MyCreditPlan.com – Smart Debt Repayment

Get out of debt, save interest, and boost your credit score

# Financial AssistantWhat is MyCreditPlan.com – Smart Debt Repayment?

Get a personalized roadmap to 0% utilization. List your expenses and debts—like credit cards, rent, and car payments—and get step-by-step instructions, payment reminders, and "unlock dates" to safely spend while maintaining $0 balances with credit bureaus.

Problem

Users struggle to create a personalized roadmap to pay off debts efficiently, save interest, and improve their credit scores.

Drawbacks: Lack of clear instructions, reminders, and oversight leading to potential missed payments and inefficient debt repayment strategies.

Solution

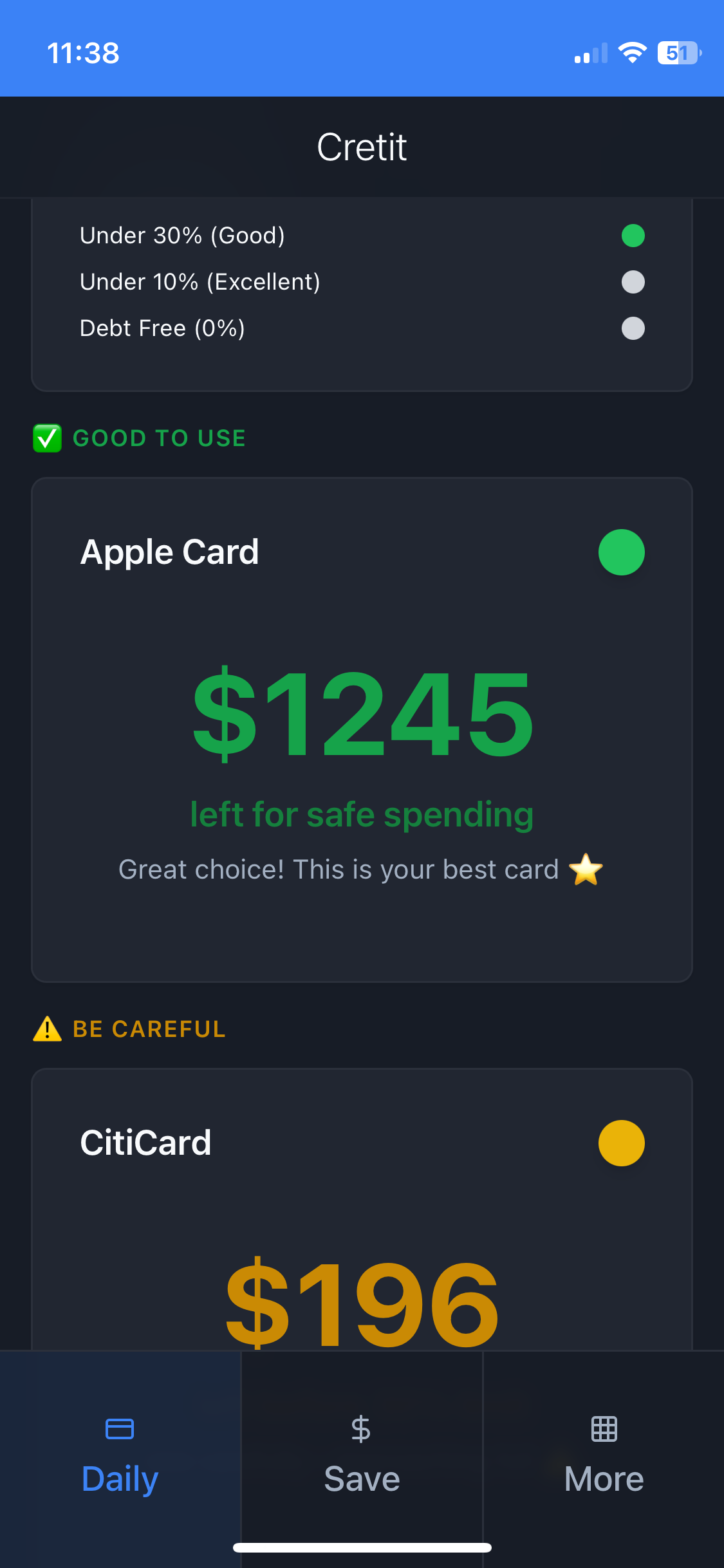

A smart debt repayment tool with a personalized roadmap to achieve 0% utilization.

Core features: Provides step-by-step instructions, payment reminders, and 'unlock dates' to help users maintain $0 balances with credit bureaus.

Customers

Individuals struggling with managing their debts, credit card balances, rent, and car payments.

Occupation or specific position: People seeking to pay off debts efficiently, save money on interest, and boost their credit scores.

Unique Features

Personalized debt repayment roadmap tailored to achieve 0% utilization.

Step-by-step instructions and payment reminders for efficient debt repayment.

Unlock dates to guide users on when they can safely spend while maintaining $0 balances.

Focus on saving interest and improving credit scores through strategic debt management.

User Comments

Easy-to-use tool with clear instructions for debt repayment.

Helped me save money on interest and manage my debts effectively.

Useful for those looking to improve their credit scores.

Great for organizing expenses and getting a clear debt repayment plan.

Highly recommended for anyone struggling with debt management.

Traction

Growing user base with positive reviews.

Increased engagement and user satisfaction.

Continuous updates and improvements based on user feedback.

Market Size

$3.88 trillion: Total consumer debt in the United States as of Q2 2021.

Increasing demand for debt management tools due to rising debt levels.

Growing market for credit score improvement services.