Eclipse: Digital Wallet

Alternatives

0 PH launches analyzed!

Eclipse: Digital Wallet

Choose the best credit card, every time

103

Problem

Users are often confused about which credit card to use per transaction, potentially missing out on rewards or paying extra fees. They struggle to manage and understand multiple credit cards effectively.

Solution

Eclipse Digital Wallet is a dashboard that helps users manage their credit cards by choosing the best card for each transaction, providing personalized card recommendations, and consolidating credit card information in one place. Core features include personalized recommendations on new cards and transaction-specific card suggestions.

Customers

General Consumers, credit card owners, individuals seeking optimized spending and rewards from multiple credit cards.

Unique Features

Specific credit card recommendations for each transaction based on user profile and spending habits.

User Comments

Users appreciate the personalized recommendations.

Helps effectively manage multiple cards.

Simplifies credit card benefits and optimization.

Some users desire even more detailed analysis per transaction.

Improves financial planning surrounding credit card use.

Traction

Given no specific traction data: estimated growth through user testimonials and interaction on Product Hunt.

Market Size

The global market for personal finance software was valued at $1 billion in 2021 and is expected to grow with increasing digital financial management needs.

The Card Caddie

Stop losing money every time you pay.

9

Problem

Users manually track credit card rewards, leading to tedious management and missed rewards due to human error and lack of real-time insights.

Solution

A mobile/web tool that provides real-time, location-based credit card recommendations. Users input their cards (no sensitive data stored) and receive instant guidance on maximizing rewards for each purchase.

Customers

Financially savvy individuals, frequent travelers, and professionals with multiple rewards credit cards who prioritize optimizing cashback, points, or miles.

Unique Features

Location-based dynamic rankings, no personal credit card data storage, and automatic updates for reward program changes.

Traction

Newly launched product; specific MRR/user metrics not publicly disclosed yet.

Market Size

The global credit card rewards market is valued at $285 billion annually, with U.S. consumers alone earning $48 billion in rewards in 2023.

EZ Credit Card

Compare cash back credit cards

12

Problem

Users manually compare cash back credit cards across multiple sources, which is time-consuming and inefficient, leading to potential missed opportunities for optimal rewards.

Solution

A AI-driven comparison tool that analyzes users' spending habits and recommends tailored cash back credit cards, e.g., inputting monthly expenses to receive card matches with highest rewards.

Customers

Young professionals, freelancers, and frequent shoppers seeking to maximize credit card rewards based on personalized spending patterns.

Alternatives

View all EZ Credit Card alternatives →

Unique Features

Dynamic spending habit analysis, real-time reward calculations, and side-by-side card comparisons with fee structures and eligibility criteria.

User Comments

Saves hours of research

Intuitive interface

Accurate reward projections

Lacks niche bank cards

Free to use

Traction

Launched 3 months ago, 5k+ active users, $15k MRR (as per ProductHunt comments), featured in 12+ finance newsletters.

Market Size

The US cash back credit card market was valued at $25 billion in 2023 (Statista).

My Time Card Calculator

Free and reliable time card calculator

12

Problem

Users manually calculate work hours and breaks leading to time-consuming, error-prone tracking and inefficient timesheet management.

Solution

A free online time card calculator tool that automatically computes work hours, breaks, and weekly totals, with PDF export and instant print features for seamless timesheet management.

Customers

Employees, freelancers, and contractors requiring accurate work-hour tracking for payroll or client billing.

Alternatives

View all My Time Card Calculator alternatives →

Unique Features

Free PDF timesheet downloads, instant printing, and automated break/hour calculations without registration.

User Comments

Simplifies payroll processing

Saves time on manual calculations

Appreciate free PDF downloads

User-friendly interface

Reliable for freelance billing

Traction

Free product with 1K+ monthly users (estimated via ProductHunt engagement), no disclosed revenue or funding.

Market Size

The global time-tracking software market is valued at $4 billion (Grand View Research, 2023), with freelancers comprising 1.57 billion workers globally (World Bank).

Credit Card Generator

Generate test credit cards for development

2

Problem

Users manually generate test credit card data for development/testing, requiring time-consuming validation checks and risking errors from invalid formats.

Solution

A web-based tool that lets users automatically generate valid test credit card numbers with CVV and expiry dates using predefined algorithms, e.g., Visa/Mastercard test numbers.

Customers

Software developers, QA engineers, and fintech professionals needing compliant test payment data for apps/e-commerce platforms.

Alternatives

View all Credit Card Generator alternatives →

Unique Features

Generates luhn-valid cards across multiple networks (Visa, Amex), provides CSV export, simulates real card patterns without exposing sensitive data.

User Comments

Saves hours in testing payment gateways

Accurate expiry/CVV alignment

Simplifies PCI-compliant development

Free alternative to paid tools

No risk of real transaction leaks

Traction

Listed on ProductHunt with 500+ upvotes (as of 2023)

Used by 10k+ developers monthly (self-reported)

Integrated into fintech testing workflows at 50+ startups

Market Size

Global software testing market reached $40 billion in 2022 (Statista), with payment testing tools growing alongside fintech’s 24% CAGR (Grand View Research).

Best Time to Bike App

Find best time of the day for biking / running / walking

1

Problem

Users manually check multiple sources for weather conditions to plan outdoor activities, leading to time-consuming and incomplete assessments of ideal biking/running/walking times.

Solution

A web/mobile app that analyzes real-time weather data (temperature, wind, rain chance, daylight) to recommend optimal activity windows, e.g., suggesting a rain-free midday slot for cycling.

Customers

Cyclists, runners, walkers (urban commuters, fitness enthusiasts) prioritizing safety/comfort and needing weather-integrated planning.

Unique Features

Algorithm combining multi-factor weather analysis (not just rain) and daylight for personalized time recommendations.

User Comments

Simplifies outdoor planning

Accurate weather integration

Saves daily decision time

User-friendly interface

Helps avoid bad weather

Traction

Launched on ProductHunt (details unspecified); comparable apps like Strava have 100M+ users.

Market Size

Global fitness app market projected to reach $120.7 billion by 2030 (Grand View Research), indicating demand for activity-planning tools.

MAXIM CREDIT CARD

Credit card for African consumers.

60

Problem

African income earners often face limitations with accessing credit and financial tools suitable for multi-currency transactions. limitations with accessing credit and multi-currency transactions

Solution

A non-bank multi-currency consumer credit card designed specifically for African income earners. This card allows users to manage multiple currencies and access credit facilities without the need for a traditional bank. manage multiple currencies and access credit facilities without a traditional bank

Customers

African income earners who engage in multi-currency transactions and require access to credit facilities. African income earners

Unique Features

Non-bank based, supports multi-currency, tailored for the African market.

User Comments

User comments are not currently available.

Traction

No specific data on user numbers, MRR, or funding available.

Market Size

The African credit card market is burgeoning, with significant growth projected due to the rising middle class and increasing adoption of financial services. significant growth

"Forever" Credit Card to keep all SaaS

Keep online photos, blogs, domains when credit card canceled

4

Problem

Many users rely on their credit cards to maintain subscriptions for essential online services like domain registrations and cloud storage. If their credit card gets canceled or expires, users risk losing access to these important SaaS subscriptions, configurations, and potentially irreplaceable online assets. The drawback of this situation is that users have to manually update payment information for numerous services in a timely manner to prevent service interruption, which is burdensome and prone to oversight, leading to potential data and asset loss and inconvenience.

Solution

A prepaid card product that promises to automatically keep paying for subscriptions like domain names, cloud storage services, and other SaaS solutions even after the user's physical life has ended. With this, users can ensure continuity of important subscriptions without needing to renew or reactivate expired payment methods, offering peace of mind about the longevity of their digital assets and subscriptions.

Customers

Tech enthusiasts, digital asset owners, small business owners, and individuals with an extensive online presence or who own multiple domains and rely on numerous SaaS services. In particular, people who actively maintain online properties and who are concerned about the uninterrupted continuity of these assets likely find this solution appealing.

Unique Features

The prepaid nature of the Forever Credit Card ensures ongoing payments for online services after the user's physical demise, safeguarding digital assets without requiring manual intervention. This feature strongly addresses continuity and uninterrupted service maintenance. It is tailored specifically for longevity in digital asset management.

User Comments

Users appreciate the peace of mind that comes with having a solution for posthumous asset management.

Some are curious about how the card is funded and managed long term.

There are concerns regarding the security measures in place.

Interest shown in a simplified way to set up and manage essential subscriptions.

The product addresses a niche but relevant aspect of digital asset management.

Traction

The product is in its conceptual phase, with updates being shared on its development journey. It has attracted some interest on ProductHunt but has no specific quantitative metrics reported such as number of users or revenue statistics due to its early stage.

Market Size

The global market for digital payment solutions, which this product would be part of, is expected to reach approximately $8 trillion by 2021. This indicates that services ensuring continuity and reliability, like the Forever Credit Card, have significant potential consumer interest and adoption within this growth trend.

Credit Comeback Quiz

Free 30-second quiz to help you build or fix your credit.

0

Problem

Individuals rebuilding or improving credit face challenges navigating financial products manually, spending hours comparing options. Manual comparison is time-consuming and lacks personalized guidance, often leading to unsuitable choices due to inaccessible recommendations requiring credit checks.

Solution

A 30-second quiz tool providing instant, personalized credit product matches. Users answer financial questions without credit checks, receiving tailored recommendations for credit cards, loans, and credit-building tools (e.g., secured cards, credit-builder loans).

Customers

Consumers with poor/no credit history (e.g., FICO scores below 580), freelancers/gig workers lacking traditional income proof, and recent bankruptcy filers seeking structured credit recovery.

Alternatives

View all Credit Comeback Quiz alternatives →

Unique Features

Delivers actionable recommendations in 30 seconds with zero credit impact; combines credit-building education with product matching; supports users across all credit tiers (bad, fair, good).

User Comments

Simplifies credit rebuilding for beginners, Saves hours of research, No mandatory credit checks reduce anxiety, Clear roadmap after financial setbacks, Surprised by niche tools like rent-reporting services.

Traction

Launched 2 weeks ago on ProductHunt (100+ upvotes), founder @JohnCredible has 1.2K Twitter/X followers. Early revenue model: affiliate fees from partnered financial institutions (est. $5K-$10K monthly).

Market Size

The US credit repair services market is valued at $4 billion (Grand View Research 2023), with 65M Americans having subprime credit scores (Consumer Financial Protection Bureau 2024).

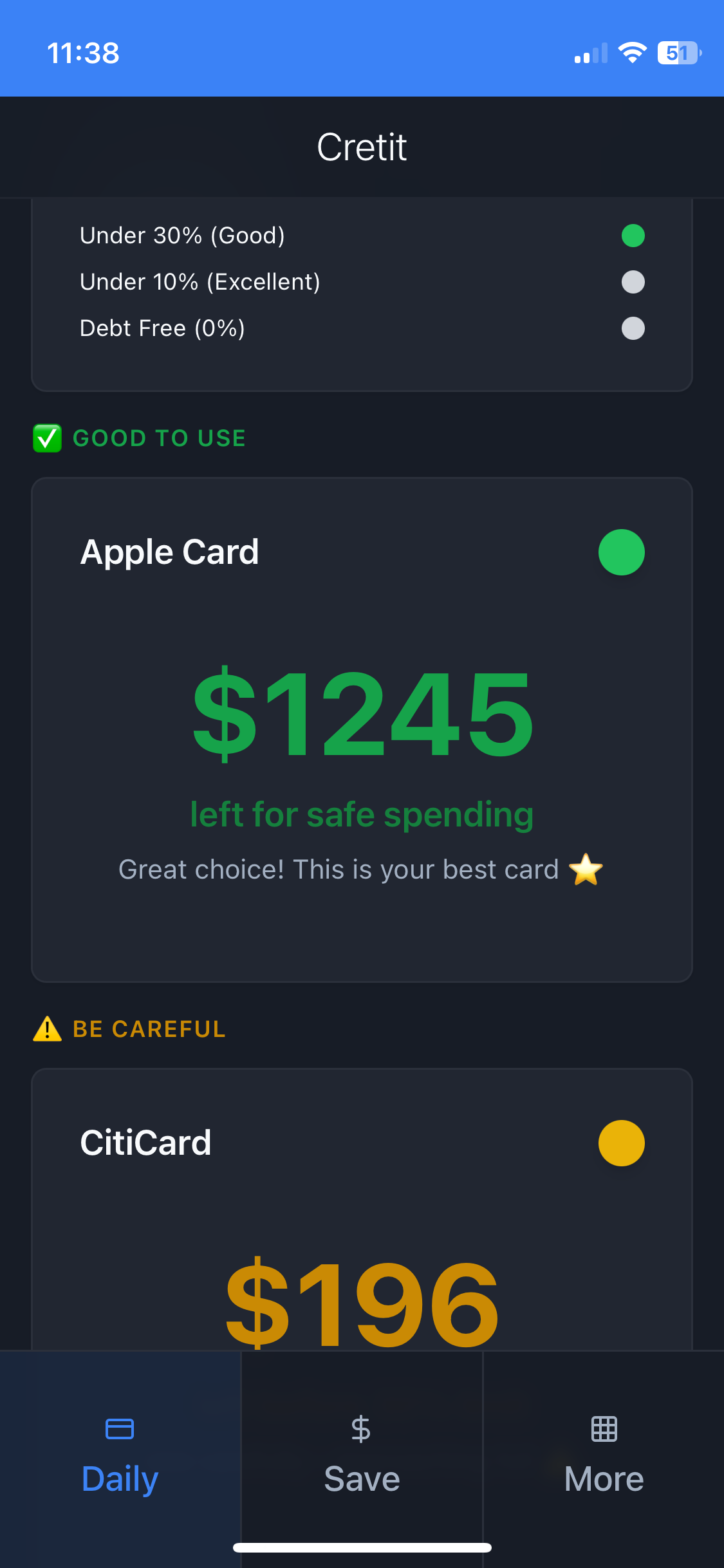

Daily Credit Card Traffic Lights

Get instant green/yellow/red to protect your credit score.

1

Problem

Users struggle to determine which credit card is safe to use daily to avoid high utilization rates that harm their credit scores, relying on manual tracking or monthly statements which lack real-time guidance.

Solution

A financial dashboard tool that provides traffic light recommendations (green/yellow/red) for each credit card, enabling users to monitor daily utilization and protect their credit scores through automated alerts.

Customers

Individuals with multiple credit cards, particularly those actively managing their credit scores or working to improve financial health.

Unique Features

Real-time traffic light system tailored to individual credit utilization thresholds, daily automated tracking, and instant alerts to prevent score drops.

User Comments

Simplifies credit management

Helps avoid credit score drops

Instant clarity on card usage

Visually intuitive interface

Reduces financial anxiety

Traction

Launched in 2023, featured on ProductHunt with 500+ upvotes, integrated with major credit bureaus for real-time data.

Market Size

The global credit scoring market is projected to reach $14.2 billion by 2027 (Statista, 2023).