KaiMoney

Alternatives

120,467 PH launches analyzed!

Problem

Users needing liquidity must rely on traditional loans requiring credit scores, which exclude those with poor credit or undervalue their investment portfolios, leading to limited access and higher interest rates.

Solution

A financial platform enabling securities-based lines of credit (SBLOC) via AI underwriting. Users connect brokerage accounts to borrow against portfolios without credit checks, e.g., accessing instant liquidity at competitive rates.

Customers

Investors, high-net-worth individuals, and wealth managers seeking liquidity without selling assets, particularly those with strong portfolios but limited credit history.

Unique Features

AI-driven underwriting ignores credit scores, focuses on portfolio value; seamless brokerage integration for real-time collateral evaluation.

User Comments

Eliminates credit score barriers

Quick access to funds

Lower rates than traditional loans

Easy brokerage linking

Transparent AI evaluation

Traction

Launched on ProductHunt in 2024; details on users/revenue unspecified. Founder’s LinkedIn: 500+ followers.

Market Size

The global securities-based lending market was valued at $100 billion in 2023, growing with rising investment activities (Allied Market Research).

Credit score portal design - ScreenRoot

Credit score portal design - case study | screenroot

5

Problem

Users currently use traditional credit score monitoring platforms that may lack intuitive design and advanced features, which hinders user engagement and comprehension.

A major drawback is the reliance on outdated interfaces, which may lead to difficulties in navigating and understanding credit information.

Solution

A redesigned credit score portal featuring intuitive design, insights, and gamified features.

Users can easily monitor their credit with improved engagement through gamified experiences.

Users receive insights that help them understand and improve their credit scores.

Customers

Individuals interested in monitoring their credit scores and managing their financial health.

Financially conscious users of all demographics who want to engage more effectively with their credit information.

Unique Features

The gamified features add an element of engagement and motivation in the credit score monitoring process.

Intuitive design enhances user navigation and understanding of complex financial data.

User Comments

The new design is more engaging and user-friendly.

Gamified features make monitoring credit scores more interesting.

Users appreciate the insights provided within the portal.

Some users feel more motivated to improve their credit scores.

Overall, the revamp has been well-received but there are always areas for further improvement.

Traction

The product has not provided specific quantitative data on traction.

Market Size

The credit monitoring services market is expected to grow from approximately $4.8 billion in 2021 to $8.7 billion by 2026, with a CAGR of 12.7%.

AI Investment Portfolio - StockGenius

Build smarter portfolios with AI in seconds

12

Problem

Users manage investments manually or using basic tools like spreadsheets, facing time-consuming research, lack of real-time insights, and difficulty benchmarking portfolios against market standards.

Solution

A mobile app leveraging AI to generate optimized portfolios instantly, allowing users to compare with benchmarks, track performance, and get actionable insights (e.g., AI-curated portfolios based on risk tolerance).

Customers

Individual investors (millennials/Gen Z), self-directed traders, and tech-savvy users seeking automated, data-driven investment strategies.

Unique Features

AI-driven portfolio optimization with real-time benchmark comparisons, performance analytics, and a user-friendly mobile-first interface.

User Comments

Saves time on research

Intuitive UI for tracking

AI recommendations are surprisingly accurate

Needs more asset classes

Helpful for beginners

Traction

Launched 3 months ago; 4.8/5 stars on app stores, 50k+ downloads, $10k MRR (estimated from subscription model).

Market Size

The global robo-advisory market is projected to reach $1.4 trillion by 2027 (Statista, 2023).

Soccer Scores - Live Score

provides real-time updates and scores for matches worldwide

9

Problem

Fans need to constantly search multiple sources or platforms to get real-time updates and scores for soccer matches worldwide.

Solution

An app that provides real-time updates and scores for soccer matches worldwide through a user-friendly interface.

Users can easily navigate through live scores, match schedules, and team statistics.

Customers

Football enthusiasts, sports fans, and individuals interested in following soccer matches globally.

Unique Features

Real-time updates for matches worldwide

User-friendly interface for easy navigation

Market Size

Global sports market size was valued at approximately $488.5 billion in 2020.

Check Free CIBIL Score

Get your detailed credit report online

0

Problem

Users need to check their credit scores and reports through traditional financial institutions or paid services, which involve time-consuming processes and limited access to expert advice.

Solution

A free online tool that allows users to check their credit score instantly, view detailed reports, and access expert advice to improve their creditworthiness for loans and financial opportunities.

Customers

Individuals applying for personal, home, car, or business loans, financial planners, and credit-conscious users seeking better loan rates.

Alternatives

View all Check Free CIBIL Score alternatives →

Unique Features

Free credit score checks, real-time reports, expert-guided improvement strategies, and nationwide trust for faster loan approvals.

User Comments

Simplifies credit monitoring

Free and reliable service

Helps secure loan approvals

Expert tips are actionable

Saves time compared to traditional methods

Traction

Trusted nationwide in India; specific user numbers/revenue not publicly disclosed but positioned as a key player in credit management.

Market Size

India's credit bureau market is projected to reach $1.2 billion by 2026, driven by growing financial awareness and loan demand.

FinTok.io: Unleash Your Investing Edge

Unlock your unfair investing advantage✨ - Invest Like a Pro

89

Problem

Investors often struggle with accessing and analyzing the financial health, profit margins, and debt coverage of stocks effectively, leading to less informed investment decisions. Struggle with accessing and analyzing financial health of stocks effectively.

Solution

FinTok.io is a web-based platform that provides users with the ability to discover and analyze investment portfolios of legendary investors like Warren Buffet. It offers a comprehensive financial health assessment tool, covering profit margins, debt coverage, and more, enabling users to invest like a pro. Provides users with ability to analyze investment portfolios and offers comprehensive financial health assessment tools.

Customers

Retail investors, finance enthusiasts, and anyone looking to enhance their investing strategies by learning from legendary investors.

Unique Features

Access to investment portfolios of legendary investors, Comprehensive financial health assessment tool, specifically evaluating profit margins, debt coverage, and more.

User Comments

Users appreciate the ease of access to legendary investors' portfolios.

The comprehensive financial health assessment tool is highly valued.

Offers unique insights that are hard to find elsewhere.

Helps users make more informed investment decisions.

Some users wish for more diverse analytical tools.

Traction

Specific traction details are not provided in the available information. Additional research is required to quantify the platform's user base, revenue, or growth rates.

Market Size

The global financial analytics market is expected to reach $11.4 billion by 2026, growing at a CAGR of 10.7% from 2021 to 2026.

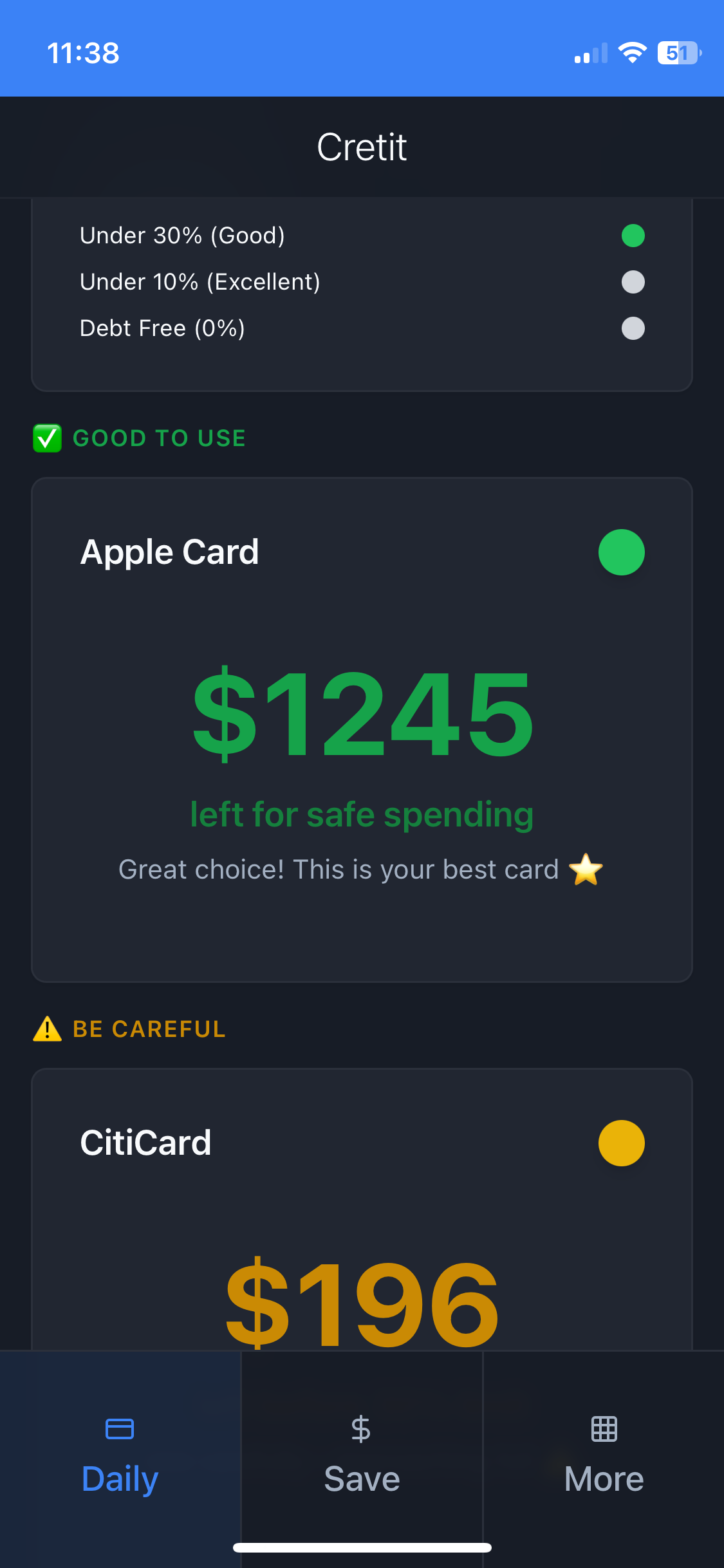

Daily Credit Card Traffic Lights

Get instant green/yellow/red to protect your credit score.

1

Problem

Users struggle to determine which credit card is safe to use daily to avoid high utilization rates that harm their credit scores, relying on manual tracking or monthly statements which lack real-time guidance.

Solution

A financial dashboard tool that provides traffic light recommendations (green/yellow/red) for each credit card, enabling users to monitor daily utilization and protect their credit scores through automated alerts.

Customers

Individuals with multiple credit cards, particularly those actively managing their credit scores or working to improve financial health.

Unique Features

Real-time traffic light system tailored to individual credit utilization thresholds, daily automated tracking, and instant alerts to prevent score drops.

User Comments

Simplifies credit management

Helps avoid credit score drops

Instant clarity on card usage

Visually intuitive interface

Reduces financial anxiety

Traction

Launched in 2023, featured on ProductHunt with 500+ upvotes, integrated with major credit bureaus for real-time data.

Market Size

The global credit scoring market is projected to reach $14.2 billion by 2027 (Statista, 2023).

EZ Credit Card

Compare cash back credit cards

12

Problem

Users manually compare cash back credit cards across multiple sources, which is time-consuming and inefficient, leading to potential missed opportunities for optimal rewards.

Solution

A AI-driven comparison tool that analyzes users' spending habits and recommends tailored cash back credit cards, e.g., inputting monthly expenses to receive card matches with highest rewards.

Customers

Young professionals, freelancers, and frequent shoppers seeking to maximize credit card rewards based on personalized spending patterns.

Alternatives

View all EZ Credit Card alternatives →

Unique Features

Dynamic spending habit analysis, real-time reward calculations, and side-by-side card comparisons with fee structures and eligibility criteria.

User Comments

Saves hours of research

Intuitive interface

Accurate reward projections

Lacks niche bank cards

Free to use

Traction

Launched 3 months ago, 5k+ active users, $15k MRR (as per ProductHunt comments), featured in 12+ finance newsletters.

Market Size

The US cash back credit card market was valued at $25 billion in 2023 (Statista).

Orion Score

Startup scoring platform

52

Problem

Startup founders often face uncertainty regarding their startup's potential for securing investments due to a lack of clear benchmarks and feedback on their startup's appeal to investors.

Solution

Orion Score is a platform where startup founders can score their startup from the perspective of getting an investment. This service potentially equips founders with insights into the strengths and weaknesses of their startup, aligned with investor expectations.

Customers

Startup founders, particularly those in the initial stages of their startup journey, looking for investment opportunities and feedback on their venture's readiness for the same.

Unique Features

Orion Score uniquely focuses on providing an investment-oriented scoring system for startups, helping founders understand their position in the competitive investment landscape.

User Comments

There are no user comments available to extract insights from.

Traction

Specific traction data such as number of users, revenue, or funding status for Orion Score is not available.

Market Size

The exact market size of startup scoring platforms is not provided, but the global startup ecosystem was valued at over $3 trillion as of the latest reports, within which such platforms can carve a niche.

Alt. Investments

Real Estate Investments, One Square Feet at a time.

1

Problem

Investors face high barriers to entry in real estate investments.

High capital requirements and complex management processes discourage smaller investors.

Solution

Online platform

Alt. simplifies real estate investing with low entry barriers. Users can invest starting from 1 sq. ft. in various properties such as office spaces, warehouses, and vacation rentals. Additionally, they can explore larger investments in ventures through Micro Invest and manage their portfolio using a Wealth Tracker.

Customers

Retail investors and individual investors seeking accessible real estate investment opportunities. They are typically in the age range of 25-45, tech-savvy, and interested in diversifying their investment portfolio with lower initial capital.

Alternatives

View all Alt. Investments alternatives →

Unique Features

Ability to invest as little as 1 sq. ft.

Wealth Tracker for managing investments

Diversification options into office, warehouse, and vacation rentals

Micro Invest option for larger equity/debt ventures

User Comments

The platform lowers the traditional barriers to real estate investment.

Easy to use and manage smaller investments.

Wealth tracker is a helpful feature.

Innovative approach to fractional real estate investing.

Some users might prefer more diverse asset options.

Traction

The specific traction details such as number of users or financial metrics were not available on Product Hunt or the provided website link.

Market Size

The global real estate investment market size was estimated to be $9.6 trillion in 2021, and it continues to grow as more platforms provide easier access to fractional investments.