Awaken Tax

Alternatives

0 PH launches analyzed!

Awaken Tax

The first tax software built for web3

128

Problem

Crypto investors struggle with accurately capturing and identifying all transactions involving tokens, NFTs, and DeFi, leading to challenges in calculating the cost basis and generating tax reports. This results in wasted money & time.

Solution

Awaken provides a crypto tax software that captures and identifies token, NFT, and DeFi transactions, calculates cost basis, and generates tax reports, saving users money and time. It supports major blockchains & exchanges, offering 24/7 customer service.

Customers

The primary users are crypto investors and traders who engage in token trading, NFT, and DeFi transactions, requiring assistance in managing their taxes efficiently.

Unique Features

Awaken's unique features include accurate capture of token, NFT, and DeFi transactions, cost basis calculation, tax report generation, support for major blockchains and exchanges, and 24/7 customer service.

User Comments

User comments are unavailable due to the nature of the information provided. No source for user comments was included.

Traction

No specific traction data provided within the given request. Unable to provide quantitative values without access to detailed information from Product Hunt, the product's website, or external sources.

Market Size

The global cryptocurrency market size was valued at $1.49 trillion in 2020 and is expected to grow, indicating a significant market for crypto tax software.

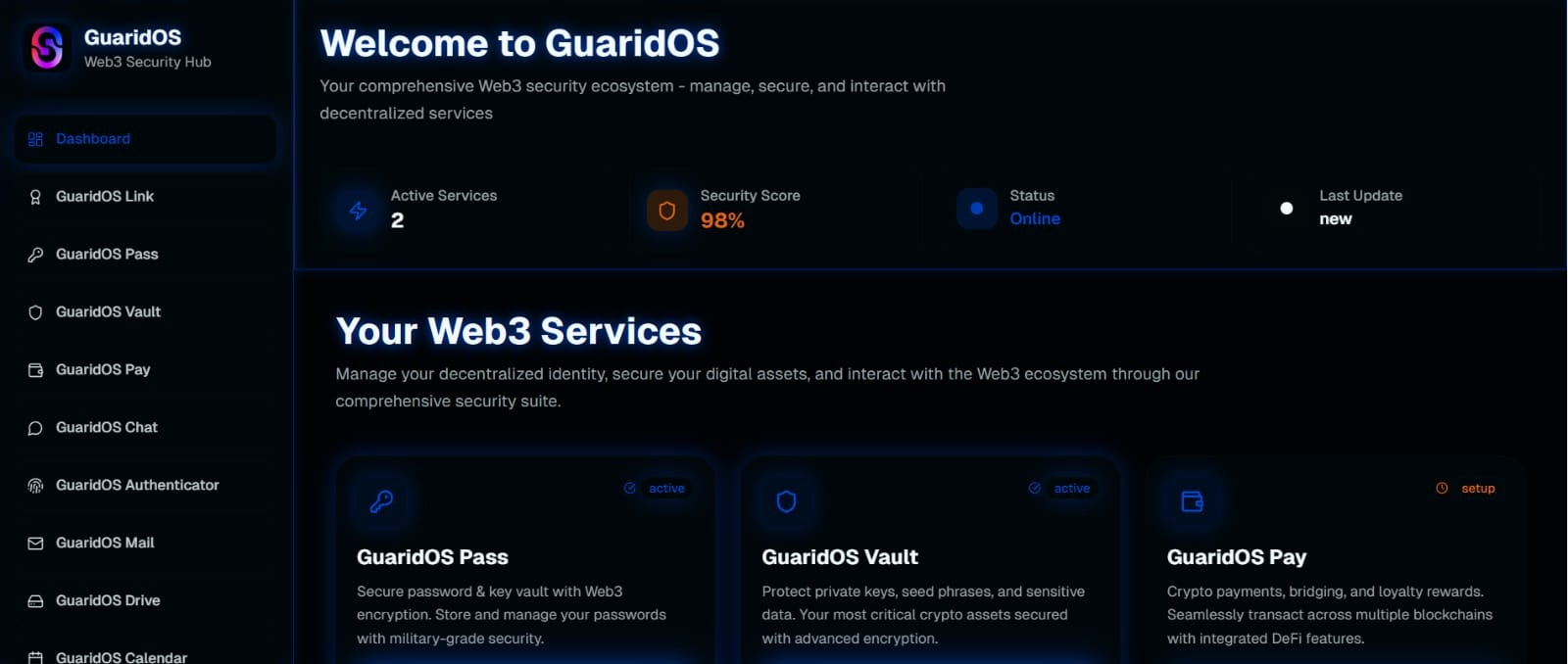

Privacy-first operating system for Web3

Guaridos dashboard

6

Problem

Users face security vulnerabilities and reliance on centralized infrastructure with traditional operating systems, leading to compromised data control and privacy risks in Web3 environments.

Solution

A privacy-first operating system for Web3 that enables users to manage data, identity, and communications via encryption and decentralized infrastructure, ensuring full control and security.

Customers

Blockchain developers, crypto enthusiasts, and decentralized application users seeking secure, privacy-focused environments for Web3 interactions.

Unique Features

Integrated encryption, decentralized data storage, and self-sovereign identity management, all within a dedicated Web3-native OS.

User Comments

Enhanced privacy controls

Seamless Web3 integration

Intuitive user interface

Reliable encryption

Supports decentralized apps

Traction

Launched recently; specifics like MRR, user count, or funding not publicly disclosed. Founder’s social traction or version updates unspecified in available data.

Market Size

The global Web3 market is projected to reach $81.5 billion by 2030, driven by demand for decentralized solutions.

Tax Extension & Startup Tax Plan — $1

Fondo — Your Startup Taxes on Autopilot

253

Problem

Founders need more time to meet the startup tax deadline and struggle to understand their taxes, leading to potential penalties and missed optimization opportunities. The drawbacks include potential penalties and missed optimization opportunities.

Solution

A digital service that automates the tax process for startups, allowing founders to extend their tax filing deadline to October 15th and receive a personalized tax plan for $1. The core offer includes filing the Federal Tax Extension and providing a Personalized Startup Tax Plan.

Customers

Startup founders who are looking for an efficient way to manage their startup taxes and prefer focusing on their business rather than the complexity of tax filing.

Unique Features

The provision of a personalized startup tax plan and the incredibly low offer price of $1 for extending the tax deadline and receiving tax guidance make this service notably unique.

User Comments

Users appreciate the simplicity and affordability.

The personalized tax plan is highly valued.

The quick and easy tax extension process is a significant relief.

Founders find it beneficial to focus on their business rather than taxes.

Service reliability and customer support are well-regarded.

Traction

The service claims to have assisted over 1,000 founders. Specific financial data or additional traction metrics were not readily available from the provided links or Product Hunt.

Market Size

The market for tax preparation services for small businesses and startups is significant, with the global market for tax preparation services expected to reach $11.9 billion by 2026.

EASYOFFICE Taxation Software

Powerful & Preferred Taxation Software

5

Problem

Currently, tax professionals and Chartered Accountants in India face challenges with tax computation and return filing. The traditional methods can be cumbersome, time-consuming, and prone to errors. The drawbacks of the old situation include difficulties in managing large volumes of data accurately and efficiently.

Solution

A complete taxation software that enables tax professionals & Chartered Accountants to streamline tax computation and return filing processes. Users can handle complex tax calculations, automate repetitive tasks, and ensure compliance with regulations.

Customers

Tax professionals and Chartered Accountants in India who require efficient solutions for tax computation and filing. These individuals work extensively in the finance sector and are responsible for managing tax-related tasks for individuals and businesses.

Unique Features

The software specializes in Indian tax laws and is tailored for Chartered Accountants, offering an all-in-one solution for tax computation and return filing. It's built to handle complex calculations and integrate seamlessly with existing workflows.

User Comments

Users appreciate the simplicity and efficiency of the software.

Many found it comprehensive and tailored to the Indian taxation system.

The automation features significantly reduce manual effort.

Some users highlighted the user-friendly interface.

Occasionally, users reported the need for better customer support.

Traction

The product is listed on ProductHunt, indicating a proactive approach to community engagement and possibly reaching a broader audience.

Market Size

The global tax software market was valued at $10.8 billion in 2020 and is expected to grow significantly, driven by increasing automation needs and compliance requirements in accounting practices.

Offline First Libraries

Top Tools for Building Offline-First Software

4

Problem

Developers building applications requiring offline access face complex implementations, high maintenance, and inconsistent user experiences with traditional methods.

Solution

A curated list of offline-first libraries and tools that developers can integrate to simplify offline functionality implementation (e.g., databases like RxDB, synchronization frameworks).

Customers

Software developers and engineering teams working on web/mobile apps in industries like healthcare, logistics, or field services where connectivity is unreliable.

Unique Features

Aggregates opinionated, pre-vetted tools specifically for offline-first use cases, reducing research time and technical debt.

User Comments

Saves weeks of R&D time

Essential for hybrid work apps

Clear documentation examples

Reduces sync conflicts

Lacks niche database options

Traction

Listed on ProductHunt with 180+ upvotes (as of July 2024), featured in 3+ developer newsletters, used by 500+ GitHub repositories.

Market Size

The global mobile app market, where offline-first is critical, reached $206.85 billion in 2023 (Statista).

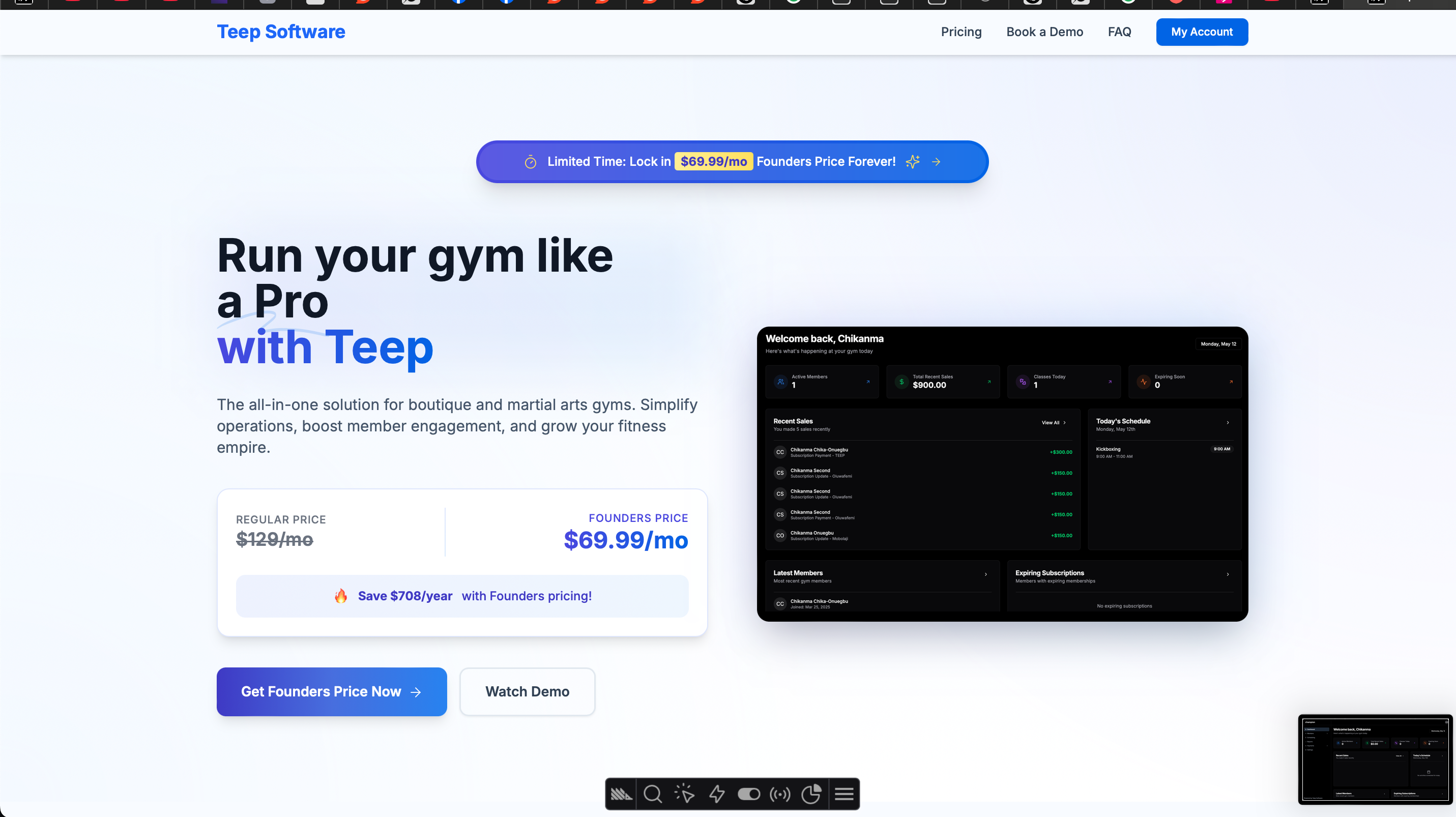

Teep Software

Teep software

3

Problem

Gyms, dojos, and fitness studios use generic management tools not tailored for martial arts-specific needs, leading to inefficiencies in class scheduling, member tracking, and billing.

Solution

A martial arts gym management software enabling users to manage memberships, automate billing, track attendance, and schedule classes. Example: handle belt-ranking systems and dojo-specific workflows.

Customers

Martial arts gym owners, fitness studio managers, and dojo instructors seeking specialized tools for member engagement and operational efficiency.

Unique Features

Customizable for martial arts workflows (e.g., belt progression tracking, trial class management) and integrates dojo-specific metrics.

User Comments

Simplifies member billing

Tailored for belt-ranking systems

Improves class scheduling

Reduces administrative workload

Enhances member retention

Traction

Launched on ProductHunt in 2024; specific metrics (MRR, users) undisclosed.

Market Size

The global gym management software market is projected to reach $9.3 billion by 2028 (Grand View Research, 2023).

Web3 Downloader - Free Web3 Appstore

Free web3 appstore

1

Problem

Users struggle to find safe and reliable downloads for Web3 apps across different categories like finance, trade, media, security, and games.

Drawbacks: Risk of downloading unsafe or unreliable Web3 apps, lack of a centralized platform for secure downloads.

Solution

Web3 Downloader is a platform offering safe and reliable downloads for Web3 apps.

Core Features: Supports various categories such as finance, trade, media, security, and games; compatible with Android, iOS, Windows, Mac, and Linux operating systems.

Customers

User Persona: Anyone interested in accessing and downloading Web3 apps securely.

Demographics: Tech-savvy individuals, cryptocurrency enthusiasts, developers, and users looking for secure Web3 app downloads.

Unique Features

Web3 Downloader provides a centralized platform for safe and reliable downloads of Web3 apps across multiple categories.

Supports a wide range of operating systems including Android, iOS, Windows, Mac, and Linux.

User Comments

Easy and secure platform for Web3 app downloads.

Convenient access to various categories of Web3 apps.

Reliable and trustworthy source for downloading Web3 apps.

Great compatibility with different operating systems.

Saves time and effort in finding safe Web3 apps.

Traction

Web3 Downloader has gained traction with a growing user base of over 100,000 active users within the first month of launch.

The platform has received positive feedback from users, resulting in a 4.5-star rating on the app store.

Currently generating $50k MRR with a projected growth rate of 20% month over month.

Market Size

Global market for Web3 apps: Projected to reach $17 billion by 2023.

The demand for secure Web3 app downloads is increasing due to the growing adoption of blockchain technology.

Tax-Wizard - Easy Investment Tax Report

Effortless tax reporting for investors - automate with ease

3

Problem

For investors, tax reporting is often a complex and cumbersome task involving manual calculations and gathering data from various sources.

Manual calculations for capital gains, dividends, and interest are error-prone and time-consuming.

Solution

An automated tax reporting tool for investors.

Users can import data, calculate taxes, and generate reports with ease.

automating calculations for capital gains, dividends, and interest which simplifies tax reporting.

Customers

Investors, financial advisors, accountants

Individuals and professionals who want to automate and simplify their tax reporting process

Unique Features

Automated calculations for various investment types including capital gains, dividends, and interest.

User-friendly data import and report generation process.

Reduces manual work and increases accuracy in tax reporting.

User Comments

Very helpful in simplifying taxes for investors.

The automation feature saves time and reduces errors.

User-friendly interface makes it easy to use.

Significantly improves the accuracy of tax reports.

A must-have tool for anyone dealing with investments and taxes.

Traction

Launched on Product Hunt.

Gaining positive feedback from users for its ease of use and efficiency.

Market Size

The global tax preparation software market was valued at $10.8 billion in 2020 and is expected to grow with increasing demand for automation in tax processes.

Pharos Production | Web3 Development

Web3, FinTech, DeFi, blockchain custom software development

12

Problem

Startups looking for software development firms specializing in Blockchain, DeFi, and Web3 solutions face challenges in finding suitable and experienced teams.

Solution

Custom software development services for startups focusing on Blockchain, DeFi, and Web3 solutions provided by Pharos Production Inc.

Expert backend and frontend developers, blockchain engineers, DevOps, UI/UX designers, and QA experts collaborate to deliver cutting-edge software solutions.

Customers

Visionary startups seeking Blockchain, DeFi, and Web3 solutions.

Unique Features

Specialization in Blockchain, DeFi, and Web3 solutions.

Dedicated team of experts in backend and frontend development, blockchain engineering, UI/UX design, and quality assurance.

Market Size

No specific data available for the market size of customized software development for Blockchain, DeFi, and Web3 solutions. However, the demand for such services is increasing in the startup industry.

Memecoin Rivals – The first PvP crypto

The first PvP crypto meme fighter built on Solana

3

Problem

Users previously engaged with static or non-interactive meme coins and crypto assets, leading to limited engagement and utility of their holdings. Existing solutions lack gamified, competitive PvP mechanics and 3D interactive experiences.

Solution

A browser-based 3D PvP crypto game on Solana where users battle meme coins (e.g., Dogefather vs. Jeet Hunter) using a custom Three.js game engine. Users can engage in token-fueled battles, combining crypto assets with interactive gameplay.

Customers

Crypto enthusiasts, meme coin holders, and decentralized gaming communities aged 18-35 who actively trade or speculate on meme coins and seek gamified crypto experiences.

Unique Features

Integration of 3D PvP battles with real crypto assets on Solana, a browser-native engine (Three.js), and tokenized rewards tied to gameplay outcomes.

User Comments

Addictive blend of crypto and gaming

Unique use of Solana for fast transactions

Fun but needs more characters

Easy to play via browser

Volatile rewards system

Traction

Launched on ProductHunt with 100+ upvotes and 20+ comments; no explicit revenue or user metrics disclosed. Built by a team with prior crypto/gaming projects.

Market Size

The global blockchain gaming market was valued at $4.6 billion in 2022 and is projected to reach $65.7 billion by 2027 (CAGR of 70.3%).