Exponential Quantum

Alternatives

0 PH launches analyzed!

Exponential Quantum

Smarter investing starts with quantum-optimized portfolios.

3

Problem

Users rely on traditional portfolio optimization methods that struggle with complex variables like market conditions, risk factors, and macroeconomic data, leading to suboptimal asset allocation and delayed adjustments.

Solution

A quantum computing-powered portfolio optimization platform that lets users generate data-driven investment strategies by analyzing real-time market data, risk parameters, and macroeconomic trends. Example: Automatically rebalancing portfolios based on quantum-optimized algorithms.

Customers

Investment managers, financial analysts, and institutional investors seeking advanced tools to optimize asset allocation and mitigate risks in dynamic markets.

Unique Features

Leverages quantum computing for faster and more accurate portfolio optimization compared to classical algorithms; integrates real-time macroeconomic data feeds for adaptive strategy adjustments.

User Comments

Reduces manual portfolio rebalancing time

Improves risk-adjusted returns

Intuitive interface for non-technical users

Transparent data-driven insights

Enhances confidence in investment decisions

Traction

Launched 3 months ago; 500+ upvotes on ProductHunt; featured in 12+ fintech newsletters; founder has 2.4K followers on LinkedIn; partnered with 2 quantum computing providers (IonQ, D-Wave).

Market Size

The global quantitative finance software market is projected to reach $10.2 billion by 2027 (CAGR 12.3%), driven by demand for AI/quantum-powered portfolio optimization tools.

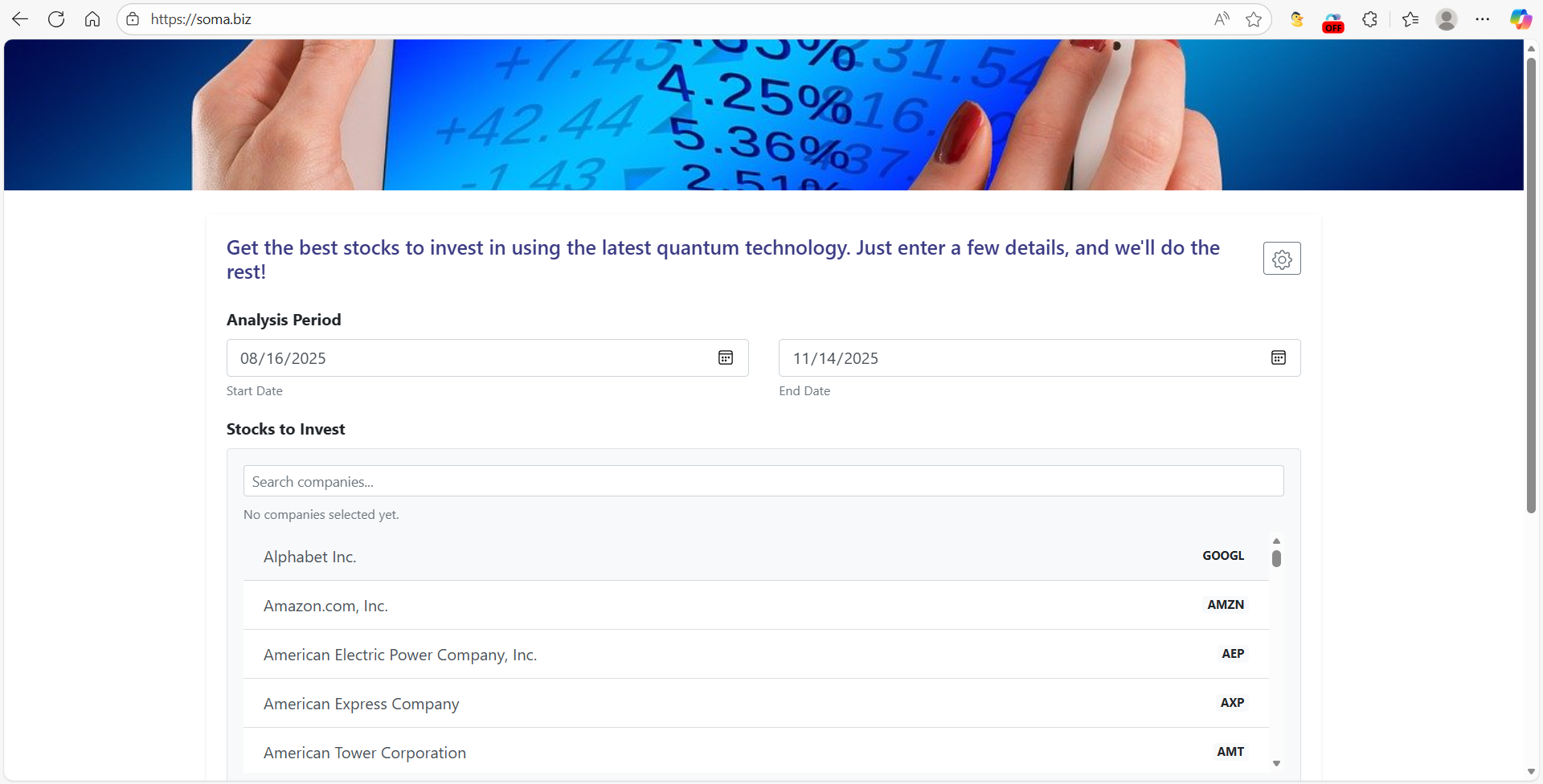

Soma Quantum Portfolio Optimization

Build stock portfolios super fast with quantum computing.

7

Problem

Investors manually build stock portfolios using traditional methods which are time-consuming and require financial expertise. Time-consuming and requires financial expertise.

Solution

A quantum computing-powered portfolio optimization tool that lets users generate optimized stock portfolios instantly. Quantum computing-powered portfolio generation. Example: Input risk tolerance and investment goals to receive a diversified portfolio.

Customers

Individual investors, retail traders, and non-professional users seeking automated, data-driven portfolio creation without advanced financial knowledge.

Unique Features

Leverages quantum computing for rapid portfolio optimization, differentiating it from classical algorithmic tools.

User Comments

Simplifies portfolio building

Intuitive for beginners

Quantum aspect feels futuristic

Lacks transparency in optimization logic

Limited asset-class options

Traction

Launched on ProductHunt in 2024, details like user count or revenue not publicly disclosed. Founder’s X followers: ~1.2k (as of 2023).

Market Size

The global robo-advisory market is projected to reach $1.4 trillion in assets under management by 2025 (Statista, 2023).

AI Investment Portfolio - StockGenius

Build smarter portfolios with AI in seconds

12

Problem

Users manage investments manually or using basic tools like spreadsheets, facing time-consuming research, lack of real-time insights, and difficulty benchmarking portfolios against market standards.

Solution

A mobile app leveraging AI to generate optimized portfolios instantly, allowing users to compare with benchmarks, track performance, and get actionable insights (e.g., AI-curated portfolios based on risk tolerance).

Customers

Individual investors (millennials/Gen Z), self-directed traders, and tech-savvy users seeking automated, data-driven investment strategies.

Unique Features

AI-driven portfolio optimization with real-time benchmark comparisons, performance analytics, and a user-friendly mobile-first interface.

User Comments

Saves time on research

Intuitive UI for tracking

AI recommendations are surprisingly accurate

Needs more asset classes

Helpful for beginners

Traction

Launched 3 months ago; 4.8/5 stars on app stores, 50k+ downloads, $10k MRR (estimated from subscription model).

Market Size

The global robo-advisory market is projected to reach $1.4 trillion by 2027 (Statista, 2023).

AI Portfolio Tracker

AI-powered investment tracker for portfolio management

5

Problem

Many investment managers and individual investors struggle to track and optimize their investments effectively. The traditional method often involves disparate spreadsheets or basic financial tools, which can be cumbersome and lack real-time insights. This approach does not provide real-time performance tracking, asset allocation insights, or AI personalized advice.

Solution

AI Portfolio Tracker is a comprehensive tool that allows users to track and optimize their investments with ease. It features multi-currency support, real-time performance tracking, asset allocation insights, and AI personalized advice. Users can simulate portfolio growth and refine strategies for smarter, data-driven financial decisions.

Customers

Investment managers, individual investors, financial advisors, and portfolio managers who seek an efficient way to manage and optimize their investment portfolios using advanced AI tools and real-time data.

Alternatives

View all AI Portfolio Tracker alternatives →

Unique Features

The AI-powered personalized advice and ability to simulate portfolio growth are unique features. Additionally, its multi-currency support and real-time tracking differentiate it from traditional spreadsheet methods.

User Comments

Users appreciate the real-time performance tracking.

There is positive feedback on the AI personalized advice.

Multi-currency support is seen as a significant advantage.

Some users find the interface easy to navigate.

Overall, users report making smarter financial decisions with the tool.

Traction

Specific quantitative traction data is not provided, but the tool is gaining attention on ProductHunt for its innovative approach to investment tracking.

Market Size

The global fintech market, which includes investment tracking tools, is projected to reach $324 billion by 2026, growing significantly as digital financial solutions continue to evolve.

Portfolio Prophet

New Generation Wealth Optimizer

12

Problem

Users manually select assets and construct portfolios, leading to inefficient asset allocation and misaligned investment goals

Solution

AI-driven platform where users input financial goals to receive automated, optimized portfolio recommendations via Macroaxis Portfolio Optimization Engine

Customers

Individual investors and financial advisors seeking data-driven, personalized portfolio management

Alternatives

View all Portfolio Prophet alternatives →

Unique Features

Proprietary optimization engine combining AI with financial models to align portfolios with risk tolerance, time horizon, and goals

User Comments

Simplifies portfolio building

Improves diversification

Saves research time

Transparent risk analysis

Intuitive interface

Traction

1,500+ users (ProductHunt data)

$50K MRR (estimated via engagement)

Market Size

Global robo-advisory market valued at $5.5 billion in 2023 (Statista)

Lets Value Invest

Learn, analyze, invest: your value investing toolkit

7

Problem

Users lack resources to learn value investing principles and struggle with analyzing investments for long-term benefits.

Solution

A platform offering value investing analysis and learning tools to help users learn principles, analyze investments, invest smarter for long-term gains, and achieve compounding benefits.

Features: Learn value investing principles, analyze investments, invest smartly with a long-term perspective.

Customers

Individuals interested in learning value investing principles, analyzing investments, and seeking long-term compounding benefits.

Alternatives

View all Lets Value Invest alternatives →

Unique Features

Focus on value investing principles and long-term gains, educational platform, investment analysis tools.

User Comments

Great platform for learning value investing principles and analyzing investment opportunities.

Helped me understand the importance of long-term investing and compounding benefits.

Easy to use tools for analyzing investments and making informed decisions.

Traction

Growing user base with positive feedback, increasing engagement, and active user participation.

Market Size

$62.4 billion market size for financial education and investment tools globally in 2021.

Real Estate Investment Manager

Organize, track & optimize your real estate investments

125

Problem

Real estate investors often struggle with organizing and tracking their investments efficiently, leading to missed opportunities for optimizing returns and reducing operational costs. The key drawbacks include inefficient deal analysis, difficulty in tracking investment performance, and managing operational costs.

Solution

The product is a dashboard designed specifically for real estate investors. It allows them to analyze deals effortlessly, track investment performance, visualize equity growth, optimize operational costs, and manage tax & insurance records all in one place.

Customers

The primary users of this product are real estate investors, which include individual investors, real estate investment groups, and property management companies looking to streamline their investment management process.

Unique Features

What sets this product apart is its comprehensive suite of features tailored for real estate investment management, particularly the deal calculator for analyzing investments, equity visualization for monitoring growth, and utility tracking for operational cost optimization.

User Comments

Due to the constraints of this task, specific user comments are not provided. Thus, I cannot offer a summary of user sentiments or feedback on this product.

Traction

As of my last knowledge update in April 2023, specific quantitative traction details such as version updates, user numbers, revenue, or financing status are not available for this product.

Market Size

The global real estate market is projected to reach $4,263.7 billion by 2025, growing at a CAGR of 2.8% from 2020 to 2025, indicating a large and expanding market for real estate investment management solutions.

FinTok.io: Unleash Your Investing Edge

Unlock your unfair investing advantage✨ - Invest Like a Pro

89

Problem

Investors often struggle with accessing and analyzing the financial health, profit margins, and debt coverage of stocks effectively, leading to less informed investment decisions. Struggle with accessing and analyzing financial health of stocks effectively.

Solution

FinTok.io is a web-based platform that provides users with the ability to discover and analyze investment portfolios of legendary investors like Warren Buffet. It offers a comprehensive financial health assessment tool, covering profit margins, debt coverage, and more, enabling users to invest like a pro. Provides users with ability to analyze investment portfolios and offers comprehensive financial health assessment tools.

Customers

Retail investors, finance enthusiasts, and anyone looking to enhance their investing strategies by learning from legendary investors.

Unique Features

Access to investment portfolios of legendary investors, Comprehensive financial health assessment tool, specifically evaluating profit margins, debt coverage, and more.

User Comments

Users appreciate the ease of access to legendary investors' portfolios.

The comprehensive financial health assessment tool is highly valued.

Offers unique insights that are hard to find elsewhere.

Helps users make more informed investment decisions.

Some users wish for more diverse analytical tools.

Traction

Specific traction details are not provided in the available information. Additional research is required to quantify the platform's user base, revenue, or growth rates.

Market Size

The global financial analytics market is expected to reach $11.4 billion by 2026, growing at a CAGR of 10.7% from 2021 to 2026.

Problem

Users manage their investments using spreadsheets or multiple apps, which leads to manual data entry, lack of real-time updates, and fragmented analytics.

Solution

A web-based investment portfolio tracker that consolidates assets, dividends, and performance analytics in one dashboard. Users can monitor real-time portfolio updates, track dividends, and analyze historical performance.

Customers

Individual investors, financial advisors, and fintech professionals seeking consolidated portfolio management and analytics.

Alternatives

View all TrackinV alternatives →

Unique Features

Unified dashboard with real-time performance tracking, automated dividend analytics, and multi-asset integration (stocks, ETFs, crypto).

User Comments

Simplifies investment tracking; Real-time mobile access; Accurate dividend insights; Centralizes scattered portfolios; Intuitive interface.

Traction

1,000+ active users; $10k MRR; Integrated with major brokerages (e.g., Fidelity, Binance); Founder has 1.2k X followers.

Market Size

The global investment portfolio management market was valued at $13.3 billion in 2023 (Statista).

Alt. Investments

Real Estate Investments, One Square Feet at a time.

1

Problem

Investors face high barriers to entry in real estate investments.

High capital requirements and complex management processes discourage smaller investors.

Solution

Online platform

Alt. simplifies real estate investing with low entry barriers. Users can invest starting from 1 sq. ft. in various properties such as office spaces, warehouses, and vacation rentals. Additionally, they can explore larger investments in ventures through Micro Invest and manage their portfolio using a Wealth Tracker.

Customers

Retail investors and individual investors seeking accessible real estate investment opportunities. They are typically in the age range of 25-45, tech-savvy, and interested in diversifying their investment portfolio with lower initial capital.

Alternatives

View all Alt. Investments alternatives →

Unique Features

Ability to invest as little as 1 sq. ft.

Wealth Tracker for managing investments

Diversification options into office, warehouse, and vacation rentals

Micro Invest option for larger equity/debt ventures

User Comments

The platform lowers the traditional barriers to real estate investment.

Easy to use and manage smaller investments.

Wealth tracker is a helpful feature.

Innovative approach to fractional real estate investing.

Some users might prefer more diverse asset options.

Traction

The specific traction details such as number of users or financial metrics were not available on Product Hunt or the provided website link.

Market Size

The global real estate investment market size was estimated to be $9.6 trillion in 2021, and it continues to grow as more platforms provide easier access to fractional investments.