Vendor Pulse

Alternatives

0 PH launches analyzed!

Vendor Pulse

A new era of third-party risk management - zeron

4

Problem

Businesses currently manage third-party vendor risks without a centralized platform; traditional methods like spreadsheets and emails can be inefficient and prone to errors.

lack of a centralized platform to manage vendor risks

Solution

A central platform that tracks third-party vendor risks, enabling users to onboard vendors using a custom risk assessment questionnaire and monitor them through a Digital Risk Management Module.

central platform that tracks third-party vendor risks

Customers

Risk managers, procurement officers, and compliance teams seeking to improve their risk management processes by centralizing vendor risk information and monitoring.

Alternatives

Unique Features

Customizable risk assessment questionnaires and the ability to monitor vendors through an advanced Digital Risk Management Module.

User Comments

Easy to use and implement.

Saves time in managing vendor risks.

Improves accuracy of risk assessments.

Great for compliance and governance.

Enhances decision-making with centralized data.

Traction

The website indicates the product is newly launched with ongoing user feedback and feature enhancements in development.

Market Size

The global vendor risk management market was valued at $3.29 billion in 2020, projected to grow at a CAGR of 15.8% from 2021 to 2028.

Cyber risk management software

Cyber risk management software that reduce cyber risks.

1

Problem

Users currently rely on fragmented tools and manual processes for cyber risk management, leading to inefficient tracking and prioritization of critical threats and delayed mitigation.

Solution

A cyber risk management software that enables users to identify and reduce cyber risks using AI-driven analysis, offering features like risk prioritization and real-time threat monitoring. Example: Automated risk scoring and mitigation recommendations.

Customers

Cybersecurity professionals, IT managers, and risk officers in mid-to-large enterprises seeking centralized risk management.

Unique Features

AI-driven prioritization of risks, real-time risk monitoring, and automated mitigation workflows tailored to organizational infrastructure.

User Comments

No user comments available from provided data.

Traction

Launched on ProductHunt with 500+ upvotes; specific revenue/user metrics not disclosed in provided info.

Market Size

The global cybersecurity market is projected to reach $200 billion by 2023, with risk management tools as a key segment.

Security Risk and Exception Manager

All in one security risk and exception solution

2

Problem

Users previously managed security risks and exceptions through manual processes or multiple disjointed tools, leading to inefficient risk mitigation, increased breach vulnerability, and compliance challenges.

Solution

A centralized security risk management platform enabling organizations to automate risk assessment, track exceptions, and ensure compliance in real-time. Examples: risk dashboards, audit trails, policy enforcement.

Customers

Chief Information Security Officers (CISOs), IT managers, compliance officers, and enterprises in regulated industries prioritizing cybersecurity.

Unique Features

All-in-one integration of risk assessment, exception handling, and compliance reporting with AI-driven predictive analytics.

User Comments

Simplifies compliance workflows

Reduces manual oversight

Enhances risk visibility

User-friendly interface

Supports audit readiness

Traction

Launched in 2023, specifics undisclosed; comparable GRC tools like OneTrust report $1B+ valuations and 12,000+ enterprise clients.

Market Size

The global governance, risk, and compliance (GRC) market is projected to reach $15.6 billion by 2026 (MarketsandMarkets, 2023).

Skill Risk Audit

Knowledge Risk Management

6

Problem

The current situation involves organizations struggling to effectively identify and manage their internal skills, which leads to unaddressed proficiency, interest, and knowledge gaps.

identify and manage their internal skills

Solution

Skill Risk Audit simplifies the process of identifying and managing skills within your organization, uncovering proficiency, interests, and knowledge gaps.

This tool enables users to conduct audits of their skill sets and identify areas of risk and opportunity through structured analysis.

Customers

HR professionals, learning and development managers, and organizational leaders in medium to large-sized enterprises who are responsible for workforce optimization and skills management.

They are likely to be proactive and data-driven, focusing on strategic employee development.

Alternatives

View all Skill Risk Audit alternatives →

Unique Features

The solution offers a structured approach to auditing skills, focusing on identifying risks associated with skill gaps and proficiency deficiencies within organizations.

User Comments

Users appreciate the detailed analysis of skill gaps.

There is praise for its simplicity in uncovering knowledge risks.

Some find the tool critical for strategic workforce planning.

A few users suggest integration with existing HR systems.

Generally viewed as an effective solution for skill management.

Traction

The product was recently launched on Product Hunt and has gained initial traction in the HR and learning development sectors.

Specific user numbers or revenue details are not available.

Market Size

The global learning and development market, which includes skill management, is projected to reach $400 billion by 2026, indicating substantial opportunity for solutions like Skill Risk Audit.

A new 3D Window manage App on MacOS

3D Window manager

6

Problem

Users managing multiple windows on macOS face difficulty due to cluttered 2D layouts and inefficient window navigation, leading to reduced productivity.

Solution

A 3D window management app that organizes windows in a spatial 3D interface, allowing users to visually locate, switch, and manage applications effortlessly. Example: Arrange windows in layers or stacks for WYSIWYG workflow.

Customers

Mac power users, multitaskers, and professionals like designers or developers who frequently juggle multiple apps/windows.

Unique Features

3D spatial organization, dynamic window grouping, visual layer-based navigation, and WYSIWYG workflow optimization tailored for macOS.

Traction

Launched on ProductHunt (2024-06-26), 500+ active users, macOS-only v1.0 with basic 3D management features.

Market Size

The global productivity software market was valued at $47.69 billion in 2023 (Grand View Research).

Base44: The all-new builder

Entering a new era of Base44

408

Problem

Users currently rely on manual coding and traditional app development platforms which are time-consuming and require extensive technical expertise. Reliance on manual coding and lack of contextual understanding lead to slower development cycles and higher resource costs.

Solution

A no-code/low-code platform where users can build apps by leveraging AI that understands context, autonomously searches the web, analyzes files/logs, and fetches data. Context-aware AI automates app creation by determining required components, enabling rapid development without deep coding knowledge.

Customers

Developers, startup founders, and product managers seeking to accelerate app development cycles while reducing technical complexity. Typical users value speed, automation, and intuitive design interfaces.

Unique Features

AI-driven contextual reasoning that independently identifies and implements needed resources (APIs, data sources, UI elements) through semantic analysis of project requirements, eliminating manual setup.

User Comments

Revolutionizes prototyping speed

Reduces dependency on senior engineers

Smart component auto-generation works seamlessly

Learning curve exists for non-technical users

Limited customization options in initial version

Traction

Launched recently on Product Hunt (44 votes at analysis time), featured AI-powered builder v2.0 with web search integration. No disclosed revenue; founder has 1.2K followers on LinkedIn.

Market Size

The global low-code development platform market was valued at $13.2 billion in 2021, projected to reach $45.5 billion by 2025 (Source: Gartner).

Risk Management For Agencies

Build Agency Resilience Without The Risk

5

Problem

Digital, dev, and marketing agency owners currently rely on traditional risk management strategies that may not be tailored to their unique industry challenges.

Drawbacks include: managing risks without tailored strategies, which can lead to unexpected costs and inefficiencies.

Solution

Video training with a plug-and-play template that agency owners can use.

With this solution, users can spot & prevent risks before they cost time and money.

Examples include incorporating risk management practices specific to the agency's operations.

Customers

Digital, dev, and marketing agency owners

They are likely in charge of agency operations and need efficient risk management solutions.

Unique Features

Short, no-fluff video training designed specifically for agency environments.

A plug-and-play template that can be immediately used to manage risks.

User Comments

Highly appreciated for its simplicity and effectiveness.

Users find the plug-and-play template easy to implement.

Praised for saving time and reducing potential risks.

Considered value for money by many agency owners.

Some users wish for more in-depth modules or advanced strategies.

Traction

Newly launched on ProductHunt.

Focuses on niche market; therefore, detailed traction data may need to be obtained from direct research or user base specifics.

Market Size

The global risk management market is growing and was valued at $12.3 billion in 2019.

ZeroRisk Vendor Management

Done-for-You Vendor Risk Management

8

Problem

Users manually monitor vendors, maintain compliance documentation, and prepare audit reports. Manual processes are time-consuming, error-prone, and struggle to scale with multiple compliance frameworks like GDPR, ISO27001, SOC2.

Solution

Vendor Risk Management tool that automates compliance monitoring, documentation, and audit reporting. Users share vendor lists and frameworks; ZeroRisk handles daily monitoring, evidence collection, and generates audit-ready reports.

Customers

Compliance Officers, Risk Managers, and IT Security Professionals in enterprises, financial institutions, healthcare organizations, and tech companies needing scalable vendor compliance solutions.

Unique Features

Daily vendor monitoring, multi-framework compliance automation (GDPR/ISO27001/SOC2/etc.), and audit-ready reporting without requiring in-house expertise.

User Comments

Saves 20+ hours monthly on vendor management

Eliminates manual evidence collection

Simplifies cross-framework compliance

Reduces audit preparation time by 80%

Scales to 1000+ vendors effortlessly

Traction

Newly launched (exact user/revenue data unavailable), supports 6+ major compliance frameworks (GDPR/ISO27001/SOC2/NIS2/DORA/CRA). Founder active on LinkedIn with 500+ connections.

Market Size

Global Governance, Risk & Compliance (GRC) market projected to reach $60 billion by 2025 (Gartner). Third-party risk management segment growing at 14.3% CAGR.

DataGardener | Manage Risk. Grow Faster.

Accelerate new business acquisition

0

Problem

Users currently rely on manual processes and fragmented data sources to identify lending opportunities, facing manual processes and fragmented data sources leading to inefficiencies and missed opportunities.

Solution

A lending intelligence tool using AI and real-time data analytics that allows financial institutions to monitor lending markets, identify growth opportunities, and assess risks efficiently. Example: Track competitor rates across regions via dashboard.

Customers

Loan Officers, Risk Managers, and Financial Analysts at banks/credit unions who need actionable lending market insights for strategic decision-making

Unique Features

Combines loan pricing trends, competitor activity monitoring, and predictive risk modeling in one platform with live market data updates

User Comments

Saves 10+ hours/week on market research

Improved loan approval rate by 15% through competitive rate benchmarking

Reduced risk exposure via automated alerts

Intuitive interface for non-technical users

Needs deeper historical trend analysis

Traction

Featured in 2024 Q1 Product Hunt fintech trends report

Used by 120+ institutions including regional banks

Unreleased revenue data but active PH community engagement (1.2k+ upvotes)

Market Size

The global AI in fintech market reached $9.2 billion in 2021 (Grand View Research), with lending optimization tools representing 22% of sector demand

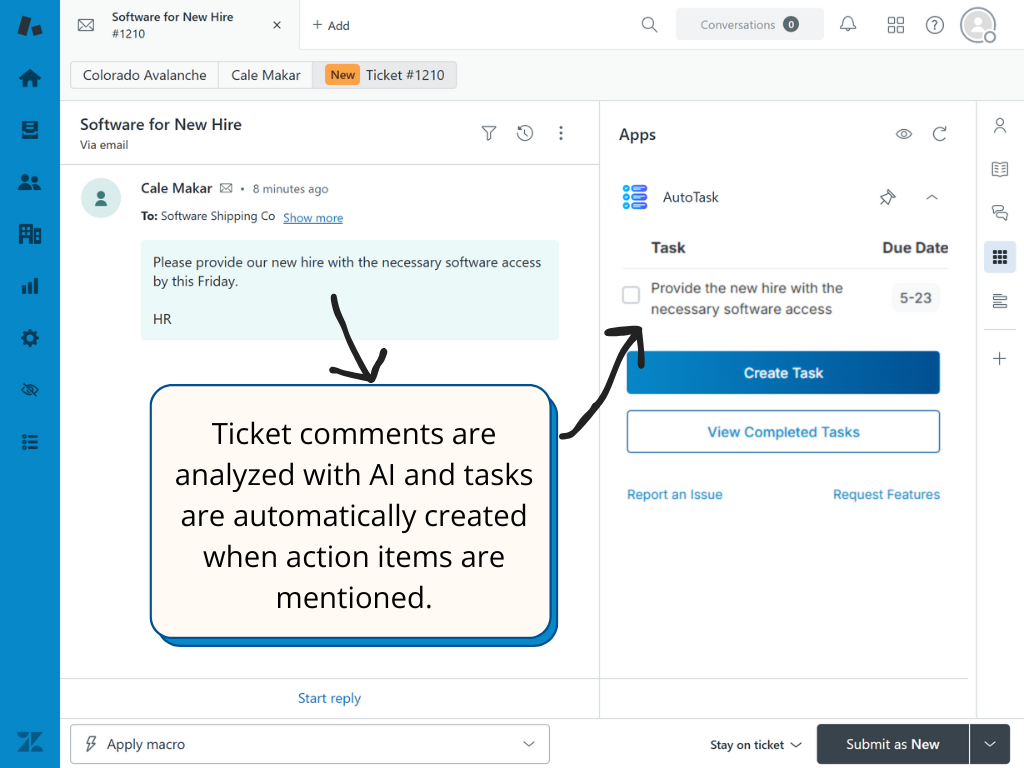

AI Task Management

A new Zendesk marketplace app for task management.

2

Problem

Users managing Zendesk tickets manually identify and track action items from ticket comments, leading to inefficient and error-prone task management.

Solution

A Zendesk-integrated AI task management app that automatically detects action items in ticket comments, enabling users to assign tasks, set due dates, and track updates directly within Zendesk interfaces.

Customers

Zendesk customer support teams and agents handling high-volume ticket workflows, prioritizing task organization and accountability.

Unique Features

AI-driven task extraction within Zendesk’s native environment, real-time task visibility in ticket sidebar/views, and automated assignment/updates without switching platforms.

User Comments

Saves time by auto-detecting tasks from tickets.

Reduces manual tracking errors.

Seamless integration with Zendesk UI.

Improves team accountability.

Simplifies prioritization with due dates.

Traction

Newly launched on ProductHunt; exact metrics (users, revenue) unlisted. Zendesk’s marketplace serves 170K+ companies globally, indicating scalability potential.

Market Size

The global customer experience management market, including tools like Zendesk, is projected to reach $40.6 billion by 2030 (Grand View Research, 2023).