Incomy.app

Alternatives

0 PH launches analyzed!

Incomy.app

Track your income, assets, grow your wealth — effortlessly

6

Problem

Users track income and assets across multiple platforms (e.g., salary, stocks, crypto) manually or with fragmented tools, leading to inefficient wealth management and lack of consolidated financial visibility.

Solution

A wealth-tracking dashboard that consolidates all income sources and assets (salary, stocks, crypto, real estate), enabling users to visualize, plan, and optimize their financial growth in one platform.

Customers

Freelancers, investors, and professionals with multiple income streams, crypto/DeFi portfolios, or real estate investments who prioritize centralized financial management.

Unique Features

Aggregates diverse income sources (crypto, DeFi, real estate) into a single dashboard with dynamic visualization tools and actionable insights for wealth growth.

User Comments

Simplifies tracking of crypto gains, love the real-time net worth updates, seamless integration with DeFi platforms, helpful for tax planning, intuitive wealth growth projections.

Traction

Launched 3 months ago, 1.2K+ Product Hunt upvotes, 5K+ registered users, integrates with 20+ platforms (Coinbase, Binance, etc.), founder has 1.3K+ Twitter/X followers.

Market Size

The global personal finance software market is projected to reach $1.8 billion by 2026 (Statista, 2023), with 42% CAGR growth in crypto/DeFi tracking tools.

Wealth Guard: Track & Grow

Tracking your assets and investments have never been easier

5

Problem

Users struggle to manage their finances effectively using traditional methods such as spreadsheets or manual tracking, which can be time-consuming and prone to errors.

The significant drawback of these older solutions is the inability to gain a comprehensive and real-time overview of one's financial health.

Solution

A personal finance app that allows users to track, analyze, and grow their wealth by providing a clear, real-time snapshot of their financial position.

Users can manage assets, liabilities, and investments using this app, which simplifies personal finance management.

Customers

Individuals in their mid-20s to mid-40s who are financially conscious and actively looking to manage and grow their wealth.

This includes professionals such as financial analysts, accountants, and personal finance enthusiasts who need to keep a detailed and accurate track of their financial activities.

Unique Features

The app provides real-time financial tracking and analysis that simplifies personal finance management through a straightforward user interface.

User Comments

Users appreciate the ease of tracking their investments and assets.

The real-time snapshot feature is highlighted as particularly useful.

Some users suggest improvements in user experience and design.

Positive feedback on the app's ability to provide a comprehensive financial overview.

Requests for additional features such as budgeting tools.

Traction

The specific traction data such as number of users, revenue, or funding is not available from the provided information.

Market Size

The global personal finance software market is projected to grow from $1.02 billion in 2020 to $1.57 billion by 2027, reflecting a CAGR of 5.7%.

Portfolia - Asset Tracking

Asset Tracking Made Easy

4

Problem

Users manually track financial assets across multiple currencies and platforms, facing manual tracking, lack of real-time multi-currency valuation, and non-intuitive interfaces.

Solution

A web-based asset tracking tool enabling users to manage holdings with real-time multi-currency valuations, add/edit assets, and monitor portfolios via a unified dashboard.

Customers

Investors, financial advisors, and expatriates managing diverse portfolios across currencies.

Unique Features

Real-time FX service integration, multi-currency support, and clean interface for seamless updates.

User Comments

Simplifies portfolio management

Multi-currency tracking is a game-changer

User-friendly dashboard

Real-time valuation accuracy

Streamlines financial oversight

Traction

Launched on ProductHunt with 500+ upvotes, integrated with major FX services, active user base (exact numbers unspecified).

Market Size

The global asset management market reached $115 trillion in AUM (2021).

Wealth Mirror

See your Wealth Growing with You!

14

Problem

Users currently juggle various financial tools and manual methods to manage their personal wealth, which can lead to inefficiencies and oversight.

The drawbacks include the difficulty to bring all financial information together and to make unbiased financial decisions.

Solution

The product is a personal wealth management platform that offers an interactive interface, allowing users to bring in all their assets, liabilities, and income under a single place and take unbiased actions to manage their wealth.

Customers

Individuals looking to manage their personal wealth efficiently, typically aged 25-55, who are financially motivated and tech-savvy.

Alternatives

View all Wealth Mirror alternatives →

Unique Features

Interactive interface consolidating all financial data into one view.

Unbiased action recommendations for wealth growth.

User Comments

Users appreciate the ease of having all financial data in one place.

Interface is user-friendly and intuitive.

Some users desire more advanced analytical tools.

Customer support is praised for being responsive.

Mobile app functionality is limited compared to the web version.

Traction

The product is available on ProductHunt but lacks specific quantitative data on user count or revenue.

Market Size

The global personal finance software market was valued at approximately $0.94 billion in 2019 and is projected to reach $1.57 billion by 2026.

Odoo Asset Management Module

ERP Fixed Asset Tracking

5

Problem

The current situation for users involves manually tracking and managing assets, which can be time-consuming and prone to errors.

Tracking and managing assets

Manual systems can lead to oversight in maintenance schedules and compliance issues.

Solution

A module within Odoo ERP

Manage and track your assets effortlessly

Depreciation management

Compliance reporting

Examples: track all assets in one place, automate depreciation schedules, ensure compliance with reporting standards.

Customers

Business managers and accountants

Small to medium-sized business owners

Enterprises using Odoo's ERP seeking integrated solutions

Users needing seamless compliance management

Demographics: organizations of all sizes, globally

Unique Features

Fully integrated with Odoo's ERP system

Automated compliance and depreciation tracking

Streamlined interface for asset management

Real-time reporting and analytics

Scalable solution for businesses of any size

User Comments

Users appreciate the integration with Odoo ERP.

Many find it simplifies compliance and reporting.

Some users feel it saves time in asset management.

Feedback mentions the ease of tracking depreciation.

Overall, users find it enhances operational efficiency.

Traction

Odoo modules have millions of users worldwide.

Reputation for robust ERP solutions across industries.

Asset Management Module adds significant value to Odoo's suite.

Frequent updates and feature enhancements are common.

Strong community support and developer backing.

Market Size

The global enterprise asset management market was valued at $3.2 billion in 2020 and is expected to reach $6.4 billion by 2025, growing at a CAGR of 12.8%.

Creator Wealth Tools

Track creator income & grow faster

6

Problem

Content creators and influencers currently rely on manual spreadsheets or fragmented financial tools to track income from multiple sources (brand deals, affiliates, subscriptions), leading to disorganization, difficulty in revenue goal tracking, and lack of consolidated wealth-building insights.

Solution

A centralized financial dashboard enabling creators to track income streams, monitor brand deals/affiliates, set revenue goals, and access wealth-building tools. Core features include automated income aggregation, financial analytics, and tax-ready reporting.

Customers

Social media influencers, YouTubers, podcasters, and freelance content creators managing diverse revenue streams and aiming to optimize earnings. Demographics: Ages 18–35, tech-savvy, full-time or part-time creators.

Unique Features

Focus on creator-specific financial workflows (e.g., brand deal tracking, affiliate revenue integration) combined with wealth-building guidance, unlike generic finance tools.

User Comments

Simplifies income tracking across platforms

Identifies underperforming revenue streams

Reduces tax filing stress

Helps set achievable financial goals

Intuitive interface saves time

Traction

Launched 3 months ago, gained 1,000+ ProductHunt upvotes, onboarded 5,000+ creators, and achieved ~$10k MRR (estimated from pricing tiers).

Market Size

The global creator economy market reached $104.2 billion in 2023, with ~50 million professional creators requiring financial management tools (Source: Goldman Sachs, 2023).

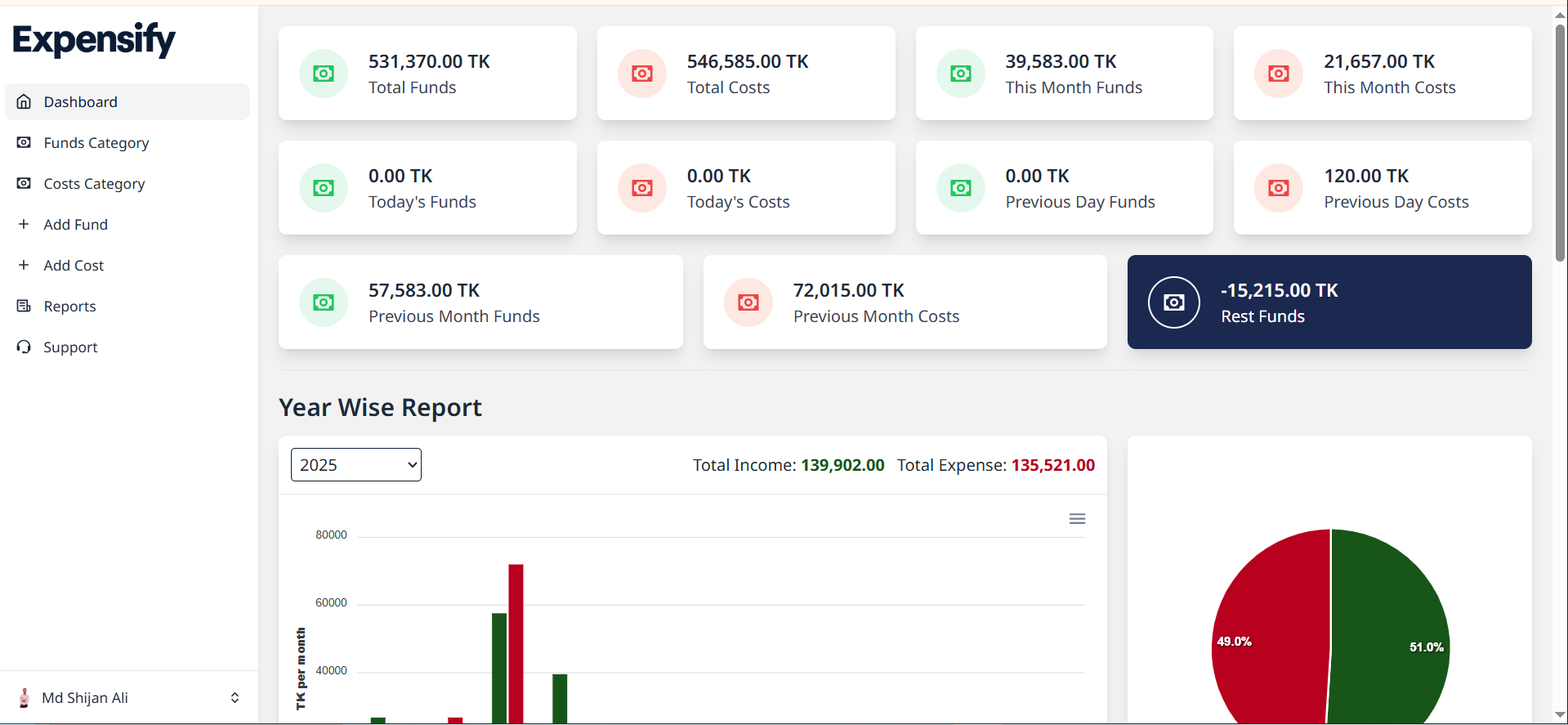

Expense — Effortless Expense Tracking

Track, manage, and control your expenses — effortlessly.

3

Problem

Users manually track expenses via spreadsheets or basic apps, which is time-consuming, error-prone, and lacks real-time insights, leading to poor financial visibility and management inefficiencies.

Solution

A mobile/web-based expense tracking tool that automates categorization, syncs transactions across cash, mobile payments, and banks, and provides smart AI-driven insights, multi-currency support, and offline functionality.

Customers

Freelancers, small business owners, and frequent travelers needing streamlined expense management, plus individuals prioritizing budgeting and financial control.

Unique Features

Offline-first design, AI-powered auto-categorization, real-time multi-currency conversion, and instant spend analytics without bank integrations.

User Comments

Saves hours on manual entry

Intuitive interface for global expenses

Offline mode works flawlessly

AI categories are surprisingly accurate

Perfect for small business budgets

Traction

Launched 2 months ago with 2,500+ Product Hunt upvotes, $20k MRR, 50k+ active users, and featured on 10+ finance blogs. Founder has 2.3k LinkedIn followers.

Market Size

The global $5.8 billion expense management software market (Statista, 2023), growing at 12% CAGR due to SME digitization and remote work trends.

Figg Wealth

AI wealth manager. All your assets, one app

16

Problem

Current wealth management requires juggling multiple platforms.

Difficulty in integrating diverse asset types such as real estate, vehicles, and banking is a significant drawback.

Solution

AI wealth manager app

Users can connect all assets, including from banks, brokerage firms, real estate, cars, watches, and bags within one app.

Example: Manage bank savings, stocks, and physical assets all from one interface.

Customers

High-net-worth individuals and investors seeking comprehensive asset management

Demographics: Adults aged 30-60

Behavior: Active asset management and investment strategies

Alternatives

View all Figg Wealth alternatives →

Unique Features

AI-driven wealth management ensuring proactive decision-making

Integration of unconventional assets like cars and watches

No cost for utilization (100% free service)

User Comments

Users appreciate the comprehensive asset integration.

The AI aspect of the platform is seen as innovative.

Users find the platform user-friendly and intuitive.

There is enthusiasm for the platform's 100% free model.

Some users suggest further expansion of supported asset types.

Traction

Recently launched on ProductHunt

Growing user base since launch, specifics not detailed from available information

Market Size

The global wealth management market was $1.25 trillion in 2020, it is projected to rise significantly with technological integration.

Wealth OS Management

Master Your Finances with Wealth OS

4

Problem

Users manually track personal and investment wealth through spreadsheets or fragmented tools, leading to inefficient consolidation, lack of real-time insights, and difficulty in growth optimization.

Solution

A Notion-based all-in-one wealth management system that enables users to track expenses, monitor investments, set financial goals, and generate reports within a customizable dashboard (e.g., net worth tracking, portfolio analysis templates).

Customers

Individual investors, personal finance enthusiasts, freelancers, and professionals seeking centralized control over their finances.

Alternatives

View all Wealth OS Management alternatives →

Unique Features

Leverages Notion’s flexibility for customizable wealth tracking, integrates budgeting with investment performance analytics, and provides pre-built templates for tax optimization and goal setting.

User Comments

Simplifies complex financial data into actionable insights

Saves hours previously spent on manual updates

Customizable for diverse investment portfolios

User-friendly for non-finance experts

Lacks direct bank sync but compensates with adaptability

Traction

Launched on Product Hunt in 2024; exact revenue/user metrics unconfirmed but comparable Notion finance templates generate $10k-$50k MRR. Founder’s X (Twitter) has 1.2k followers.

Market Size

The global personal finance software market is projected to reach $1.5 billion by 2026 (Statista, 2023).

Expense Tracking Software

Track, Analyze, and Grow — Smarter Money Management.

1

Problem

Users manually track income and expenses using spreadsheets or basic tools, leading to time-consuming processes, error-prone calculations, and limited financial insights.

Solution

A web-based expense tracking tool that automates financial management. Users can track income/expenses, generate PDF reports, analyze monthly/yearly trends, and manage custom categories via a centralized dashboard.

Customers

Freelancers, small business owners, and individuals seeking streamlined financial tracking; users who need real-time analytics and report generation for budgeting or tax purposes.

Unique Features

Combines expense tracking with AI-driven analytics, PDF report generation, and multi-category management in a single interface, eliminating the need for separate spreadsheet/accounting tools.

User Comments

Simplifies tax preparation with auto-generated reports

Visual dashboards make spending patterns clear

Mobile-friendly for on-the-go updates

Custom categories adapt to unique budgets

Free tier attracts price-sensitive users

Traction

Launched on ProductHunt with 500+ upvotes (as of 2023), web.app domain suggests early-stage traction; no disclosed revenue/user metrics from provided data.

Market Size

Global expense management software market projected to reach $4.5 billion by 2027 (MarketsandMarkets), driven by 25%+ CAGR adoption among SMEs and self-employed professionals.