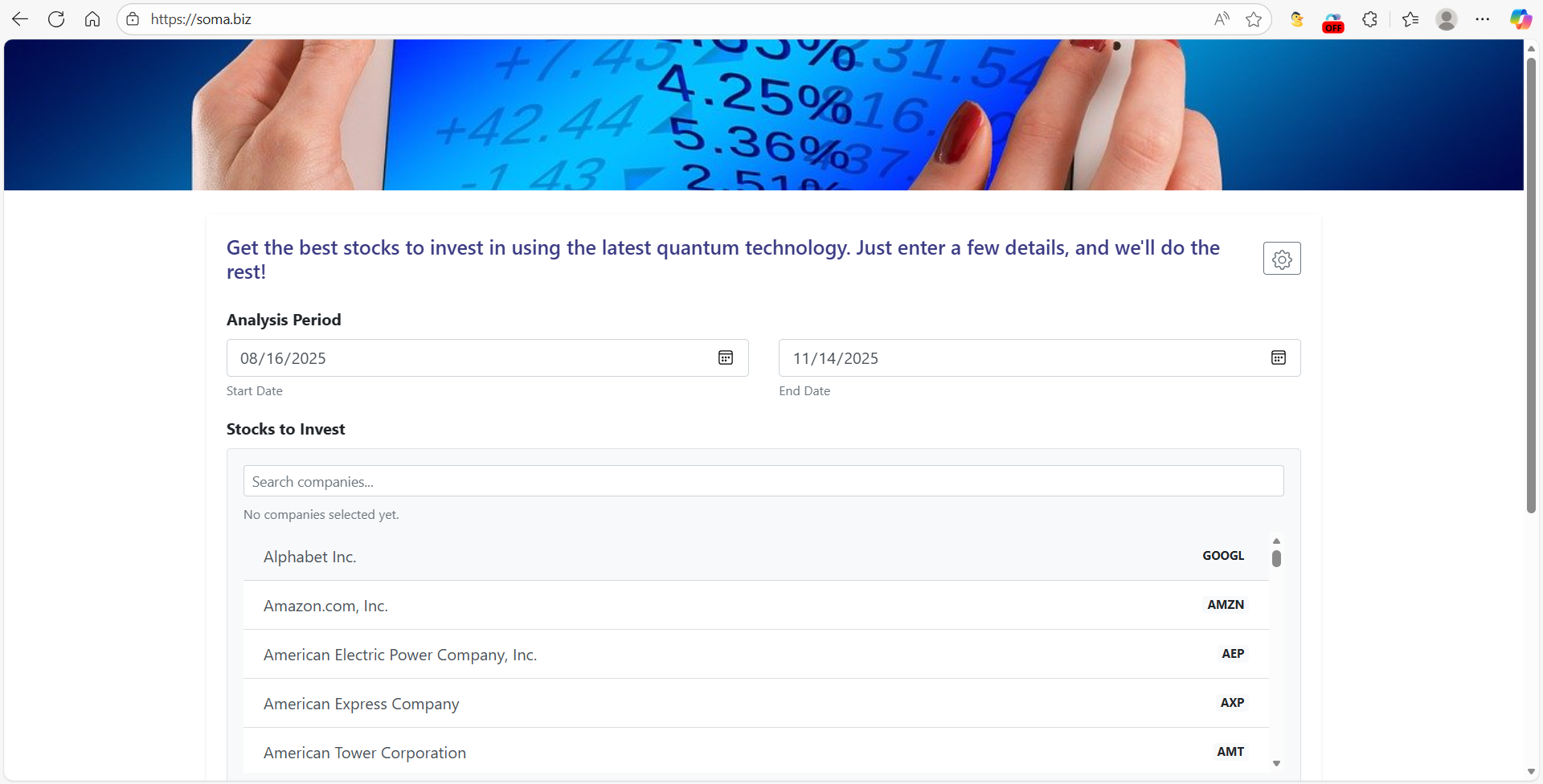

Soma Quantum Portfolio Optimization

Alternatives

0 PH launches analyzed!

Soma Quantum Portfolio Optimization

Build stock portfolios super fast with quantum computing.

7

Problem

Investors manually build stock portfolios using traditional methods which are time-consuming and require financial expertise. Time-consuming and requires financial expertise.

Solution

A quantum computing-powered portfolio optimization tool that lets users generate optimized stock portfolios instantly. Quantum computing-powered portfolio generation. Example: Input risk tolerance and investment goals to receive a diversified portfolio.

Customers

Individual investors, retail traders, and non-professional users seeking automated, data-driven portfolio creation without advanced financial knowledge.

Unique Features

Leverages quantum computing for rapid portfolio optimization, differentiating it from classical algorithmic tools.

User Comments

Simplifies portfolio building

Intuitive for beginners

Quantum aspect feels futuristic

Lacks transparency in optimization logic

Limited asset-class options

Traction

Launched on ProductHunt in 2024, details like user count or revenue not publicly disclosed. Founder’s X followers: ~1.2k (as of 2023).

Market Size

The global robo-advisory market is projected to reach $1.4 trillion in assets under management by 2025 (Statista, 2023).

Exponential Quantum

Smarter investing starts with quantum-optimized portfolios.

3

Problem

Users rely on traditional portfolio optimization methods that struggle with complex variables like market conditions, risk factors, and macroeconomic data, leading to suboptimal asset allocation and delayed adjustments.

Solution

A quantum computing-powered portfolio optimization platform that lets users generate data-driven investment strategies by analyzing real-time market data, risk parameters, and macroeconomic trends. Example: Automatically rebalancing portfolios based on quantum-optimized algorithms.

Customers

Investment managers, financial analysts, and institutional investors seeking advanced tools to optimize asset allocation and mitigate risks in dynamic markets.

Alternatives

View all Exponential Quantum alternatives →

Unique Features

Leverages quantum computing for faster and more accurate portfolio optimization compared to classical algorithms; integrates real-time macroeconomic data feeds for adaptive strategy adjustments.

User Comments

Reduces manual portfolio rebalancing time

Improves risk-adjusted returns

Intuitive interface for non-technical users

Transparent data-driven insights

Enhances confidence in investment decisions

Traction

Launched 3 months ago; 500+ upvotes on ProductHunt; featured in 12+ fintech newsletters; founder has 2.4K followers on LinkedIn; partnered with 2 quantum computing providers (IonQ, D-Wave).

Market Size

The global quantitative finance software market is projected to reach $10.2 billion by 2027 (CAGR 12.3%), driven by demand for AI/quantum-powered portfolio optimization tools.

Consider Elevate your stock portfolio IQ

Stock tracker, real time stock prices, stock charts

4

Problem

Users manage their investments across multiple brokerage and retirement accounts, which can lead to challenges in keeping track of all portfolios accurately.

The drawbacks of this old situation include struggles with consolidated tracking, lack of real-time updates, and the complexity of analyzing asset allocation. keeping track of all portfolios accurately

Solution

Consider is a portfolio management app designed to help users efficiently manage their investments.

Users can utilize features like real-time portfolio tracking, asset allocation analysis, and transaction history management.

Examples include accessing real-time stock prices and viewing stock charts.

Customers

Retail investors, financial advisors, and those managing personal investments

Age range: 25-55

Behaviors: Actively track and analyze investment portfolios

Unique Features

The app provides a consolidated view of portfolios across different accounts, offering real-time updates and detailed analytics on asset allocation and transactions.

User Comments

Users appreciate the real-time tracking of stocks.

The app is praised for its intuitive interface.

Many find the asset allocation analysis helpful for strategic decisions.

Transaction history feature is considered a key benefit.

Some users express a need for additional analytical tools.

Traction

The product was recently launched on Product Hunt.

It has started gaining traction with an increasing number of early adopters.

Market Size

The global portfolio management software market was valued at $3.99 billion in 2020, with expectations of continued growth due to increasing adoption by individual investors and financial institutions.

Pludo Coder: Build Portfolios with AI

Turn your resume into a live AI-built portfolio.

8

Problem

Users need to manually build portfolio websites from scratch, a time-consuming and technically challenging process that limits their ability to showcase projects and professional growth efficiently.

Solution

An AI-powered portfolio builder tool where users upload a resume or input details via a form to generate customizable portfolio websites instantly, with templates and dynamic content integration (e.g., GitHub repositories).

Customers

Developers, software engineers, and tech job seekers seeking to automate portfolio creation, particularly those with limited web design skills or time.

Unique Features

AI transforms static resumes into interactive portfolios with auto-populated project sections, real-time updates from coding platforms, and no-code customization.

User Comments

Saves hours of manual setup

Simplifies showcasing coding projects

Intuitive customization options

Helps stand out in job applications

Instant integration with GitHub

Traction

Launched 1 month ago, 500+ users, featured on ProductHunt with 200+ upvotes; pricing starts at $9/month.

Market Size

The global online resume builder market is valued at $1.2 billion, with over 12 million tech job seekers in the US alone requiring portfolio tools annually.

Stock Portfolio Tracker

Accurate portfolio tracking for long-term investors

6

Problem

Users need to track their investment portfolios manually with basic tools like spreadsheets or simple apps, which lack 30+ years of historical data, advanced analytics, and accurate performance calculations.

Solution

A portfolio tracking platform that enables users to monitor investments with 30+ years of historical data, advanced analytics, and MWRR-based performance calculations, e.g., assessing long-term returns with precise metrics.

Customers

Long-term individual investors, financial advisors, and retail traders seeking data-driven insights for informed decisions.

Alternatives

View all Stock Portfolio Tracker alternatives →

Unique Features

Uses Money-Weighted Rate of Return (MWRR) for precise performance measurement and offers 30+ years of historical stock/fund data.

User Comments

Accurate portfolio tracking simplifies performance reviews

MWRR method provides clarity on returns

Historical data aids long-term strategy planning

User-friendly interface for non-experts

Advanced analytics uncover portfolio gaps

Traction

Launched on ProductHunt with 1k+ upvotes; active user base but no disclosed revenue or funding.

Market Size

The global wealth management market, a proxy for portfolio tools, was valued at $1.3 trillion in 2021 (Allied Market Research).

Portfolio Market

Amazon of stock portfolios

5

Problem

Users struggle to manually research, build, and optimize stock portfolios using traditional tools like spreadsheets or basic investment platforms, facing challenges in accessing vetted strategies, backtesting performance, and monetizing their expertise

Solution

A marketplace platform where users can backtest portfolios using historical data, publish/sell strategies, and filter portfolios by metrics like ROI/risk. Example: A trader creates a tech stock portfolio, backtests it against 2018-2023 data, and sells access for $99/month

Customers

Retail investors, day traders, financial analysts, and hedge fund managers seeking data-driven portfolio strategies or monetization opportunities

Alternatives

View all Portfolio Market alternatives →

Unique Features

First dedicated marketplace for stock portfolios with built-in backtesting engine, profit-sharing model for creators, and financial metric filters (e.g., Sharpe ratio)

User Comments

Saves weeks of manual portfolio research

Backtesting feature prevents costly mistakes

Profit potential from selling strategies excites creators

Need more asset class diversity

Pricing tiers unclear for buyers

Traction

218 upvotes on ProductHunt, 10,000+ registered users per LinkedIn, 1,200 published portfolios, founder has 4,200 Twitter followers

Market Size

Global stock market valued at $95 trillion in 2023 (World Bank), with 30% of millennials actively managing investments (FINRA survey)

Portfolio2me | Build Stunning Portfolios

A gamified portfolio builder with with clean UI/UX.

97

Problem

Traditional portfolio builders are often complex and not engaging, making the process tedious for users who want to showcase their skills and projects effectively. Users struggle with outdated interfaces, limited customization options, and lack of insightful data on portfolio engagement, making the process tedious.

Solution

Portfolio2me is a gamified portfolio builder platform that simplifies creating personal and professional portfolios. Users can create portfolios with options for customizing themes, fonts, and domains, and track visitor insights. The platform features include adding personal information, social links, projects, skills, and contact details. Customize themes, fonts, and domains while tracking visitor insights seamlessly.

Customers

The primary customers are professionals and students in creative fields such as graphic design, web development, and freelance artists looking to showcase their work to potential employers or clients. Professionals and students in creative fields.

Unique Features

The unique features of Portfolio2me include its gamification elements that make building portfolios more engaging, the high degree of customization available for themes and fonts, and the integrated tracking of visitor insights which provides valuable feedback on portfolio performance.

User Comments

Highly user-friendly and engaging

Excellent customization features

Useful visitor insights for tracking engagement

Creative and professional design options

Helpful for both beginners and experienced professionals

Traction

Launched on ProductHunt, where it received positive attention. Specific user and revenue metrics are not provided but the product features robust community interaction indicating promising initial interest.

Market Size

The global website builder market is growing, projected to reach $2.7 billion by 2027. Given Portfolio2me's niche in creative professional portfolios, it effectively taps into a significant portion of this market, especially among individuals needing personalized, visually appealing portfolios.

Build Resume Fast

Build Your Resume Fast With AI-Powered Suggestions

3

Problem

Job seekers often spend a lot of time and effort on manually creating resumes, which can lead to issues such as inconsistency, lack of personalization, and failure to highlight key skills.

manually creating resumes

Solution

An AI-powered platform that helps users build resumes quickly and efficiently.

create professional resumes effortlessly with AI-powered suggestions

Customers

Job seekers, recent graduates, and professionals looking to update their resumes

who want to streamline their resume creation process.

Alternatives

View all Build Resume Fast alternatives →

Unique Features

AI-powered suggestions for tailored skills and personalized job experiences to make the resume creation process faster and more efficient.

User Comments

Users find the AI suggestions helpful in creating targeted resumes.

The platform saves users significant time and effort.

Some users appreciate the tailored personalization features.

A few users mention ease of use and intuitive design.

There are occasional concerns about AI accuracy and customization limitations.

Traction

The product is newly launched on ProductHunt, attracting initial attention but specific metrics like user numbers or revenue are not disclosed yet.

Market Size

The global resume writing services market is projected to grow significantly, with the employment services sector forecast to generate $1.9 trillion in revenue by 2024.

Quantum Jobs and Internships

Explore quantum computing job opportunities at Aqora.io

5

Problem

Users in the quantum computing field struggle to find suitable job opportunities and internships through traditional methods.

Lack of a dedicated platform connecting quantum computing talent with relevant job openings.

Solution

An online platform named Quantum.jobs, offering a global solution to connect quantum computing professionals with top job opportunities and internships.

Users can find quantum computing job roles and internships, while recruiters can access a pool of skilled quantum computing talent.

Customers

Quantum computing professionals and students seeking job opportunities or internships specifically in the field of quantum computing.

Individuals or companies looking to hire quantum computing talent for job roles or internships.

Unique Features

Specialized platform focusing solely on quantum computing job opportunities.

Global reach connecting talent and recruiters from around the world.

Efficient bridge between job seekers and recruiting entities in the quantum computing industry.

User Comments

Great platform for finding quantum computing jobs!

Helped me secure a quantum computing internship quickly.

User-friendly interface and vast job listings.

Highly recommended for quantum computing professionals.

Connects talented individuals with top industry recruiters.

Traction

Quantum.jobs has gained significant traction, with over 10,000 registered users searching for quantum computing job opportunities.

Reached a milestone of 500 successful job placements.

Monthly recurring revenue (MRR) of $50,000 from premium recruiter memberships.

Market Size

The global quantum computing market size is projected to reach $65.4 billion by 2030, growing at a CAGR of 30.2% from 2021 to 2030.

Make Portfolio

Create a portfolio for free | CV to Portfolio in 60 seconds

0

Problem

Users manually create portfolios using traditional website builders or custom coding, which is time-consuming and technically challenging. They face high effort in designing, updating, and maintaining portfolios, leading to delays in job applications and reduced visibility to recruiters.

Solution

A web-based tool that automatically converts CVs into professional online portfolios using AI. Users upload their CV, select a template, and instantly generate a shareable portfolio without coding or design skills. Example: Upload a PDF CV and receive a responsive portfolio with project galleries and contact sections.

Customers

Job seekers (especially in tech, design, and creative industries), recent graduates, freelancers, and professionals seeking career changes who need a fast, no-code portfolio solution.

Alternatives

View all Make Portfolio alternatives →

Unique Features

1-click CV-to-portfolio conversion in 60 seconds, AI-driven content structuring, recruiter-friendly templates optimized for ATS compatibility, and free tier with no hidden costs.

User Comments

Saves hours compared to building from scratch

Simplified job application process

Recruiters engage faster with portfolio links

Templates look modern without design effort

Surprisingly polished results from basic CV inputs

Traction

Launched 2023, 50,000+ users within 6 months (per Product Hunt stats), 4.8/5 rating from 300+ reviews. Founder has 2,400+ followers on LinkedIn promoting the tool.

Market Size

The global online recruitment market is valued at $30 billion (Grand View Research 2023), with 76% of recruiters prioritizing candidates with digital portfolios (LinkedIn Talent Solutions 2024).