What is alphaAI Capital?

alphaAI Capital dynamically manages your portfolio using AI, shifting between aggressive and defensive modes as market conditions change. Access fully-automated leveraged ETF, crypto ETF, and tax-aware strategies tailored to your risk profile.

Problem

Investors manually manage their portfolios and struggle to react quickly to market volatility, leading to missed opportunities and emotional decision-making.

Solution

AI-driven trading app where users automate portfolio adjustments via AI that dynamically switches between aggressive/defensive strategies based on real-time markets (e.g., leveraged ETF, crypto ETF allocations).

Customers

Individual investors (ages 25–50) with moderate to high risk tolerance, tech-savvy professionals, and active traders seeking automated tax-aware strategies.

Unique Features

Real-time AI market adaptation, automated tax-loss harvesting, and integration of leveraged/crypto ETFs without manual rebalancing.

User Comments

Saves time on market monitoring

Reduces emotional trading decisions

Simplifies tax optimization

Adapts faster than human analysis

Supports diverse risk profiles

Traction

Exact metrics unavailable, but comparable robo-advisors like Betterment manage over $35 billion AUM; Product Hunt launch likely targets early adopters in trading communities.

Market Size

Global robo-advisory market projected to reach $1.4 trillion AUM by 2025 (Statista, 2023).

Alternative Products

AI Forge APP AI-Generated Content Market

ecommerce, apps, app market, ai tools, ai apps, ai-generated

# App Builder

Keist.ai - AI trading strategies

The Smartest Way to Trade Crypto - AI-powered trading

# Investing Assistant

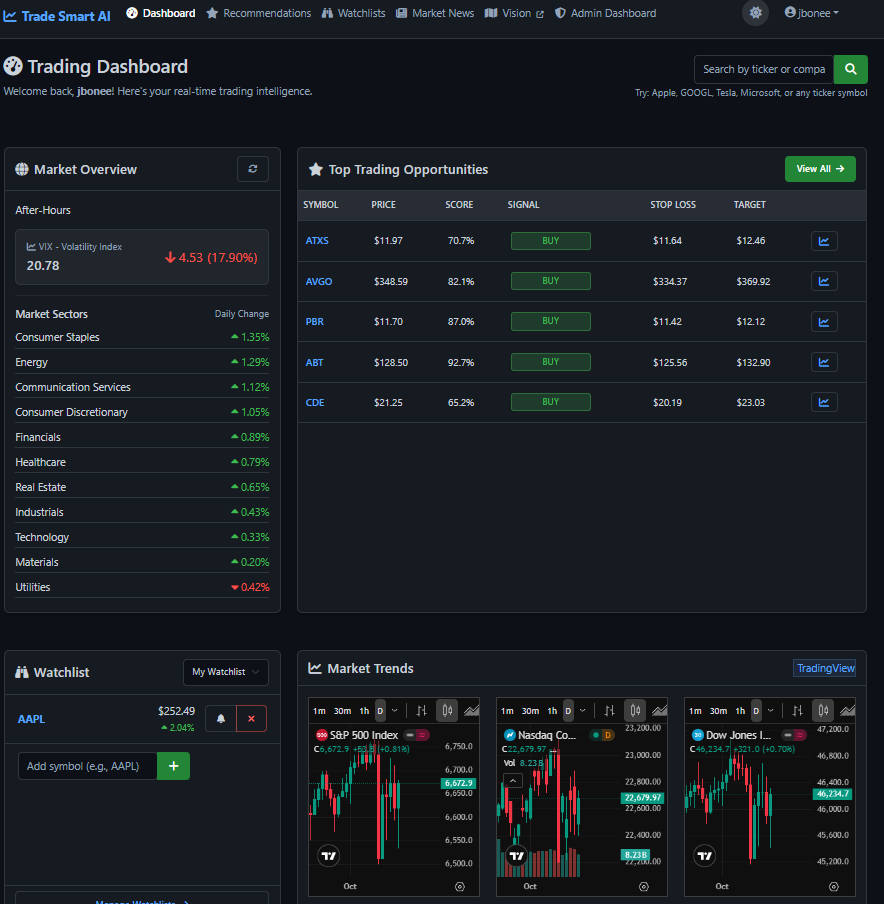

Trade Smart - AI Market Intelligence

AI trading signals with hedge fund-grade market analysis

# Investing Assistant