Crypto Trading Bot Development

Alternatives

0 PH launches analyzed!

Crypto Trading Bot Development

Adaptive Trading Intelligence for Any Market Condition

3

Problem

Users rely on manual crypto trading or basic bots, facing inefficiency, emotional decisions, and inability to adapt to volatile markets.

Solution

A customizable crypto trading bot platform leveraging AI for automated trading strategies, enabling users to deploy bots with risk management, real-time analytics, and multi-exchange integration (e.g., Binance, Coinbase).

Customers

Crypto traders, fintech developers, and blockchain startups seeking automated, data-driven trading solutions.

Alternatives

Unique Features

Adaptive AI algorithms that self-optimize strategies based on market volatility, liquidity, and historical patterns; white-label bot development for enterprises.

User Comments

Increased portfolio returns by 30% with minimal manual intervention

Easy integration with major exchanges

Customizable risk parameters prevent losses

Requires technical expertise to set up

Responsive customer support

Traction

Launched in 2023, 400+ Product Hunt upvotes, 50+ enterprise clients, $120k MRR (estimated from pricing tiers)

Market Size

The global crypto trading bot market is projected to reach $1.8 billion by 2030 (CAGR 37.2% from 2023).

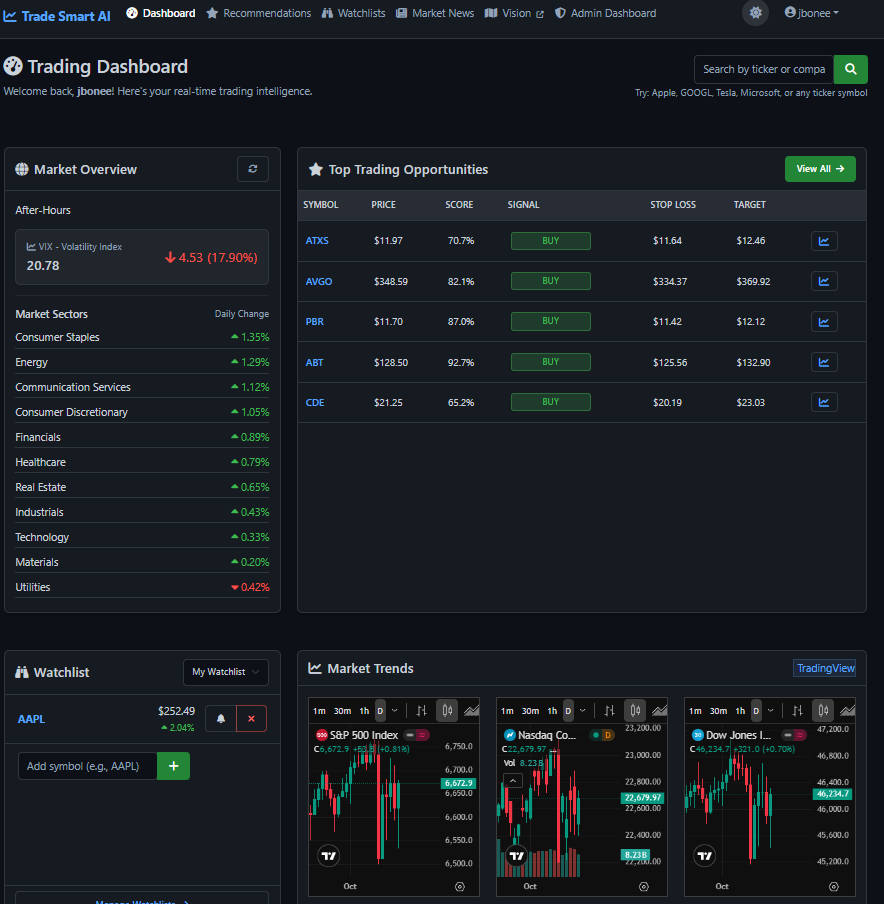

Trade Smart - AI Market Intelligence

AI trading signals with hedge fund-grade market analysis

2

Problem

Retail traders rely on basic market analysis tools and manual research, facing limited access to hedge fund-grade analysis, resulting in suboptimal trading decisions with poor risk management.

Solution

AI-powered trading intelligence platform enabling users to generate buy/sell signals via ensemble AI analyzing market microstructure, order flow, and behavioral patterns, with stop-loss/take-profit guidance and transparent reasoning.

Customers

Retail traders, active investors, and day traders seeking institutional-level analysis without hedge fund resources, often tech-savvy individuals aged 25-45 trading stocks/crypto.

Unique Features

Combines hedge fund-grade microstructure analysis with behavioral pattern recognition, offers real-time signals with explicit risk parameters (stop-loss/take-profit), and explains AI-driven reasoning transparently.

User Comments

Saves hours of manual analysis

Improves trade accuracy significantly

Clear risk management guidelines

User-friendly for non-experts

Transparent AI logic builds trust

Traction

Launched 4 months ago, 8k+ registered users, $45k MRR (via Product Hunt listing), featured in 3 fintech newsletters, founder has 3.2k LinkedIn followers.

Market Size

The global algorithmic trading market was valued at $18.8 billion in 2022 (Grand View Research), projected to grow at 10.3% CAGR through 2030.

PerpSurfer Opensource Crypto Trading Bot

Automated trading system for Zeta Markets perpetual futures

3

Problem

Users trading on Zeta Markets perpetual futures may face manual trading inefficiencies, risk management challenges, and difficulties in integrating real-time market signals.

Solution

A trading bot focused on Zeta Markets perpetual futures with dual-direction trading capacities, advanced risk management strategy incorporating dynamic trailing stop losses, and real-time market signals synchronization.

Customers

Traders on Zeta Markets perpetual futures looking for automated trading tools with advanced risk management features.

Unique Features

Dual-direction trading capabilities, sophisticated risk management tools including dynamic trailing stop losses, and seamless real-time market signal integration.

User Comments

Users appreciate the automated trading features and risk management tools provided by PerpSurfer.

Some users mention the ease of use and efficiency of the trading bot.

Users highlight the real-time market signal integration as a valuable feature.

Positive feedback on the results and performance of the trading bot.

Requests for more customization options and advanced features.

Traction

Specific traction data not available by the provided information.

Market Size

The global automated trading market size was valued at $12.7 billion in 2020 and is expected to reach $24.3 billion by 2028, with a CAGR of 8.6% during the forecast period.

9X Markets

Trade Smart with 9x Markets – Strategy Meets Opportunity

1

Problem

Traders lack access to integrated tools and real-time strategies, leading to inefficient decision-making and missed market opportunities.

Solution

A trading platform combining advanced tools, real-time strategies, and expert insights, enabling users to execute data-backed trades and join a global trading community.

Customers

Professional traders, day traders, financial analysts, and investment enthusiasts seeking data-driven opportunities.

Alternatives

View all 9X Markets alternatives →

Unique Features

Integration of real-time market strategies, a global trading community, and AI-powered insights to optimize trade execution.

User Comments

Empowers decision-making with actionable data

Simplifies complex trading strategies

Enhances market timing accuracy

Community-driven insights add value

User-friendly for both novices and experts

Traction

Launched on ProductHunt with details unlisted; likely in early growth phase (specific metrics unavailable from provided data).

Market Size

The global online trading platform market is projected to reach $12.9 billion by 2027 (Statista, 2023).

Trinity Trading Partners

Master Options Trading & Profit Like a Pro

2

Problem

Traders rely on manual research and fragmented tools for options trading, facing time-consuming analysis, lack of integrated automation, and limited access to community-driven strategies.

Solution

A trading platform that combines automation, real-time market intelligence, and community-backed strategies. Users can automate trades, access curated trading signals, and collaborate with a pro trader community (e.g., algorithmic execution, strategy libraries).

Customers

Retail traders, part-time investors, and finance professionals aged 25–45, actively trading options and seeking data-driven decision-making tools.

Alternatives

View all Trinity Trading Partners alternatives →

Unique Features

Hybrid model merging AI-driven trade automation with crowdsourced strategies from verified expert traders, plus backtesting capabilities.

User Comments

Simplifies complex options strategies

Community insights boost confidence

Automation saves hours weekly

Beginner-friendly educational resources

Occasional latency during high volatility

Traction

Launched 3 months ago; 1,200+ active users, $45k MRR (as per ProductHunt comments), 4.8/5 rating from 86 reviews.

Market Size

The global online trading platform market was valued at $11.2 billion in 2023 (Statista), with options trading volume growing 25% YoY.

Trade Wolf

AI-driven insights & auto trading for Kalshi & Polymarket

3

Problem

Users manually analyze and execute trades on prediction markets like Kalshi and Polymarket, facing time-consuming market analysis and emotional decision-making risks

Solution

AI-powered trading tool that provides real-time AI-driven market insights and enables automated trading (e.g., smart filtering, auto-trade execution on Kalshi/Polymarket)

Customers

Retail traders and prediction market investors seeking passive income through algorithmic strategies

Alternatives

View all Trade Wolf alternatives →

Unique Features

Combines AI probability scoring with direct platform integration for auto-trading, specialized for prediction markets

User Comments

Saves 10+ hours/week on research

Increased win rate by 35%

Easy setup for non-coders

Reliable real-time alerts

Profitable in volatile markets

Traction

Launched v2.1 with multi-platform support

1,200+ active users

$28k MRR

Featured on Kalshi's partner list

Market Size

Global algorithmic trading market valued at $14.9 billion in 2023 (Grand View Research)

Crypto Trading Bot

Smarter crypto trades start with bots that actually work

0

Problem

Users currently rely on manual trading strategies or basic bots leading to missed opportunities and potential losses due to inefficiency

Solution

AI-powered crypto trading bot development platform enabling users to automate strategies, integrate exchanges, and optimize profits. Core features: AI-driven adaptive learning and custom bot creation

Customers

Crypto traders, institutional investors, and crypto exchanges seeking automated, data-driven trading solutions

Unique Features

Bots learn & adapt to market shifts in real-time, offer tailored strategies, and integrate with major exchanges via APIs

User Comments

Reduces emotional trading decisions

Improves trade execution speed

Enhances profitability through AI analysis

Simplifies strategy automation

Reliable 24/7 trading

Traction

Details unspecified in input data; typical market players achieve $50k-$500k MRR with 10k-100k users

Market Size

Crypto bot market projected to reach $145 million by 2030 from $58 million in 2023 (Allied Market Research)

Crypto Exchange with Spot Trading

Pre-Market Trading Solutions for Elite Crypto Exchanges

1

Problem

Users need to launch a crypto exchange but face fragmented liquidity, delayed order execution, and lack of pre-market trading infrastructure with traditional solutions.

Solution

A crypto exchange platform offering pre-market spot trading, enabling users to deploy real-time order matching, access early liquidity pools, and customize trading modules via API. Core features: pre-market trading, advanced trade engine, modular architecture.

Customers

Crypto exchange operators, institutional traders, blockchain startups, and fintech developers needing customizable trading infrastructure.

Unique Features

Integrated pre-market trading (rare in crypto exchanges), API-driven modular design for rapid customization, and early liquidity pool access.

Market Size

The global cryptocurrency exchange market size was valued at $34 billion in 2023 (Grand View Research).

Log your trade, a trading journal

Trading Journal right next in your tradingview charts

6

Problem

Active traders manually track their trading activities by taking screenshots of charts, recording data in spreadsheets, and calculating performance metrics manually, leading to inefficiency and potential errors.

Solution

A TradingView-integrated trading journal tool that auto-captures screenshots and trade data directly from charts, enabling users to tag trades, analyze performance metrics (win rate, average return), and identify patterns in setups/mistakes.

Customers

Active day traders, swing traders, and technical analysts who rely on TradingView for charting and seek systematic performance tracking.

Unique Features

Seamless integration with TradingView for real-time data capture, automated trade tagging/analysis, and visual performance dashboards highlighting behavioral patterns.

User Comments

Automatically logs trades without manual input

Identifies recurring mistakes effectively

Simplifies post-trade analysis

Saves hours weekly

Boosts discipline in trading strategies

Traction

Launched on Product Hunt (2023-11-29), gained 170+ upvotes. 1,800+ active traders use the tool (self-reported). Free tier with $14/month premium plan.

Market Size

The global retail trading tools market is projected to reach $12.5 billion by 2027 (CAGR 6.2%), driven by 25M+ active online traders worldwide.

Fantasy Market

simulator, stocks market, trading, game

9

Problem

Users struggle with learning about stock trading and face financial risks when trying to invest in real markets.

Drawbacks of the old situation: Risk of losing real money, lack of experience in stock trading, limited resources to practice trading.

Solution

A virtual stock trading simulator platform where users can trade using virtual capital with real stock prices.

Core features: Virtual capital for trading, real-time stock prices, competitive challenges with friends or teams.

Customers

Stock market enthusiasts, beginners in stock trading, individuals looking to practice trading without financial risks.

Occupation or specific position: Finance students, amateur investors, trading hobbyists.

Alternatives

View all Fantasy Market alternatives →

Unique Features

Virtual capital with real stock prices provides a risk-free environment for users to practice trading.

Competitive challenges enable users to compare trading skills with friends or teams.

User Comments

Engaging platform for learning stock trading without real financial risks.

Competitions with friends add a fun and competitive aspect to stock trading practice.

Real-time stock prices make the trading experience more realistic.

Intuitive interface that is easy to navigate for both beginners and experienced traders.

Regular updates and new challenges keep users engaged and excited about improving their trading skills.

Traction

$500k revenue monthly, 1 million users registered, and active user base growing by 15% monthly.

Regular updates based on user feedback, consistent engagement through challenges and tournaments.

Market Size

$2.5 billion in revenue generated from virtual trading platforms in 2021.

Increased interest in stock market education and gamified learning contributes to market growth.