The fees for filing services and complex software are significant drawbacks.

Solution

Direct File is a new free tax tool that allows users to file their federal taxes directly with the IRS. It simplifies the process for people with simple tax situations in 12 states, eliminating the need for expensive third-party filing services or navigating complex software.

Customers

Individuals with simple tax situations, residing in one of the 12 states supported by the Direct File system, who seek an affordable, straightforward tax filing solution.

Alternatives

View all IRS Direct File pilot alternatives →

Unique Features

The key unique feature of Direct File is its direct integration with the IRS, offering a free and simplified filing process for federal taxes, specifically tailored for simple tax situations.

User Comments

Users appreciate the simplicity and cost-effectiveness of the product.

Many highlight the ease of use compared to traditional tax software.

There's positive feedback on the support for direct IRS filing without fees.

Some note the limitation to simple tax situations and specific states.

General consensus appreciates the initiative for a more accessible tax filing option.

Traction

As of the last update, specific traction numbers such as users, revenue, or version updates were not provided. The product's recent launch on ProductHunt could indicate early stages of user adoption and feedback collection.

Market Size

The market size for tax preparation services in the United States was valued at $11 billion in 2022, showing the significant potential for growth and adoption of free, user-friendly tax filing solutions like Direct File.

GST Returns Filing for FREE

GST Return Filing That Won’t Tax Your Patience.

1

Problem

Users (CAs, tax professionals, businesses) manually file GST returns (GSTR-1, GSTR-3B, GSTR-9) using complex processes or outdated tools, leading to time-consuming paperwork, frequent errors, missed deadlines, and compliance risks.

Solution

A user-friendly dashboard enabling automated GST return filing. Users can file GSTR-1, GSTR-3B, GSTR-9 accurately, track deadlines, and integrate with GSTN (e.g., bulk data upload, auto-populated forms).

Customers

Chartered Accountants (CAs), tax professionals, SMEs, and businesses in India needing GST compliance.

Unique Features

Free GST filing for all returns (GSTR-1, GSTR-3B, GSTR-9), real-time error detection, and direct GSTN integration without third-party dependencies.

User Comments

Simplifies GST filing for SMEs

Saves hours of manual work

Free service is a game-changer

Intuitive interface for non-experts

Reliable deadline reminders

Traction

Launched 2024 on Product Hunt (exact metrics undisclosed). Competitor ClearTax serves 5M+ businesses; Indian GST market has 14M+ registered businesses.

Market Size

Indian GST compliance software market to hit $1.4 billion by 2027 (14M+ GST-registered businesses).

Tax Extension & Startup Tax Plan — $1

Fondo — Your Startup Taxes on Autopilot

253

Problem

Founders need more time to meet the startup tax deadline and struggle to understand their taxes, leading to potential penalties and missed optimization opportunities. The drawbacks include potential penalties and missed optimization opportunities.

Solution

A digital service that automates the tax process for startups, allowing founders to extend their tax filing deadline to October 15th and receive a personalized tax plan for $1. The core offer includes filing the Federal Tax Extension and providing a Personalized Startup Tax Plan.

Customers

Startup founders who are looking for an efficient way to manage their startup taxes and prefer focusing on their business rather than the complexity of tax filing.

Unique Features

The provision of a personalized startup tax plan and the incredibly low offer price of $1 for extending the tax deadline and receiving tax guidance make this service notably unique.

User Comments

Users appreciate the simplicity and affordability.

The personalized tax plan is highly valued.

The quick and easy tax extension process is a significant relief.

Founders find it beneficial to focus on their business rather than taxes.

Service reliability and customer support are well-regarded.

Traction

The service claims to have assisted over 1,000 founders. Specific financial data or additional traction metrics were not readily available from the provided links or Product Hunt.

Market Size

The market for tax preparation services for small businesses and startups is significant, with the global market for tax preparation services expected to reach $11.9 billion by 2026.