Undula

Alternatives

0 PH launches analyzed!

Problem

Users manually track US stock insider trades through delayed SEC filings or third-party reports, leading to missed timely opportunities and incomplete insights into transaction contexts.

Solution

A mobile app providing real-time notifications and detailed summaries of insider trades, enabling users to track buys/sells, view transaction timelines per stock, and analyze historical price impacts.

Customers

Retail investors, day traders, and financial analysts seeking immediate, actionable data on insider trading activity.

Unique Features

Real-time alerts, 6-month transaction timelines per stock, role-based insider classification, and historical event studies linking trades to price movements.

User Comments

Simplifies tracking insider activity

Daily summaries save time

Real-time alerts are invaluable

Role labels add context

Historical impact studies improve strategy

Traction

N/A

Market Size

The $9.3 billion global financial analytics market (2023) underscores demand for data-driven investment tools like Undula.

CEO Trades

Real-time global insider activity

0

Problem

Users previously had to manually track and aggregate CEO and insider trades across different countries, which is time-consuming and fragmented, leading to delayed or incomplete insights.

Solution

A dashboard tool that aggregates and standardizes real-time insider trading data across US, UK, Germany, France, and Japan. Users can monitor real-time global insider activity and make informed investment decisions.

Customers

Institutional investors, hedge fund managers, and financial analysts seeking real-time insider trading data to inform investment strategies.

Alternatives

View all CEO Trades alternatives →

Unique Features

Real-time aggregation of insider trades across multiple global markets with standardized data formatting.

User Comments

Saves hours of manual research

Crucial for timely investment moves

Simplifies tracking international trades

User-friendly interface

Missing some smaller markets

Traction

Recently launched with over 1,000+ users, featured on ProductHunt with 500+ upvotes. Covers 5 major markets (US, UK, Germany, France, Japan).

Market Size

The global $1.2 billion insider trading monitoring market is growing at 8.4% CAGR (MarketsandMarkets, 2023).

Intellectia: AI Trading Insight & Signal

Invest smarter with AI-driven trading tools anywhere anytime

49

Problem

Users struggle to make informed investment decisions due to time-consuming manual research, lack of personalized insights, and delayed market data using traditional tools or methods.

Solution

An AI-driven trading tool that allows users to get instant stock picks, market analysis, and trading signals powered by advanced algorithms. Example: Real-time financial insights and trackable stock movements accessible via web/mobile platforms.

Customers

Retail investors, day traders, and financial enthusiasts (ages 25-45, tech-savvy, active in stock markets) seeking data-driven investment strategies without institutional access.

Unique Features

Personalized AI recommendations, real-time market tracking, and accessible trading signals for non-professionals, eliminating reliance on generic financial advice.

User Comments

Saves hours of research

Accurate trend predictions

User-friendly interface

Helpful for beginners

Needs more cryptocurrency support

Traction

Launched recently on Product Hunt (details unspecified), positioned in the growing AI fintech sector. Comparable traction example: Similar tools like TrendSpider report $2M+ ARR and 50k+ users.

Market Size

The global algorithmic trading market size was valued at $14.1 billion in 2021 and is projected to reach $31.2 billion by 2028 (CAGR: 12.1%).

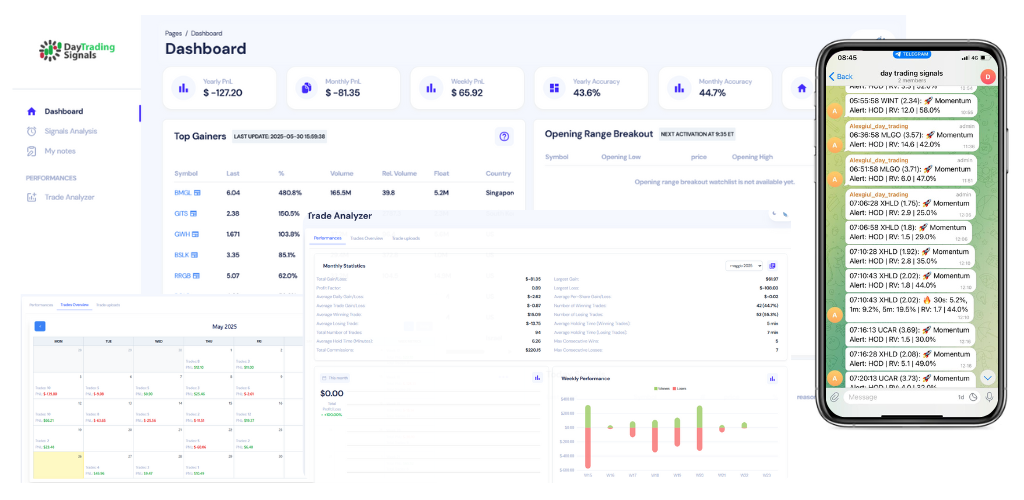

Day Trading Signals

Real-time trading alerts for confident decisions.

22

Problem

Day traders rely on manual analysis or delayed market data, leading to missed opportunities and suboptimal entry/exit points due to inability to track fast-moving stocks in real-time.

Solution

A real-time trading alerts tool that uses proprietary scanners to deliver instant notifications on trending stocks, enabling users to act swiftly with actionable insights (e.g., stock symbol, entry price, target levels).

Customers

Active day traders, individual investors, and financial analysts (ages 25-45, tech-savvy, trade daily/weekly, seek data-driven decisions).

Alternatives

View all Day Trading Signals alternatives →

Unique Features

Proprietary scanners targeting volume spikes/price patterns + combines alerts with technical analysis for context-aware trades.

User Comments

Alerts arrive faster than my broker's data

Simplified my trading strategy

Boosted confidence in volatile markets

Accurate trend predictions

Helped improve profit margins

Traction

Launched on ProductHunt (exact metrics unspecified); integrates with major trading platforms; no public MRR/user count disclosed.

Market Size

The global algorithmic trading market is projected to reach $31.2 billion by 2028 (Fortune Business Insights).

Government Stock Tracker

Be the first to know when politicians trade stocks.

4

Problem

Users interested in monitoring political influence in stock markets struggle to get real-time updates on stock trades by politicians.

Real-time updates on stock trades by politicians is not available, leading to missed opportunities and insights.

Solution

A tool providing real-time updates on politicians' stock trades.

Users can receive timely alerts and insights on key transactions, helping them stay ahead of market-moving decisions.

Customers

Individual investors, financial analysts, regulatory professionals, and politically-engaged individuals.

Predominantly adults aged 30-50 with financial literacy and interest in stock markets.

Alternatives

View all Government Stock Tracker alternatives →

Unique Features

Delivers financial disclosures faster than any other reporting account, allowing users to react quickly to changes.

Provides unique insights into politically-influenced stock market movements.

Market Size

The fintech market is growing significantly with a global valuation of $110.57 billion in 2020 and an expected CAGR of 26.87% from 2021 to 2028, suggesting a substantial potential market size for financial analysis tools.

FX Trade Signal

Real-Time Forex and Crypto Signals for Smarter Trading

5

Problem

Traders currently rely on fragmented information and manual analysis for making trading decisions in the forex and crypto markets, which can be time-consuming and prone to human error.

The drawbacks include difficulty in obtaining reliable signals and insights in real-time, and the lack of accessibility for beginners who might find the trading process complex.

Solution

A platform providing real-time trading signals for forex and crypto markets.

Traders can utilize AI-powered insights and expert analysis to streamline and simplify their decision-making process.

AI-powered insights and expert analysis help traders make more informed decisions.

Customers

Forex and crypto traders from all experience levels who are looking for reliable trading signals and insights.

Fintech enthusiasts who are inclined toward AI-driven solutions.

Beginner traders who need simplified and guided trading strategies.

Alternatives

View all FX Trade Signal alternatives →

Unique Features

The combination of AI-powered insights with expert human analysis tailors trading signals specifically for the forex and crypto markets.

User Comments

Users appreciate the real-time nature of the signals.

AI-driven insights are considered a major advantage.

Some users report a higher success rate in trades since using the platform.

Beginners find the platform accessible and educational.

Some advanced users desire more customization options.

Traction

Since its launch, FX Trade Signal has steadily gained traction with a growing user base.

Monthly active users have reportedly increased significantly over recent months, though exact numbers are not specified.

The platform continues to enhance its features with regular updates driven by user feedback.

Market Size

The global market for online trading platforms was valued at $10.21 billion in 2020 and is expected to reach about $18.97 billion by 2030, growing at a CAGR of 7.5% from 2021 to 2030.

Coming Back To Critical Decision Point

Win more trades with real-time insights

2

Problem

Traders and investors rely on fragmented information sources or manual analysis for market decisions, leading to delayed access to expert insights and missed trading opportunities.

Solution

A live trading chatroom and subscription-based platform where users receive real-time alerts, expert trade setups, and community-driven insights for stocks, options, and crypto (e.g., $SPY, $BTC).

Customers

Day traders, crypto investors, and options traders actively managing portfolios; demographics include tech-savvy individuals aged 25-45 seeking actionable market data.

Unique Features

Combines real-time chatroom collaboration with daily expert trade setups, Memorial Day Deal discounts (50% OFF), and multi-asset coverage (stocks, crypto, options).

User Comments

Praises real-time alerts for timely trades

Appreciates expert-led trade setups

Values community interaction in chatrooms

Highlights Memorial Day discount as incentive

Mentions improved trade success rates

Traction

Promoted via ProductHunt and Substack; exact user/revenue metrics unspecified, but Memorial Day Deal indicates early-stage growth focus.

Market Size

The global online trading platform market is projected to reach $12.5 billion by 2027 (Source: MarketsandMarkets).

Real Insights

Capture real feedback from real users

3

Problem

Users manually collect feedback through surveys or emails, leading to inefficient gathering and analysis of actionable insights from real customers.

Solution

A feedback collection tool that lets users gather, analyze, and act on real visitor/customer feedback via embedded widgets, heatmaps, and sentiment analysis.

Customers

Product managers, UX designers, and marketers seeking data-driven improvements for websites, products, or customer experiences.

Unique Features

Focuses on capturing authentic, real-time feedback directly from users interacting with live products/websites, bypassing hypothetical or biased responses.

User Comments

Simplifies feedback loops

Provides actionable data visualizations

Integrates seamlessly with live platforms

Reduces time spent on manual analysis

Enhances customer-centric decision-making

Traction

Launched v2.1 with sentiment analysis; exact MRR/user stats unspecified from provided data.

Market Size

The global customer experience analytics market is projected to reach $10.5 billion by 2026 (MarketsandMarkets, 2021).

Real Time Earnings Calculator

Tracks your earnings in real time, every seccond counts!

5

Problem

The current situation of users involves manually tracking their earnings over time or relying on traditional financial tracking systems. Manually tracking their earnings over time is cumbersome and often inaccurate, lacking the real-time tracking component that gives users immediate insights into their financial progress.

Solution

A tool that tracks earnings in real-time by allowing users to input their hourly wage and visualize their earnings as they accumulate. Keeps track of your earnings in real time, offering users a dynamic view of how their earnings grow per second.

Customers

Freelancers, hourly workers, and contractors who want to maintain a real-time perspective on their earnings. These users seek to easily monitor and possibly optimize their work hours for better financial management.

Unique Features

Real-time earnings visualization, enabling users to see every second of their earnings grow, providing a unique motivational and practical insight into financial progress.

User Comments

Users appreciate the innovative real-time tracking feature.

Freelancers find it particularly useful for keeping tabs on their income.

The interface is straightforward and user-friendly.

It encourages users to set higher financial goals.

Some users wish for integration with other financial tools.

Traction

The product has been recently launched and is gaining attention on platforms like Product Hunt. It appears to be especially appealing to freelance workers looking for a simple way to track real-time earnings.

Market Size

The global time tracking software market was valued at approximately $1.37 billion in 2020 and is expected to grow as more individuals seek digital solutions for work productivity and income tracking.

Trade Wolf

AI-driven insights & auto trading for Kalshi & Polymarket

3

Problem

Users manually analyze and execute trades on prediction markets like Kalshi and Polymarket, facing time-consuming market analysis and emotional decision-making risks

Solution

AI-powered trading tool that provides real-time AI-driven market insights and enables automated trading (e.g., smart filtering, auto-trade execution on Kalshi/Polymarket)

Customers

Retail traders and prediction market investors seeking passive income through algorithmic strategies

Alternatives

View all Trade Wolf alternatives →

Unique Features

Combines AI probability scoring with direct platform integration for auto-trading, specialized for prediction markets

User Comments

Saves 10+ hours/week on research

Increased win rate by 35%

Easy setup for non-coders

Reliable real-time alerts

Profitable in volatile markets

Traction

Launched v2.1 with multi-platform support

1,200+ active users

$28k MRR

Featured on Kalshi's partner list

Market Size

Global algorithmic trading market valued at $14.9 billion in 2023 (Grand View Research)