Personal Loan Schemes

Alternatives

0 PH launches analyzed!

Personal Loan Schemes

Apply for instant personal loans

3

Problem

Users face lengthy and complex processes when applying for personal loans through traditional banks or financial institutions. Slow approval times and extensive documentation requirements create barriers to accessing urgent funds.

Solution

A digital platform enabling users to apply for instant personal loans with quick approval and minimal paperwork. Examples: streamlined online application, real-time eligibility checks, and direct disbursement.

Customers

Salaried professionals, freelancers, or individuals with urgent financial needs seeking hassle-free loan solutions.

Alternatives

Unique Features

Simplified documentation, instant eligibility verification, and disbursement within hours (vs. days in traditional systems).

User Comments

Saves time compared to banks

Easy to use interface

Transparent terms

Quick disbursement

Helpful for emergencies

Traction

Launched recently on ProductHunt (specific metrics unavailable). Comparable fintech lenders like Upstart report $800M+ annual revenue.

Market Size

The global digital lending platform market was valued at $10.7 billion in 2023 (Grand View Research).

Fibe Instant Personal Loan App

instant personal loan app

7

Problem

Users facing financial emergencies need quick access to personal loans but encounter hassle and delays in the traditional loan application processes.

Drawbacks: Long waiting times, extensive paperwork, and complex approval criteria make it challenging for users to obtain urgent funds.

Solution

Mobile app solution that enables users to apply for instant personal loans seamlessly and quickly.

Core features: Easy application process, quick approval, and disbursement of funds, hassle-free experience.

Customers

Individuals facing urgent financial needs such as medical emergencies or sudden expenses.

Occupation: Anyone in need of quick personal loans without the typical hassle.

Unique Features

Instant approval and disbursement of personal loans, streamlined application process, and user-friendly experience.

User Comments

Fast and convenient loan process.

Great help during emergencies.

Simple and hassle-free experience.

Highly recommended for quick personal loans.

Responsive customer support.

Traction

Growing user base with positive reviews and feedback.

Increased number of downloads and active users on the app.

Market Size

$18.76 billion market size for personal loans in India in 2021, with a growing demand for quick and hassle-free loan solutions.

Instant mudra

Quick and fast loan app

6

Problem

Users need quick access to personal loans but face tedious traditional processes, slow approvals, and inflexible borrowing options.

Solution

A mobile app that enables users to apply for personal loans quickly via digital documentation, receive instant approval, and access funds ranging from ₹3,000 to ₹30,000.

Customers

Salaried professionals and self-employed individuals in India needing immediate funds for emergencies or personal expenses.

Unique Features

Eliminates physical paperwork, offers instant approval, and provides loans up to ₹30,000 with a fully digital process.

User Comments

Fast loan disbursement within hours.

Easy application but high interest rates.

Concerns about data privacy policies.

Helpful for urgent cash needs.

Limited loan amounts for new users.

Traction

Launched in 2023, 100,000+ downloads on Google Play Store, active in major Indian cities.

Market Size

India’s digital lending market is projected to reach $350 billion by 2028 (Ken Research, 2023).

Personal Loan | Stashfin

Best Personal Loan App in India

6

Problem

Users looking for personal loans in India face slow approval processes, rigid repayment terms, limited loan amounts, high-interest rates, and excessive documentation requirements.

Solution

A mobile app that provides fast loan approvals, flexible repayment options, loan amounts up to ₹5,00,000, competitive interest rates, and minimal documentation requirements.

Customers

Indian individuals in need of personal loans who value fast approvals, flexible repayment terms, and competitive interest rates.

Alternatives

View all Personal Loan | Stashfin alternatives →

Unique Features

Fast approvals

Flexible repayment options

Competitive interest rates

Loan amounts up to ₹5,00,000

Minimal documentation requirements

User Comments

Easy to use and fast approval process

Flexible repayment options are convenient

Competitive interest rates compared to other options

Minimal documentation makes the process hassle-free

Great app for personal loans in India

Traction

Stashfin has garnered over 100k downloads on the Google Play Store.

Reports suggest that Stashfin has a growing user base with positive feedback on its services.

Market Size

The personal loan market in India is estimated to be worth around USD 14 billion in 2021.

Quick Cash ( Instant Loan )

📲 Quick Cash App – Instant Emergency Loans

0

Problem

Users face delays in accessing emergency funds through traditional loans due to slow approval processes and extensive documentation requirements.

Solution

A mobile app offering instant emergency loans with minimal documentation, enabling fast approval and direct bank transfers. Users apply via the app, receive quick decisions, and secure transactions.

Customers

Freelancers, gig workers, and individuals with urgent cash needs who lack immediate access to traditional banking services.

Unique Features

Combines AI-driven credit assessment with minimal documentation, instant approval, and direct fund transfers to bank accounts.

User Comments

Simplified application process

Rapid access to funds

High interest rates

Transparent terms

Secure transactions

Traction

Launched recently on ProductHunt; specific metrics (users, revenue) not publicly disclosed.

Market Size

The global digital lending platform market is projected to reach $26.8 billion by 2027 (Allied Market Research).

personal loans in Florida SpeedyFundsNow

flexible & fast approval

1

Problem

Users looking for personal loans in Florida are currently facing the challenge of relying on traditional banking methods, which often involve a lengthy approval process and rigid terms. This can be particularly problematic for individuals seeking financial assistance for urgent needs or with fair credit scores. The traditional approach can impede timely access to funds and limit flexibility in repayment options. Lengthy approval process and rigid terms.

Solution

A platform that helps users find the best personal loans in Florida with quick approvals and flexible terms. Users can discover various lenders to meet their financial needs, particularly for those with fair credit. This service allows users to compare different loan options efficiently and facilitate their loan processing.

Customers

Individuals residing in Florida who are in need of personal loans, especially those with fair credit scores. These users are typically adults in their mid-20s to mid-50s, who may seek financial assistance for personal expenditures, emergencies, or refinancing existing debts. They value quick loan approvals and flexibility in loan terms.

Unique Features

The key uniqueness of this service lies in its ability to offer a variety of loan options with quick approval processes and flexible terms. Unlike traditional methods, this platform specifically caters to the needs of users with fair credit, making it more inclusive.

User Comments

Many users appreciate the speed of approval.

Flexibility in loan terms is highly valued.

The platform is seen as user-friendly.

Some users feel there could be more options for various credit scores.

Overall, the service is considered convenient and meets user needs effectively.

Traction

This product is newly introduced and aligns financial loan services with modern expectations of speedy service. Within a short time post-launch, it may not have accumulated extensive traction data. However, being featured on platforms like ProductHunt suggests that it has gained visibility, potentially attracting initial user interest and engagement in Florida.

Market Size

The personal loan market in the United States is significant, with estimates suggesting that the total outstanding personal loan debt in the U.S. was over $150 billion in 2021. The specific market in Florida would contribute significantly to this number, given its large population and diverse economic activities.

Problem

Users face delays and require extensive documentation for traditional loans, leading to slow approval processes and cumbersome paperwork.

Solution

A mobile app offering instant personal loans of ₹50,000–₹3,00,000 with AI-driven approval, no collateral, and direct bank transfers within minutes. Users apply via a paperless process.

Customers

Salaried professionals, freelancers, and gig workers in India needing urgent funds for emergencies or short-term needs.

Unique Features

Real-time credit scoring via social media/data analysis, instant disbursement, flexible repayment tenure (3–18 months), and no physical documentation.

User Comments

Quick loan approval without paperwork; Transparent fee structure; Seamless app experience; Useful for emergencies; High interest rates for short tenures.

Traction

Launched in 2016, 1M+ downloads, $40M+ total loans disbursed, 4.2/5 rating on Play Store, 300+ corporate partnerships for salary-linked repayments.

Market Size

India’s digital lending market reached $350 billion in 2023, growing at 39.5% CAGR, driven by demand for instant credit among millennials.

Instant Fund

Get No Credit Check Loans Guaranteed Approval

1

Problem

Users facing financial emergencies often struggle to get quick loans, especially with credit checks delaying the process.

Solution

A platform offering guaranteed approval payday loans of up to R5000 without the need for credit checks.

Users can access instant funds within the same day to address financial emergencies with ease.

Customers

Individuals who require quick financial assistance without the hassle of credit checks.

Unique Features

Guaranteed approval loans without the need for credit checks, providing quick access to funds for emergencies.

User Comments

Fast and reliable service for urgent financial needs.

Convenient process with no credit check requirements.

Helped me address my financial emergency quickly.

Great option for those with bad credit history.

Highly recommended for instant financial support.

Traction

Growing user base seeking quick and hassle-free loan approvals.

Increased demand for instant financial solutions.

Positive user feedback and recommendations.

Achieving high loan approval rates and customer satisfaction.

Market Size

The global payday loans market size was valued at around $81 billion in 2020 and is expected to grow at a CAGR of over 3% from 2021 to 2027.

Perfect Apply

Instant AI personal statement scoring & feedback.

5

Problem

Users manually revise personal statements with time-consuming iterations and subjective feedback, leading to inconsistent quality and delayed submissions.

Solution

AI-powered tool where users paste drafts to receive multi-dimensional scores (clarity, coherence, etc.) and section-level fixes. Example: Edit based on AI feedback and re-score for improvement.

Customers

Students applying to colleges or graduate programs, aged 18–25, who draft and refine essays repeatedly.

Unique Features

Instant scoring across metrics (e.g., academic relevance), actionable fixes, and iterative re-scoring post-edits.

User Comments

Saves hours of manual editing

Improves essay structure effectively

Objective feedback boosts confidence

Quick iteration for deadlines

Easy-to-follow fixes.

Traction

1k+ users since launch (ProductHunt), featured on 150+ educational platforms, founder has 2.5k LinkedIn followers.

Market Size

Global college application consulting market valued at $2.5 billion in 2023 (HolonIQ).

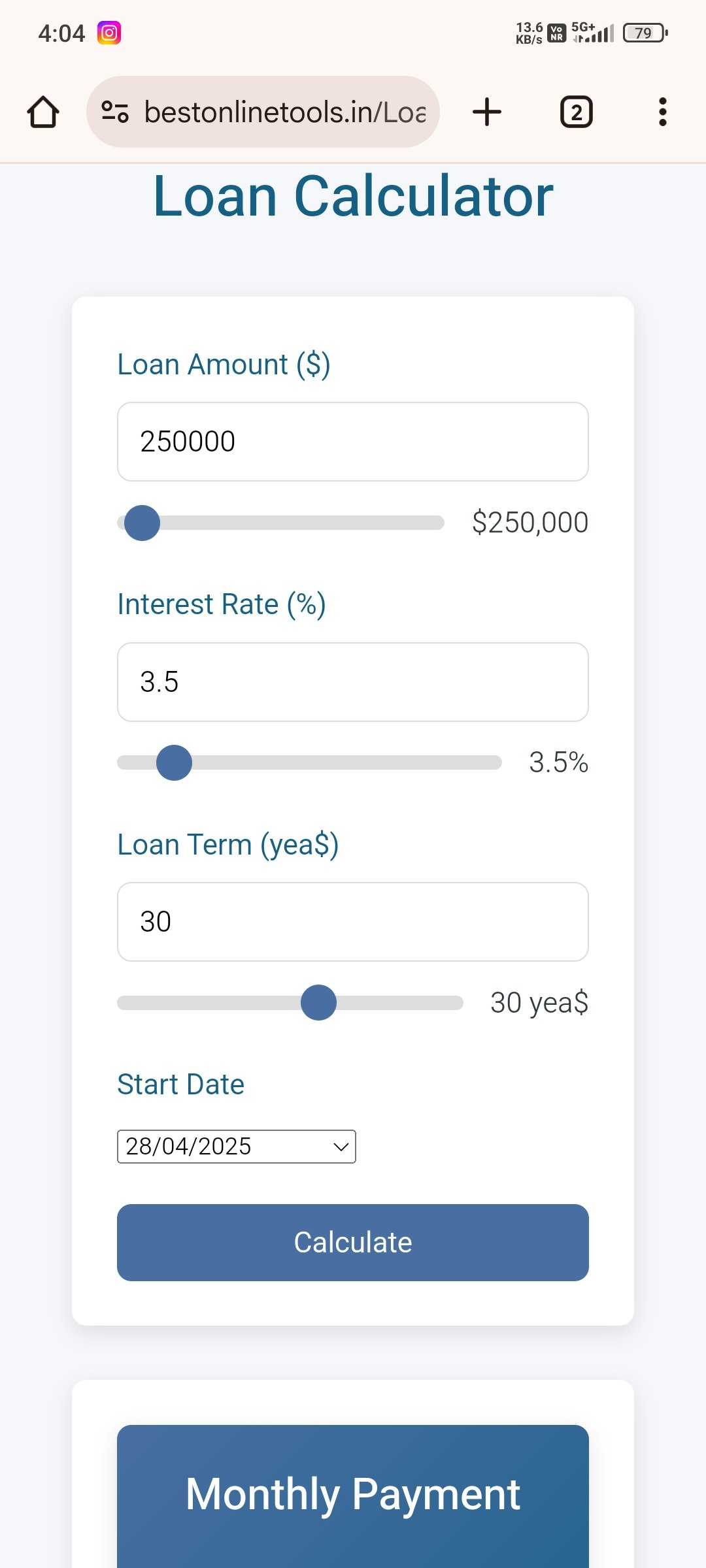

Loan Calculator

Free Loan Calculator

3

Problem

Users need to manually calculate loan details like EMI, interest rates, and total loan amounts using spreadsheets or basic tools, which are time-consuming and error-prone.

Solution

A web-based loan calculator tool that allows users to input loan parameters and instantly calculate EMI, interest rates, and total loan amounts automatically. Examples: personal, home, car, and business loan planning.

Customers

Borrowers, financial advisors, and loan officers (demographics: adults aged 25–60, financially conscious individuals, small business owners).

Unique Features

Supports multiple loan types (personal, home, car, business), provides instant results without signup, and offers accuracy for informed financial decisions.

Traction

Launched on ProductHunt (specific metrics unavailable due to limited data).

Market Size

The global personal loan market was valued at $50 billion in 2023 (Source: Grand View Research).