Lilypay

Alternatives

0 PH launches analyzed!

Problem

Families traditionally pay upfront for funeral expenses, leading to financial stress and debt for over half of households unable to afford immediate costs.

Solution

A fintech platform offering buy now, pay later funeral and cemetery loans, enabling users to split payments into manageable installments for funeral services, burial plots, or memorial arrangements.

Customers

Individuals planning funerals for deceased family members, middle-to-low-income households, and funeral homes seeking to expand payment options for clients.

Alternatives

Unique Features

Specialized BNPL model exclusively for funeral and memorial costs, with direct partnerships with funeral service providers.

User Comments

Provides critical financial relief during grief

Simplifies access to essential services

Lacks widespread funeral home partnerships

Transparent payment terms

Limited awareness in rural areas

Traction

Newly launched with partnerships in select U.S. regions; exact user numbers undisclosed. Funeral industry valued at ~$20B annually in the U.S., indicating scalable demand.

Market Size

The U.S. funeral services market was valued at $20 billion in 2023 (IBISWorld).

Buy Github Account (Order now)

Buy Github Account (order now)

1

Problem

Users looking for Github accounts may face security risks, authentication issues, and high costs.

Solution

An e-commerce platform offering Buy Github Accounts with PVA Verification, providing fully secure and authenticated Github accounts at affordable rates.

Customers

Developers, tech entrepreneurs, IT professionals, and businesses seeking Github accounts for various projects and collaborations.

Unique Features

Secure and fully authenticated Github accounts at affordable rates, offering both new and old accounts with PVA Verification.

User Comments

Affordable Github accounts with quick delivery.

Seamless account verification process.

Great customer service for any account-related issues.

Trusted source for authentic Github accounts.

Easy ordering process and secure transactions.

Traction

The product has gained traction with an increasing number of customers due to its reliable and affordable Github account offerings.

Market Size

The global market for IT services is projected to reach $1.2 trillion by 2025, indicating a significant demand for secure and authenticated IT-related products and services like Github accounts.

Should I Pay Off Loan

Smarter Choices, Better Future

3

Problem

Users struggle with manually calculating and understanding the financial implications of paying off loans early, leading to potential financial mistakes or missed opportunities due to complex loan terms, interest rates, and prepayment penalties.

Solution

A web-based financial analysis tool where users input loan details to simulate repayment scenarios. Comprehensive algorithms evaluate interest savings, penalties, and opportunity costs, providing personalized recommendations (e.g., a user checks if paying off a $50k mortgage early saves more than investing).

Customers

Individuals with mortgages, student loans, or personal loans; demographics: ages 25-50, tech-savvy, income $50k-$150k. They frequently budget, invest, or seek debt-management strategies.

Unique Features

Scenario simulations (e.g., adjusting timelines or interest rates), interactive dashboard visualizing long-term impacts, and customizable inputs for taxes/inflation.

User Comments

Clears confusion about prepayment trade-offs

Saves hours of manual calculations

Simple interface for non-experts

Needs more loan types (e.g., business loans)

Lacks tax implications in results

Traction

Launched 2024, 10k+ users, $5k MRR. Founder has 1.2k LinkedIn followers. Version 1.0 focuses on basic loans; plans to add tax analysis and multi-loan comparisons.

Market Size

The $3.4 billion personal finance software market (2023) and $1.7 trillion U.S. student loan debt indicate high demand for debt-management tools.

Affordable Loan to Buy a House

Debt-to-Income Affordable Monthly Mortgage for Home Purchase

6

Problem

Potential home buyers face challenges in understanding their monthly mortgage payment capacity and the total loan amount they can afford.

The traditional process might not clearly explain the relation between debt-to-income ratio and affordable monthly payments, leading to confusion.

Understanding their monthly mortgage payment capacity

Relation between debt-to-income ratio and affordable monthly payments

Solution

An online tool that calculates affordable monthly mortgage payments based on the user's financial situation, specifically focusing on the debt-to-income ratio.

Users can input their financial information to determine their monthly mortgage payment capacity and total loan amount.

Calculates affordable monthly mortgage payments

Customers

Potential home buyers, mainly individuals aged 25-45, who are financially planning to purchase a house and need clarity on their mortgage capabilities.

They are likely to be employed or self-employed, with a moderate level of financial literacy, looking to transition from renting to owning a home.

Unique Features

Focuses on debt-to-income ratios to provide a realistic picture of what users can afford in terms of monthly mortgage payments and total loan amount.

Helps users compare buying vs. renting, aiding in better decision making.

User Comments

Users appreciate the clarity offered by the tool in understanding their mortgage capabilities.

Some users find the debt-to-income analysis particularly useful.

The product is praised for simplifying complex financial calculations.

A few users wish it had more personalized features or recommendations.

Overall, the tool is seen as an informative resource for potential home buyers.

Traction

As a Product Hunt listing, specific traction details such as user numbers or revenue are not provided. Additional external research might be required to gather precise data.

Market Size

The global mortgage lending market was valued at approximately $7.3 trillion in 2020, and it is expected to grow steadily as more individuals seek homeownership and financial tools to aid them.

Problem

Users manually decide who pays in group settings, leading to arguments and inefficiency.

Solution

A mobile app offering four interactive mini-games (e.g., Magic Finger, Roulette) to randomly and entertainingly determine who pays the bill.

Customers

Young professionals, families, and friends who frequently dine or socialize in groups and seek a fair, fun decision method.

Unique Features

Unique gamified approach with multiple mini-games, combining randomness and humor to reduce friction in group payment decisions.

User Comments

Solves payment disputes playfully

Engaging for group gatherings

Easy to use and visually appealing

Makes paying bills less awkward

Adds excitement to routine decisions

Traction

Launched on Product Hunt (exact metrics unavailable from provided data). Requires Bing search for detailed traction (e.g., downloads, revenue).

Market Size

The global mobile app market is projected to reach $935 billion by 2027 (Statista, 2023), with social/fun apps driving engagement.

Flash Loan Bot

Turbocharge Your Trading Victory With Our Flash Loan Bot

4

Problem

Current situation involves users trying to profit within the DeFi space but facing significant challenges.

Drawbacks: DeFi inefficiencies lead to unrealized potential profits and complexities in executing arbitrage opportunities.

Solution

It's a Flash Loan Bot designed to capitalize on DeFi inefficiencies.

With this bot, users can automate arbitrage trading strategies, optimizing profit potential in flash loans.

Customers

Cryptocurrency traders and DeFi investors seeking to leverage technology for automated trading opportunities.

They are typically tech-savvy individuals familiar with blockchain technologies.

Unique Features

The bot specifically targets flash loan opportunities and streamlines the process of executing them, something not commonly available in standard trading tools.

Traction

Little available data about versions or user base specifics, but the focus is on generating returns and utilizing DeFi inefficiencies.

Market Size

The global DeFi market, a growing segment in the cryptocurrency industry, exceeded $13 billion in total value locked by 2023.

CrediSure Mobile App

Credit scores, Loans & BNPL, all in one app

2

Problem

Users face challenges managing their credit scores and accessing financial services in Nigeria. Traditional methods are fragmented, requiring multiple platforms for credit checks, loan applications, and BNPL options. Lack of integrated solutions and limited financial flexibility hinder financial growth.

Solution

A mobile app combining credit score management, loan access, and BNPL services. Users can check/build credit scores, access loans, and use flexible payment options in one platform. Example: Track credit health and apply for instant loans.

Customers

Nigerian young professionals, small business owners, and individuals seeking credit who need streamlined financial tools to build creditworthiness and access funds.

Unique Features

All-in-one financial hub integrating credit monitoring, loan services, and BNPL with a focus on transparency and user empowerment.

User Comments

Simplifies loan applications

Helps improve credit scores

Convenient BNPL options

User-friendly interface

Trustworthy financial partner

Traction

Newly launched on ProductHunt (specific metrics like users/MRR not publicly disclosed).

Market Size

Nigeria’s digital lending market is projected to reach $3 billion by 2025 (Statista).

Buy Verified Binance Accounts

Buy Verified Binance Accounts

1

Problem

Users looking to trade on Binance may face challenges in creating and verifying accounts, leading to potential delays and hindrances in accessing the platform.

Drawbacks of the old situation: Manual account creation and verification processes can be time-consuming and error-prone.

Solution

Email and telecommunication form for purchasing pre-verified Binance accounts

Users can: Buy pre-verified Binance accounts without the hassle of manual creation and verification processes.

Core features: 100% Good quality USA, UK, CA verified Binance accounts with a 100% money-back guarantee.

Customers

Traders on Binance seeking to quickly access verified accounts without undergoing manual verification.

Unique Features

Pre-verification of accounts saves time and ensures a smooth onboarding process for traders.

User Comments

Quick and reliable service for acquiring verified accounts.

Convenient and efficient way to access Binance accounts.

Positive feedback on the quality and reliability of the accounts provided.

Satisfied users appreciate the money-back guarantee offered.

Some users value the multiple communication channels for support.

Traction

Specific traction details are not available from the provided sources.

Market Size

Global market size for trading accounts: The market for verified trading accounts is significant and growing, with demand for streamlined onboarding processes.

Pay Once Apps

Discover pay-once apps and save money; use them forever

73

Problem

Users are overwhelmed by subscription-based apps leading to high monthly expenses and subscription fatigue. The drawbacks are the ongoing monthly costs and the complexity of managing multiple subscriptions.

Solution

Pay Once is a website that curates a collection of apps and software available for a one-time purchase. Users can discover and buy independent and well-established apps that they can use forever without recurring fees. Discover pay-once apps and save money; use them forever.

Customers

Cost-conscious consumers who prefer owning software outright to avoid recurring subscription fees, including individual users and small business owners looking for cost-effective software solutions.

Unique Features

The unique selling proposition of Pay Once is its focus on apps and software that require a single payment for lifetime access, distinguishing it from the common subscription-based model.

User Comments

Users appreciate the cost-saving aspect of pay-once apps.

Many find the site useful for discovering new and independent software.

Positive feedback on the variety of software categories covered.

Users value the convenience of avoiding monthly or annual subscriptions.

Some users express a desire for more frequent updates and additions to the available apps.

Traction

As of the latest data available, specific quantitative metrics such as number of users, MRR, or funding information for Pay Once were not disclosed.

Market Size

Specific market size data for pay-once software platforms is not readily available. However, the global software market, which includes a segment for such products, was valued at $593.4 billion in 2022.

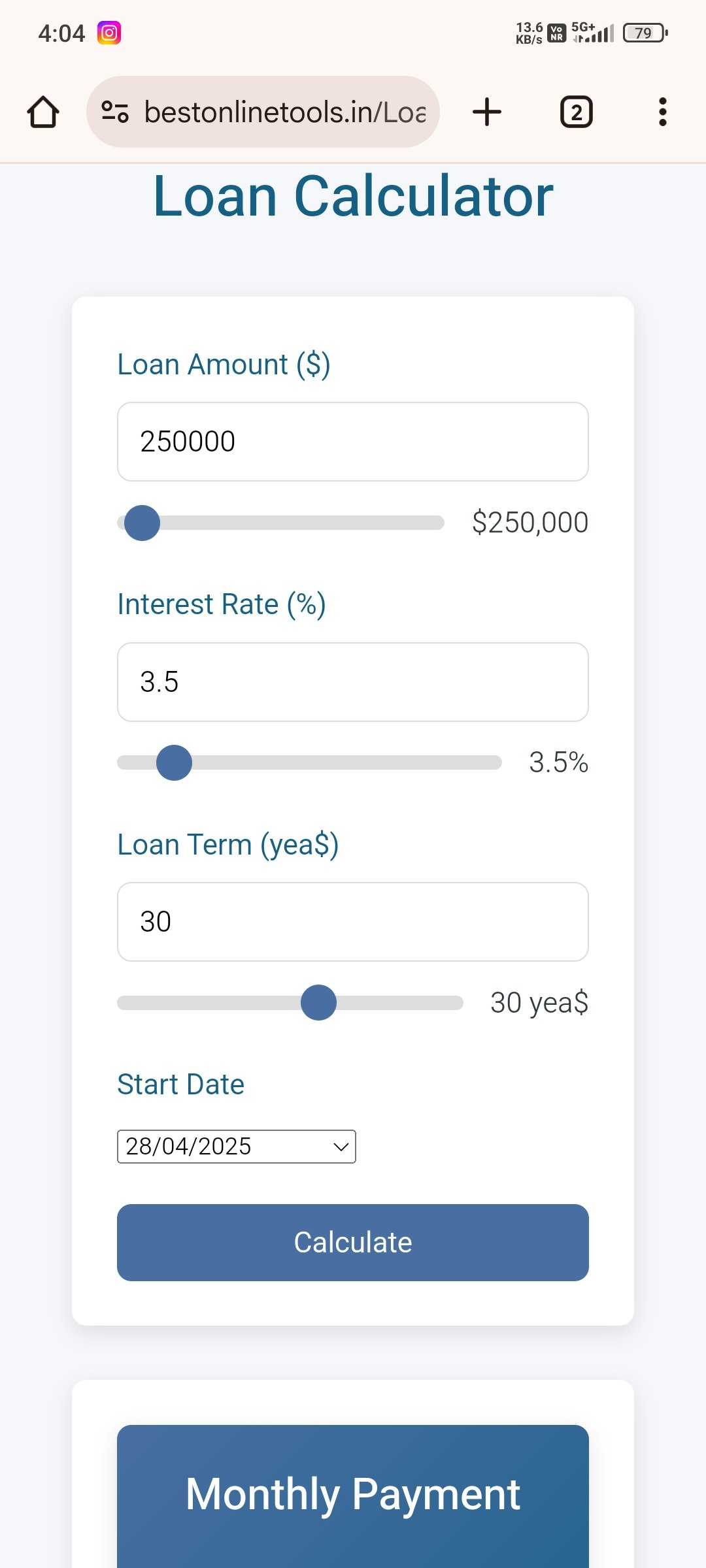

Loan Calculator

Free Loan Calculator

3

Problem

Users need to manually calculate loan details like EMI, interest rates, and total loan amounts using spreadsheets or basic tools, which are time-consuming and error-prone.

Solution

A web-based loan calculator tool that allows users to input loan parameters and instantly calculate EMI, interest rates, and total loan amounts automatically. Examples: personal, home, car, and business loan planning.

Customers

Borrowers, financial advisors, and loan officers (demographics: adults aged 25–60, financially conscious individuals, small business owners).

Unique Features

Supports multiple loan types (personal, home, car, business), provides instant results without signup, and offers accuracy for informed financial decisions.

Traction

Launched on ProductHunt (specific metrics unavailable due to limited data).

Market Size

The global personal loan market was valued at $50 billion in 2023 (Source: Grand View Research).