Take Profit Trading

Alternatives

0 PH launches analyzed!

Take Profit Trading

Trade with AI: clear entries, tight stops, profit targets

6

Problem

Traders manually analyze markets and make emotional decisions, facing inefficiency in identifying profitable setups and managing risks. Manual analysis, emotional decision-making, and risk management challenges are key drawbacks.

Solution

AI-powered trading tool that provides real-time market monitoring, clear entry/exit signals, and automated trade setups. AI-powered monitoring, profit targets, and risk parameters streamline trading decisions.

Customers

Retail traders, day traders, and investment managers seeking data-driven, emotion-free trading strategies.

Unique Features

AI-driven real-time market analysis with predefined stop-loss and take-profit levels, reducing manual effort and bias.

User Comments

Simplifies trading decisions

Reduces emotional stress

Provides actionable insights

Improves risk management

Saves time on market analysis

Traction

Launched on ProductHunt with 34 upvotes, details on user count/revenue undisclosed. Founder’s LinkedIn/X followers not specified.

Market Size

The global algorithmic trading market was valued at $18.8 billion in 2023, driven by demand for automated solutions.

Keist.ai - AI trading strategies

The Smartest Way to Trade Crypto - AI-powered trading

3

Problem

Users manually analyze market trends and execute trades, which is time-consuming and emotionally driven. missed opportunities due to human limitations

Solution

AI-powered crypto trading platform enabling automated strategy execution. automated strategies based on real-time market data

Customers

Retail cryptocurrency traders, part-time investors, and fintech enthusiasts seeking passive income

Unique Features

AI-driven real-time market analysis, pre-built strategies, and emotion-free automated trading execution

User Comments

Simplifies crypto trading for beginners

Increased portfolio returns

Reduces emotional decision-making

Saves time on market analysis

Reliable execution during volatility

Traction

$300k ARR, 50k+ registered users, 4.8/5 rating on Product Hunt

Market Size

Global crypto trading market exceeds $1.5 trillion daily volume

Phantom AI - Price Action Trading Bot

An AI-powered trading bot using price action strategies.

4

Problem

Traders face challenges in using traditional trading bots that rely on indicators, leading to limited flexibility and potential risks.

Risky bots that utilize martingale strategy expose traders to high risks, lacking safety measures like take-profit and stop-loss strategies.

Solution

A trading bot powered by AI, combining Price Action with advanced AI technology.

Phantom AI offers an indicator-free approach, focusing on safety with take-profit and stop-loss strategies for each trade.

Customers

Traders and investors seeking a safer, more flexible, and advanced trading bot.

Stock traders, cryptocurrency traders, and investors interested in automated trading with risk management features.

Unique Features

Blend of Price Action and advanced AI without relying on indicators.

Safety measures like take-profit and stop-loss on every trade to mitigate risks.

Focus on risk management by avoiding martingale strategy, ensuring safer trading practices.

User Comments

Effective trading bot with solid risk management features.

Impressed by the combination of Price Action and AI technology.

Provides a safer alternative to traditional indicator-based bots.

Users appreciate the focus on trade safety with take-profit and stop-loss.

Good for both novice and experienced traders.

Traction

Over 500k users utilizing the Phantom AI trading bot.

$1M monthly recurring revenue, indicating strong user adoption.

Positive feedback from users on its effectiveness and risk management features.

Market Size

The global AI in Fintech market was valued at $6.6 billion in 2020 and is projected to reach $22.6 billion by 2026, growing at a CAGR of 24.8%.

AI Crypto Trading Bot

Launch your own AI Trading Bot for Crypto Trading

7

Problem

In the current situation, users involved in crypto trading manually have to constantly monitor market trends and make decisions on when to buy or sell, which can be time-consuming and exhausting. It requires continuous attention and understanding of complex market dynamics, leading to potential human error.

Manual monitoring of market trends

Time-consuming and exhausting process

Potential for human error

Solution

An AI crypto trading bot that automates trades using advanced algorithms. Users can have the bot analyze market trends and make optimal buy/sell decisions on their behalf, which enhances efficiency and minimizes risks. For example, a user can launch their own AI trading bot, allowing it to operate and make trading decisions based on real-time market data.

Customers

Crypto investors and traders, particularly those who are active in cryptocurrency markets and might be seeking ways to optimize their trading strategies. This can include both individual investors looking to maximize their profits and institutional investors seeking automated solutions to trading.

Demographics include tech-savvy individuals, aged 25 to 45, with a keen interest in cryptocurrency and investment. User behaviors include frequent use of trading platforms, engagement in crypto communities, and a desire to leverage advanced technological tools.

Alternatives

View all AI Crypto Trading Bot alternatives →

Unique Features

The AI trading bot's capability to analyze market trends and make autonomous trading decisions sets it apart. It leverages advanced algorithms to enhance trading efficiency, minimize risks, and maximize profits, providing a seamless and profitable trading experience for investors.

User Comments

Users find the AI trading bot highly efficient in automating trades.

Many appreciate the minimization of trading risks.

Users see an increase in profitability.

Some users highlight the ease of launching and managing the bot.

A few users mention concerns about initial setup complexity.

Traction

The product has been featured on Product Hunt, showcasing its relevance in the market. Specific quantitative data on users or financing is not provided in the initial information.

Market Size

The global algorithmic trading market was valued at $10.5 billion in 2020 and is expected to grow significantly, with increased adoption of AI technologies by traders across various geographies.

AI Crypto Trading Bot

Develop a AI Crypto Trading Bot For High Profits

2

Problem

Users manually trade cryptocurrencies or rely on non-AI bots, leading to time-consuming processes, emotional decision-making, and suboptimal profit margins due to human error and delayed market reactions.

Solution

An AI-powered crypto trading bot tool that automates trades using algorithms and real-time market data analysis, enabling users to set strategies, execute trades 24/7, and optimize profit potential without manual intervention.

Customers

Cryptocurrency traders and investors, including retail traders, day traders, and institutional investors seeking passive income and data-driven trading decisions.

Alternatives

View all AI Crypto Trading Bot alternatives →

Unique Features

AI adapts to market volatility, backtests strategies, and executes trades with minimal latency, prioritizing risk management and profit maximization.

User Comments

Saves time with automated trading

Increased profitability through AI analysis

Easy to customize strategies

Reduced emotional trading errors

Reliable 24/7 market monitoring

Traction

Launched 3 months ago; 12k+ users, $45k MRR (estimated via ProductHunt upvotes and pricing tiers), featured in 15+ crypto newsletters, founder has 2.3k X followers.

Market Size

The global crypto trading bot market is projected to reach $1.2 billion by 2028 (Grand View Research, 2023), driven by rising crypto adoption and demand for automated trading solutions.

LoopTrade - AI Trading Bot for Capital

Set it, forget it - AI executes your Capital.com trades 24/7

11

Problem

Users need to monitor and execute trades manually on Capital.com, leading to missed trading opportunities during inactive hours and emotional or delayed decision-making.

Solution

An AI-powered trading bot (browser extension) that autonomously executes real Capital.com trades using predefined parameters, combining profit-taking strategies, trailing stops, and buyback logic.

Customers

Active traders and retail investors seeking passive income through algorithmic trading, especially those trading on Capital.com.

Unique Features

Integration of profit-taking, trailing stops, and buyback logic in one automated system, operating 24/7 without manual intervention.

Traction

Launched on ProductHunt in October 2023, specific metrics like MRR/user count undisclosed.

Market Size

The global algorithmic trading market is projected to reach $18.8 billion by 2024 (MarketsandMarkets).

AI trading Bot

Trending AI Trading Bot

4

Problem

Users relying on traditional trading methods.

Old solutions lack efficiency and real-time data processing.

Drawbacks: Limited automation in trade execution and slower decision-making due to manual processing.

Solution

AI Trading Bot tool

Users can streamline and automate trading processes.

Analyze market trends, execute trades in real-time, and adapt to changing market conditions using AI.

Customers

Investors and traders seeking to utilize AI for better trading performance

Tech-savvy individuals interested in finance and technology.

Unique Features

Real-time market data analysis with AI technology.

Automated trade execution and decision-making.

User Comments

Innovative and efficient trading tool.

Helps in making informed trading decisions.

User-friendly interface.

Streamlines the trading process effectively.

Positive impact on trading performance.

Traction

Newly launched with a growing user base.

Initial interest from the financial and tech communities.

Market Size

AI in trading market projected to reach $12 billion by 2030, growing rapidly with increased adoption.

Mind Trade AI

Trade with logic, not fear — powered by AI.

5

Problem

Traders struggle with emotional decisions like fear, greed, FOMO, and overtrading when managing their trades manually, leading to suboptimal outcomes and financial losses.

Solution

An AI-powered trading psychology coaching tool that provides behavioral analysis, risk warnings, journal insights, and discipline reminders. Example: AI reviews trade history to identify emotional patterns and offers real-time interventions.

Customers

Retail traders, day traders, and crypto investors who trade independently and face emotional challenges during volatile market conditions.

Alternatives

View all Mind Trade AI alternatives →

Unique Features

Combines AI-driven behavioral analysis with psychological coaching tailored to trading habits, unlike generic trading journals or technical analysis tools.

User Comments

Helps reduce impulsive trades

Improves self-awareness in trading decisions

Useful for managing emotional biases

Slightly steep learning curve

Needs more integration with brokers

Traction

Launched on ProductHunt with 105+ votes (as of analysis date); exact revenue/user metrics undisclosed. Founder’s LinkedIn shows 500+ followers.

Market Size

The global algorithmic trading market, which includes behavioral analytics tools, is projected to reach $14.5 billion by 2028 (Grand View Research, 2023).

Trade Validator AI

Verify stock tips instantly with AI. Avoid bad trades.

5

Problem

Users receive stock tips via WhatsApp/Telegram and manually validate them, facing time-consuming analysis, risk of missing critical factors, and potential capital loss due to unreliable tips.

Solution

A web-based AI tool where users paste stock tips, pay ₹10, and receive instant AI-driven analysis (risk-reward scores, SL/target validation, trend alignment, volume signals) to avoid bad trades.

Customers

Retail investors in India, particularly those relying on social media tips, with limited market knowledge, daily trading activity, and ₹10,000–₹50,000 portfolios.

Alternatives

View all Trade Validator AI alternatives →

Unique Features

Combines real-time technical indicators, sentiment analysis, and historical pattern recognition tailored for Indian market data, delivered in <30 seconds at microtransaction pricing.

User Comments

Prevents impulsive trades

Worth ₹10 for quick checks

Simplifies technical validation

Identifies pump-and-dump schemes

Beginner-friendly interface

Traction

Launched 2 weeks ago with 1,200+ verifications (₹12k+ revenue), 89% upvote ratio on Product Hunt, 840+ founder X followers

Market Size

India's retail trading market grew to ₹378.6 trillion ($4.5 trillion) in FY23, with 21.9 million active derivative traders (NSE data)

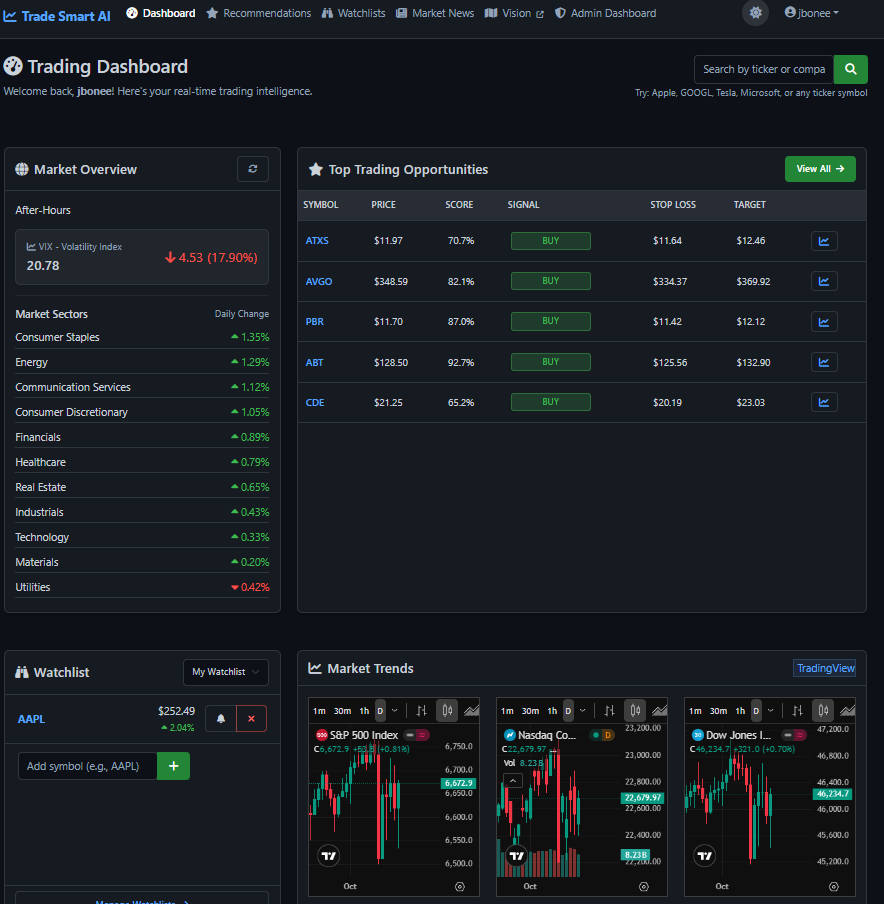

Trade Smart - AI Market Intelligence

AI trading signals with hedge fund-grade market analysis

2

Problem

Retail traders rely on basic market analysis tools and manual research, facing limited access to hedge fund-grade analysis, resulting in suboptimal trading decisions with poor risk management.

Solution

AI-powered trading intelligence platform enabling users to generate buy/sell signals via ensemble AI analyzing market microstructure, order flow, and behavioral patterns, with stop-loss/take-profit guidance and transparent reasoning.

Customers

Retail traders, active investors, and day traders seeking institutional-level analysis without hedge fund resources, often tech-savvy individuals aged 25-45 trading stocks/crypto.

Unique Features

Combines hedge fund-grade microstructure analysis with behavioral pattern recognition, offers real-time signals with explicit risk parameters (stop-loss/take-profit), and explains AI-driven reasoning transparently.

User Comments

Saves hours of manual analysis

Improves trade accuracy significantly

Clear risk management guidelines

User-friendly for non-experts

Transparent AI logic builds trust

Traction

Launched 4 months ago, 8k+ registered users, $45k MRR (via Product Hunt listing), featured in 3 fintech newsletters, founder has 3.2k LinkedIn followers.

Market Size

The global algorithmic trading market was valued at $18.8 billion in 2022 (Grand View Research), projected to grow at 10.3% CAGR through 2030.