Decode.tax

Alternatives

0 PH launches analyzed!

Decode.tax

Automatically analyze your tax return & save money

103

Problem

Users struggle with understanding their tax returns and identifying areas where they can save money due to the complex nature of taxation. Understanding complex tax returns and identifying saving opportunities are significant issues.

Solution

Decode Tax is a tool that allows users to automatically analyze their tax returns. By uploading their return documents, the system provides a clear breakdown and generates smart recommendations for saving money on taxes. Automatically analyze tax returns and generate smart saving recommendations.

Customers

This product is most suited for individual taxpayers, small business owners, and freelancers who find tax returns complex and wish to optimize their tax savings.

Alternatives

Unique Features

Decode Tax's uniqueness lies in its automatic analysis of tax returns and the generation of user-specific recommendations to save money, all presented in a user-friendly manner.

User Comments

Users appreciate the simplicity and effectiveness of the tool.

Many found it helpful in making sense of their tax situation.

Feedback highlights the value of personalized saving recommendations.

The tool's user-friendly interface has received positive remarks.

Some users expressed desire for more advanced features or detailed guidance.

Traction

There was no specific quantitative traction information available from the provided sources or Product Hunt. However, the product's presence on Product Hunt suggests early-stage engagement and interest from potential users.

Market Size

The global tax preparation services market size was valued at $11.3 billion in 2021 and is expected to grow.

Save Money

Goal tracker - achieve your financial dreams

7

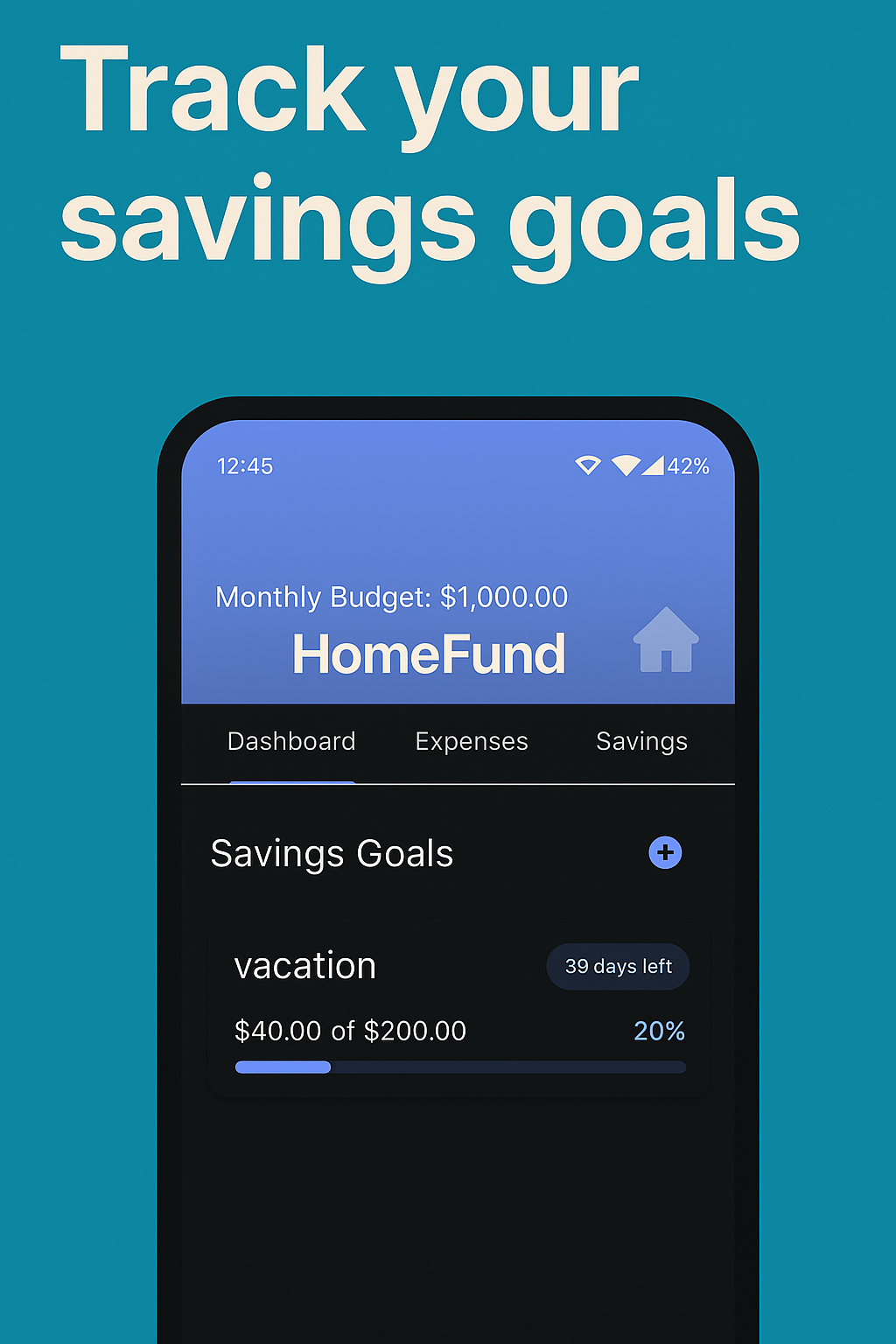

Problem

Users struggle to track savings and achieve financial goals manually or with generic budgeting tools, leading to poor financial discipline and delayed milestones.

Solution

A mobile app that allows users to set, track, and manage financial goals, providing budget tips and progress visualization. Example: set a vacation fund goal with monthly savings targets.

Customers

Young professionals, freelancers, and financially conscious individuals seeking structured financial planning and debt reduction.

Alternatives

View all Save Money alternatives →

Unique Features

Combines goal-based savings tracking with personalized budget recommendations and progress analytics in one interface.

User Comments

Simplifies goal setting

Motivates consistent saving

User-friendly interface

Lacks investment integration

Needs multi-currency support

Traction

Launched in 2022, 50k+ downloads on Google Play Store, featured on ProductHunt with 1.2k+ upvotes, founder has 2.5k followers on LinkedIn.

Market Size

The global personal finance software market is projected to reach $1.5 billion by 2026 (Statista, 2023).

Save Right

Easy tax saving

73

Problem

Individuals often struggle to optimize their taxes due to the complexity of tax laws and the personalization needed for effective strategies, leading to potential overpayment and missed saving opportunities. struggle to optimize their taxes due to the complexity of tax laws

Solution

Save Right is a web-based platform that allows users to upload their salary slip or tax statement to receive personalized recommendations for tax optimization in less than 45 seconds. The algorithm considers Indian tax laws, salary structure, and personal data.

Customers

The primary users are employed individuals in India who are looking for ways to optimize their taxes and maximize savings efficiently.

Unique Features

The product's unique feature is its ability to provide instant personalized tax optimization recommendations by analyzing uploaded salary slips or tax statements in less than 45 seconds, specifically tailored to Indian tax laws and individual financial details.

User Comments

User comments are not available as the information is not provided and cannot be accessed through the provided links.

Traction

Traction details are not available as the information is not provided and cannot be accessed through the provided links.

Market Size

The Indian tax preparation software market, which offers a contextual scope for Save Right, is anticipated to grow significantly. While specific figures for Save Right's market size are unavailable, the overall financial software market in India is expected to reach $393 million by 2025.

Easy Return

Income tax return filing in india

4

Problem

Users in India need to file income tax returns manually or through complex software, facing time-consuming steps, lack of clear guidance, and difficulty tracking TDS refunds.

Solution

An online tax filing platform where users can file ITR with step-by-step guidance, track TDS refunds, and generate project reports. Examples: guided e-filing, automated tax calculations.

Customers

Salaried employees, freelancers, and small business owners in India requiring simplified tax compliance.

Unique Features

Integrated TDS refund tracking and project report generation alongside ITR filing, with real-time assistance.

User Comments

Simplifies tax filing process

Helpful for first-time filers

Saves time on refund tracking

Clear interface

Affordable service

Traction

Launched 3 days ago on ProductHunt with 56 upvotes. Founder has 120 followers on X. No disclosed revenue or user count.

Market Size

India's income tax filers reached 80 million in 2023 (Income Tax Department data).

Awaken Tax

The first tax software built for web3

128

Problem

Crypto investors struggle with accurately capturing and identifying all transactions involving tokens, NFTs, and DeFi, leading to challenges in calculating the cost basis and generating tax reports. This results in wasted money & time.

Solution

Awaken provides a crypto tax software that captures and identifies token, NFT, and DeFi transactions, calculates cost basis, and generates tax reports, saving users money and time. It supports major blockchains & exchanges, offering 24/7 customer service.

Customers

The primary users are crypto investors and traders who engage in token trading, NFT, and DeFi transactions, requiring assistance in managing their taxes efficiently.

Alternatives

View all Awaken Tax alternatives →

Unique Features

Awaken's unique features include accurate capture of token, NFT, and DeFi transactions, cost basis calculation, tax report generation, support for major blockchains and exchanges, and 24/7 customer service.

User Comments

User comments are unavailable due to the nature of the information provided. No source for user comments was included.

Traction

No specific traction data provided within the given request. Unable to provide quantitative values without access to detailed information from Product Hunt, the product's website, or external sources.

Market Size

The global cryptocurrency market size was valued at $1.49 trillion in 2020 and is expected to grow, indicating a significant market for crypto tax software.

Home Fund – Simple savings goal tracker

Track your money goals and save up visually, with no clutter

3

Tax Extension & Startup Tax Plan — $1

Fondo — Your Startup Taxes on Autopilot

253

Problem

Founders need more time to meet the startup tax deadline and struggle to understand their taxes, leading to potential penalties and missed optimization opportunities. The drawbacks include potential penalties and missed optimization opportunities.

Solution

A digital service that automates the tax process for startups, allowing founders to extend their tax filing deadline to October 15th and receive a personalized tax plan for $1. The core offer includes filing the Federal Tax Extension and providing a Personalized Startup Tax Plan.

Customers

Startup founders who are looking for an efficient way to manage their startup taxes and prefer focusing on their business rather than the complexity of tax filing.

Unique Features

The provision of a personalized startup tax plan and the incredibly low offer price of $1 for extending the tax deadline and receiving tax guidance make this service notably unique.

User Comments

Users appreciate the simplicity and affordability.

The personalized tax plan is highly valued.

The quick and easy tax extension process is a significant relief.

Founders find it beneficial to focus on their business rather than taxes.

Service reliability and customer support are well-regarded.

Traction

The service claims to have assisted over 1,000 founders. Specific financial data or additional traction metrics were not readily available from the provided links or Product Hunt.

Market Size

The market for tax preparation services for small businesses and startups is significant, with the global market for tax preparation services expected to reach $11.9 billion by 2026.

Saving Diary

Your personal saving diary for smarter money habits

8

Problem

Users often lack a structured way to manage and track personal finances, leading to difficulties in maintaining control over individual savings and expenditures.

track expenses

set savings goals

Solution

An intuitive app that serves as a personal saving diary.

Users can track expenses and set savings goals, gaining personalized insights to manage their finances effectively.

Examples include tracking daily expenses for budgeting or setting and tracking progress towards a future goal like buying a car or a vacation.

Customers

Young professionals and millennials who are tech-savvy and interested in personal finance management.

Demographics could range from college students to working professionals in their late 20s and 30s.

These users typically aim to improve financial health and savings through accessible and easy-to-use digital tools.

Alternatives

View all Saving Diary alternatives →

Unique Features

User-friendly interface focused on simplicity.

Personalized financial insights and reports.

Capability to set custom savings goals directly within the app.

User Comments

Users appreciate the simplicity and ease of use.

Many find the personalized insights very helpful in tracking finances.

The feature to set and follow savings goals is popular.

Users noted that the app helps in reducing unnecessary expenses.

Feedback has been generally positive about the intuitive design.

Traction

Early-stage product listed on ProductHunt.

Product known for its simplification of financial tracking.

Growing interest among users looking for personal finance solutions.

Market Size

The personal finance software market was valued at $1.1 billion in 2020 and is expected to grow significantly, driven by increased demand for digital financial solutions.

Tax-Wizard - Easy Investment Tax Report

Effortless tax reporting for investors - automate with ease

3

Problem

For investors, tax reporting is often a complex and cumbersome task involving manual calculations and gathering data from various sources.

Manual calculations for capital gains, dividends, and interest are error-prone and time-consuming.

Solution

An automated tax reporting tool for investors.

Users can import data, calculate taxes, and generate reports with ease.

automating calculations for capital gains, dividends, and interest which simplifies tax reporting.

Customers

Investors, financial advisors, accountants

Individuals and professionals who want to automate and simplify their tax reporting process

Unique Features

Automated calculations for various investment types including capital gains, dividends, and interest.

User-friendly data import and report generation process.

Reduces manual work and increases accuracy in tax reporting.

User Comments

Very helpful in simplifying taxes for investors.

The automation feature saves time and reduces errors.

User-friendly interface makes it easy to use.

Significantly improves the accuracy of tax reports.

A must-have tool for anyone dealing with investments and taxes.

Traction

Launched on Product Hunt.

Gaining positive feedback from users for its ease of use and efficiency.

Market Size

The global tax preparation software market was valued at $10.8 billion in 2020 and is expected to grow with increasing demand for automation in tax processes.

1099 Tax Filing

Fast, accurate self-employed tax filing

5

Problem

Currently, users are facing challenges with filing 1099 taxes using traditional methods, which often involve manual entry of expenses and deductions. This process is not only time-consuming but can also be prone to errors. The drawbacks include manual entry of expenses and deductions, leading to inaccuracies and inefficiencies.

Solution

Everlance Tax Filing is an all-in-one platform that allows users to file federal and state 1099 taxes effortlessly. It offers features like auto-imported deductions, guarantees accuracy, and provides $1M in audit protection. By automating the process, users can simplify tax season and ensure compliance effortlessly.

Customers

Self-employed individuals and freelancers who frequently file 1099 taxes. These individuals often look for ways to streamline the tax filing process and ensure accuracy without investing too much time. Self-employed individuals and freelancers usually prefer solutions that offer simplicity and audit protection.

Alternatives

View all 1099 Tax Filing alternatives →

Unique Features

One of the unique features of Everlance Tax Filing is its auto-imported deductions, which minimize human error and improve accuracy. Additionally, the platform offers a significant $1M in audit protection, providing peace of mind for users concerned about potential audits.

User Comments

The product simplifies the tax filing process.

Users appreciate the auto-import feature for deductions.

The audit protection provides added security.

Some users find it fast and efficient.

There are positive remarks about accuracy guarantees.

Traction

While specific financial or user metrics are not listed in the provided information, Everlance Tax Filing is likely gaining traction among self-employed individuals due to its unique features like audit protection and auto-imported deductions, which address common pain points in 1099 tax filing.

Market Size

The market size for online tax preparation services, which includes platforms like Everlance Tax Filing, was valued at approximately $11.8 billion in 2020 and is expected to grow due to the increasing number of freelancers and self-employed individuals seeking efficient tax solutions.