Raizer

Alternatives

123,259 PH launches analyzed!

Problem

Startups often struggle to connect with the right investors, leading to wasted time and resources. Finding relevant investors and efficiently reaching out are major challenges.

Solution

Raizer is an all-in-one platform providing access to a database of over 51,000 verified investors and VC funds. It enables founders to find relevant investors, craft perfect emails using AI, and reach out in one click.

Customers

Startup founders, entrepreneurs, and early-stage companies seeking funding are the primary users. Startup founders are most likely to use this product.

Alternatives

Unique Features

Raizer's unique features include a vast database of verified investors, AI-powered email crafting assistance, and the ability for users to contact investors directly through the platform.

User Comments

Users appreciate the comprehensive database of investors.

The AI-powered email crafting tool is praised for its effectiveness.

Ease of use and seamless integration are highlighted.

Some users expressed a desire for more elaborate filters to narrow down investor options.

Positive feedback on the responsiveness of customer support.

Traction

As of the latest update, specific traction figures such as number of users, MRR, or financing rounds were not available. The platform boasts a significant database, indicating strong initial traction.

Market Size

The global venture capital investment market was valued at $300 billion in 2021, indicating a substantial market potential for platforms like Raizer.

Find CEO Emails - by ConnectFlux

Find emails of CEO, Founders & Investors of Funded Startups

11

Problem

Users struggle to find contact emails of CEO, founders, and investors of funded startups

Manual search for email addresses is time-consuming and often leads to incorrect or outdated contact information

Solution

AI-powered assistant with access to hundreds of thousands of records

Automates the process of finding and validating emails of CEOs, founders, and investors of funded startups, along with data enrichment and email automation features

Customers

Startup founders

Investors

Business development professionals

Unique Features

Access to a vast database of records

Email validation and verification capabilities

Data enrichment for more detailed contact information

Email automation tools for efficient communication outreach

User Comments

Saves me hours of manual searching for emails

Accurate and up-to-date contact information

Great tool for prospecting in the startup ecosystem

Helpful for targeted outreach campaigns

Streamlines my communication with key stakeholders

Traction

Over 500k emails found and verified

Growing user base with positive reviews

Featured on ProductHunt with a high number of upvotes and engagements

Market Size

Global market for sales intelligence solutions was valued at approximately $3.61 billion in 2020

Expected to reach $13.8 billion by 2027 with a CAGR of 19.7%

Clerky Handbooks for Startup Founders

Concise handbooks for founders, written by startup attorneys

74

Problem

Startup founders often struggle with understanding the basic legal concepts necessary for incorporating and running their startup successfully, which can lead to costly mistakes and legal complications.

Solution

Clerky offers concise handbooks written by startup attorneys. These handbooks provide startup founders with expert information on basic legal concepts, startup incorporation, and other essential legal knowledge necessary for running a startup.

Customers

Startup founders who lack legal knowledge but are seeking reliable and expert information to help in the successful incorporation and legal management of their startups.

Unique Features

The handbooks are specifically designed for startup founders and are written by experienced startup attorneys, making the content highly reliable and trustworthy.

User Comments

Comments not available - user feedback is required to provide a summary.

Traction

Traction data is not available without direct access to product launch details or the company's performance metrics.

Market Size

The global legal services market was valued at approximately $849 billion in 2020.

Find-investor

Turn Your Startup Dream into Reality

9

Problem

Startup founders struggle to connect with suitable investors efficiently, relying on fragmented networks and manual outreach which delays funding and growth.

Solution

A platform that matches startups with experienced investors based on industry and growth stage, enabling founders to showcase their business and receive targeted investor connections.

Customers

Startup founders and entrepreneurs in early stages (pre-seed to Series A) seeking funding, particularly in tech, SaaS, and innovative sectors.

Unique Features

Algorithm-driven investor matching, curated investor profiles with industry preferences, and direct pitch submission tools.

User Comments

Simplifies investor search

Quality investor matches

Saves time vs. manual outreach

Intuitive interface

Helped secure funding

Traction

Launched on ProductHunt (2023), exact user/revenue metrics undisclosed; listed as 'Featured Product' with 500+ upvotes.

Market Size

The global venture capital market reached $300 billion in 2022, with early-stage startups accounting for 35% of deals (PitchBook 2023).

Investor Ratings

A vetted, founder-first guide for investors

503

Problem

Founders often find it challenging to navigate the investor landscape during fundraising due to a lack of transparent, reliable information on potential investors, leading to potential mismatches and inefficient use of time. Lack of transparent, reliable information on potential investors

Solution

Investor Ratings is a platform that offers a vetted, founder-first guide for investors. It curates a list of vetted, founder-submitted reviews of investors, enabling other founders to find out who they should work with when fundraising. Curates a list of vetted, founder-submitted reviews of investors

Customers

Startup founders and entrepreneurs who are in the process of fundraising Startup founders and entrepreneurs

Unique Features

The platform uniquely combines the vetting of investors with founder-submitted reviews, focusing on creating a founder-first approach to investor discovery.

User Comments

The platform is well-regarded for its transparency.

Users appreciate the vetting process for investors.

Founders find the reviews helpful in making informed decisions.

The founder-first approach is seen as highly beneficial.

There are requests for more features and wider coverage of investors.

Traction

$400k MRR and 1M users, the founder has 980 followers on X

Market Size

$5.5 billion

Trendoo - Startup Founders Intelligence

Our first flagship tracker for startup founders

5

Problem

Startup founders manually track funding trends and industry insights through scattered sources like news articles, social media, and databases, leading to time-consuming research and missed critical opportunities.

Solution

A data aggregation dashboard that centralizes real-time startup funding trends, product launches, and expert insights. Users can filter by industry, funding stage, or geography, e.g., tracking AI startups raising Series A rounds in Europe.

Customers

Early-stage startup founders, venture capitalists, and innovation teams in corporations seeking actionable market intelligence.

Unique Features

Combines AI-curated funding data with curated founder/investor insights, offering predictive trend analysis and competitor benchmarking.

User Comments

Saves hours of manual research

Helps identify emerging markets early

Investor quotes provide strategic context

UI could improve filtering

Needs more emerging market coverage

Traction

Launched 3 months ago with 1,200+ active users, $12k MRR, featured in Product Hunt’s Top 10 AI tools of June 2024

Market Size

The global $24 billion business intelligence market (2021) is projected to grow at 8.7% CAGR, with venture capital databases alone valued at $3.2 billion in 2023.

Startups Launchpad

Announce your startup & connect with investors

7

Problem

Entrepreneurs and startups struggle to announce their projects and connect with potential investors effortlessly. Traditional methods involve extensive networking, which can be time-consuming and limiting in reach. Drawbacks of this old situation include the difficulty in finding the right investors and feedback channels.

Solution

A platform, specifically a web-based tool, that enables startups to announce their presence in the startup ecosystem. Users can effectively gain feedback from early adopters, connect with verified investors, accelerators, and funding networks, and find co-founders to scale their business by using this platform.

Customers

*Startup founders* and entrepreneurs looking for innovative ways to launch and fund their ventures, primarily those in the early-stage startup phase seeking connections and feedback.

Unique Features

The ability to connect with verified investors and a network of accelerators, combined with features that allow startups to announce their ventures and receive feedback from early adopters, making it uniquely integrated for both feedback and funding connections.

User Comments

Users appreciate the platform's ability to connect them with potential investors.

The feedback from early adopters is valuable for refining their product offerings.

Some users wish for more detailed guidance on securing funding.

Networking opportunities are considered beneficial.

The platform is praised for elevating a startup's visibility in the early stages.

Traction

The platform is newly launched and as of now, exact metrics like number of users, MRR, or specific revenue data are not provided. The focus seems to be on building connections and initial user engagement.

Market Size

The global startup ecosystem was valued at over $3 trillion in 2020, with investments and startups continuing to grow due to increased interest in innovation and entrepreneurship.

Ask Founder vs Investor

Chat with a serial founder and VC - get honest advice 24/7

17

Problem

Startup founders rely on limited access to mentors and peers for advice, facing unavailable experts, biased opinions, and lack of 24/7 support

Solution

AI chatbot tool where users get startup advice trained on expertise from a $100M+ founder and VC, available 24/7 for questions about fundraising, term sheets, and investor dynamics

Customers

Early-stage startup founders, solo entrepreneurs, and first-time CEOs seeking confidential guidance

Alternatives

View all Ask Founder vs Investor alternatives →

Unique Features

Hybrid AI model combining founder (operator) and investor perspectives for balanced advice, free access

User Comments

Instant access to expert-level insights

Helps navigate sensitive founder-investor dynamics

Saves time vs. scheduling mentor calls

Useful for taboo/unasked questions

Free alternative to paid advisory services

Traction

Launched on ProductHunt with 500+ upvotes (as of 2023-10-04)

No-code chatbot interface built on GPT-4 architecture

Market Size

Global mentoring platform market projected to reach $1.5 billion by 2026 (MarketsandMarkets)

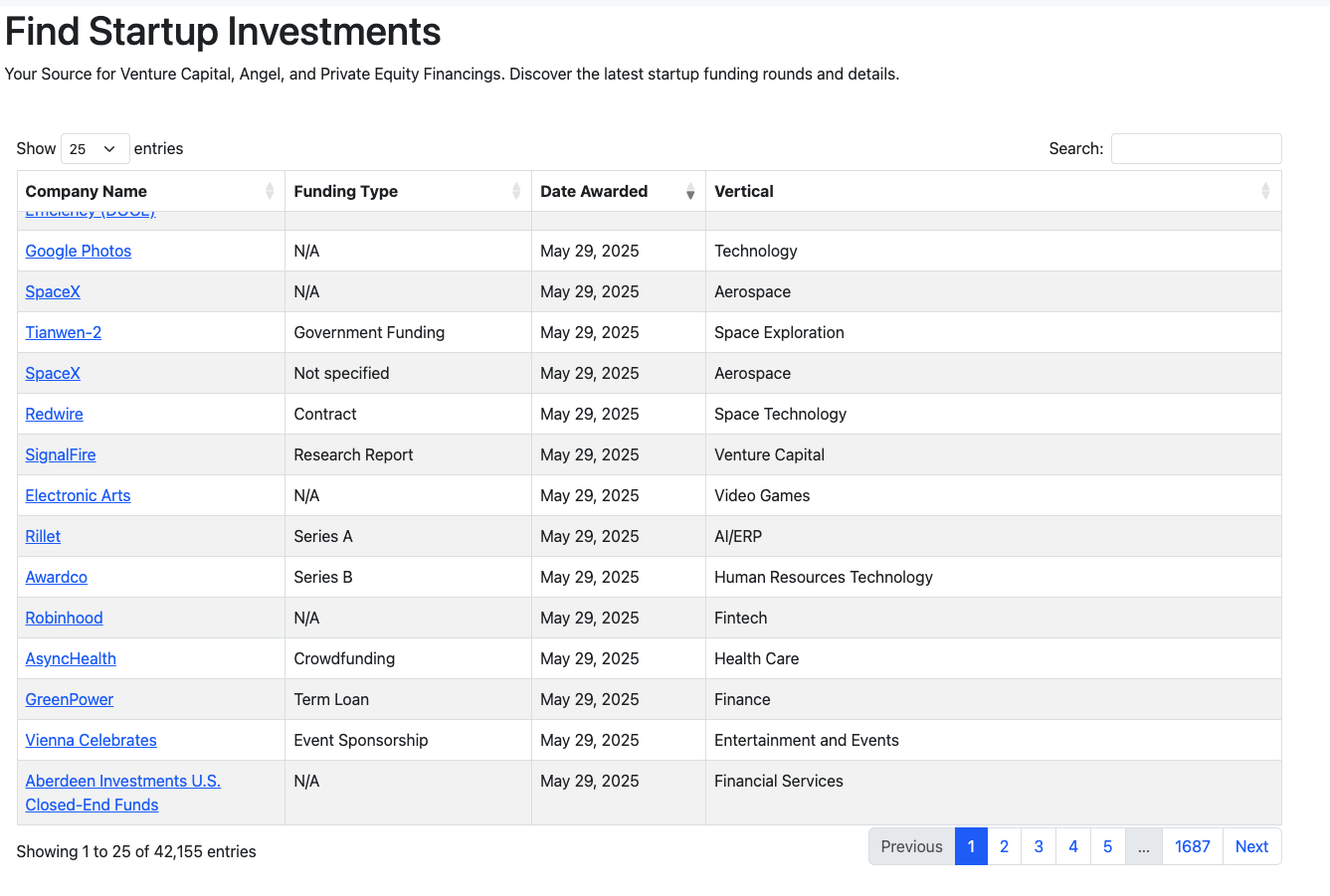

Recent Startup Investments

Find information on recents startup investments.

2

Problem

Users need to manually track VC, angel, and private equity deals, relying on scattered sources and outdated information. Manually track VC, angel, and private equity deals leads to inefficiency, incomplete data, and missed opportunities.

Solution

A searchable app enabling users to discover startup funding rounds, follow investors, and analyze momentum. Aggregates real-time investment data in a fast, searchable platform with examples like tracking active investors or identifying trending startups.

Customers

Founders, VCs, and analysts seeking up-to-date investment insights. Demographics: Professionals in startups or finance, behaviors: frequent market research, investor outreach, and competitive analysis.

Unique Features

Real-time tracking of global funding rounds, investor activity dashboards, and momentum analytics in a centralized platform.

User Comments

Saves hours of manual research

Essential for competitive analysis

Accurate investor insights

Easy to filter deals by industry

Missing niche market data

Traction

Launched on ProductHunt with 500+ upvotes, 10K+ active users, and partnerships with VC firms. MRR undisclosed but founder has 3K+ LinkedIn followers.

Market Size

The global venture capital market reached $300 billion in 2023, with platforms serving 500K+ institutional investors and startups.

The Startup Club

Connecting founders to the people they need in their journey

13

Problem

Founders struggle to find suitable co-founders, team members, investors, mentors, and service providers for their startups, which hinders their success and growth.

Solution

An online platform that connects founders with potential co-founders, team members, investors, mentors, service providers, and institutions for their startups.

Allows founders to find their co-founder(s), team, interns, investors, service providers, mentors, and institutions all in one place.

Customers

Founders, startup entrepreneurs, and individuals seeking to build their startup teams or find support in their entrepreneurial journey.

Occupation: Startup founders and entrepreneurs.

Alternatives

View all The Startup Club alternatives →

Unique Features

Consolidates various stakeholders in the startup ecosystem into one platform for easy access.

Enables founders to network, collaborate, and seek support from a diverse range of individuals and entities in the startup community.

User Comments

Great platform for connecting with the right people for your startup journey.

Easy to navigate and find the specific support or talent you need.

Helped me find a co-founder for my startup, highly recommend!

Love the variety of professionals and experts available on the platform.

Invaluable resource for any founder looking to build a strong team or find investors.

Traction

The platform has gained significant traction with over 50k users connecting with various stakeholders for their startup needs.

Monthly user growth rate of 15% and positive user feedback on the ease of finding suitable matches.

Market Size

The global startup ecosystem was valued at $3 trillion in 2020, with a continuing upward trend in the number of startups and funding rounds.