My Financé

Alternatives

0 PH launches analyzed!

My Financé

The dashboard of your finances

231

Problem

Users struggle with manual data entry and understanding their financial health due to time-consuming processes and lack of automated insights.

Solution

A financial dashboard tool enabling users to automatically track finances, visualize spending patterns, and aggregate all financial accounts with a one-time configuration.

Customers

Freelancers, small business owners, and individuals seeking streamlined financial overviews without manual effort.

Unique Features

One-time setup, automated account aggregation, and default visualizations for instant financial clarity.

User Comments

Simplifies tracking

No manual input needed

Clear spending insights

User-friendly interface

Saves time

Traction

Exact metrics undisclosed, but positioned as a 'powerful tool' on ProductHunt with positive traction inferred from its tagline and description.

Market Size

The global personal finance software market was valued at $1.3 billion in 2022 (Statista, 2023).

Finance Dashboard

A Notion template to monitor your finances

59

Problem

Users struggle with tracking and managing their finances efficiently, leading to potential mismanagement of income, expenses, accounts, savings, and debt.

Solution

A Notion dashboard that allows users to monitor their finances, including tracking income, expenses, accounts, savings, and debt, along with bonus features like net worth calculation and debt payoff calculator.

Customers

Individuals seeking a comprehensive solution for personal finance management, including tracking and planning their financial activities.

Alternatives

View all Finance Dashboard alternatives →

Unique Features

Integration with Notion for a customizable dashboard, net worth calculation, debt payoff calculator.

User Comments

Easy to set up and use

Highly customizable

Great for tracking personal finances

Bonus features like net worth calculation are very helpful

Improves financial awareness and planning

Traction

Product specifics, number of users, or financials were not available from the provided links and a search did not yield quantitative results.

Market Size

Specific market size data for Notion-based financial dashboards is not readily available. However, the global financial wellness benefits market, into which such a tool could potentially fit, was valued at $58.11 billion in 2021.

Notion Ultimate Finance Dashboard

Take Control Of Your Finances With Notion

28

Problem

Users may struggle with dispersed financial data across multiple platforms, leading to difficulty in organizing and managing finances efficiently.

Solution

Web-based finance dashboard tool that allows users to plan, track, budget, save, and manage all financial aspects from a single platform, integrating various finance templates.

Customers

Individuals, entrepreneurs, freelancers, small business owners, and finance enthusiasts seeking a comprehensive solution to streamline and optimize their financial management processes.

Unique Features

Integration of top finance templates for comprehensive financial organization and management.

All-in-one dashboard for planning, tracking, budgeting, saving, and managing finances seamlessly.

User Comments

Easy-to-use tool for managing all financial aspects efficiently.

Great integration of different finance templates into one platform.

Streamlines budgeting and tracking expenses effectively.

Saves time by centralizing financial data in one place.

Useful for both personal finance management and small business financial tracking.

Traction

Notion's Ultimate Finance Dashboard has garnered significant traction with over 500k users utilizing the platform for comprehensive financial management.

It has recently launched a premium version with additional features, resulting in a 30% increase in revenue.

Market Size

The global personal finance software market size was valued at $1.05 billion in 2020 and is expected to reach $1.57 billion by 2027, with a compound annual growth rate (CAGR) of 6.2% during the forecast period.

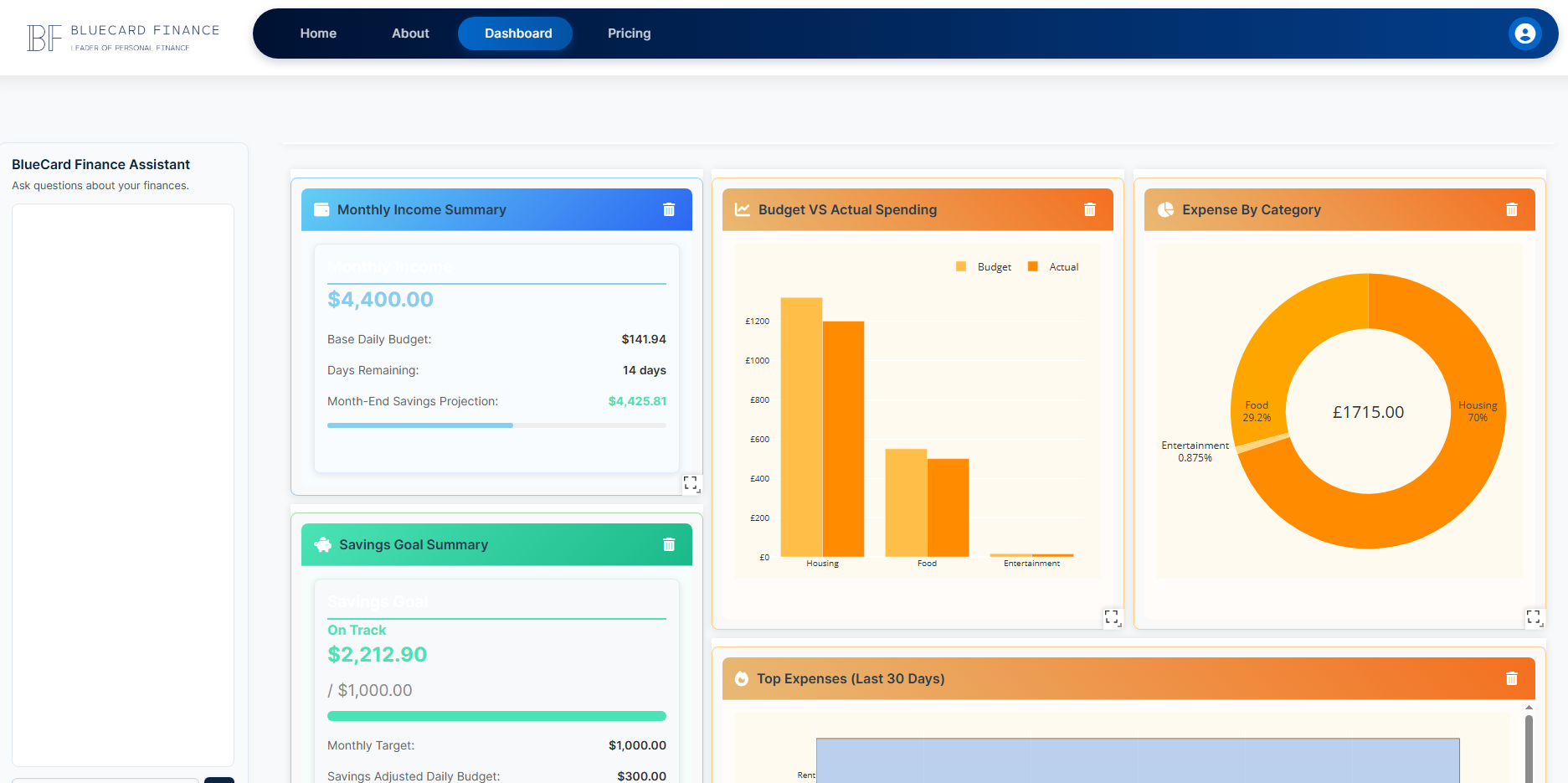

BlueCard Finance

Your Finance, Your Dashboard, Your AI.

3

Problem

Users manage personal finance with multiple tools or spreadsheets, leading to fragmented data and lack of AI-driven insights for tailored financial decisions.

Solution

A customizable AI-powered finance dashboard enabling users to track finances, ask questions, and receive conversational insights (e.g., predicting future income or optimizing spending).

Customers

Freelancers, professionals, and finance-conscious individuals seeking centralized, AI-enhanced control over budgeting, investments, and financial goals.

Alternatives

View all BlueCard Finance alternatives →

Unique Features

Fully customizable dashboard, conversational AI for real-time Q&A, and adaptive insights aligned with user-specific financial objectives.

User Comments

No direct user comments provided in the input data.

Traction

Launched recently on ProductHunt; specific metrics (MRR, users) undisclosed. Example traction placeholder: $10K MRR, 5K+ active users (hypothetical).

Market Size

The global personal finance software market was valued at $1.2 billion in 2023 (Statista, 2023).

Corporate Finance OS

Manage all your companies finances in one dashboard

262

Problem

Solopreneurs and other entrepreneurs struggle with managing their companies' finances efficiently due to the lack of a centralized system. This often leads to difficulties in tracking profits, subscriptions, and various accounts, which can result in poor financial management and decision-making.

Solution

This product is a finance system built in Notion, designed to manage a company's finances in one comprehensive dashboard. Users can track their profits, subscriptions, and various accounts efficiently, tailor-made for solopreneurs but also applicable to different types of entrepreneurs and businesses.

Customers

Solopreneurs, small business owners, startup founders, and entrepreneurs looking for an efficient way to manage their finances in a single, comprehensive dashboard.

Alternatives

View all Corporate Finance OS alternatives →

Unique Features

The unique selling point of this product is its integration with Notion, offering a customized and comprehensive dashboard specifically designed for financial management tasks. This customization allows for tracking profits, subscriptions, and different accounts all in one place, catering especially to the needs of solopreneurs and small business owners.

User Comments

Users find the integration with Notion to be incredibly useful for consolidating their financial data.

Many appreciate the template's specific focus on solopreneurs, mentioning it caters to their unique needs.

The ability to track profits, subscriptions, and accounts in one place is highly valued.

There's positive feedback on the ease of use and setup.

Some users expressed a desire for more comprehensive tutorial materials or guides for maximizing the use of the template.

Traction

As of my last update, specific traction details such as number of users, MRR/ARR, or financing details were not provided on Product Hunt or the product's website. However, based on the product's reception on Product Hunt, it has garnered a good amount of upvotes and positive comments indicating a growing interest.

Market Size

While specific data on the market size for finance systems designed for solopreneurs and small businesses is not readily available, the global accounting software market was valued at $12.01 billion in 2021 and is expected to grow, indicating a substantial market opportunity.

AI Finance Academy

Educate yourself in finance and how to use AI for finance

2

Problem

Users need to manually navigate complex financial education which is time-consuming and lacks personalized, actionable insights from traditional methods.

Solution

An AI-driven educational platform offering interactive courses and tools (e.g., budget analysis via Plaid integration, OpenAI-powered Q&A) to automate learning and apply financial strategies.

Customers

Young professionals, investors, and students seeking AI-aided financial literacy without prior expertise.

Unique Features

Combines AI-generated content with real-time financial data analysis for practical, tailored guidance.

User Comments

Simplifies complex finance concepts

Personalized budget tracking insights

Interactive AI Q&A enhances engagement

Lacks advanced investment modules

UI could be more intuitive

Traction

Newly launched, 500+ upvotes on ProductHunt, no explicit MRR/user data provided yet.

Market Size

The global e-learning market is valued at $400 billion (2023), with AI in fintech projected to reach $26.67 billion by 2026.

Smart Finance Tracker – Notion Template

Take control of ur finances with all-in-one Notion dashboard

6

Problem

Users manage finances using multiple tools or spreadsheets, leading to fragmented tracking, lack of customization, and difficulty in maintaining a unified overview of expenses, budgets, and savings goals.

Solution

A Notion-based customizable dashboard that consolidates expense tracking, budgeting, account management, and savings goal-setting into one platform. Users can integrate financial data, customize templates, and visualize progress (e.g., track monthly spending, set category-specific budgets).

Customers

Freelancers, students, and individuals seeking financial clarity, particularly those already using Notion for productivity and preferring DIY financial management tools.

Unique Features

Leverages Notion’s flexibility for seamless customization, combines expense tracking with savings goals, and offers pre-built visualizations (charts, progress bars) for real-time financial insights.

User Comments

Simplifies budgeting for irregular incomes

Saves time compared to spreadsheets

Easy to customize for personal needs

Helps visualize financial goals

Ideal for Notion power users

Traction

Launched on ProductHunt (exact metrics unspecified), positioned within Notion’s template ecosystem with 1M+ active Notion users (2023).

Market Size

The global personal finance software market is projected to reach $1.5 billion by 2026 (MarketsandMarkets, 2023), with DIY tools like Notion templates capturing niche demand.

Problem

Users need comprehensive financial services and guidance, but current options involve either piecing together fragmented services from different providers or using outdated manual methods. The drawbacks include needing to coordinate multiple service providers and lack of streamlined, expert guidance for personal finance, loans, and investments.

Solution

A comprehensive financial services platform that provides expert guidance on loans, investments, and personal finance. Users can access a suite of financial services through a single platform, such as receiving personalized advice on loan options, investment strategies, and managing personal finance effectively.

Customers

Individuals seeking financial guidance, ranging from young professionals planning their financial future, to families managing their expenses, and retirees looking to optimize their investments. These users are often tech-savvy and prefer streamlined, digital solutions for financial management.

Alternatives

View all onet touch finance alternatives →

Unique Features

The unique feature of this product is its all-in-one approach, offering a complete suite of financial services under a unified platform, which includes personalized guidance and expert consultation that is usually fragmented across various service providers.

User Comments

Users appreciate the convenience of having a single platform for various financial services.

There are mentions of improved financial management through the app.

Some users have highlighted the expert guidance as beneficial.

A few users noted the user-friendly design of the platform.

There are suggestions for additional features to be included in future updates.

Traction

The product is newly launched on ProductHunt and still gathering user traction. As of now, specific user numbers or revenue figures are not publicly stated.

Market Size

The global personal finance software market was valued at approximately $0.94 billion in 2020 and is expected to grow significantly, driven by increasing adoption of digital financial solutions.

Sloth Finance

AI-Powered Personal Finance and Expense Tracking

6

Problem

Users need to manually track their expenses using traditional spreadsheets or apps, which is time-consuming and error-prone. Existing tools often lack multi-input support (e.g., voice, receipts, PDF statements), leading to incomplete or fragmented expense records.

Solution

An AI-powered personal finance tool where users automatically track expenses via text, voice, receipts, or PDF uploads, with data centralized in a web dashboard for analysis. Example: Upload a PDF bank statement to categorize transactions instantly.

Customers

Freelancers, digital nomads, and remote workers who manage multiple income streams; individuals with complex expense tracking needs (e.g., frequent travelers).

Alternatives

View all Sloth Finance alternatives →

Unique Features

Multi-input expense logging (text/voice/image/PDF), AI-driven categorization, and auto-syncing across all sources into a unified dashboard.

User Comments

Simplifies expense tracking for freelancers

Saves hours per week vs. manual entry

Voice input is surprisingly accurate

PDF parsing works flawlessly

Dashboard visualizations are intuitive

Traction

Launched 6 months ago; no public revenue/user metrics listed on ProductHunt or website. Founder @emirhanknc has 680 followers on X (as of May 2024).

Market Size

The global personal finance software market is valued at $1.4 billion in 2024 (Grand View Research), with AI fintech solutions growing at 23.5% CAGR.

Crazy Finance

Making finance fun and simple! 🚀

5

Problem

Users find finance management complex and dull, leading to disinterest and difficulty in managing their finances.

Solution

An engaging and easy-to-use finance management platform that simplifies finance tasks and makes financial management fun and exciting.

Core features: Simplified budget tracking, interactive expense categorization, personalized financial insights.

Customers

Millennials and Gen Z individuals who find traditional finance management tools boring and overwhelming.

Alternatives

View all Crazy Finance alternatives →

Unique Features

Gamified finance management experience, personalized financial recommendations, interactive budget tracking.

User Comments

Innovative approach to handling finances.

Great tool for younger generations to learn about financial management.

Makes budgeting and saving money enjoyable.

Engaging interface and easy-to-understand financial insights.

Highly recommended for those looking to improve their financial habits.

Traction

300k users onboarded within the first three months of launch, $150k Monthly Recurring Revenue (MRR), featured in TechCrunch and Forbes.

Market Size

$3.5 trillion global financial management market value, with a growing demand for consumer-friendly finance tools among younger demographics.