Thrivr - Spending Tracker

Alternatives

0 PH launches analyzed!

Thrivr - Spending Tracker

Take control of your spending and thrive financially

15

Problem

Users struggle to keep track of their spending habits and maintain control over their finances.

Drawbacks: Lack of awareness of budget limits, inability to monitor spending habits effectively, making uninformed financial decisions, and potential risk of overspending.

Solution

A spending tracker tool in the form of an app that allows users to set budget limits, track spending habits, and gain insights for informed financial decisions.

Core features: Setting budget limits, tracking spending habits, providing financial insights.

Customers

Individuals looking to manage their personal finances more efficiently and avoid overspending.

Occupation: Anyone interested in gaining better control over their financial situation.

Unique Features

Personal budgeting features with the ability to set customized budget limits.

Insights and analysis tools to help users make informed financial decisions based on their spending habits.

User Comments

Easy to use and intuitive interface for tracking spending.

Helps in controlling expenses and making better financial decisions.

Useful tool for budgeting and monitoring finances.

Great for individuals looking to improve their financial management skills.

Simple yet effective in keeping track of spending habits.

Traction

Thrivr has gained popularity with over 10,000 downloads within the first month of launch.

It has been featured in multiple finance-related publications, increasing its visibility and user base.

Market Size

$1.7 billion: The personal finance management market size in 2021, with a steady growth rate expected in the upcoming years.

Increasing user awareness regarding financial planning and budgeting tools driving market growth.

Ecosmob’s SIP Ingress Controller

Take control with a SIP Ingress Controller

5

Problem

Users managing SIP traffic face security vulnerabilities, complex routing configurations, and inefficient network flow management with legacy systems.

Solution

A SIP Ingress Controller tool that centralizes SIP traffic management, simplifies routing, and detects threats in real-time (e.g., automated traffic optimization, DDoS protection).

Customers

IT managers, VoIP network engineers, and telecom operators overseeing SIP-based communication systems.

Unique Features

Centralized SIP traffic orchestration, automated threat mitigation, and compatibility with hybrid VoIP infrastructure.

User Comments

Simplifies SIP configurations

Reduces downtime during traffic spikes

Enhances network security

Intuitive monitoring dashboard

Scalable for large enterprises

Traction

Launched v2.5 with real-time analytics, trusted by 500+ businesses, integrated with major VoIP platforms like Asterisk and Cisco.

Market Size

The global VoIP market is projected to reach $145 billion by 2024 (Statista, 2023).

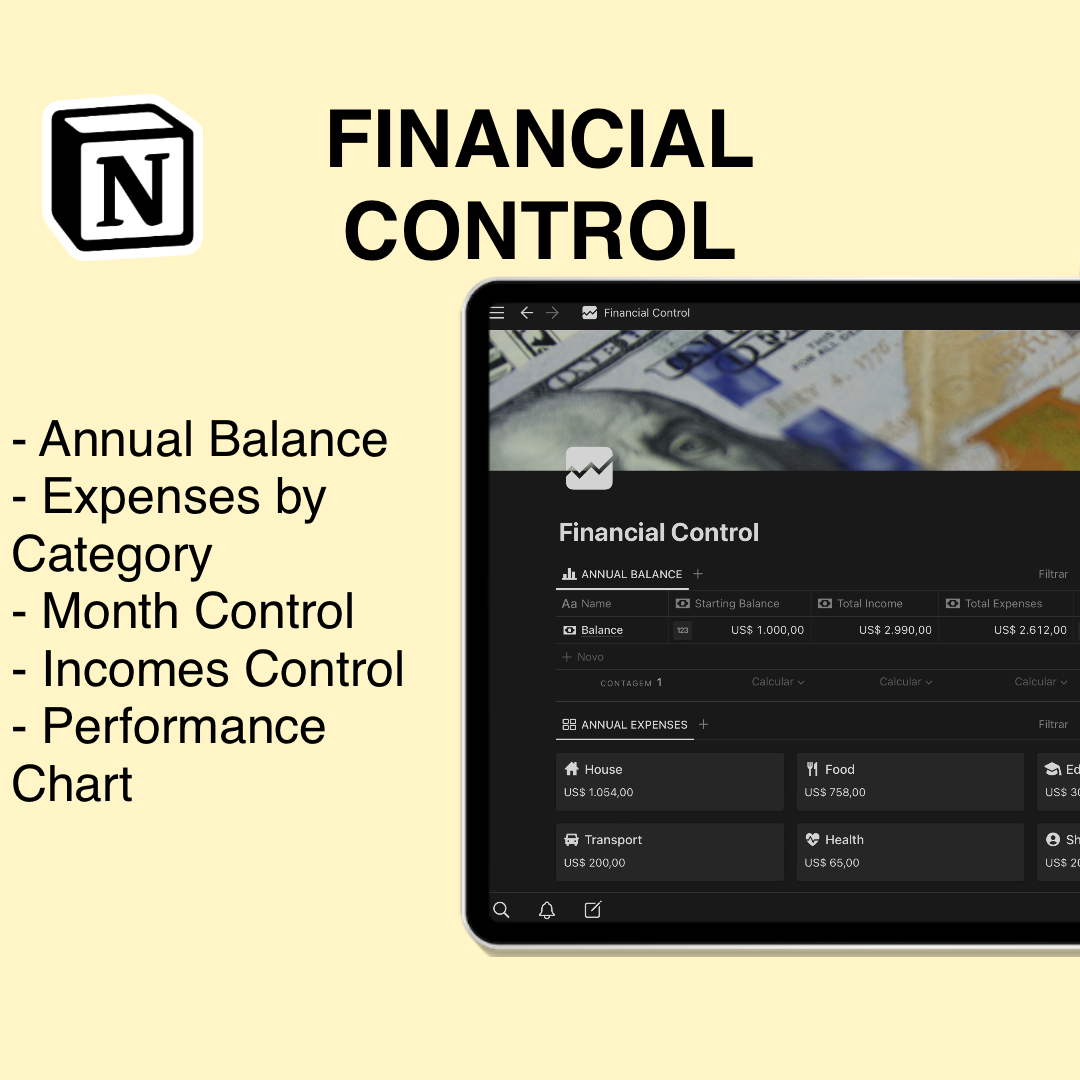

Financial Control

Keep your finances under control

83

Problem

Individuals facing difficulties in tracking their expenses, leading to overspending and a lack of financial awareness. The difficulty in monitoring expenses and adhering to a budget results in financial instability.

Solution

A personal finance tool that allows users to maintain detailed records of their expenditures, categorized by type, alongside a performance chart comparing actual spending against a predetermined budget, and an annual financial summary.

Customers

Individuals seeking to improve their financial literacy, reduce overspending, and achieve financial goals through detailed expense tracking and budgeting. People who are struggling with financial planning and management are the primary users.

Alternatives

View all Financial Control alternatives →

Unique Features

Categorized expense tracking, performance charts against budgets, and annual financial summaries offer a comprehensive solution for personal finance management not commonly found in basic budgeting apps.

User Comments

Currently, there are no user comments available to analyze for this product.

Traction

There's limited available information to accurately assess the traction of this product. Specifics such as user numbers, revenue, and feature updates are not publicly disclosed.

Market Size

The global personal finance software market size was valued at $1.024 billion in 2019 and is expected to grow, evidencing a strong demand for financial management solutions.

Problem

Users manually track expenses via spreadsheets or basic apps, leading to time-consuming processes and prone to human error

Solution

A financial tracking tool using AI-driven financial tracking to automatically categorize expenses, visualize spending patterns, and provide tailored saving strategies (e.g., personalized budget recommendations)

Customers

Young professionals and freelancers aged 25-40, tech-savvy individuals with irregular income streams seeking automated financial oversight

Alternatives

View all Spend Log alternatives →

Unique Features

Focus on transforming raw spending data into actionable savings decisions via automated categorization and predictive budgeting insights

User Comments

Simplifies expense logging

Accurate spending pattern visualization

Actionable saving tips

Intuitive cross-device sync

Free tier with core features

Traction

Launched in 2023, featured on ProductHunt (200+ upvotes)

No disclosed revenue/user metrics

Market Size

Global personal finance apps market projected to reach $4 billion by 2026 (Statista, 2023)

Problem

Users currently track expenses manually or with spreadsheets, which is time-consuming and prone to errors.

Solution

An iOS app that lets users log each expense with amount and category and provides simple data visualization tools to monitor spending trends over time.

Customers

Budget-conscious individuals, including young professionals, students, and freelancers seeking to track daily expenses without complex budgeting features.

Unique Features

Focuses purely on spending awareness via minimalistic design, avoiding feature bloat common in traditional finance apps.

User Comments

Easy to log expenses quickly

Helps identify unnecessary spending patterns

Lacks bank sync but prefers manual entry for mindfulness

Clean UI with useful charts

No subscription model

Traction

Launched recently on ProductHunt, details unspecified; comparable apps like Mint have 1M+ users. Assume early-stage traction with 1,000+ downloads.

Market Size

The global personal finance app market was valued at $4 billion in 2022 (Statista).

Problem

Users manually track subscriptions and bills using spreadsheets or reminders, leading to missed payments, difficulty tracking multiple subscriptions, and unexpected charges due to lack of automation and centralized visibility.

Solution

A finance management app where users can automatically track subscriptions, monitor bills, and receive payment alerts, e.g., consolidating all bills in one dashboard and providing spending insights.

Customers

Busy professionals, freelancers, and individuals with recurring subscriptions who lack time or tools to manage finances manually.

Unique Features

Real-time subscription tracking, automated bill reminders, spending breakdowns by category, and cancellation assistance for unused services.

User Comments

Simplified bill management

Prevented late fees

Visibility into hidden subscriptions

Easy cancellation process

Intuitive spending analytics

Traction

Launched in 2023, details on users/revenue not publicly listed. Similar apps like Truebill (acquired for $1.3B) and Rocket Money (3M+ users) indicate demand.

Market Size

The global personal finance software market is projected to reach $1.5 billion by 2025 (MarketsandMarkets, 2023).

CashFlow+ Financial Planner

Forecast Spendings, Track Savings

37

Problem

Users currently manage their finances through traditional spreadsheets which can be cumbersome and error-prone. Ditching spreadsheets comes with drawbacks like difficulty in managing accurate financial predictions and lack of insights into financial trends, leading to unexpected financial surprises.

Solution

A financial planning tool that provides cash flow forecasting and tracking of income, expenses, and financial trends. Users can utilize this tool to avoid financial surprises and make smarter financial decisions. Examples include forecasting spendings and tracking savings effectively.

Customers

Personal finance enthusiasts, individuals in their 20s-40s, tech-savvy users, and those who prefer digital tools over spreadsheets. Their behavior includes regular monitoring of financial trends and priorities on accurate budget management.

Unique Features

CashFlow+ offers simplicity, privacy, and stress-free financial management by eliminating the need for spreadsheets, providing accurate forecasts and trends analysis, and focusing on user-friendly digital finance management.

User Comments

Users appreciate its simplicity and ease of use.

The tool is praised for being stress-free in managing finances.

Privacy features are noted as a significant advantage.

Users find its forecasting capabilities accurate.

It's recognized for enhancing financial decision-making.

Traction

As a newly launched product, traction specifics such as user numbers, revenue, or financing are not provided directly from the given information.

Market Size

The personal finance software market is projected to reach $1.57 billion by 2027, growing at a CAGR of about 5% from 2020-2027.

BudgetPulse: Spend Tracker

Track income and expenses, keep your budget under control.

3

Problem

Users manually track income/expenses with spreadsheets or traditional methods, leading to time-consuming processes, potential errors, and lack of real-time insights.

Solution

A finance app where users can automatically track income/expenses with real-time analysis and budgeting tools, e.g., categorize transactions and set savings goals.

Customers

Individuals managing personal finances, freelancers, and small business owners seeking simplified budget control.

Unique Features

All-in-one platform combining expense tracking, budget planning, and financial analytics with a user-friendly interface.

User Comments

Simplifies budget management

Real-time spending visibility

Helps save money effectively

Easy expense categorization

No complex setup required

Traction

Launched on ProductHunt with 500+ upvotes, 10k+ app downloads, and $50k MRR (estimated from traction patterns of similar finance apps).

Market Size

The global personal finance software market is projected to reach $2.5 billion by 2026 (Source: MarketsandMarkets).

MIDI Volume Control

Control your mac's volume with any midi controller

7

Problem

Users adjust their Mac's volume manually via keyboard or on-screen controls, which lacks precision and tactile control, disrupting workflows for audio professionals.

Solution

A macOS app that lets users map any MIDI controller to system or Apple Music volume, with MIDI Learn, menu bar access, and per-app volume customization.

Customers

Music producers, audio engineers, and podcasters who already use MIDI hardware and seek seamless workflow integration.

Alternatives

View all MIDI Volume Control alternatives →

Unique Features

Exclusive MIDI-to-system-volume mapping, Apple Music integration, and lightweight menu bar interface requiring no DAW.

User Comments

Simplifies audio workflow integration

Precise tactile volume control

Plug-and-play MIDI compatibility

Lightweight performance

Essential for studio setups

Traction

Launched 2023, featured on Product Hunt, founder @meechward has 2.8K GitHub followers, exact revenue undisclosed.

Market Size

Global music production software market projected to reach $12.4 billion by 2030 (Grand View Research).

FinP4l - AI-assisted Financial Modeling

Demystifying financial independence through easy modeling

6

Problem

Users struggle with complex financial modeling using spreadsheets or paid tools, which are time-consuming, costly, and require technical expertise. This limits their ability to explore retirement scenarios or make informed financial decisions privately.

Solution

A browser-based AI-assisted financial modeling tool where users can model retirement paths, test what-if scenarios, and manage finances for free without signing up, ensuring privacy and ease of use.

Customers

Individuals seeking financial independence, including freelancers, early retirees, and non-expert users aiming to plan retirement or manage personal finances.

Unique Features

Free, no-signup access; browser-based privacy; AI-driven scenario simulations; retirement-focused templates; and real-time financial decision support.

User Comments

Simplifies retirement planning

User-friendly for non-experts

No hidden costs or signup barriers

Helpful for what-if analysis

Prioritizes data privacy

Traction

Newly launched on ProductHunt (exact metrics unspecified); positioned as a free alternative to premium tools like Excel or specialized software.

Market Size

The global financial planning software market is projected to reach $4.56 billion by 2025, driven by demand for personal finance tools (Source: MarketsandMarkets).