What is Exponential Quantum?

Exponential Quantum is a portfolio optimization platform that uses quantum computing to select assets and allocate weights based on market conditions, risk factors, and macroeconomic data. It provides disciplined, data-driven investment strategies.

Problem

Users rely on traditional portfolio optimization methods that struggle with complex variables like market conditions, risk factors, and macroeconomic data, leading to suboptimal asset allocation and delayed adjustments.

Solution

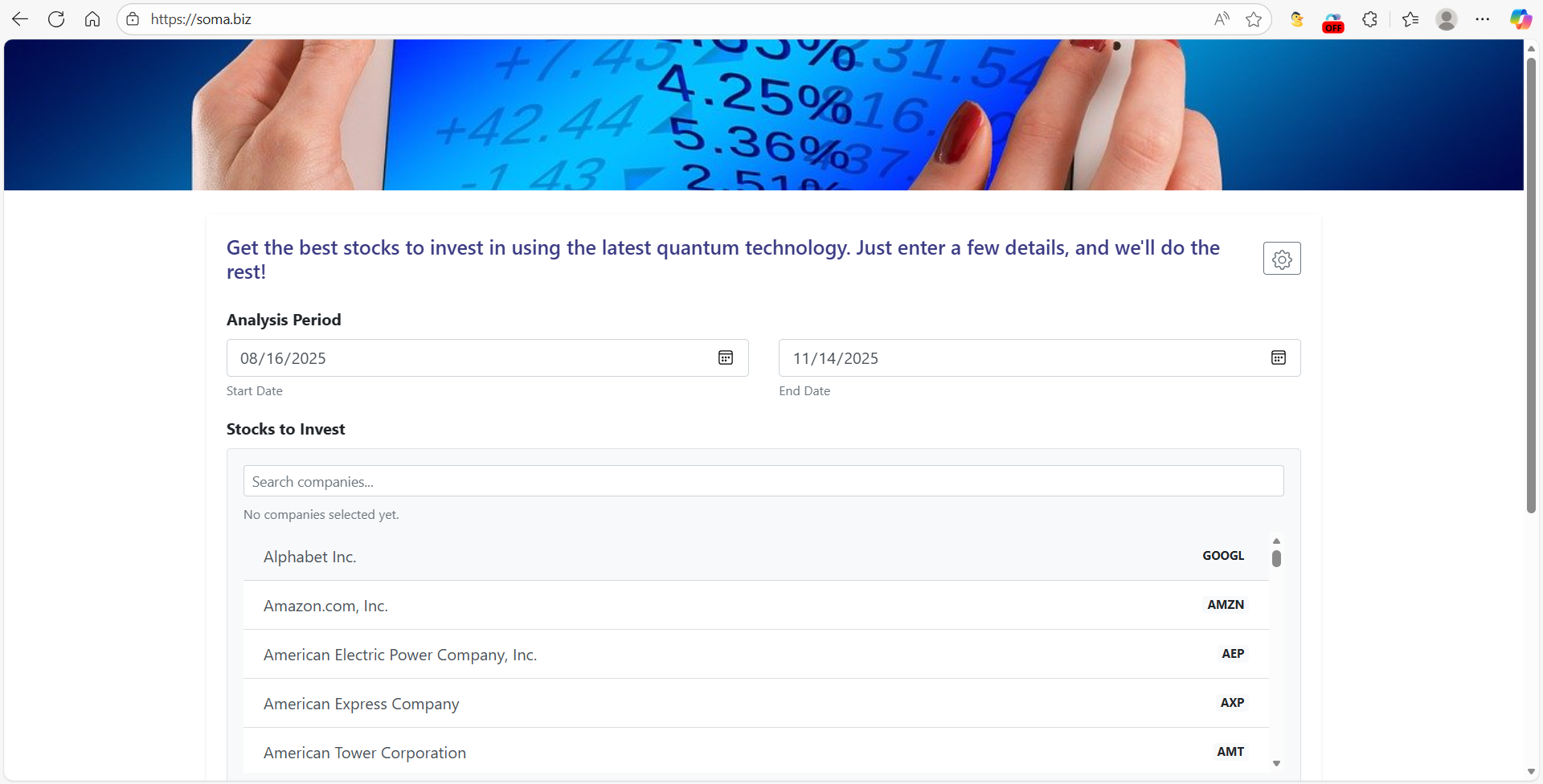

A quantum computing-powered portfolio optimization platform that lets users generate data-driven investment strategies by analyzing real-time market data, risk parameters, and macroeconomic trends. Example: Automatically rebalancing portfolios based on quantum-optimized algorithms.

Customers

Investment managers, financial analysts, and institutional investors seeking advanced tools to optimize asset allocation and mitigate risks in dynamic markets.

Unique Features

Leverages quantum computing for faster and more accurate portfolio optimization compared to classical algorithms; integrates real-time macroeconomic data feeds for adaptive strategy adjustments.

User Comments

Reduces manual portfolio rebalancing time

Improves risk-adjusted returns

Intuitive interface for non-technical users

Transparent data-driven insights

Enhances confidence in investment decisions

Traction

Launched 3 months ago; 500+ upvotes on ProductHunt; featured in 12+ fintech newsletters; founder has 2.4K followers on LinkedIn; partnered with 2 quantum computing providers (IonQ, D-Wave).

Market Size

The global quantitative finance software market is projected to reach $10.2 billion by 2027 (CAGR 12.3%), driven by demand for AI/quantum-powered portfolio optimization tools.