Trade Smart - AI Market Intelligence

AI trading signals with hedge fund-grade market analysis

# Investing AssistantWhat is Trade Smart - AI Market Intelligence?

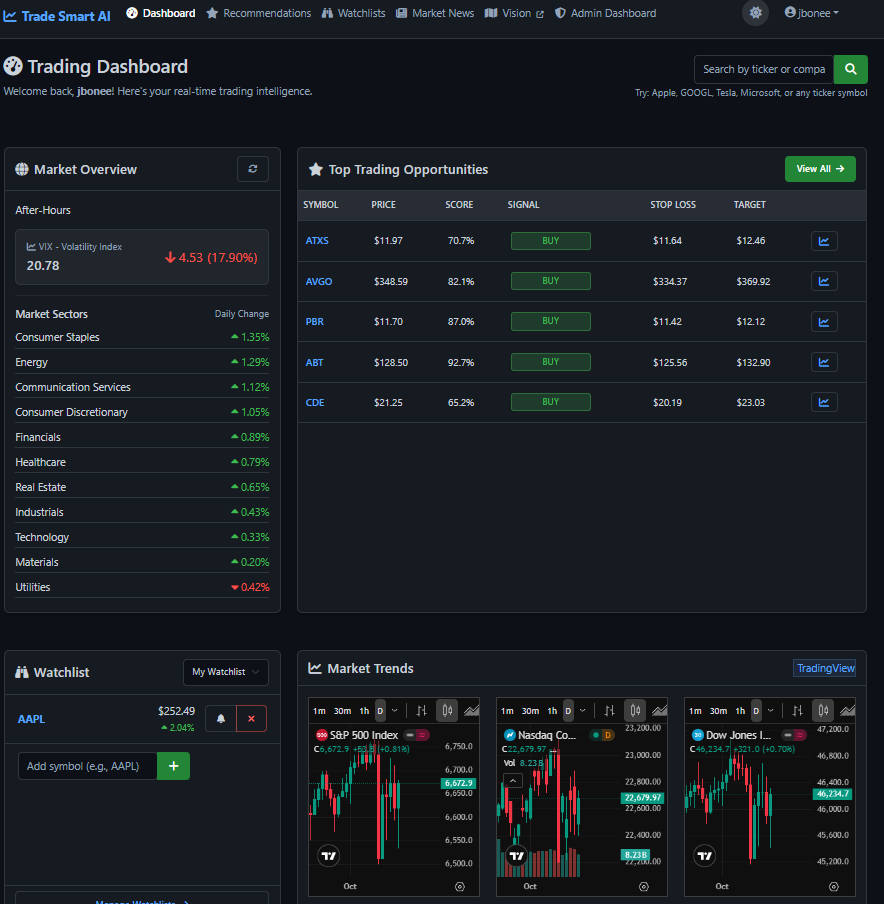

Hedge fund-grade trading signals for retail traders. Our ensemble AI analyzes market microstructure, order flow, and behavioral patterns to generate buy/sell recommendations. Every signal includes stop-loss, take-profit, and transparent reasoning.

Problem

Retail traders rely on basic market analysis tools and manual research, facing limited access to hedge fund-grade analysis, resulting in suboptimal trading decisions with poor risk management.

Solution

AI-powered trading intelligence platform enabling users to generate buy/sell signals via ensemble AI analyzing market microstructure, order flow, and behavioral patterns, with stop-loss/take-profit guidance and transparent reasoning.

Customers

Retail traders, active investors, and day traders seeking institutional-level analysis without hedge fund resources, often tech-savvy individuals aged 25-45 trading stocks/crypto.

Unique Features

Combines hedge fund-grade microstructure analysis with behavioral pattern recognition, offers real-time signals with explicit risk parameters (stop-loss/take-profit), and explains AI-driven reasoning transparently.

User Comments

Saves hours of manual analysis

Improves trade accuracy significantly

Clear risk management guidelines

User-friendly for non-experts

Transparent AI logic builds trust

Traction

Launched 4 months ago, 8k+ registered users, $45k MRR (via Product Hunt listing), featured in 3 fintech newsletters, founder has 3.2k LinkedIn followers.

Market Size

The global algorithmic trading market was valued at $18.8 billion in 2022 (Grand View Research), projected to grow at 10.3% CAGR through 2030.