Recent Startup Investments

Alternatives

0 PH launches analyzed!

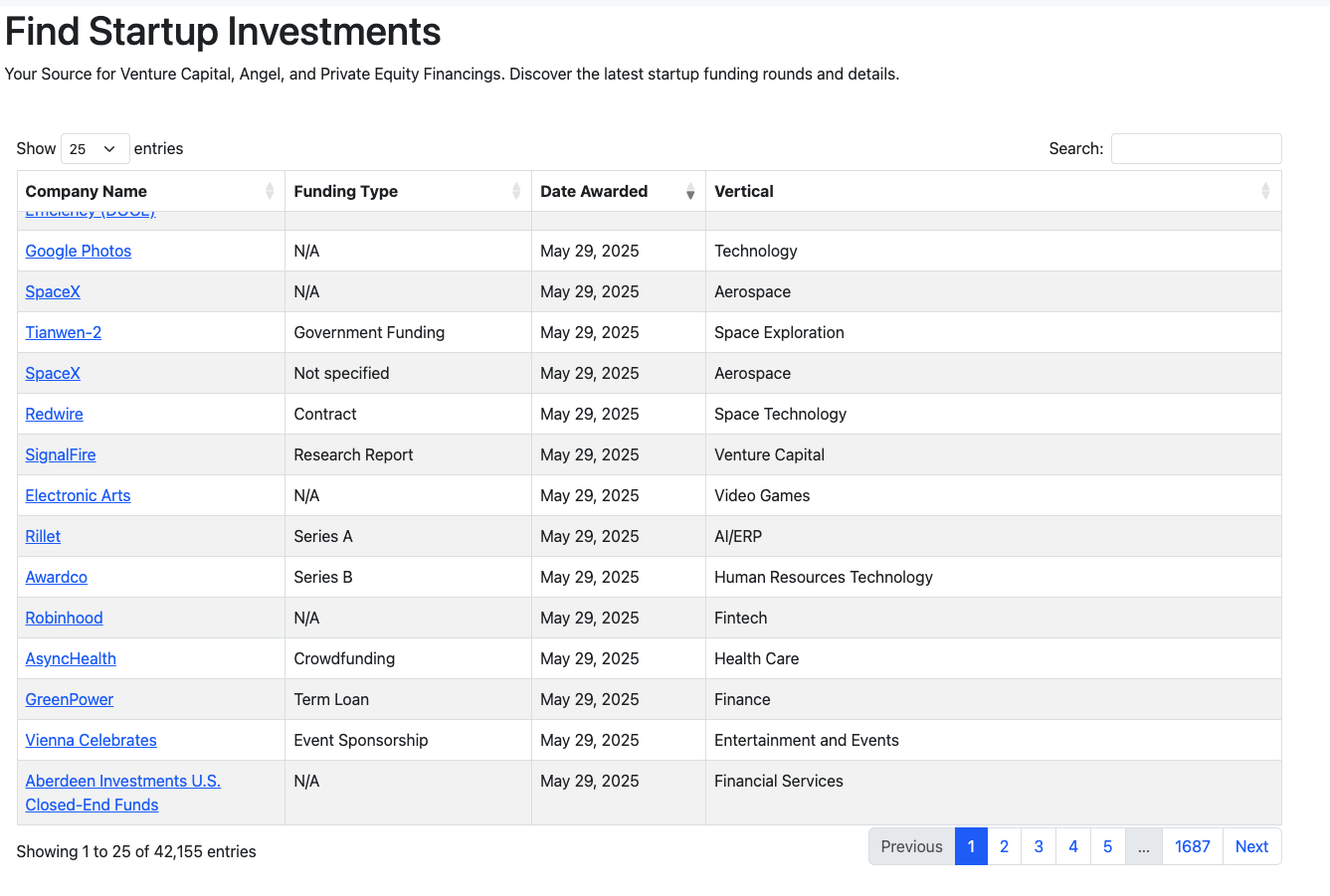

Recent Startup Investments

Find information on recents startup investments.

2

Problem

Users need to manually track VC, angel, and private equity deals, relying on scattered sources and outdated information. Manually track VC, angel, and private equity deals leads to inefficiency, incomplete data, and missed opportunities.

Solution

A searchable app enabling users to discover startup funding rounds, follow investors, and analyze momentum. Aggregates real-time investment data in a fast, searchable platform with examples like tracking active investors or identifying trending startups.

Customers

Founders, VCs, and analysts seeking up-to-date investment insights. Demographics: Professionals in startups or finance, behaviors: frequent market research, investor outreach, and competitive analysis.

Alternatives

Unique Features

Real-time tracking of global funding rounds, investor activity dashboards, and momentum analytics in a centralized platform.

User Comments

Saves hours of manual research

Essential for competitive analysis

Accurate investor insights

Easy to filter deals by industry

Missing niche market data

Traction

Launched on ProductHunt with 500+ upvotes, 10K+ active users, and partnerships with VC firms. MRR undisclosed but founder has 3K+ LinkedIn followers.

Market Size

The global venture capital market reached $300 billion in 2023, with platforms serving 500K+ institutional investors and startups.

Find Startup Name

Find a startup name - with available domain

4

Problem

Individuals starting a new business struggle to come up with a suitable and available name for their startup, including a matching domain name.

Solution

An online tool that provides suggested startup names along with available domain names for free.

Customers

Entrepreneurs, startup founders, and individuals looking to name their new businesses and secure corresponding domain names.

Unique Features

Provides matching domain names alongside suggested startup names for free.

User Comments

Saves time and effort in brainstorming names and checking domain availability.

Useful tool for new ventures and ideas.

Generates creative suggestions efficiently.

Simplified the naming process for startups.

Eases the stress of finding a suitable name for businesses.

Traction

The tool has gained popularity among entrepreneurs and startup enthusiasts.

Positive user feedback and growing user base.

Market Size

$52 billion was generated by the global domain industry in 2020, demonstrating the significance of securing suitable domain names for businesses.

View StartUp

View Startup,your gateway to discovering innovative startups

1

Problem

Users discover innovative startups by manually searching for innovative startups which is time-consuming and lacks centralized information, making it difficult to track key details like location, founding date, background, and social media links.

Solution

A web platform that aggregates startup profiles, enabling users to explore company details (location, founding date, background) and access social media links to connect, follow, and network. Example: Browse startups with filters for industry or founding year.

Customers

Investors, entrepreneurs, marketers, and tech researchers seeking real-time insights into emerging startups for investment, partnerships, or market analysis.

Unique Features

Centralized database with curated startup profiles, social media integration, and filters for location/industry to streamline discovery.

User Comments

Saves hours of manual research

Useful for tracking competitors

Social links simplify networking

Needs more detailed financial data

Interface could be more intuitive

Traction

Featured on ProductHunt (exact metrics unspecified). Additional traction data unavailable from provided sources.

Market Size

The global market research industry was valued at $76 billion in 2021 (Statista), reflecting demand for curated business insights.

Startup Triangle Premium is Live!

AI-powered insights for smarter startup investing

4

Problem

Investors manually evaluate startups using traditional methods which are time-consuming and often overlook critical risks or hidden opportunities due to human bias and limited data analysis capabilities.

Solution

AI-powered dashboard that enables users to generate comprehensive startup evaluation reports, predict success probabilities, and benchmark against industry standards, e.g., analyzing financials, market trends, and founder backgrounds via machine learning.

Customers

Venture capitalists, angel investors, and startup founders (demographics: 30-55yo professionals; behaviors: frequent deal evaluations, portfolio management, and data-driven decision-making).

Unique Features

Combines qualitative pitch analysis with quantitative metrics (e.g., burn rate, TAM) and real-time ecosystem monitoring for holistic startup scoring.

Traction

No quantitative traction data provided; ProductHunt launch page mentions recent Premium version release and partnerships with venture firms.

Market Size

The global venture capital investment market was valued at $300 billion in 2022 (Statista), with AI in fintech projected to grow at 23.5% CAGR from 2023–2030 (Grand View Research).

Most Innovative Startup

Vote for the world's most innovative startup

3

Problem

Users previously relied on fragmented sources like news articles and industry reports to track innovative startups, leading to inefficient discovery and lack of real-time community input.

Solution

A web-based voting platform where users can vote and globally rank startups in real-time, enabling crowdsourced discovery of innovative ventures.

Customers

Entrepreneurs, investors, and tech enthusiasts (ages 25-45) seeking data-driven insights into emerging startups.

Alternatives

View all Most Innovative Startup alternatives →

Unique Features

Global community-driven voting mechanism emphasizing real-time results and ecosystem-wide participation.

User Comments

Simplifies trend tracking

Offers fresh startup perspectives

Engages global audiences

Needs deeper founder profiles

Encourages networking

Traction

Launched recently; exact user numbers and revenue undisclosed. Featured on ProductHunt with initial traction.

Market Size

The global venture capital market reached $343 billion in 2021 (Statista 2022), indicating a large addressable market for startup-discovery tools.

Predictive Investments by Parsers VC

AI predicting funding rounds based on startup or VC website

223

Problem

Startups and VCs struggle to identify potential investment opportunities due to a lack of accurate, data-driven insights, leading to missed connections and opportunities. Struggle to identify potential investment opportunities due to a lack of accurate, data-driven insights.

Solution

AI-based dashboard that predicts funding rounds based on 26 parameters allowing startups to receive a list of potential investors and vice versa. Predicts funding rounds based on 26 parameters.

Customers

Startups seeking funding, VCs looking for viable investment opportunities.

Unique Features

Uses AI to analyze 26 different parameters for predicting investment opportunities, providing tailored lists for startups and VCs.

User Comments

Provides accurate predictions enhancing investment decisions.

Saves time in identifying suitable investment opportunities.

The 26 parameter analysis provides detailed insights.

Beneficial for both startups and VCs.

User-friendly interface.

Traction

Newly launched features on ProductHunt.

Positive user feedback and high engagement levels.

Market Size

$334.5 billion was the global venture capital investment in 2022.

Startup Jobs

Free startup job board with more than 2000 members

121

Problem

People interested in working at startups face difficulties in finding a centralized platform that lists available positions, leading to a fragmented job search experience and potentially missing out on opportunities.

Solution

Startup Jobs by Binh Pham is a simple and straightforward job alerts website designed for startup enthusiasts, offering a centralized platform to explore opportunities with over 2000 members and more than 100 startups.

Customers

Job seekers interested in startup culture, recent graduates looking for innovative work environments, and professionals seeking a career shift towards more dynamic companies are the primary users of this platform.

Alternatives

View all Startup Jobs alternatives →

Unique Features

The focus on startup opportunities exclusively, simplicity and straightforwardness of the platform, and the existing member base of over 2000 startup enthusiasts provide a unique value proposition.

User Comments

Easy to navigate and find relevant jobs.

Great for discovering new startups.

Helpful in networking with like-minded professionals.

Limited in terms of advanced search options.

A growing database of startups increases chances of finding a good match.

Traction

Over 2000 members, more than 100 startups in the database, which signifies a growing community and increasing opportunities for job seekers and startups alike.

Market Size

The global online job board market size was valued at $18 billion in 2020, with a growing trend towards niche and specialized job boards.

Startups Launchpad

Announce your startup & connect with investors

7

Problem

Entrepreneurs and startups struggle to announce their projects and connect with potential investors effortlessly. Traditional methods involve extensive networking, which can be time-consuming and limiting in reach. Drawbacks of this old situation include the difficulty in finding the right investors and feedback channels.

Solution

A platform, specifically a web-based tool, that enables startups to announce their presence in the startup ecosystem. Users can effectively gain feedback from early adopters, connect with verified investors, accelerators, and funding networks, and find co-founders to scale their business by using this platform.

Customers

*Startup founders* and entrepreneurs looking for innovative ways to launch and fund their ventures, primarily those in the early-stage startup phase seeking connections and feedback.

Unique Features

The ability to connect with verified investors and a network of accelerators, combined with features that allow startups to announce their ventures and receive feedback from early adopters, making it uniquely integrated for both feedback and funding connections.

User Comments

Users appreciate the platform's ability to connect them with potential investors.

The feedback from early adopters is valuable for refining their product offerings.

Some users wish for more detailed guidance on securing funding.

Networking opportunities are considered beneficial.

The platform is praised for elevating a startup's visibility in the early stages.

Traction

The platform is newly launched and as of now, exact metrics like number of users, MRR, or specific revenue data are not provided. The focus seems to be on building connections and initial user engagement.

Market Size

The global startup ecosystem was valued at over $3 trillion in 2020, with investments and startups continuing to grow due to increased interest in innovation and entrepreneurship.

Clerky Handbooks for Startup Founders

Concise handbooks for founders, written by startup attorneys

74

Problem

Startup founders often struggle with understanding the basic legal concepts necessary for incorporating and running their startup successfully, which can lead to costly mistakes and legal complications.

Solution

Clerky offers concise handbooks written by startup attorneys. These handbooks provide startup founders with expert information on basic legal concepts, startup incorporation, and other essential legal knowledge necessary for running a startup.

Customers

Startup founders who lack legal knowledge but are seeking reliable and expert information to help in the successful incorporation and legal management of their startups.

Unique Features

The handbooks are specifically designed for startup founders and are written by experienced startup attorneys, making the content highly reliable and trustworthy.

User Comments

Comments not available - user feedback is required to provide a summary.

Traction

Traction data is not available without direct access to product launch details or the company's performance metrics.

Market Size

The global legal services market was valued at approximately $849 billion in 2020.

Find CEO Emails - by ConnectFlux

Find emails of CEO, Founders & Investors of Funded Startups

11

Problem

Users struggle to find contact emails of CEO, founders, and investors of funded startups

Manual search for email addresses is time-consuming and often leads to incorrect or outdated contact information

Solution

AI-powered assistant with access to hundreds of thousands of records

Automates the process of finding and validating emails of CEOs, founders, and investors of funded startups, along with data enrichment and email automation features

Customers

Startup founders

Investors

Business development professionals

Unique Features

Access to a vast database of records

Email validation and verification capabilities

Data enrichment for more detailed contact information

Email automation tools for efficient communication outreach

User Comments

Saves me hours of manual searching for emails

Accurate and up-to-date contact information

Great tool for prospecting in the startup ecosystem

Helpful for targeted outreach campaigns

Streamlines my communication with key stakeholders

Traction

Over 500k emails found and verified

Growing user base with positive reviews

Featured on ProductHunt with a high number of upvotes and engagements

Market Size

Global market for sales intelligence solutions was valued at approximately $3.61 billion in 2020

Expected to reach $13.8 billion by 2027 with a CAGR of 19.7%