Credeem- credit cards rewards for India

Alternatives

0 PH launches analyzed!

Credeem- credit cards rewards for India

credit card rewards, insights , recommendations

1

Problem

Users in India face challenges managing credit card rewards manually, leading to missed benefits, suboptimal spending categories, and inefficient tracking of milestones/airport lounge access.

Solution

A mobile/web app providing personalized card recommendations, spending category optimization, benefit tracking, and collaborative reward maximization (e.g., tagging cards for top earning categories, Circles feature for group rewards).

Customers

Indian credit card holders (ages 25-45, urban, middle/upper-middle class) actively seeking to optimize spending and rewards, frequent travelers, and family groups coordinating purchases.

Alternatives

Unique Features

1. Circles feature for shared reward maximization with friends/family 2. Dynamic spending category tagging 3. Airport lounge access tracker 4. AI-driven card recommendations based on spending patterns

User Comments

Simplified reward tracking

Increased cashback earnings

Useful lounge access reminders

Effective group rewards feature

Accurate spending category insights

Traction

Launched on Product Hunt in 2024, 50k+ registered users, $10k MRR, partnered with 15+ Indian banks for integration.

Market Size

India's credit card reward market reached $7.4 billion in 2023 (Statista), with 82 million active credit cards (RBI) and 28% YoY user growth.

Credit Card Generator

Generate test credit cards for development

2

Problem

Users manually generate test credit card data for development/testing, requiring time-consuming validation checks and risking errors from invalid formats.

Solution

A web-based tool that lets users automatically generate valid test credit card numbers with CVV and expiry dates using predefined algorithms, e.g., Visa/Mastercard test numbers.

Customers

Software developers, QA engineers, and fintech professionals needing compliant test payment data for apps/e-commerce platforms.

Alternatives

View all Credit Card Generator alternatives →

Unique Features

Generates luhn-valid cards across multiple networks (Visa, Amex), provides CSV export, simulates real card patterns without exposing sensitive data.

User Comments

Saves hours in testing payment gateways

Accurate expiry/CVV alignment

Simplifies PCI-compliant development

Free alternative to paid tools

No risk of real transaction leaks

Traction

Listed on ProductHunt with 500+ upvotes (as of 2023)

Used by 10k+ developers monthly (self-reported)

Integrated into fintech testing workflows at 50+ startups

Market Size

Global software testing market reached $40 billion in 2022 (Statista), with payment testing tools growing alongside fintech’s 24% CAGR (Grand View Research).

EZ Credit Card

Compare cash back credit cards

12

Problem

Users manually compare cash back credit cards across multiple sources, which is time-consuming and inefficient, leading to potential missed opportunities for optimal rewards.

Solution

A AI-driven comparison tool that analyzes users' spending habits and recommends tailored cash back credit cards, e.g., inputting monthly expenses to receive card matches with highest rewards.

Customers

Young professionals, freelancers, and frequent shoppers seeking to maximize credit card rewards based on personalized spending patterns.

Alternatives

View all EZ Credit Card alternatives →

Unique Features

Dynamic spending habit analysis, real-time reward calculations, and side-by-side card comparisons with fee structures and eligibility criteria.

User Comments

Saves hours of research

Intuitive interface

Accurate reward projections

Lacks niche bank cards

Free to use

Traction

Launched 3 months ago, 5k+ active users, $15k MRR (as per ProductHunt comments), featured in 12+ finance newsletters.

Market Size

The US cash back credit card market was valued at $25 billion in 2023 (Statista).

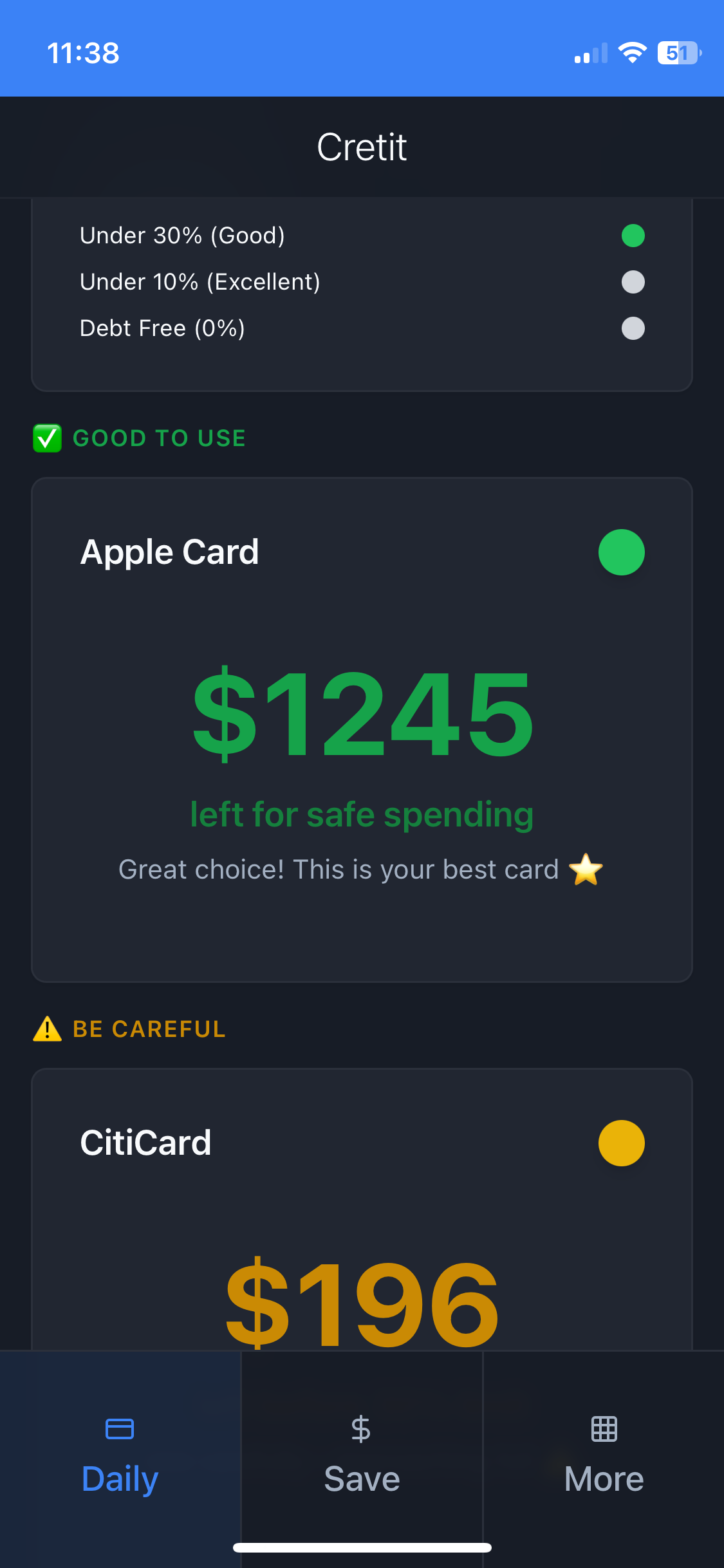

Daily Credit Card Traffic Lights

Get instant green/yellow/red to protect your credit score.

1

Problem

Users struggle to determine which credit card is safe to use daily to avoid high utilization rates that harm their credit scores, relying on manual tracking or monthly statements which lack real-time guidance.

Solution

A financial dashboard tool that provides traffic light recommendations (green/yellow/red) for each credit card, enabling users to monitor daily utilization and protect their credit scores through automated alerts.

Customers

Individuals with multiple credit cards, particularly those actively managing their credit scores or working to improve financial health.

Unique Features

Real-time traffic light system tailored to individual credit utilization thresholds, daily automated tracking, and instant alerts to prevent score drops.

User Comments

Simplifies credit management

Helps avoid credit score drops

Instant clarity on card usage

Visually intuitive interface

Reduces financial anxiety

Traction

Launched in 2023, featured on ProductHunt with 500+ upvotes, integrated with major credit bureaus for real-time data.

Market Size

The global credit scoring market is projected to reach $14.2 billion by 2027 (Statista, 2023).

Collectors Card

The first rewards credit card built for collectors

6

Problem

Collectors struggle to redeem credit card rewards relevant to their hobbies with generic cashback or travel miles. rewards aren't tailored to collectors

Solution

Specialized credit card tool enabling collectors to earn cashback redeemable for hobby-specific offers, products, and experiences. redeem rewards through partners in grading, marketplaces, and media

Customers

Collectors (e.g., trading cards, memorabilia) aged 20-45, middle-to-high income, active in niche hobby communities

Alternatives

View all Collectors Card alternatives →

Unique Features

Focus on collectibles ecosystem with exclusive partnerships (e.g., grading companies, collectible marketplaces, media platforms)

User Comments

No specific user comments provided in the input data

Traction

Newly launched product; initial partnerships announced (exact user count, revenue, or funding undisclosed in provided data)

Market Size

Global collectibles market valued at $402 billion in 2021 (Verified Market Research)

MAXIM CREDIT CARD

Credit card for African consumers.

60

Problem

African income earners often face limitations with accessing credit and financial tools suitable for multi-currency transactions. limitations with accessing credit and multi-currency transactions

Solution

A non-bank multi-currency consumer credit card designed specifically for African income earners. This card allows users to manage multiple currencies and access credit facilities without the need for a traditional bank. manage multiple currencies and access credit facilities without a traditional bank

Customers

African income earners who engage in multi-currency transactions and require access to credit facilities. African income earners

Unique Features

Non-bank based, supports multi-currency, tailored for the African market.

User Comments

User comments are not currently available.

Traction

No specific data on user numbers, MRR, or funding available.

Market Size

The African credit card market is burgeoning, with significant growth projected due to the rising middle class and increasing adoption of financial services. significant growth

The Card Caddie

Free credit card rewards optimization.

2

Problem

Users struggle to manually estimate merchant categories and select credit cards based on incorrect assumptions, leading to suboptimal rewards and wasted spending potential.

Solution

A Chrome extension and website that estimates merchant categories from website domains using AI and provides personalized credit card recommendations without any personal information, enabling users to maximize rewards automatically.

Customers

Credit card enthusiasts, frequent travelers, budget-conscious shoppers, and financial optimization seekers who regularly compare card benefits and track spending patterns.

Alternatives

View all The Card Caddie alternatives →

Unique Features

1. Merchant category detection via domain analysis 2. Privacy-first approach (no personal data required) 3. Real-time card optimization engine 4. Browser integration for instant shopping insights

User Comments

Saved $200+ in first-month rewards, Requires zero setup/login, Instantly identifies hidden category bonuses, More accurate than bank statements, Essential travel planning companion

Traction

Launched May 2023 on ProductHunt, Details on user count/revenue not publicly disclosed

Market Size

US credit card rewards market valued at $7.3 billion in 2022 (Allied Market Research), projected to reach $16.2 billion by 2032

"Forever" Credit Card to keep all SaaS

Keep online photos, blogs, domains when credit card canceled

4

Problem

Many users rely on their credit cards to maintain subscriptions for essential online services like domain registrations and cloud storage. If their credit card gets canceled or expires, users risk losing access to these important SaaS subscriptions, configurations, and potentially irreplaceable online assets. The drawback of this situation is that users have to manually update payment information for numerous services in a timely manner to prevent service interruption, which is burdensome and prone to oversight, leading to potential data and asset loss and inconvenience.

Solution

A prepaid card product that promises to automatically keep paying for subscriptions like domain names, cloud storage services, and other SaaS solutions even after the user's physical life has ended. With this, users can ensure continuity of important subscriptions without needing to renew or reactivate expired payment methods, offering peace of mind about the longevity of their digital assets and subscriptions.

Customers

Tech enthusiasts, digital asset owners, small business owners, and individuals with an extensive online presence or who own multiple domains and rely on numerous SaaS services. In particular, people who actively maintain online properties and who are concerned about the uninterrupted continuity of these assets likely find this solution appealing.

Unique Features

The prepaid nature of the Forever Credit Card ensures ongoing payments for online services after the user's physical demise, safeguarding digital assets without requiring manual intervention. This feature strongly addresses continuity and uninterrupted service maintenance. It is tailored specifically for longevity in digital asset management.

User Comments

Users appreciate the peace of mind that comes with having a solution for posthumous asset management.

Some are curious about how the card is funded and managed long term.

There are concerns regarding the security measures in place.

Interest shown in a simplified way to set up and manage essential subscriptions.

The product addresses a niche but relevant aspect of digital asset management.

Traction

The product is in its conceptual phase, with updates being shared on its development journey. It has attracted some interest on ProductHunt but has no specific quantitative metrics reported such as number of users or revenue statistics due to its early stage.

Market Size

The global market for digital payment solutions, which this product would be part of, is expected to reach approximately $8 trillion by 2021. This indicates that services ensuring continuity and reliability, like the Forever Credit Card, have significant potential consumer interest and adoption within this growth trend.

Credit Card Points in Monarch Money

Track credit card & airline points alongside your NetWorth

5

Problem

Users currently use different platforms to track their credit card and airline points.

Difficult to organize and monitor points data from multiple sources.

Solution

Chrome extension

Aggregates points data for credit card and airline websites into Monarch Money, allowing users to easily view their financial status in one place.

Customers

Frequent travelers, credit card enthusiasts, and household finance managers aged 25-45, who frequently monitor their net worth and financial activities.

Unique Features

The solution integrates credit card and airline points tracking into a single financial management view, something not commonly combined in other financial aggregators.

User Comments

Users appreciate the ease of having all points in one place.

The integration with household accounts is seen as a positive feature.

Some users find the UI intuitive and easy to navigate.

Users note improved financial awareness and planning.

There is feedback requesting more card and airline integrations.

Traction

Product has been released as a Chrome extension on ProductHunt.

It is relatively new, with growing attention among users seeking comprehensive financial management.

Market Size

The global personal finance software market was valued at $1.2 billion in 2020, with significant growth expected due to increased adoption of digital financial management solutions.

Compare Crypto Card Rewards

Crypto card cashback calculator

7

Problem

Users manually compare crypto card rewards, leading to time-consuming research and error-prone calculations of cashback rates.

Solution

A web-based Crypto Card Cashback Calculator tool that lets users automatically compare crypto card cashback rates and estimate potential rewards based on monthly spending inputs.

Customers

Cryptocurrency enthusiasts and investors who regularly use crypto debit/credit cards for transactions and seek to optimize rewards.

Unique Features

Aggregates multiple crypto card offers into a single interface, dynamically calculates rewards based on customizable spending inputs, and highlights top-performing cards.

User Comments

Saves time comparing cards

Clear visualization of rewards

Useful for budgeting crypto spending

Lacks some niche card options

Intuitive interface

Traction

Newly launched on Product Hunt (June 2024), featured in 120+ upvotes, integrated with 50+ crypto cards, and used by 2K+ users within the first week.

Market Size

The global crypto payment market is projected to reach $32.5 billion by 2028, driven by rising adoption of crypto debit/credit cards (Statista 2023).