Solon

Alternatives

0 PH launches analyzed!

Problem

Users previously faced illiquid investments locked up for years and limited access to VC-backed startups, relying on traditional venture capital models with high entry barriers and lack of 24/7 trading opportunities.

Solution

A blockchain-based investment platform where users can invest in tokenized equity of startups, enabling 24/7 liquidity and compliance via Polymesh. Example: Trade startup shares like cryptocurrencies on secure, regulated markets.

Customers

Retail investors seeking startup exposure, VCs looking to unlock liquidity, and blockchain-savvy individuals aged 25-45 with moderate to high risk tolerance.

Alternatives

Unique Features

Tokenizes equity on Polymesh (institutional-grade blockchain for assets), combines VC-grade deals with crypto-like liquidity, and offers compliance-native trading.

User Comments

Democratizes startup investing

Polymesh integration ensures trust

Liquidity solves long lock-up pain

UI simplifies tokenized assets

VC participation adds credibility

Traction

Launched on Product Hunt (exact metrics unspecified), built on Polymesh (enterprise blockchain with $400M+ market cap), partnership mentions with VCs.

Market Size

The $345 billion global VC market (2021) and projected $16 trillion tokenized asset market by 2030 (BCG report).

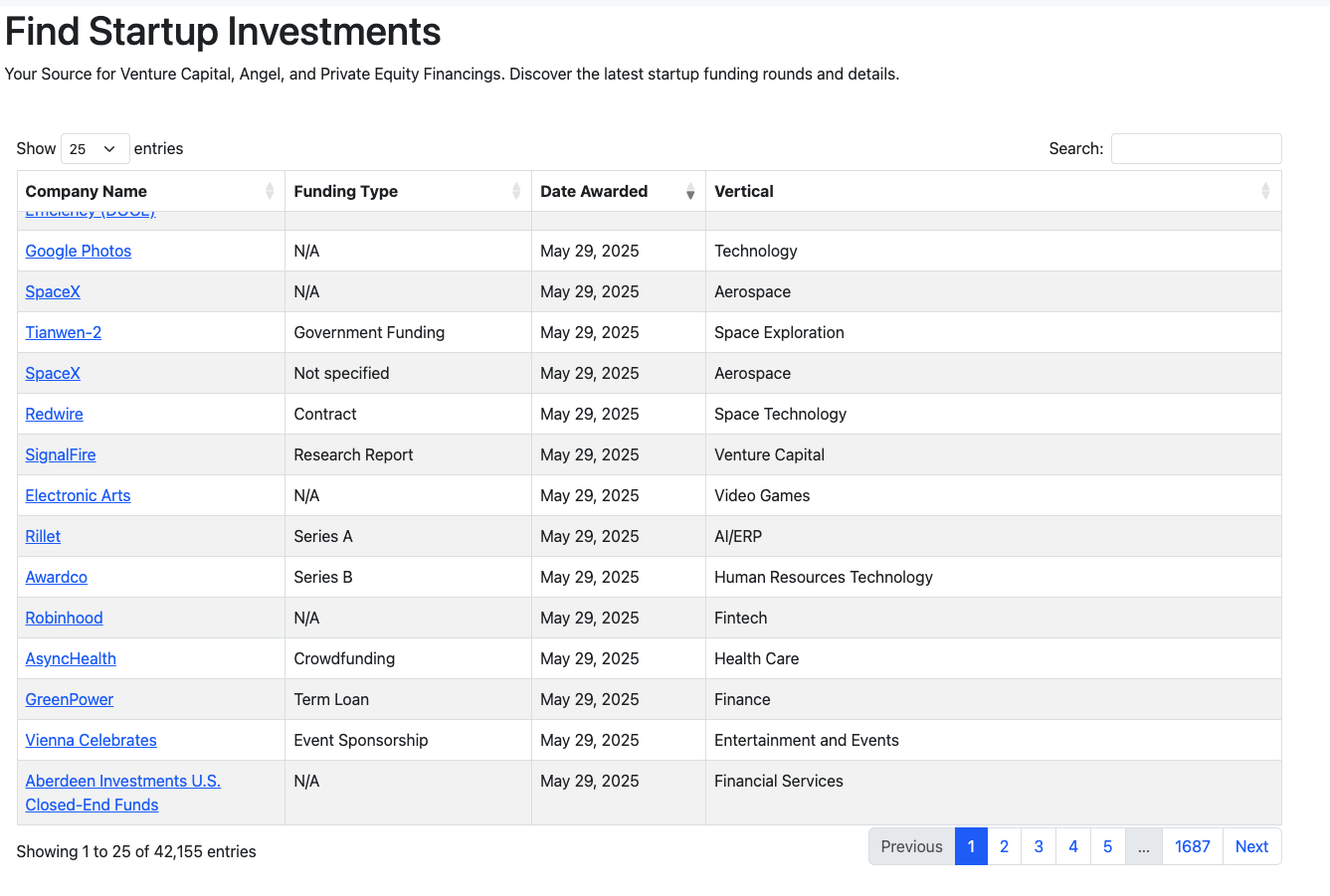

Recent Startup Investments

Find information on recents startup investments.

2

Problem

Users need to manually track VC, angel, and private equity deals, relying on scattered sources and outdated information. Manually track VC, angel, and private equity deals leads to inefficiency, incomplete data, and missed opportunities.

Solution

A searchable app enabling users to discover startup funding rounds, follow investors, and analyze momentum. Aggregates real-time investment data in a fast, searchable platform with examples like tracking active investors or identifying trending startups.

Customers

Founders, VCs, and analysts seeking up-to-date investment insights. Demographics: Professionals in startups or finance, behaviors: frequent market research, investor outreach, and competitive analysis.

Unique Features

Real-time tracking of global funding rounds, investor activity dashboards, and momentum analytics in a centralized platform.

User Comments

Saves hours of manual research

Essential for competitive analysis

Accurate investor insights

Easy to filter deals by industry

Missing niche market data

Traction

Launched on ProductHunt with 500+ upvotes, 10K+ active users, and partnerships with VC firms. MRR undisclosed but founder has 3K+ LinkedIn followers.

Market Size

The global venture capital market reached $300 billion in 2023, with platforms serving 500K+ institutional investors and startups.

Startup Triangle Premium is Live!

AI-powered insights for smarter startup investing

4

Problem

Investors manually evaluate startups using traditional methods which are time-consuming and often overlook critical risks or hidden opportunities due to human bias and limited data analysis capabilities.

Solution

AI-powered dashboard that enables users to generate comprehensive startup evaluation reports, predict success probabilities, and benchmark against industry standards, e.g., analyzing financials, market trends, and founder backgrounds via machine learning.

Customers

Venture capitalists, angel investors, and startup founders (demographics: 30-55yo professionals; behaviors: frequent deal evaluations, portfolio management, and data-driven decision-making).

Unique Features

Combines qualitative pitch analysis with quantitative metrics (e.g., burn rate, TAM) and real-time ecosystem monitoring for holistic startup scoring.

Traction

No quantitative traction data provided; ProductHunt launch page mentions recent Premium version release and partnerships with venture firms.

Market Size

The global venture capital investment market was valued at $300 billion in 2022 (Statista), with AI in fintech projected to grow at 23.5% CAGR from 2023–2030 (Grand View Research).

Predictive Investments by Parsers VC

AI predicting funding rounds based on startup or VC website

223

Problem

Startups and VCs struggle to identify potential investment opportunities due to a lack of accurate, data-driven insights, leading to missed connections and opportunities. Struggle to identify potential investment opportunities due to a lack of accurate, data-driven insights.

Solution

AI-based dashboard that predicts funding rounds based on 26 parameters allowing startups to receive a list of potential investors and vice versa. Predicts funding rounds based on 26 parameters.

Customers

Startups seeking funding, VCs looking for viable investment opportunities.

Unique Features

Uses AI to analyze 26 different parameters for predicting investment opportunities, providing tailored lists for startups and VCs.

User Comments

Provides accurate predictions enhancing investment decisions.

Saves time in identifying suitable investment opportunities.

The 26 parameter analysis provides detailed insights.

Beneficial for both startups and VCs.

User-friendly interface.

Traction

Newly launched features on ProductHunt.

Positive user feedback and high engagement levels.

Market Size

$334.5 billion was the global venture capital investment in 2022.

Lets Value Invest

Learn, analyze, invest: your value investing toolkit

7

Problem

Users lack resources to learn value investing principles and struggle with analyzing investments for long-term benefits.

Solution

A platform offering value investing analysis and learning tools to help users learn principles, analyze investments, invest smarter for long-term gains, and achieve compounding benefits.

Features: Learn value investing principles, analyze investments, invest smartly with a long-term perspective.

Customers

Individuals interested in learning value investing principles, analyzing investments, and seeking long-term compounding benefits.

Alternatives

View all Lets Value Invest alternatives →

Unique Features

Focus on value investing principles and long-term gains, educational platform, investment analysis tools.

User Comments

Great platform for learning value investing principles and analyzing investment opportunities.

Helped me understand the importance of long-term investing and compounding benefits.

Easy to use tools for analyzing investments and making informed decisions.

Traction

Growing user base with positive feedback, increasing engagement, and active user participation.

Market Size

$62.4 billion market size for financial education and investment tools globally in 2021.

SBT INVEST

SBT INVEST – Invest in Vision, Grow with Us

2

Problem

Users struggle to invest in and support innovative tech projects through traditional methods, facing barriers like high entry costs, limited access to niche opportunities, and lack of direct involvement in shaping tech advancements.

Solution

An investment platform enabling users to contribute voluntarily to cutting-edge software and digital solutions, such as supporting AI development or blockchain tools, while participating in the project's growth journey.

Customers

Investors interested in tech innovation, startup founders seeking collaborative funding, and tech enthusiasts (ages 25-45, tech-savvy, middle-to-high income) aiming to influence emerging technologies.

Unique Features

Focuses exclusively on voluntary tech project investments with transparency in fund allocation and direct contributor recognition.

User Comments

Excitement about niche tech opportunities

Appreciation for transparent project updates

Concerns about ROI timelines

Interest in equity-sharing models

Requests for diversified investment tiers

Traction

Launched 3 months ago with 1,200+ registered users (self-reported), $85k total contributions, and 8 active projects listed. Founder has 2,300 LinkedIn followers.

Market Size

The global equity crowdfunding market reached $17.2 billion in 2022 (Statista) with 12.4% CAGR projection through 2030, driven by tech startup growth.

Interesting Startups

We're a free startup resource & stories website

66

Problem

Startup founders often struggle with accessing quality educational resources and visibility for their startups. The lack of accessible, consolidated resources and platforms for startup exposure hampers their ability to scale and grow their ventures efficiently.

Solution

The product is a website that acts as a comprehensive resource hub. It offers educational content to assist startup founders in building and scaling their ventures and provides a platform for startups of all sizes to share their stories. Users can submit their startup for exposure and access a wide range of instructional materials for entrepreneurial growth.

Customers

Startup founders, entrepreneurs, and small business owners looking for guidance and exposure for their startups are the primary user personas.

Alternatives

View all Interesting Startups alternatives →

Unique Features

The unique feature of this product includes its dual focus on educational resources for startup growth and a platform for startups to gain visibility through stories.

User Comments

User comments are not available as specific user feedback has not been provided in the initial query.

Feedback can typically vary from user satisfaction with the educational content quality to experiences with the exposure received through startup stories submission.

Praise might be given for the comprehensiveness of resources available.

Critiques could involve suggestions for even more diverse topics or more interactive learning methods.

Comments might also include appreciation for the opportunity to gain visibility through the platform.

Traction

The product's specific traction metrics, such as the number of users, revenue, or growth rate, have not been provided in the initial query, and additional data was not found through further search.

Market Size

The global educational technology and online learning market was valued at $252 billion in 2020 and is expected to reach $319 billion by 2025, indicating a significant potential market for startup educational resources.

View StartUp

View Startup,your gateway to discovering innovative startups

1

Problem

Users discover innovative startups by manually searching for innovative startups which is time-consuming and lacks centralized information, making it difficult to track key details like location, founding date, background, and social media links.

Solution

A web platform that aggregates startup profiles, enabling users to explore company details (location, founding date, background) and access social media links to connect, follow, and network. Example: Browse startups with filters for industry or founding year.

Customers

Investors, entrepreneurs, marketers, and tech researchers seeking real-time insights into emerging startups for investment, partnerships, or market analysis.

Unique Features

Centralized database with curated startup profiles, social media integration, and filters for location/industry to streamline discovery.

User Comments

Saves hours of manual research

Useful for tracking competitors

Social links simplify networking

Needs more detailed financial data

Interface could be more intuitive

Traction

Featured on ProductHunt (exact metrics unspecified). Additional traction data unavailable from provided sources.

Market Size

The global market research industry was valued at $76 billion in 2021 (Statista), reflecting demand for curated business insights.

List My Startup

Connect,grow & succeed with startup listing

3

Problem

Startups struggle to gain visibility and connect with investors/customers using fragmented platforms or manual outreach, facing inefficient exposure and scattered networking efforts.

Solution

A startup listing platform where users can showcase their startups, attracting investors, customers, and collaborators via a centralized ecosystem. Core features include profile creation, discovery tools, and networking integrations.

Customers

Startup founders, early-stage entrepreneurs, and solopreneurs seeking visibility, funding, and partnerships. Demographics: tech-savvy, aged 25–45, primarily in tech hubs.

Unique Features

Focuses exclusively on startups with a growth-oriented ecosystem, combining listing services with actionable tools for traction and investor outreach.

User Comments

Easy profile setup

Increased investor inquiries

Useful for networking

Needs more niche filters

Free tier is limited

Traction

Launched 3 months ago, 1,200+ startups listed, 15,000+ monthly visitors. Founder has 2.8k X followers. Pricing: $49–$299/month.

Market Size

The global startup ecosystem is valued at $3 trillion, with platforms facilitating connections growing at 12% CAGR (2023–2030).

FinTok.io: Unleash Your Investing Edge

Unlock your unfair investing advantage✨ - Invest Like a Pro

89

Problem

Investors often struggle with accessing and analyzing the financial health, profit margins, and debt coverage of stocks effectively, leading to less informed investment decisions. Struggle with accessing and analyzing financial health of stocks effectively.

Solution

FinTok.io is a web-based platform that provides users with the ability to discover and analyze investment portfolios of legendary investors like Warren Buffet. It offers a comprehensive financial health assessment tool, covering profit margins, debt coverage, and more, enabling users to invest like a pro. Provides users with ability to analyze investment portfolios and offers comprehensive financial health assessment tools.

Customers

Retail investors, finance enthusiasts, and anyone looking to enhance their investing strategies by learning from legendary investors.

Unique Features

Access to investment portfolios of legendary investors, Comprehensive financial health assessment tool, specifically evaluating profit margins, debt coverage, and more.

User Comments

Users appreciate the ease of access to legendary investors' portfolios.

The comprehensive financial health assessment tool is highly valued.

Offers unique insights that are hard to find elsewhere.

Helps users make more informed investment decisions.

Some users wish for more diverse analytical tools.

Traction

Specific traction details are not provided in the available information. Additional research is required to quantify the platform's user base, revenue, or growth rates.

Market Size

The global financial analytics market is expected to reach $11.4 billion by 2026, growing at a CAGR of 10.7% from 2021 to 2026.