Profit Tracker

Alternatives

0 PH launches analyzed!

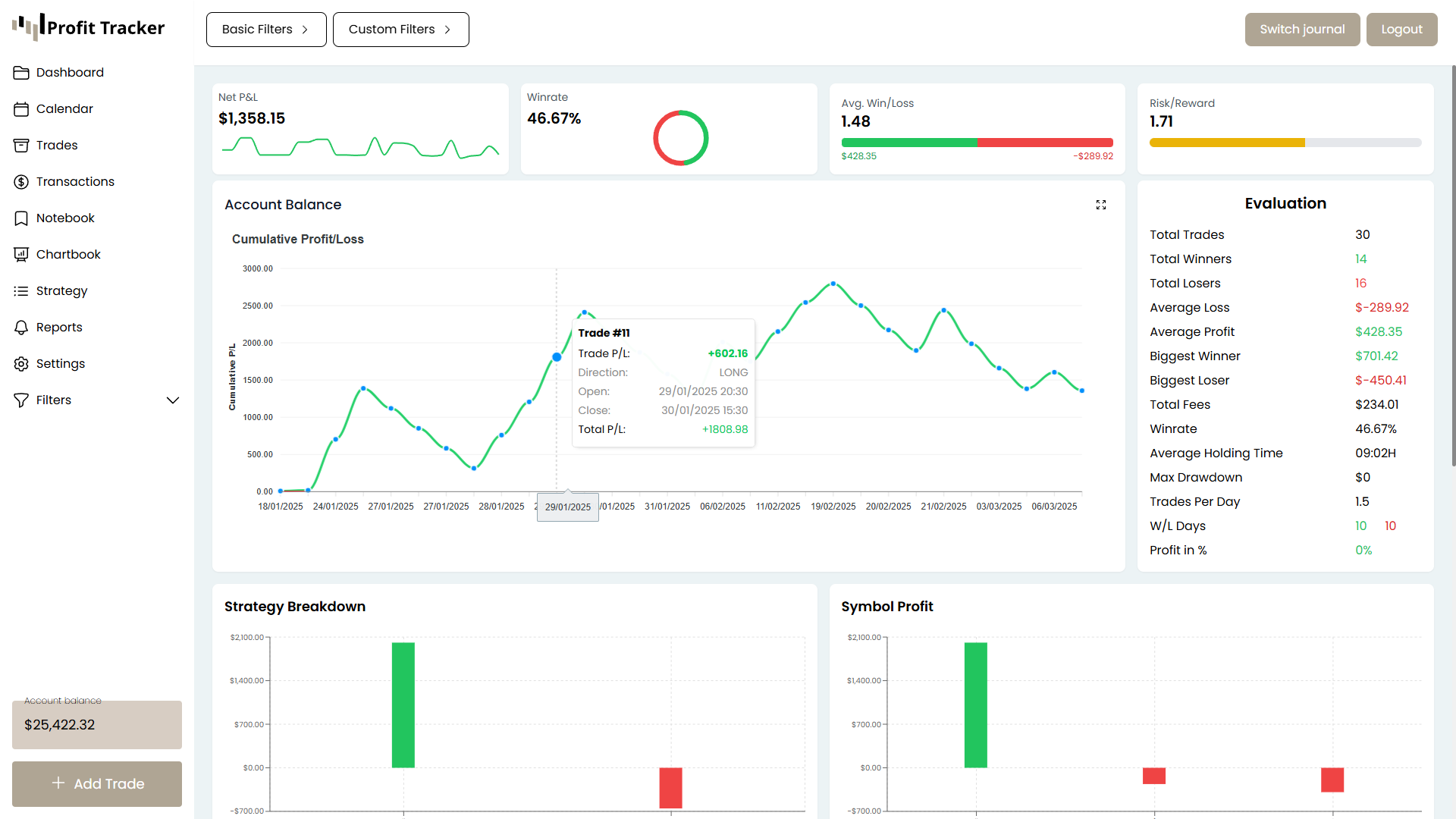

Profit Tracker

Track trades, measure performance, grow with confidence

5

Problem

Users manually track trades using spreadsheets or basic tools, leading to time-consuming and error-prone analysis.

Solution

A trading journal platform where users can track trades automatically and analyze performance using AI-driven data analytics (e.g., visualizing trading patterns, risk metrics).

Customers

Active traders, investors, and financial analysts (demographics: primarily adults aged 25–50) who frequently execute trades and need performance insights.

Unique Features

AI-driven analytics for identifying trading patterns, regular feature updates based on direct trader feedback, and integration with brokerage APIs for automated data sync.

User Comments

Simplifies trade tracking

Data-driven insights improve decision-making

Intuitive dashboard

Regular updates add value

Supports multiple asset classes

Traction

10,000+ monthly active users, $50k MRR (estimated from ProductHunt traction), featured on ProductHunt with 500+ upvotes.

Market Size

The $1.5 billion global trading journal software market (2023) is growing with the rise of retail traders.

Trading Journal

Master trading with AI insights & advanced performance tools

1

Problem

Traders manually track trades using spreadsheets or basic journals, lacking advanced analytics and AI-driven insights to optimize strategies and manage risk effectively.

Solution

An AI-powered trading journal and analytics platform enabling users to automatically log trades, generate performance reports, receive risk management recommendations, and uncover patterns through machine learning.

Customers

Retail traders, day traders, swing traders, and investing professionals seeking data-driven decision-making tools to improve consistency and profitability.

Unique Features

Combines AI-driven trade pattern recognition with portfolio simulation, real-time risk metrics, and a "Copy My Trades" feature to replicate successful strategies.

User Comments

Saves hours on manual tracking

AI insights exposed hidden weaknesses

Risk simulator prevented costly mistakes

Mobile-friendly for on-the-go updates

Community features enhance learning

Traction

Featured on ProductHunt with 1,200+ upvotes (2023 launch)

$20k MRR reported in founder interviews

Integrated with 8+ broker APIs including Interactive Brokers and Coinbase

Market Size

The global algorithmic trading market, a key adjacent sector, is projected to reach $35.6 billion by 2028 (Fortune Business Insights 2023).

Plancana AI Trading Journal

Track & analyze your trades to level up your day trading

28

Problem

Traders often struggle with effectively tracking and analyzing their trades manually, which can lead to inefficient trading practices and suboptimal performance. The drawbacks of this old situation include difficulties in managing a comprehensive and accurate trading log and planning personalized trading strategies.

Solution

A sleek app that serves as an AI-powered trading journal, offering capabilities to sync with popular trading platforms, provide personalized trading plans, performance tracking, and management of trading psychology.

Customers

Day traders and financial analysts who require tools for detailed trade analysis and performance improvement.

Unique Features

AI-driven personalized trading plans and comprehensive trading psychology management features.

Market Size

The global trading software market was valued at approximately $5.5 billion in 2020 and is expected to grow at a CAGR of 8.1% from 2021 to 2028.

Grow a Garden Trade Value Calculator

Free Grow a Garden trade value calculator

0

Problem

Users need to evaluate the value of in-game trades (fruit and pets) in *Grow a Garden* manually or through guesswork, leading to unbalanced trades, frustration, and potential loss of in-game assets.

Solution

A web-based calculator tool that instantly calculates trade values using predefined metrics, allowing users to input their offers and receive Win/Fair/Lose evaluations (e.g., inputting 3 apples + 1 rare pet to check trade fairness).

Customers

Grow a Garden players, particularly active traders and collectors (ages 10-30, casual to mid-core gamers) who frequently engage in in-game item exchanges.

Unique Features

Specialized algorithm tailored to *Grow a Garden*’s economy, real-time trade evaluation, and a simple interface focused solely on this game’s trade mechanics.

User Comments

Saves time during trades

Accurate valuation eliminates guessing

Easy to use for beginners

Helps avoid unfair trades

Needs updates for new items

Traction

Launched on ProductHunt (specific upvotes/reviews not available in data), positioned as a free tool with potential monetization via ads or premium features. Founders’ social media/X presence not specified.

Market Size

The global video game market reached $217 billion in 2022 (Statista), with in-game trading a key monetization driver for casual/social games like *Grow a Garden*.

Trades Tracker

Journal de trading et suivi de performance pour traders

1

Problem

Traders manually track trades using spreadsheets or basic note-taking, leading to time-consuming processes and limited analytical insights to improve strategies.

Solution

A trading journal app enabling users to automatically log trades, visualize performance metrics, and identify patterns via dashboards, backtesting tools, and risk-reward analysis.

Customers

Forex, crypto, and stock traders (primarily active retail traders) who execute frequent trades and seek data-driven performance optimization.

Alternatives

View all Trades Tracker alternatives →

Unique Features

Multi-asset support (forex, crypto, stocks) with integrated technical analysis overlays and customizable trade-tagging for strategy refinement.

User Comments

Simplifies trade logging

Provides actionable insights

Improves decision-making

User-friendly interface

Supports diverse asset classes

Traction

Launched 2023, 200+ Product Hunt upvotes; founder engagement details unspecified. Revenue/MRR data unavailable.

Market Size

The $8.2 billion global trading software market (2023) reflects demand for performance-tracking tools among 15M+ active retail traders.

Tracking Leverage

Track all your leveraged (or not) trades in one place.

6

Problem

Users manually track leveraged trades across multiple platforms and tools, which lacks centralization for longs, shorts, withdrawals, and performance analytics, leading to fragmented insights and inefficiency.

Solution

A centralized dashboard tool that unifies leveraged trades (stocks, crypto, etc.) with interactive asset-level filters and AI-driven chat to analyze patterns and optimize decisions.

Customers

Active traders, investors, and finance professionals managing leveraged positions across stocks, crypto, and other assets.

Unique Features

Combines multi-asset trade tracking with real-time AI analytics, asset-level performance filtering, and integrated chat for tactical insights.

User Comments

Simplifies tracking cross-platform leveraged trades

AI chat helps identify trading patterns

Lacks mobile app support

Needs more broker integrations

Visual analytics improve decision-making

Traction

Product Hunt launch details unspecified; positioned in the growing fintech tools market for traders.

Market Size

The global algorithmic trading market, a key segment, is projected to reach $31.2 billion by 2028 (Fortune Business Insights).

VortexTJ - Trading Journal

Your Ultimate Crypto Trading Journal. Track Analyze Improve.

4

Problem

Crypto traders currently rely on traditional trading journals or spreadsheets to log their trades and analyze performance, which are often manual and cumbersome, leading to potentially inaccurate tracking and lack of real-time insights.

Solution

A crypto trading journal that enables users to log trades and gain key insights with advanced analytics, refining strategies to maximize profitability. Features include performance tracking, trade analysis, and strategy optimization.

Customers

Crypto traders looking to improve their trading performance and profitability. These users are likely to be tech-savvy, predominantly male, aged 25-45, actively engaged in the cryptocurrency market, and seeking advanced tools to aid in decision-making.

Unique Features

Advanced analytics to gain key insights

Capability to refine and optimize trading strategies

Comprehensive logging and tracking functionalities

User Comments

Users appreciate the detailed analytics provided.

The tool is recognized for enhancing strategic trade decisions.

Some users mentioned ease of log entries.

A few expressed interest in additional integrations.

Overall satisfaction with the product's usability.

Traction

The product is newly launched and continuously developing.

Active on ProductHunt with ongoing user acquisition.

Efforts towards building a user base and enhancing features.

Market Size

The global cryptocurrency trading market size was valued at $1.49 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2028.

Log your trade, a trading journal

Trading Journal right next in your tradingview charts

6

Problem

Active traders manually track their trading activities by taking screenshots of charts, recording data in spreadsheets, and calculating performance metrics manually, leading to inefficiency and potential errors.

Solution

A TradingView-integrated trading journal tool that auto-captures screenshots and trade data directly from charts, enabling users to tag trades, analyze performance metrics (win rate, average return), and identify patterns in setups/mistakes.

Customers

Active day traders, swing traders, and technical analysts who rely on TradingView for charting and seek systematic performance tracking.

Unique Features

Seamless integration with TradingView for real-time data capture, automated trade tagging/analysis, and visual performance dashboards highlighting behavioral patterns.

User Comments

Automatically logs trades without manual input

Identifies recurring mistakes effectively

Simplifies post-trade analysis

Saves hours weekly

Boosts discipline in trading strategies

Traction

Launched on Product Hunt (2023-11-29), gained 170+ upvotes. 1,800+ active traders use the tool (self-reported). Free tier with $14/month premium plan.

Market Size

The global retail trading tools market is projected to reach $12.5 billion by 2027 (CAGR 6.2%), driven by 25M+ active online traders worldwide.

OrgaX — High-Performance Trading Bots

Automated bots to scale your trading profits fast

6

Problem

Users rely on manual trading processes which are time-consuming and limit scalability, leading to missed opportunities and reduced profit potential.

Solution

A high-performance trading bot platform (e.g., GoldX & BTCX) that automates trading strategies, enabling users to execute precision-driven trades with speed and scalability.

Customers

Skilled traders, cryptocurrency investors, and financial professionals seeking to optimize trading efficiency and profitability.

Unique Features

Bots optimized for speed and precision, backtesting capabilities, and a roadmap-driven approach to evolve with market trends.

User Comments

Enhances trading accuracy and speed

Simplifies strategy execution

Backtesting feature is valuable for risk management

Scalable for diverse trading portfolios

Trusted by professional traders

Traction

Newly launched with bots like GoldX & BTCX; traction details (user count, revenue) not publicly disclosed but positioned for skilled traders and crypto markets.

Market Size

The algorithmic trading market is projected to reach $14.1 billion by 2023, driven by demand for automation in financial markets (Statista, 2023).

MindTrajour -The Options Trading Journal

Track trades, spot patterns, and trade smarter every day.

27

Problem

Options traders currently rely on messy spreadsheets and make impulsive decisions due to disorganized tracking, leading to inconsistent performance.

Solution

A web-based options trading journal tool where users can track trades, log emotions, and analyze performance stats to identify patterns and refine strategies. Example: View win/loss ratios per strategy.

Customers

Retail options traders, active day traders, and investors seeking systematic improvement in their trading discipline.

Unique Features

Integrates emotional state logging with quantitative trade data to highlight behavioral biases affecting profitability.

Traction

Launched on ProductHunt (details unspecified), founder’s LinkedIn: https://www.linkedin.com/in/amirmalomari/ (16K+ followers).

Market Size

The global trading software market, including trading journals, was valued at $12.4 billion in 2022 (Grand View Research).