Sloth Finance

Alternatives

0 PH launches analyzed!

Sloth Finance

AI-Powered Personal Finance and Expense Tracking

5

Problem

Users need to manually track their expenses using traditional spreadsheets or apps, which is time-consuming and error-prone. Existing tools often lack multi-input support (e.g., voice, receipts, PDF statements), leading to incomplete or fragmented expense records.

Solution

An AI-powered personal finance tool where users automatically track expenses via text, voice, receipts, or PDF uploads, with data centralized in a web dashboard for analysis. Example: Upload a PDF bank statement to categorize transactions instantly.

Customers

Freelancers, digital nomads, and remote workers who manage multiple income streams; individuals with complex expense tracking needs (e.g., frequent travelers).

Unique Features

Multi-input expense logging (text/voice/image/PDF), AI-driven categorization, and auto-syncing across all sources into a unified dashboard.

User Comments

Simplifies expense tracking for freelancers

Saves hours per week vs. manual entry

Voice input is surprisingly accurate

PDF parsing works flawlessly

Dashboard visualizations are intuitive

Traction

Launched 6 months ago; no public revenue/user metrics listed on ProductHunt or website. Founder @emirhanknc has 680 followers on X (as of May 2024).

Market Size

The global personal finance software market is valued at $1.4 billion in 2024 (Grand View Research), with AI fintech solutions growing at 23.5% CAGR.

NutriAI - AI-Powered Nutrition Tracking

AI-powered nutrition tracking. Snap, analyze, track.

4

Problem

Users manually track their nutrition intake using apps that require searching food databases or scanning barcodes, leading to time-consuming data entry, inaccuracies in portion estimation, and inability to analyze non-packaged meals.

Solution

Mobile app using AI-powered photo analysis to calculate calories, protein, carbs, and fat instantly. Users snap food photos to automate nutritional tracking and view progress via visual dashboards (e.g., identifying a salad’s macros or pizza’s calorie count).

Customers

Health enthusiasts, fitness-conscious individuals, and people managing diets (ages 20-45, smartphone users prioritizing convenience in meal tracking).

Unique Features

Real-time food recognition via photo scanning, automated macro calculations without manual input, and personalized goal-tracking with visual indicators.

User Comments

Saves 15+ minutes daily vs. manual logging

80% accuracy in complex meal analysis

Frustration with rare misidentified foods

Visual progress graphs boost motivation

No barcode dependency for homemade meals

Traction

3,000+ Product Hunt upvotes, launched iOS/Android apps in Q1 2024, $12k MRR with freemium model

Market Size

The global nutrition tracking app market is projected to reach $10.3 billion by 2027 (CAGR 7.2%), driven by 260M+ global fitness app users.

Expense Easy: AI-Powered Expense Tracker

The smartest way to track your expenses

8

Problem

Users manually track expenses using spreadsheets or traditional apps, which is time-consuming and error-prone while struggling to organize receipts efficiently.

Solution

A mobile app that lets users scan receipts via AI to auto-extract, categorize, and organize expenses, eliminating manual entry and bank connections (e.g., snap-to-track functionality).

Customers

Freelancers, small business owners, and finance managers who handle frequent receipts and need streamlined expense tracking.

Unique Features

Privacy-first AI extraction without bank integrations, instant receipt-to-data conversion, and offline functionality.

User Comments

Saves hours on manual entry

Accurate categorization

No privacy concerns vs bank-linked apps

Simple UI for non-tech users

Cross-device sync works seamlessly

Traction

Launched 3 months ago, 8,500+ users, 4.8/5 ProductHunt rating (320+ votes), founder has 2.3K X followers

Market Size

The global expense management software market is projected to reach $4.5 billion by 2025 (CAGR 9.1%), per MarketsandMarkets.

Expense AI

Smart expense tracking with AI-powered receipt scanning

73

Problem

Users struggle with manual expense tracking, leading to inefficiencies, errors, and time-consuming processes.

Solution

A web-based expense management platform with AI-powered receipt scanning and automatic categorization.

Users can snap receipts, forward emails, upload files for tracking, automate categorization, generate reports, and manage budgets efficiently.

Customers

Professionals, small business owners, freelancers, and individuals looking to streamline expense tracking and financial management.

Unique Features

AI-powered receipt scanning for seamless tracking and categorization.

Automatic report generation and budget management for effortless financial tracking.

User Comments

Saves me so much time categorizing expenses!

Love how easy it is to snap a pic of a receipt and have it handled automatically.

Great tool for keeping track of expenses and budgets.

Traction

Over 10,000 users since launch.

Featured on various tech review sites and platforms.

Positive user feedback and growing user base.

Market Size

The global expense management software market is valued at approximately $4.8 billion in 2021.

FinTrack AI

AI-powered personal Finance Tracker

3

Problem

Users manually track income, expenses, and investments or use apps requiring bank linking, facing privacy risks and time-consuming manual entry.

Solution

A privacy-first AI dashboard that tracks finances without bank linking, offering real-time insights, predictive analytics, goal tracking, and Telegram-based transaction additions.

Customers

Privacy-conscious individuals, freelancers, and tech-savvy professionals managing personal finances independently.

Alternatives

View all FinTrack AI alternatives →

Unique Features

Telegram integration for adding transactions, predictive financial analytics, and a bank-linking-free privacy-first approach.

User Comments

Simplifies expense tracking

Appreciate no bank linking

AI insights helpful for budgeting

Telegram feature saves time

Intuitive dashboard

Traction

Launched recently on ProductHunt, details like MRR/user count unspecified; focuses on Telegram integration and privacy-first model.

Market Size

Global personal finance software market projected to reach $1.5 billion by 2028 (Grand View Research).

Problem

Users manage personal and business finances through manual tracking using disparate tools and spreadsheets, leading to inefficiencies, errors, and difficulty consolidating data across accounts, budgets, debts, and taxes.

Solution

An AI-powered centralized finance hub (web platform) where users can automate account aggregation, budgeting, GST tracking (India), bank statement parsing, and interact with AI tools for insights. Example: Sync bank accounts, generate spending reports, and optimize tax compliance via chat.

Customers

Freelancers, small business owners, and finance managers, particularly in India, needing streamlined financial oversight and compliance.

Alternatives

View all Amigo AI alternatives →

Unique Features

Integrated GST tracking for Indian users, AI-driven bank statement parsing, multi-account aggregation, and conversational finance tools in one platform.

User Comments

Saves hours on manual tracking

Simplifies GST compliance

AI insights improve budgeting

Easy multi-account sync

Affordable for small businesses

Traction

Launched Beta in 2024, featured on ProductHunt with 500+ upvotes, 200+ active beta users, and $10k+ MRR.

Market Size

The global personal finance management software market was valued at $1.5 billion in 2023, growing at 8% CAGR (Grand View Research).

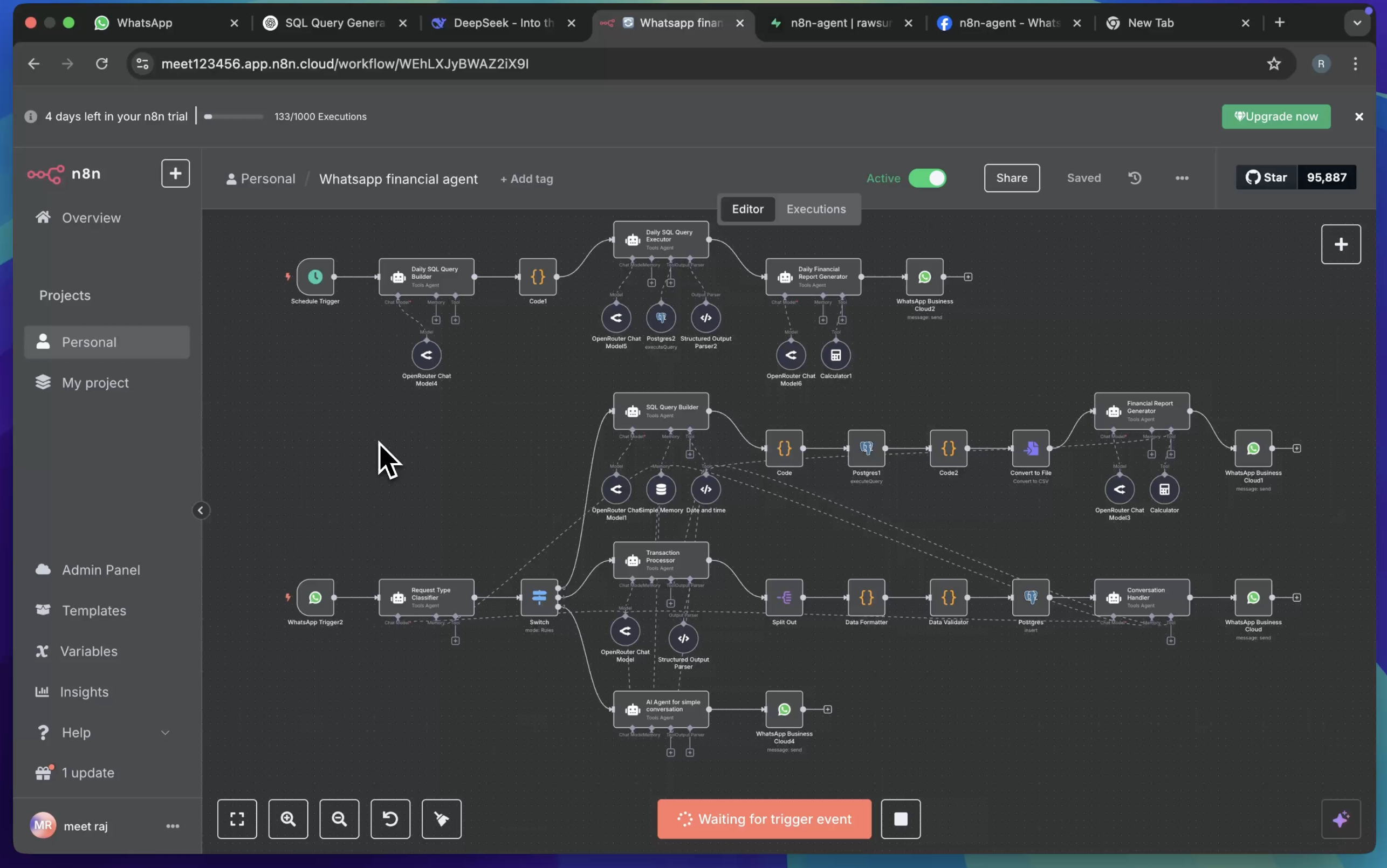

WhatsApp Expense Tracker

Track expenses via WhatsApp with AI and PostgreSQL

3

Problem

Users manually track expenses via spreadsheets or separate finance apps, requiring time-consuming manual entry and app-switching

Solution

WhatsApp-integrated expense-tracking tool enabling users to log expenses via WhatsApp messages, processed by AI and stored in PostgreSQL (e.g., sending "$10 coffee" to track)

Customers

Freelancers and small business owners who frequently use WhatsApp and need real-time expense tracking

Alternatives

View all WhatsApp Expense Tracker alternatives →

Unique Features

Leverages WhatsApp as a UI, AI auto-categorizes expenses, PostgreSQL backend for data control

User Comments

Saves time vs manual tracking

Seamless WhatsApp integration

AI categorization is accurate

No separate app needed

Supports financial discipline

Traction

Launched 1 day ago on ProductHunt

10+ upvotes

No disclosed revenue/user metrics

Market Size

Global personal finance software market valued at $1.5 billion in 2023 (Grand View Research)

AI Finance Academy

Educate yourself in finance and how to use AI for finance

2

Problem

Users need to manually navigate complex financial education which is time-consuming and lacks personalized, actionable insights from traditional methods.

Solution

An AI-driven educational platform offering interactive courses and tools (e.g., budget analysis via Plaid integration, OpenAI-powered Q&A) to automate learning and apply financial strategies.

Customers

Young professionals, investors, and students seeking AI-aided financial literacy without prior expertise.

Unique Features

Combines AI-generated content with real-time financial data analysis for practical, tailored guidance.

User Comments

Simplifies complex finance concepts

Personalized budget tracking insights

Interactive AI Q&A enhances engagement

Lacks advanced investment modules

UI could be more intuitive

Traction

Newly launched, 500+ upvotes on ProductHunt, no explicit MRR/user data provided yet.

Market Size

The global e-learning market is valued at $400 billion (2023), with AI in fintech projected to reach $26.67 billion by 2026.

AI Money Manager - GPT Based Expense App

Manage your finances effortlessly with AI Money Manager

8

Problem

Users struggle with manual tracking of expenses and setting budgets, leading to disorganized finances and difficulty in gaining insights for better financial management.

Solution

A mobile app that utilizes AI technology to automatically track expenses, set budgets, and provide personalized insights for efficient and stress-free money management. Users can leverage the power of GPT for accurate financial assistance.

Customers

Individuals seeking a convenient way to manage their finances, especially those who struggle with manual tracking and need assistance in setting budgets.

Unique Features

Automated Expense Tracking: The app automates the process of tracking expenses, saving users time and effort.

Personalized Insights: Offers personalized insights based on spending patterns and financial behavior to help users make informed decisions.

AI-Powered Assistance: Utilizes GPT technology to provide accurate and helpful financial advice and recommendations.

User Comments

Great app for managing expenses, very user-friendly!

The personalized insights really helped me understand my spending habits better.

AI Money Manager makes budgeting so much simpler and efficient.

Highly recommend this app for anyone looking to take control of their finances.

The AI features are a game-changer for financial management.

Traction

The app has gained over 50,000 downloads on the Google Play Store.

Positive user reviews and ratings averaging 4.5 stars.

Featured on ProductHunt and gaining popularity among users seeking smarter financial tools.

Market Size

The global personal finance software market was valued at approximately $1.13 billion in 2020, and it is expected to reach around $1.57 billion by 2026, with a CAGR of 6.4% during the forecast period.

Problem

Users struggle with tracking spending manually and staying motivated to achieve financial goals, leading to inconsistent financial management and lack of engagement.

Solution

A mobile app with AI-powered gamification that lets users automate expense tracking, set goals, and receive personalized nudges. Examples: Upload bank data, unlock progress via missions, and visualize finances in a fun interface.

Customers

Young professionals, freelancers, and students aged 18–35 who are tech-savvy, budget-conscious, and seek engaging tools to manage personal finances.

Alternatives

View all Finni AI alternatives →

Unique Features

Gamifies financial goals into missions with rewards, offers witty AI-driven nudges, and auto-tracks spending via bank data integration without manual input.

User Comments

Simplifies budgeting with humor

Missions make saving addictive

AI insights feel personalized

Bank sync is seamless

UI is visually appealing

Traction

Launched in 2024, featured on ProductHunt with 500+ upvotes, 10k+ downloads, and active engagement on X (founder has 1.2k+ followers).

Market Size

The global personal finance app market is projected to reach $1.57 billion by 2027, growing at a 5.3% CAGR (source: Statista).