Baton Analytics

Alternatives

120,465 PH launches analyzed!

Baton Analytics

The "Credit Score" for Creators & Influencers

6

Problem

Creators and influencers rely on self-reported or unreliable metrics to prove their value to brands, leading to lack of transparency and trust in partnerships

Solution

Analytics platform enabling users to access 100% Instagram-verified performance data, generate exportable report cards, and showcase credibility for brand collaborations

Customers

Social media influencers, content creators, brand managers, and marketing agencies seeking data-driven partnership decisions

Unique Features

Exclusive Instagram API integration for verified metrics, dual focus on creator and brand needs, free pricing model

User Comments

No user comments available in provided data

Traction

Launched recently on Product Hunt, free-to-use model with unspecified user count

Market Size

Global influencer marketing market reached $21.1 billion in 2023 (Influencer Marketing Hub)

Credit score portal design - ScreenRoot

Credit score portal design - case study | screenroot

5

Problem

Users currently use traditional credit score monitoring platforms that may lack intuitive design and advanced features, which hinders user engagement and comprehension.

A major drawback is the reliance on outdated interfaces, which may lead to difficulties in navigating and understanding credit information.

Solution

A redesigned credit score portal featuring intuitive design, insights, and gamified features.

Users can easily monitor their credit with improved engagement through gamified experiences.

Users receive insights that help them understand and improve their credit scores.

Customers

Individuals interested in monitoring their credit scores and managing their financial health.

Financially conscious users of all demographics who want to engage more effectively with their credit information.

Unique Features

The gamified features add an element of engagement and motivation in the credit score monitoring process.

Intuitive design enhances user navigation and understanding of complex financial data.

User Comments

The new design is more engaging and user-friendly.

Gamified features make monitoring credit scores more interesting.

Users appreciate the insights provided within the portal.

Some users feel more motivated to improve their credit scores.

Overall, the revamp has been well-received but there are always areas for further improvement.

Traction

The product has not provided specific quantitative data on traction.

Market Size

The credit monitoring services market is expected to grow from approximately $4.8 billion in 2021 to $8.7 billion by 2026, with a CAGR of 12.7%.

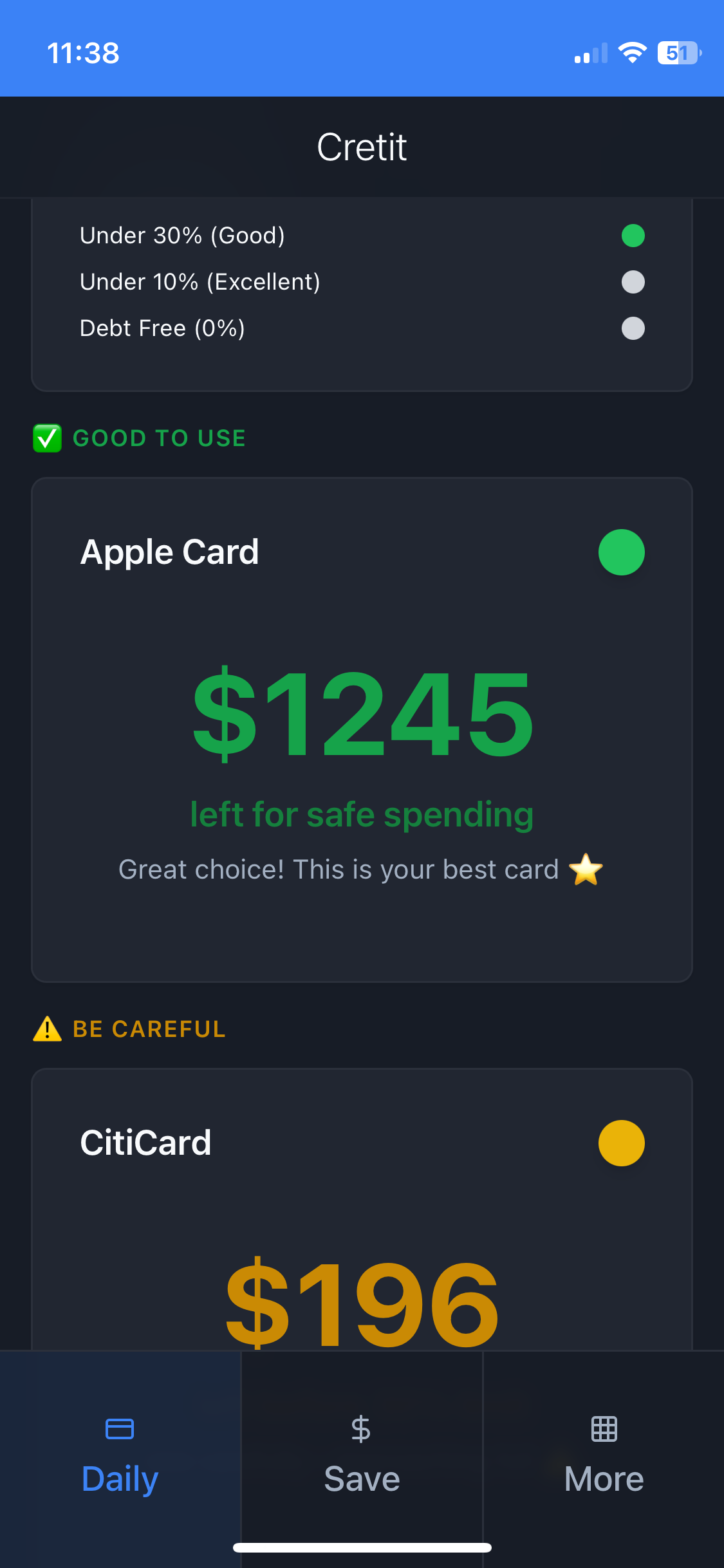

Daily Credit Card Traffic Lights

Get instant green/yellow/red to protect your credit score.

1

Problem

Users struggle to determine which credit card is safe to use daily to avoid high utilization rates that harm their credit scores, relying on manual tracking or monthly statements which lack real-time guidance.

Solution

A financial dashboard tool that provides traffic light recommendations (green/yellow/red) for each credit card, enabling users to monitor daily utilization and protect their credit scores through automated alerts.

Customers

Individuals with multiple credit cards, particularly those actively managing their credit scores or working to improve financial health.

Unique Features

Real-time traffic light system tailored to individual credit utilization thresholds, daily automated tracking, and instant alerts to prevent score drops.

User Comments

Simplifies credit management

Helps avoid credit score drops

Instant clarity on card usage

Visually intuitive interface

Reduces financial anxiety

Traction

Launched in 2023, featured on ProductHunt with 500+ upvotes, integrated with major credit bureaus for real-time data.

Market Size

The global credit scoring market is projected to reach $14.2 billion by 2027 (Statista, 2023).

Check Free CIBIL Score

Get your detailed credit report online

0

Problem

Users need to check their credit scores and reports through traditional financial institutions or paid services, which involve time-consuming processes and limited access to expert advice.

Solution

A free online tool that allows users to check their credit score instantly, view detailed reports, and access expert advice to improve their creditworthiness for loans and financial opportunities.

Customers

Individuals applying for personal, home, car, or business loans, financial planners, and credit-conscious users seeking better loan rates.

Alternatives

View all Check Free CIBIL Score alternatives →

Unique Features

Free credit score checks, real-time reports, expert-guided improvement strategies, and nationwide trust for faster loan approvals.

User Comments

Simplifies credit monitoring

Free and reliable service

Helps secure loan approvals

Expert tips are actionable

Saves time compared to traditional methods

Traction

Trusted nationwide in India; specific user numbers/revenue not publicly disclosed but positioned as a key player in credit management.

Market Size

India's credit bureau market is projected to reach $1.2 billion by 2026, driven by growing financial awareness and loan demand.

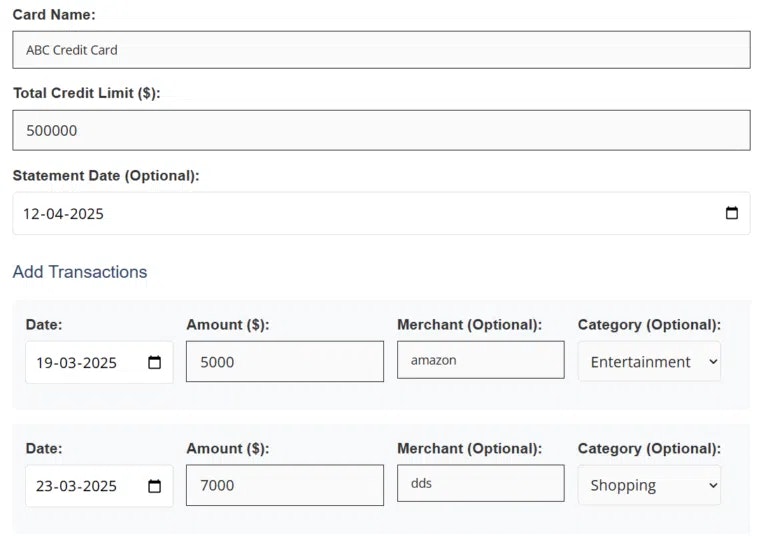

Calculate Well Hub

Manage spending & boost credit score

6

Problem

Users manually track credit card expenses and use basic budgeting apps, facing inefficient expense monitoring, difficulty avoiding fees, and limited credit score improvement.

Solution

A credit card tracking tool (dashboard) that lets users monitor spending, avoid fees, and improve credit scores through automated tracking, Excel reports, and premium tips.

Customers

Individuals managing personal finances, particularly credit card users aged 25-45 seeking to avoid fees and boost credit scores.

Alternatives

View all Calculate Well Hub alternatives →

Unique Features

Free Excel report generation, integration of expense tracking with actionable credit score tips, and a premium tier for advanced analytics.

User Comments

Simplifies expense tracking with automated reports

Helps avoid late fees through reminders

Free tier is comprehensive compared to competitors

Useful for improving credit score awareness

Excel integration saves time

Traction

Launched on ProductHunt with 150+ upvotes (as of analysis date), free tool with growing user base; specifics on revenue/users undisclosed.

Market Size

The global personal finance software market was valued at $1.01 billion in 2022, projected to reach $1.71 billion by 2030 (CAGR: 6.8%).

Finted Score

Measure Trust, Minimize Risk

11

Problem

Users rely on traditional banking credit scores for assessing customer creditworthiness, but banking credit score is not enough, leading to potential risks and incomplete financial profiles.

Solution

A credit assessment tool that enables users to analyze creditworthiness beyond traditional banking scores by enlisting customers, generating analytical reports, and providing emergency fraud alerts. Example: Track credit health dynamically and receive real-time risk alerts.

Customers

Financial institutions, lenders, and FinTech companies seeking comprehensive credit risk analysis and fraud detection for underbanked or high-risk customers.

Alternatives

View all Finted Score alternatives →

Unique Features

Combines non-traditional data sources with credit scores, offers frequent analytical updates, and sends real-time alerts for suspicious activities.

User Comments

Improves risk assessment accuracy

Simplifies compliance checks

Reduces defaults via proactive alerts

Useful for emerging markets

Requires more data integration options

Traction

Launched on ProductHunt with 180+ upvotes; specifics on revenue/users undisclosed but positioned in the growing alternative credit scoring market.

Market Size

The global alternative credit scoring market is projected to reach $15.3 billion by 2027, driven by FinTech adoption and underbanked populations.

Problem

Users needing liquidity must rely on traditional loans requiring credit scores, which exclude those with poor credit or undervalue their investment portfolios, leading to limited access and higher interest rates.

Solution

A financial platform enabling securities-based lines of credit (SBLOC) via AI underwriting. Users connect brokerage accounts to borrow against portfolios without credit checks, e.g., accessing instant liquidity at competitive rates.

Customers

Investors, high-net-worth individuals, and wealth managers seeking liquidity without selling assets, particularly those with strong portfolios but limited credit history.

Alternatives

View all KaiMoney alternatives →

Unique Features

AI-driven underwriting ignores credit scores, focuses on portfolio value; seamless brokerage integration for real-time collateral evaluation.

User Comments

Eliminates credit score barriers

Quick access to funds

Lower rates than traditional loans

Easy brokerage linking

Transparent AI evaluation

Traction

Launched on ProductHunt in 2024; details on users/revenue unspecified. Founder’s LinkedIn: 500+ followers.

Market Size

The global securities-based lending market was valued at $100 billion in 2023, growing with rising investment activities (Allied Market Research).

Problem

Users struggle with clients ignoring overdue invoices, leading to unpaid debts and wasted collection efforts. Current solutions like manual follow-ups or legal action are time-consuming and often ineffective.

Solution

A debt collection tool where users upload unpaid invoices to automatically lower the client’s business credit score and add the default to their public credit report. Example: Uploading an invoice triggers a 30-day payment window; if unpaid, the default remains publicly visible.

Customers

Freelancers, small business owners, and finance teams dealing with persistent non-paying clients, especially in B2B sectors where credit reputation matters.

Alternatives

View all Credote alternatives →

Unique Features

Leverages credit score penalties as leverage for payment; defaults are permanently recorded in public reports if unpaid within 30 days.

User Comments

No user comments available from provided data.

Traction

Launched on Product Hunt (exact metrics not disclosed). Founders’ social traction or revenue data unavailable in provided sources.

Market Size

The global debt collection market was valued at $15.3 billion in 2023 (Grand View Research).

Pody Network

Build your credit score while learning

2

Problem

Students struggle to access loans due to lack of collateral or credit history and traditional credit scoring systems ignoring academic/behavioral data

Solution

A credit scoring tool that lets users build credit scores via learning behavior, spending habits, and digital achievements, enabling access to zero-collateral loans

Customers

Students without financial collateral, young professionals building credit, and educational institutions seeking financial solutions for learners

Unique Features

Leverages non-traditional metrics (e.g., course completion rates, academic performance) and digital footprints (e.g., certifications, online achievements) to assess creditworthiness

User Comments

Simplifies loan access for students

Innovative use of academic data

Transparent credit-building process

Supports financial inclusion

Needs wider institutional partnerships

Traction

Launched in 2024, details on users/revenue unspecified; positioned in the global alternative credit scoring market

Market Size

The global alternative credit scoring market is projected to reach $7.3 billion by 2027 (Allied Market Research)

Problem

Current users rely on traditional credit systems for financial operations within the DeFi space.

These traditional systems often have high collateral requirements and lack automation in financial management.

Solution

AI-powered DeFi platform that provides on-chain credit scoring and automated financial management.

Users can reduce collateral requirements, optimize lending, and automate staking.

Examples include AI-driven credit evaluations and smart contract-enabled staking.

Customers

DeFi investors, cryptocurrency traders, and blockchain enthusiasts looking to enhance their financial operations.

Tech-savvy individuals interested in decentralized finance and automated financial management.

Unique Features

Integration of AI with DeFi services for credit scoring and financial management.

Use of smart contracts for automation, significantly reducing manual financial processes.

User Comments

Users appreciate the reduction in collateral requirements.

Positive feedback on the integration of AI for precise credit scoring.

Some users find the platform's automation features convenient.

There are concerns about the complexity of understanding the AI mechanisms.

Excitement around potential savings in time and resources.

Traction

The product is a newly launched feature as on the information available on ProductHunt.

Currently gathering initial user feedback and building its early user base.

Market Size

The global decentralized finance (DeFi) market was valued at $11.78 billion in 2021 and is projected to grow significantly.