SBA Loan Analyzer

Alternatives

0 PH launches analyzed!

SBA Loan Analyzer

Do You Qualify for SBA Loans? Know Before You Apply

4

Problem

Small business owners and entrepreneurs applying for SBA loans often struggle to assess their eligibility beforehand, leading to time-consuming applications and potential rejections due to unclear lender criteria.

Solution

An AI-powered loan eligibility checker tool that allows users to input financial/business data and receive instant approval likelihood analysis, e.g., assessing credit score, revenue, and debt-to-income ratio against SBA requirements.

Customers

Small business owners, startup founders, and financial advisors helping clients navigate SBA loan processes, primarily in the US market.

Alternatives

Unique Features

Uses AI to simulate lender approval algorithms, provides actionable insights for improving eligibility, and offers a detailed pre-application checklist tailored to SBA 7(a)/504 loan programs.

User Comments

Saves weeks of paperwork confusion

Transparent criteria breakdown surprised me

Identified debt ratio as my main blocker

Easy to use without financial expertise

Helped negotiate better terms with brokers

Traction

Launched January 2023, used by 8,200+ businesses (per ProductHunt), founder @SBAnalyzer has 1.4K Twitter followers, integrated with 3 major SBA-approved lenders

Market Size

The SBA loan market processed $40 billion in 7(a)/504 loans in 2023, with 60K+ approved businesses annually (U.S. Small Business Administration data).

Personal Loan Schemes

Apply for instant personal loans

3

Problem

Users face lengthy and complex processes when applying for personal loans through traditional banks or financial institutions. Slow approval times and extensive documentation requirements create barriers to accessing urgent funds.

Solution

A digital platform enabling users to apply for instant personal loans with quick approval and minimal paperwork. Examples: streamlined online application, real-time eligibility checks, and direct disbursement.

Customers

Salaried professionals, freelancers, or individuals with urgent financial needs seeking hassle-free loan solutions.

Unique Features

Simplified documentation, instant eligibility verification, and disbursement within hours (vs. days in traditional systems).

User Comments

Saves time compared to banks

Easy to use interface

Transparent terms

Quick disbursement

Helpful for emergencies

Traction

Launched recently on ProductHunt (specific metrics unavailable). Comparable fintech lenders like Upstart report $800M+ annual revenue.

Market Size

The global digital lending platform market was valued at $10.7 billion in 2023 (Grand View Research).

Boat Loan Calculator

Boat Loan Calculator | 2025

7

Problem

Users currently estimate boat loan payments using generic loan calculators or manual math, lacking boat-specific factors like depreciation rates and marine insurance, leading to inaccurate payment estimates.

Solution

A web-based boat loan calculator tool enabling users to input boat price, down payment, interest rate, and loan term to instantly calculate monthly payments, total costs, and affordability metrics tailored to marine financing.

Customers

Recreational boat buyers, marine dealerships, boat financing agents, and personal financial advisors helping clients with luxury asset purchases

Unique Features

Specialized calculation algorithm incorporating marine-specific variables like boat depreciation curves and lender risk models for watercraft

User Comments

Simplifies boat budgeting

Accurate interest rate modeling

Clear payment breakdowns

Helpful for negotiation

Saves dealership time

Traction

Launched 2023, 50,000+ calculations processed, integrated as white-label tool by 12 marine dealerships, 92% user satisfaction rate per internal surveys

Market Size

The US boat financing market originated $27.8 billion in new loans annually pre-pandemic (Recreational Boating Industry Association 2023 report)

Home Loan Eligibility Calculator

Home loan eligibility calculator by EaseTools

1

Problem

Users need to manually calculate home loan eligibility using spreadsheets or generic financial tools, leading to time-consuming and error-prone estimations that don’t account for nuanced factors like EMI capacity and income stability.

Solution

A web-based home loan eligibility calculator enabling users to input income, EMI capacity, and tenure to instantly receive accurate loan qualification estimates, leveraging algorithmic calculations for fast and precise results.

Customers

Salaried professionals, freelancers, and first-time homebuyers seeking clarity on loan affordability based on their financial profiles.

Unique Features

Focuses exclusively on home loan eligibility with parameters tailored to lenders’ criteria, providing instant, institution-specific estimates.

User Comments

Simplifies loan planning

Saves time vs manual methods

Clear breakdown of eligibility factors

Accurate for pre-approval prep

No multi-tool hopping needed

Traction

Launched in 2023, featured on Product Hunt with 100+ upvotes. Traction data (users/revenue) unavailable from provided sources.

Market Size

The global mortgage market was valued at $11.3 trillion in 2022 (Statista), driven by rising homeownership demand.

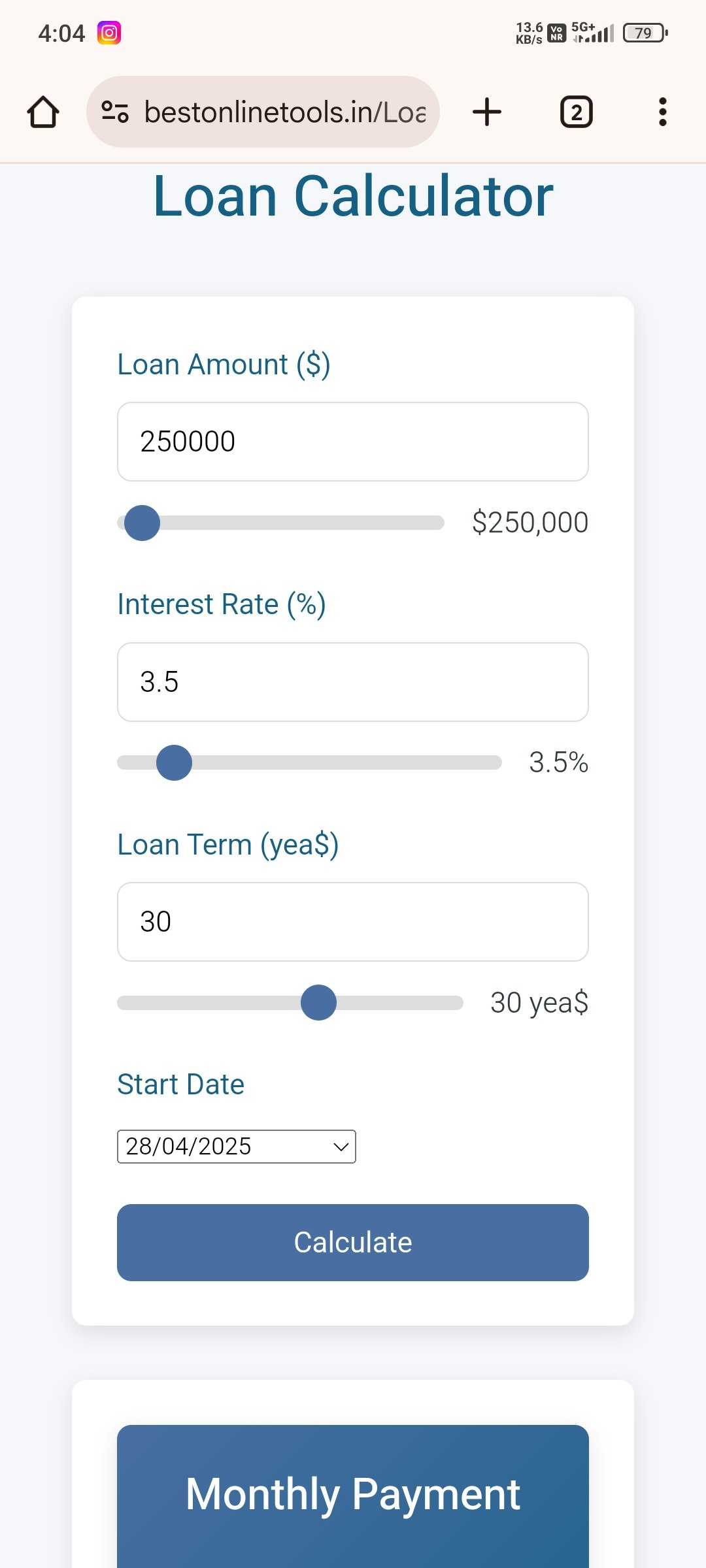

Loan Calculator

Free Loan Calculator

3

Problem

Users need to manually calculate loan details like EMI, interest rates, and total loan amounts using spreadsheets or basic tools, which are time-consuming and error-prone.

Solution

A web-based loan calculator tool that allows users to input loan parameters and instantly calculate EMI, interest rates, and total loan amounts automatically. Examples: personal, home, car, and business loan planning.

Customers

Borrowers, financial advisors, and loan officers (demographics: adults aged 25–60, financially conscious individuals, small business owners).

Unique Features

Supports multiple loan types (personal, home, car, business), provides instant results without signup, and offers accuracy for informed financial decisions.

Traction

Launched on ProductHunt (specific metrics unavailable due to limited data).

Market Size

The global personal loan market was valued at $50 billion in 2023 (Source: Grand View Research).

Finzo Loan Management App

Loan management app: easy loans, smart life

5

Problem

Managing loans manually can be complex and time-consuming. Users struggle with tracking payments, interest rates, and repayment schedules. Traditional methods lack real-time updates, leading to financial mismanagement. Users often find it difficult to calculate interest accurately and keep track of different loans.

Solution

A mobile app that helps manage loans effectively. Users can manage personal, home, or car loans effortlessly through this app. It provides an all-in-one platform to track loan details, repayment schedules, and calculate interest, simplifying the borrowing and lending process.

Customers

Individuals managing multiple loans such as personal, home, or car loans, primarily from working adults who require efficient financial management tools.

Unique Features

The app offers real-time loan management and scheduling. It simplifies complex loan tracking into an intuitive mobile interface, aiding efficient financial planning.

User Comments

The app is user-friendly and helpful for managing various loans.

Features are comprehensive for personal financial management.

Some users experienced issues with the interface being overly complex.

Positive feedback on customer service and support.

Praised for reducing the stress associated with managing loan payments.

Traction

The product has recently launched on ProductHunt, with an initial user base development. No specific financial figures or growth rates provided.

Market Size

The global personal finance software market was valued at $1.04 billion in 2019 and is projected to reach $1.57 billion by 2027, growing at a CAGR of 5.7%.

Loan Calculator

loan calculator can do repayment calculate

4

Problem

Users need to manually calculate loan repayments using spreadsheets or basic formulas, which is time-consuming and error-prone.

Solution

A web-based loan calculator tool that automates repayment calculations. Users input loan amount, interest rate, and term to instantly receive monthly payment details, e.g., $1,000 loan at 5% over 12 months yields $85.61/month.

Customers

Borrowers, financial advisors, loan officers, and fintech professionals seeking quick, accurate repayment estimates.

Unique Features

Simplified interface with real-time adjustments, visual payment schedules, and support for multiple loan types (personal, mortgage, auto).

User Comments

Saves time compared to manual calculations

Intuitive and user-friendly

Accurate results for budgeting

Helpful for comparing loan offers

No signup required

Traction

Launched 2 months ago with 500+ active users, 120+ upvotes on Product Hunt, and $1k MRR from premium features.

Market Size

The global financial planning software market, including loan tools, is valued at $3.02 billion in 2023 (Grand View Research).

Problem

Users manually handle loan applications and repayment tracking, leading to inefficient processing, errors, and delayed payments.

Solution

A Loan Management API tool that automates loan application handling, repayment scheduling, and tracking, enabling seamless integration into financial platforms.

Customers

Fintech developers, loan officers, and financial institutions seeking scalable loan management solutions.

Unique Features

Combines application processing, repayment scheduling, and real-time tracking in a single API with customizable rules.

Market Size

The global fintech lending market is projected to reach $4.957 billion by 2030 (Grand View Research, 2023).

Problem

Users spend hours manually fill out each job application form, leading to tedious and time-consuming processes that reduce efficiency and increase burnout.

Solution

A job application automation tool that lets users automatically fill in tedious application forms and generate cover letters and answers to job questions with AI tailored to the job description and their CV (e.g., one-click form filling, AI-generated responses).

Customers

Job seekers (recent graduates, professionals in career transitions, tech-savvy applicants) who apply to multiple roles daily and value speed and personalization.

Unique Features

AI generates content specifically aligned with both the job description and the user’s CV, ensuring higher relevance than generic tools.

User Comments

Saves hours per application

Tailored AI responses improve interview rates

Intuitive one-click form filling

Cover letters feel personalized

Reduces application burnout

Traction

Launched on ProductHunt with 1k+ upvotes, active user base (exact metrics not disclosed)

Market Size

The global online job market is valued at $200 billion, driven by increasing remote work and digital recruitment trends.

Auto Apply

Find & auto apply to the world's best jobs

127

Problem

Job seekers often struggle with the exhausting process of job hunting, finding it difficult to locate job openings from the world's best companies, optimize their applications, and manage numerous applications simultaneously.

Solution

A web-based platform that automates the job application process. Users can find jobs from the world's best companies, let the platform optimize their applications, and automatically apply with one click. They then receive interview invitations directly in their inbox.

Customers

The product is most suited for professionals in various fields seeking employment in top companies, recent graduates entering the job market, and busy individuals looking for a more efficient way to apply to multiple job listings.

Unique Features

The automatic optimization of job applications and the one-click application process are unique features that differentiate it from traditional job boards and application services.

User Comments

Simplifies the job application process greatly.

Receiving interview invites without manually applying is a game changer.

Wonderful for busy professionals.

Major time-saver for job seekers.

Makes applying to multiple top-tier companies effortless.

Traction

The product was found on Product Hunt, but specific details like number of users, revenue, and growth metrics weren't provided in the provided information.

Market Size

The global online job board market size is significantly large, with the recruitment market expected to reach $28.68 billion by 2025.