Yamawake

Alternatives

0 PH launches analyzed!

Problem

The users currently face challenges in launching tokens in a fair and transparent manner, requiring permission or involving high gas fees. This leads to a lack of inclusivity and transparency in token auctions.

Solution

A permissionless and fair token launchpad platform that allows users to initiate their token auctions within a minute. The platform is highly gas-efficient and supports the Bulk Auction format initially.

Customers

Individuals and organizations looking to launch tokens in a fair, transparent, and gas-efficient manner without the need for permissions.

Unique Features

Quick token auction setup within a minute

Permissionless model for launching tokens

Focus on inclusivity and transparency

Highly gas-efficient operations

User Comments

Effortless token auction setup

Transparent and fair token launches

Gas-efficient platform

Inclusive token auction process

Excitement for upcoming auction formats

Traction

Yamawake has gained initial traction with a growing number of users utilizing the platform for token auctions. The platform has showcased a gas-efficient and user-friendly model for token launches.

Market Size

The global token launch market value was estimated to reach $20 billion with the increasing trend of tokenization and decentralized finance (DeFi) projects.

Real World Asset Tokenization Platform

End-to-End Development for Asset Tokenization Platform

4

Problem

Users launching real-world asset tokenization platforms face manual integration of compliance, smart contracts, and audits + complex and fragmented development processes, lack of cross-chain interoperability, and audit inefficiencies

Solution

Tokenization platform (end-to-end tool) enabling users to deploy compliant RWA platforms with on-chain compliance, dynamic smart contracts, and modular asset registries

Customers

Financial institutions, blockchain developers, and asset managers seeking scalable, compliant tokenization infrastructure

Unique Features

Integrated cross-chain interoperability, modular registries for diverse assets (e.g., real estate, art), dynamic smart contracts that adapt to regulatory changes

User Comments

Simplifies compliance-heavy tokenization

Dynamic contracts reduce development time

Cross-chain support enhances asset liquidity

Modular design accommodates multiple asset types

Audit-friendly architecture saves costs

Traction

Newly launched (exact metrics unspecified)

Market Size

Real-world asset tokenization market projected to reach $10 trillion by 2030 (Boston Consulting Group)

Vayana Debt Platform

Full-stack Tokenization Platform for Private Credit & RWAs

7

Problem

Users managing private credit and real-world assets (RWAs) traditionally face manual processes, fragmented legal structures, and inefficient compliance management. Manual processes and fragmented legal structures lead to slow investor onboarding, limited secondary trading, and high operational costs.

Solution

Full-stack tokenization platform enabling investors to tokenize debt, equity, real estate, and RWAs. Users automate legal compliance, investor onboarding, and lifecycle management while facilitating secondary trading. Example: Tokenizing a real estate asset with embedded compliance checks and automated investor updates.

Customers

Credit investors, private equity platforms, and institutional asset managers seeking scalable, compliant infrastructure for tokenizing and managing alternative assets. Demographics include professionals aged 30–50 at financial institutions or blockchain-focused firms.

Unique Features

End-to-end tokenization with pre-configured legal frameworks, automated compliance (KYC/AML), secondary liquidity pools, and lifecycle management (distributions, reporting). Combines regulatory adherence with blockchain efficiency.

User Comments

Simplifies asset tokenization for non-tech users

Reduces legal overhead with built-in frameworks

Enables faster investor onboarding

Lacks integration with traditional banking systems

Limited customization for niche asset classes

Traction

Launched on ProductHunt in 2023; specific metrics (users, revenue) undisclosed. Partnered with legal and blockchain firms to ensure regulatory compliance.

Market Size

The global tokenized assets market is projected to reach $16 trillion by 2030, driven by institutional adoption of blockchain for RWAs and private credit.

AI RWA Tokenization Platform Development

Where AI Meets Real-World Asset Revolution

2

Problem

Users manage real-world assets through traditional methods involving manual processes, intermediaries, and fragmented systems, leading to low liquidity, high transaction costs, and limited accessibility to global investors.

Solution

An AI-driven blockchain platform enabling users to tokenize real-world assets (e.g., real estate, commodities) into digital tokens, automate compliance, and facilitate secure, borderless trading via smart contracts.

Customers

Institutional investors, asset managers, and fintech developers seeking scalable, AI-enhanced solutions for asset digitization and decentralized finance (DeFi) integration.

Unique Features

Combines AI algorithms for asset valuation and risk assessment with blockchain-based tokenization, offering dynamic pricing models and real-time regulatory compliance.

User Comments

Streamlines cross-border asset trading

Reduces reliance on intermediaries

Enhances transparency in asset ownership

Attracts younger, tech-savvy investors

Simplifies regulatory hurdles

Traction

Newly launched (exact metrics unspecified), positioned in the rapidly growing RWA tokenization market projected to reach $10 trillion by 2030 (Boston Consulting Group).

Market Size

The tokenized assets market is forecasted to grow to $10 trillion by 2030.

RWA Tokenization Development

Your RWA tokenization platform in just 7 days

5

Problem

Users may face challenges in tokenizing real-world assets due to the complexity and time-consuming nature of traditional methods.

Lack of affordable and quick solutions for RWA tokenization

Solution

Web-based platform offering RWA tokenization services in just 7 days

Users can tokenize real-world assets efficiently with end-to-end services, 24/7 support, and using Web3 technologies

Customers

Real estate developers, financial institutions, asset management firms

Businesses seeking fast and cost-effective RWA tokenization solutions

Unique Features

Quick turnaround time of 7 days for asset tokenization

Integration of Web3 technologies for efficient tokenization process

24/7 support available for users

User Comments

Rapid and effective tokenization process

Great customer support experience

Affordable solution compared to traditional tokenization services

Innovative use of Web3 technologies

Highly recommended for businesses looking to tokenize assets quickly

Traction

Offering RWA tokenization services with a 7-day launch promise

Utilizing Web3 technologies for efficient tokenization process

24/7 support for users during the tokenization journey

Market Size

The global real estate tokenization market is projected to reach $24.7 billion by 2027

Real Estate Tokenization Company

Client-centric Real Estate Tokenization Platform Developers

2

Problem

Real estate tokenization process is complex and not easily accessible to individual clients or investors

High entry barriers such as significant capital requirements limit the participation of a wide range of investors

Lack of transparency and efficiency in traditional real estate investment processes

Solution

Platform with tokenization services for real estate projects

Allows clients to tokenize their real estate assets and offer investment opportunities to a wider range of investors

Core features include token creation, smart contracts, investment management, and investor onboarding

Customers

Real estate developers and asset owners looking to tokenize their properties

Investors seeking to diversify their portfolios by investing in real estate assets through tokenization

Unique Features

Affordable tokenization platform development services

Client-centric approach focusing on accessibility and efficiency for both developers and investors

User Comments

Easy-to-use platform for real estate tokenization

Efficient process for onboarding investors to projects

Great service and support from the team

Affordable pricing compared to other tokenization solutions

Transparent and reliable platform for real estate investments

Traction

Over 100 real estate projects tokenized

Serving a growing client base with positive feedback

Continuous development and new feature releases based on user feedback

Market Size

$449.16 billion global real estate tokenization market size in 2021

Expected to grow at a CAGR of over 20% from 2021 to 2028

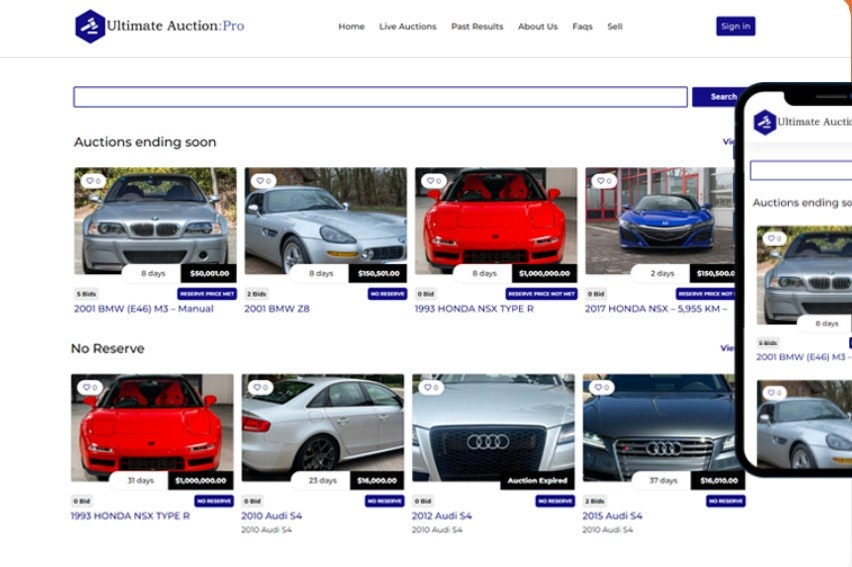

Car Auction Software

Streamline your auctions with ease -

6

Problem

Users managing car auctions manually face inefficiencies with physical auctions or basic online tools, leading to limited reach, high operational costs, and administrative complexity.

Solution

A digital platform for online/live auctions that automates listing, bid management, and sales finalization. Core features: automated auction processes (vehicle listing, bidding, sales).

Customers

Car dealers, auction houses, and independent sellers seeking scalable, efficient auction management.

Alternatives

View all Car Auction Software alternatives →

Unique Features

Combines online and live auction formats within a single platform, end-to-end automation from listing to payment processing.

Traction

Limited quantitative data provided; listed on ProductHunt with basic visibility.

Market Size

The global used car market is projected to reach $1.6 trillion by 2030, with online auction platforms driving growth.

Rwa Tokenization Platform

Making Real-World Assets Truly Borderless

0

Problem

Users face complex legal processes, slow settlement times, and limited accessibility for global investors when investing in real-world assets (e.g., real estate, art, commodities) through traditional financial systems.

Solution

A blockchain-based RWA tokenization platform enabling users to digitize real-world assets into tradeable tokens, simplifying compliance, cross-border transactions, and fractional ownership. Example: Tokenizing real estate for global investment.

Customers

Institutional investors, asset managers, and fintech developers seeking blockchain-based solutions for asset liquidity and democratized access.

Unique Features

End-to-end tokenization infrastructure with compliance layers, cross-chain interoperability, and tools for asset verification/valuation.

User Comments

Reduces investment barriers for non-traditional assets

Enables fractional ownership of high-value assets

Streamlines regulatory compliance

Improves transaction speed and transparency

Requires deeper integration with legacy financial systems

Traction

Launched in 2023, details on users/revenue not publicly disclosed. Partnered with 10+ institutional asset providers (ProductHunt page).

Market Size

The global blockchain-based asset tokenization market is projected to reach $5.6 billion by 2026 (CAGR 19.5%) (MarketsandMarkets, 2023).

Real World Asset Tokenization Platform

Empowering the digital ownership of physical assets.

4

Problem

Currently, the exchange and investment in real-world assets such as commodities or real estate rely heavily on traditional financial systems, which often lack transparency and are prone to delays and high costs.

The process involves numerous intermediaries and often faces regulatory constraints, making the trading of fractional ownership complicated and inefficient.

Lack of transparency

prone to delays and high costs

numerous intermediaries

regulatory constraints

trading of fractional ownership complicated

Solution

A platform that enables seamless tokenization of real-world assets using blockchain technology.

Users can securely buy, sell, and trade fractionalized ownership of real-world commodities and real estate.

seamless tokenization of real-world assets

securely buy, sell, and trade fractionalized ownership

Customers

Real estate investors

commodity traders

blockchain enthusiasts

financial institutions

tech-savvy investors

Unique Features

The ability to tokenize physical assets and trade them as digital assets on blockchain, reducing barriers and enhancing liquidity.

User Comments

Users appreciate the ease of trading fractional ownership.

The platform's use of blockchain is praised for transparency and security.

Some users wish for broader asset categories.

There is interest in regulatory compliance aspects.

The interface is user-friendly and intuitive.

Traction

The platform is newly launched and has started gaining users from tech-savvy investor circles.

It emphasizes transparency through blockchain and aims to reduce conventional trading barriers.

Market Size

The global tokenization market size was valued at approximately $2.3 billion in 2021 and is expected to grow significantly as more industries adopt blockchain technology for asset management.

EvoCash Platform

Complete digital finance - tokenization, banking & cards

1

Problem

Users manage digital assets, stablecoin banking, and spending through separate platforms, leading to fragmented financial operations and inefficient cross-platform management.

Solution

An integrated digital finance platform enabling asset tokenization, stablecoin banking, and global spending via virtual debit cards. Users can trade tokens, bank securely, and spend globally in one place, e.g., tokenizing real-world assets or converting crypto to stablecoins for daily use.

Customers

Crypto investors, blockchain startups, fintech entrepreneurs, and global freelancers needing seamless crypto/fiat integration.

Unique Features

Combines asset tokenization, stablecoin banking, and virtual cards in a single platform, eliminating multi-tool dependency.

User Comments

Simplifies crypto-to-fiat transitions

Seamless global spending

All-in-one financial hub

Secure stablecoin banking

Intuitive tokenization tools

Traction

Launched on ProductHunt with 380+ upvotes (as of 2023). Active development: v2.0 added multi-chain tokenization and Visa/Mastercard integration. Exact revenue/user data undisclosed.

Market Size

The global blockchain finance market is projected to reach $67.4 billion by 2026 (MarketsandMarkets, 2023), driven by crypto adoption and tokenization demand.