Mergen Trade Tracker

Alternatives

0 PH launches analyzed!

Mergen Trade Tracker

trade tracker

3

Problem

Users manually track trades using spreadsheets or basic tools, leading to time-consuming and error-prone analysis and limited community-driven insights.

Solution

An AI-powered trade tracking tool where users log trades, analyze performance metrics (e.g., win rate, risk-reward ratios), and access a community for shared strategies. Example: AI identifies trading patterns and suggests optimizations.

Customers

Active traders, investors, and financial analysts seeking data-driven decision-making and peer collaboration.

Unique Features

Combines AI-driven trade analysis with a community platform for strategy sharing and real-time feedback.

User Comments

Simplifies trade logging and performance review

Community insights add actionable value

Free tier limitations frustrate power users

AI-generated reports lack depth for advanced traders

Intuitive interface compared to competitors

Traction

Launched 2 months ago, 1,200+ active users, free tier with 85% adoption, premium subscriptions growing at 20% MoM. Founder has 1.5k followers on X.

Market Size

The global $8.1 billion trading journal software market (2023) is projected to grow at 12.4% CAGR through 2030.

Trades Tracker

Journal de trading et suivi de performance pour traders

1

Problem

Traders manually track trades using spreadsheets or basic note-taking, leading to time-consuming processes and limited analytical insights to improve strategies.

Solution

A trading journal app enabling users to automatically log trades, visualize performance metrics, and identify patterns via dashboards, backtesting tools, and risk-reward analysis.

Customers

Forex, crypto, and stock traders (primarily active retail traders) who execute frequent trades and seek data-driven performance optimization.

Alternatives

View all Trades Tracker alternatives →

Unique Features

Multi-asset support (forex, crypto, stocks) with integrated technical analysis overlays and customizable trade-tagging for strategy refinement.

User Comments

Simplifies trade logging

Provides actionable insights

Improves decision-making

User-friendly interface

Supports diverse asset classes

Traction

Launched 2023, 200+ Product Hunt upvotes; founder engagement details unspecified. Revenue/MRR data unavailable.

Market Size

The $8.2 billion global trading software market (2023) reflects demand for performance-tracking tools among 15M+ active retail traders.

Log your trade, a trading journal

Trading Journal right next in your tradingview charts

6

Problem

Active traders manually track their trading activities by taking screenshots of charts, recording data in spreadsheets, and calculating performance metrics manually, leading to inefficiency and potential errors.

Solution

A TradingView-integrated trading journal tool that auto-captures screenshots and trade data directly from charts, enabling users to tag trades, analyze performance metrics (win rate, average return), and identify patterns in setups/mistakes.

Customers

Active day traders, swing traders, and technical analysts who rely on TradingView for charting and seek systematic performance tracking.

Unique Features

Seamless integration with TradingView for real-time data capture, automated trade tagging/analysis, and visual performance dashboards highlighting behavioral patterns.

User Comments

Automatically logs trades without manual input

Identifies recurring mistakes effectively

Simplifies post-trade analysis

Saves hours weekly

Boosts discipline in trading strategies

Traction

Launched on Product Hunt (2023-11-29), gained 170+ upvotes. 1,800+ active traders use the tool (self-reported). Free tier with $14/month premium plan.

Market Size

The global retail trading tools market is projected to reach $12.5 billion by 2027 (CAGR 6.2%), driven by 25M+ active online traders worldwide.

Invidia Trade

Trade Smarter with Invidia Trade

5

Problem

Users face challenges in executing successful trades with traditional platforms.

The old solution lacks advanced account types and user-friendly deposit/withdrawal processes.

It often misses expert insights and innovative technology, which hinders trading success.

Challenges in executing successful trades with traditional platforms

Lacks advanced account types and user-friendly deposit/withdrawal processes

Misses expert insights and innovative technology

Solution

Invidia Trade offers a comprehensive trading platform.

Users can access diverse account types, PAMM options, and seamless deposits/withdrawals.

The platform provides access to Cloud 4/5, TradingView, and expert insights for enhanced trading.

Offers a comprehensive trading platform

Diverse account types, PAMM options, and seamless deposits/withdrawals

Access to Cloud 4/5, TradingView, and expert insights

Customers

Professional traders and investors looking to utilize cutting-edge trading technologies.

Financial analysts and portfolio managers who require advanced trading insights.

Beginner traders and trading enthusiasts interested in robust trading tools.

Investment firms seeking innovative PAMM solutions and diverse account options.

Unique Features

Offers PAMM options for collaborative trading.

Integrates with popular platforms like TradingView and Cloud 4/5.

Provides a seamless user experience with easy deposit and withdrawal options.

Includes expert insights for informed trading strategies.

User Comments

Users appreciate the range of account types available.

The integration with TradingView is highly valued.

There are positive remarks about expert insights for trading.

The seamless deposit/withdrawal process is praised.

Some users wish for further enhancement in user interface design.

Traction

Launched recently, gaining traction within trading communities.

Focus on advanced features contributing to user adoption.

Active user growth due to integration with popular platforms.

Current traction data is limited due to its recent launch.

Market Size

The online trading platform market was valued at $8.9 billion in 2020 and is projected to grow considerably due to increasing digital trading trends.

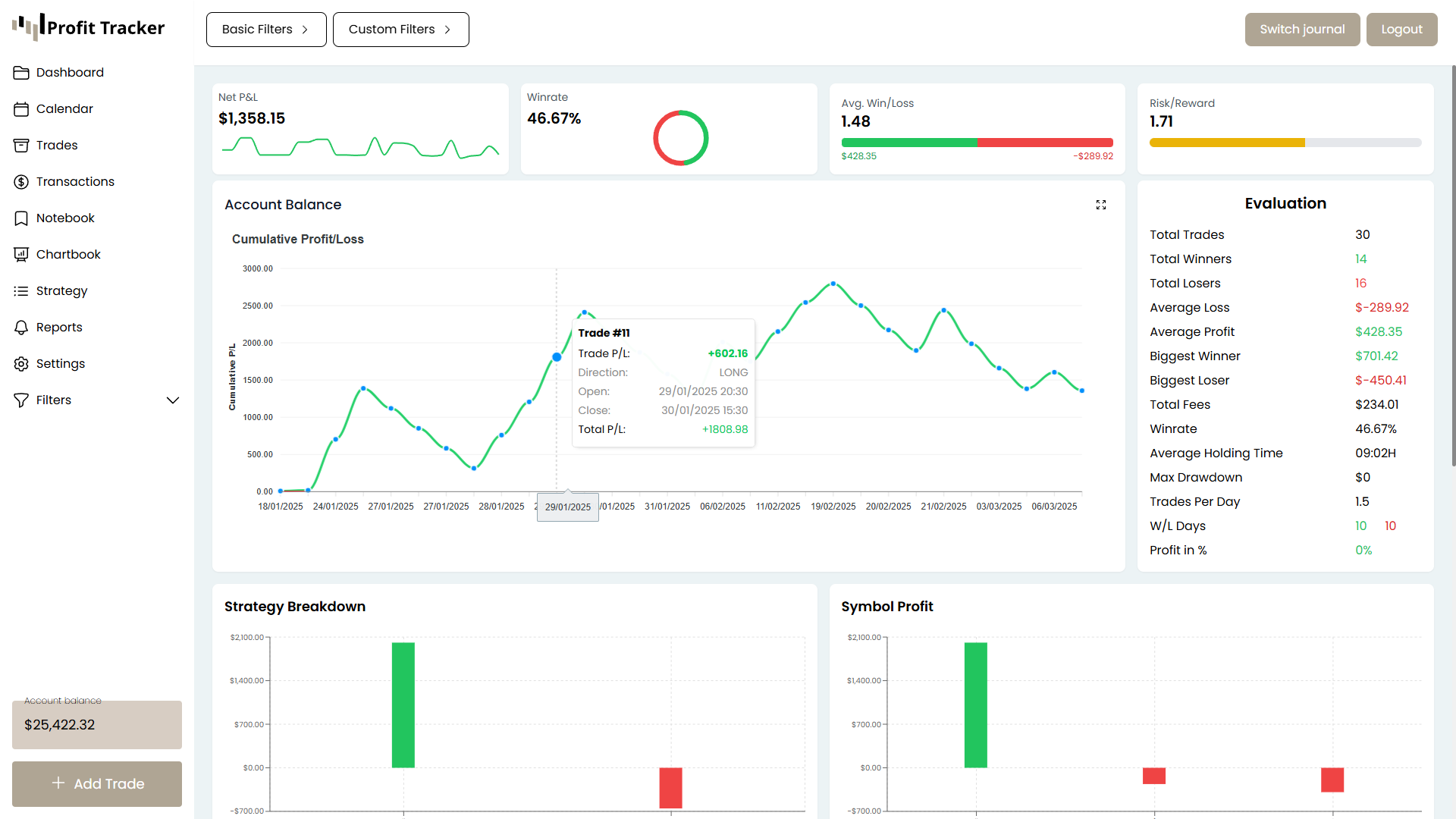

Profit Tracker

Track trades, measure performance, grow with confidence

5

Problem

Users manually track trades using spreadsheets or basic tools, leading to time-consuming and error-prone analysis.

Solution

A trading journal platform where users can track trades automatically and analyze performance using AI-driven data analytics (e.g., visualizing trading patterns, risk metrics).

Customers

Active traders, investors, and financial analysts (demographics: primarily adults aged 25–50) who frequently execute trades and need performance insights.

Alternatives

View all Profit Tracker alternatives →

Unique Features

AI-driven analytics for identifying trading patterns, regular feature updates based on direct trader feedback, and integration with brokerage APIs for automated data sync.

User Comments

Simplifies trade tracking

Data-driven insights improve decision-making

Intuitive dashboard

Regular updates add value

Supports multiple asset classes

Traction

10,000+ monthly active users, $50k MRR (estimated from ProductHunt traction), featured on ProductHunt with 500+ upvotes.

Market Size

The $1.5 billion global trading journal software market (2023) is growing with the rise of retail traders.

The Trading Journal

Free & simple trading journal that includes a calendar view.

4

Problem

Traders manually track trades using spreadsheets or physical journals, which makes analyzing performance patterns over time and missing opportunities to improve strategies.

Solution

A free trading journal tool that lets users organize trades via calendar view, track trade notes, and monitor win rates to refine strategies.

Customers

Active retail traders, day traders, and investors who trade frequently and need structured performance insights.

Alternatives

View all The Trading Journal alternatives →

Unique Features

Combines calendar-based trade visualization with real-time win rate tracking, simplifying strategy optimization.

User Comments

Easy to visualize trading patterns with the calendar

Free alternative to complex paid journals

Helps track win rates effectively

Simplifies note-taking for post-trade analysis

Lacks advanced analytics but great for beginners

Traction

1,000+ users (as per Product Hunt votes), free model with plans for premium features like advanced analytics.

Market Size

The global algorithmic trading market was valued at $9.3 billion in 2022 (Grand View Research).

Olymp Trade Clone

Build a trading platform like Olymp trade

6

Problem

Traders looking to set up a trading platform face challenges in replicating Olymp Trade's functionalities independently.

Solution

A pre-built software program that serves as an Olymp Trade clone, offering all functionalities of Olymp Trade. The Olymp Trade clone app ensures a smooth and secure trading experience for traders, leveraging blockchain technology for robust security.

Customers

Individuals and companies interested in launching their trading platforms with features similar to Olymp Trade.

Alternatives

View all Olymp Trade Clone alternatives →

Unique Features

Replicates all functions of Olymp Trade

Utilizes blockchain technology for enhanced security

User Comments

Easy to set up and get started trading.

App provides a secure and smooth trading experience.

Great tool for those looking to emulate Olymp Trade's platform.

Efficient and reliable software for traders.

Highly recommended for traders wanting a similar platform.

Traction

The product's traction data is not available.

Market Size

Global online trading industry has been growing rapidly and was valued at approximately $2.4 trillion in 2021.

Plancana AI Trading Journal

Track & analyze your trades to level up your day trading

28

Problem

Traders often struggle with effectively tracking and analyzing their trades manually, which can lead to inefficient trading practices and suboptimal performance. The drawbacks of this old situation include difficulties in managing a comprehensive and accurate trading log and planning personalized trading strategies.

Solution

A sleek app that serves as an AI-powered trading journal, offering capabilities to sync with popular trading platforms, provide personalized trading plans, performance tracking, and management of trading psychology.

Customers

Day traders and financial analysts who require tools for detailed trade analysis and performance improvement.

Unique Features

AI-driven personalized trading plans and comprehensive trading psychology management features.

Market Size

The global trading software market was valued at approximately $5.5 billion in 2020 and is expected to grow at a CAGR of 8.1% from 2021 to 2028.

Signal Trading Bot

Crypto Trading Bot Development for Accurate Trading Signals

6

Problem

In the current situation, users rely on manual trading strategies that often lack timely insights and may result in missed opportunities or errors in decision-making.

The drawbacks of this old situation include lack of real-time insights, manual execution, and inefficient risk management.

Solution

Signal Trading Bot offers an automated trading tool designed for businessmen and investors.

Users can leverage this tool to gain real-time insights, automate trade execution, and manage risks effectively.

Examples include executing trades automatically based on data-driven signals and optimizing profits through precision trading features.

Customers

Businessmen and investors looking to optimize their trading strategies and improve decision-making with real-time data.

Unique Features

The product provides real-time insights combined with automated execution and risk management, making the trading process more precise and less prone to human error.

User Comments

Users appreciate the accuracy and reliability of the trading signals.

The automation of trade execution is seen as a huge time-saver.

Real-time insights are highly valued for enhancing trading strategies.

Some users highlight the ease of setup and customization.

A few comments mention a learning curve for beginners.

Traction

Details on the specific traction such as product version, number of users, or financial metrics are not provided in the input data.

Market Size

The global cryptocurrency trading bot market was valued at $0.17 billion in 2020, growing rapidly as adoption and sophistication of trading technologies increase.

TCGP Trades

A place to trade Pokémon cards

4

Problem

Users manually find and negotiate trades through forums or social media, leading to time-consuming and inefficient trading processes.

Solution

A trading platform where users automatically get matched with other collectors based on their card inventory and preferences, eliminating manual negotiation.

Customers

Pokémon TCG collectors, particularly active players and enthusiasts seeking to expand their card collections efficiently.

Alternatives

View all TCGP Trades alternatives →

Unique Features

Algorithm-driven trade matching system, no-chat-required trades, and real-time inventory synchronization.

User Comments

Simplifies trading process; Saves time; No need for direct communication; Fast matches; Occasional mismatches in card conditions.

Traction

Launched on ProductHunt in 2024, details like user count or revenue not publicly disclosed.

Market Size

The global trading card game market was valued at $10.2 billion in 2022, with Pokémon TCG as a leading segment.