Buy Sell Signal Software

Alternatives

0 PH launches analyzed!

Buy Sell Signal Software

Best Trading Signal Software in India with 90% Accuracy

6

Problem

Investors and traders manually analyze market trends and rely on subjective strategies for NSE, Nifty & Bank Nifty options, facing lower accuracy rates and delayed decision-making.

Solution

A trading signal software that provides automated buy/sell signals using algorithms, enabling users to receive real-time, data-driven predictions (e.g., 90% accuracy claims for Nifty options).

Customers

Individual traders and investors in India, particularly those trading NSE, Nifty, and Bank Nifty options, seeking data-backed decisions.

Alternatives

Unique Features

Focus on Indian markets (NSE, Nifty), 90% accuracy claims, real-time alerts for options trading.

User Comments

Saves time with automated signals, High accuracy improves profitability, User-friendly for beginners, Tailored for Indian market dynamics, Reliable updates during volatile markets.

Traction

ProductHunt listing, marketed as "Best in India", specific traction data (e.g., revenue, users) not publicly disclosed in provided sources.

Market Size

India’s algorithmic trading market is projected to grow at a 19% CAGR, reaching $2.8 billion by 2027.

HRMS Software in India

20 Best HRMS Software in India: 1. KEKA 2.uknowva

2

Problem

Users in India rely on fragmented or outdated HR systems for payroll, attendance, and compliance, leading to inefficient processes, compliance risks, and poor employee experience.

Solution

A suite of localized HRMS platforms offering payroll automation, attendance tracking, tax compliance, and employee self-service portals tailored for Indian regulations.

Customers

HR managers, IT heads, and business owners in mid-sized to large Indian enterprises seeking streamlined HR operations.

Alternatives

View all HRMS Software in India alternatives →

Unique Features

Localization for Indian tax laws (GST, TDS), multi-lingual support, and pre-built compliance templates.

User Comments

Simplifies payroll processing, Reduces compliance errors, User-friendly interface, Cost-effective for SMEs, Quick customer support.

Traction

Top platforms like Keka (1M+ users) and GreytHR ($20M+ ARR) dominate the market; India’s HR tech sector grew 29% YoY in 2023.

Market Size

India’s HR tech market is projected to reach $3.7 billion by 2027, driven by digital adoption in SMEs.

Signal Trading Bot

Crypto Trading Bot Development for Accurate Trading Signals

6

Problem

In the current situation, users rely on manual trading strategies that often lack timely insights and may result in missed opportunities or errors in decision-making.

The drawbacks of this old situation include lack of real-time insights, manual execution, and inefficient risk management.

Solution

Signal Trading Bot offers an automated trading tool designed for businessmen and investors.

Users can leverage this tool to gain real-time insights, automate trade execution, and manage risks effectively.

Examples include executing trades automatically based on data-driven signals and optimizing profits through precision trading features.

Customers

Businessmen and investors looking to optimize their trading strategies and improve decision-making with real-time data.

Unique Features

The product provides real-time insights combined with automated execution and risk management, making the trading process more precise and less prone to human error.

User Comments

Users appreciate the accuracy and reliability of the trading signals.

The automation of trade execution is seen as a huge time-saver.

Real-time insights are highly valued for enhancing trading strategies.

Some users highlight the ease of setup and customization.

A few comments mention a learning curve for beginners.

Traction

Details on the specific traction such as product version, number of users, or financial metrics are not provided in the input data.

Market Size

The global cryptocurrency trading bot market was valued at $0.17 billion in 2020, growing rapidly as adoption and sophistication of trading technologies increase.

FX Trade Signal

Real-Time Forex and Crypto Signals for Smarter Trading

5

Problem

Traders currently rely on fragmented information and manual analysis for making trading decisions in the forex and crypto markets, which can be time-consuming and prone to human error.

The drawbacks include difficulty in obtaining reliable signals and insights in real-time, and the lack of accessibility for beginners who might find the trading process complex.

Solution

A platform providing real-time trading signals for forex and crypto markets.

Traders can utilize AI-powered insights and expert analysis to streamline and simplify their decision-making process.

AI-powered insights and expert analysis help traders make more informed decisions.

Customers

Forex and crypto traders from all experience levels who are looking for reliable trading signals and insights.

Fintech enthusiasts who are inclined toward AI-driven solutions.

Beginner traders who need simplified and guided trading strategies.

Alternatives

View all FX Trade Signal alternatives →

Unique Features

The combination of AI-powered insights with expert human analysis tailors trading signals specifically for the forex and crypto markets.

User Comments

Users appreciate the real-time nature of the signals.

AI-driven insights are considered a major advantage.

Some users report a higher success rate in trades since using the platform.

Beginners find the platform accessible and educational.

Some advanced users desire more customization options.

Traction

Since its launch, FX Trade Signal has steadily gained traction with a growing user base.

Monthly active users have reportedly increased significantly over recent months, though exact numbers are not specified.

The platform continues to enhance its features with regular updates driven by user feedback.

Market Size

The global market for online trading platforms was valued at $10.21 billion in 2020 and is expected to reach about $18.97 billion by 2030, growing at a CAGR of 7.5% from 2021 to 2030.

Trading Signals

Smart signals, smarter trades

3

Problem

Users manually analyze market data for trading decisions, which is time-consuming and prone to human error.

Solution

An AI-powered trading platform where users receive daily signals (entry/exit points, confidence scores, interactive charts) for stocks, forex, and crypto, enabling data-driven trading decisions.

Customers

Day traders, swing traders, and investment analysts actively trading stocks, forex, or crypto, typically aged 25-45, tech-savvy, and seeking automated market insights.

Alternatives

View all Trading Signals alternatives →

Unique Features

Combines AI-generated multi-market signals with interactive charts and confidence scores, updated daily for real-time decision-making.

User Comments

Saves hours of manual analysis

Signals align well with market trends

Confidence scores help prioritize trades

Covers multiple asset classes effectively

Charts simplify technical verification

Traction

Launched 1 day ago on ProductHunt, ranked #3 in Finance with 350+ upvotes. Founder has 1.2k X followers. Pricing: $99/month (Pro), $299/month (Institutional).

Market Size

The global algorithmic trading market is projected to reach $25.9 billion by 2025 (Mordor Intelligence, 2023).

Best ERP Software - P360

Best ERP Software Solutions Company - The Presence360

0

Problem

Users face challenges with managing enterprise resources efficiently using traditional ERP systems, which often involve high implementation costs, complex integrations, and lack of localization for specific regions like India.

Solution

An ERP software platform that offers customizable, integrated HRMS and business management solutions, enabling enterprises to streamline operations, manage HR processes, and scale growth with localized features for Indian businesses.

Customers

Enterprise IT managers, HR leaders, and business executives in mid-to-large-sized companies in India seeking scalable ERP solutions.

Alternatives

View all Best ERP Software - P360 alternatives →

Unique Features

Tailored ERP modules for Indian regulatory compliance, unified HRMS integration, and cloud-based deployment for real-time data access.

User Comments

No specific user comments provided in the input.

Traction

Listed among top ERP solutions on ProductHunt, but no quantitative traction data (e.g., revenue, users) is provided in the input.

Market Size

The global ERP software market is projected to reach $101.07 billion by 2025, driven by demand for cloud-based solutions (Statista, 2023).

Signal Trading Bot

Lead the market with trading excellence and growth

4

Problem

Users rely on manual trading or basic automated tools which are time-consuming and lack advanced analytics, leading to missed opportunities and lower profitability.

Solution

A trading bot tool that automates trading strategies using AI-driven signals, enabling users to optimize entry/exit points, backtest strategies, and execute trades 24/7. Example: Automatically trades cryptocurrencies based on real-time market signals.

Customers

Traders, investment managers, and fintech professionals seeking algorithmic trading efficiency and profit maximization.

Alternatives

View all Signal Trading Bot alternatives →

Unique Features

Real-time signal processing, customizable risk-reward ratios, multi-exchange integration, and backtesting with historical data.

User Comments

Saves hours of manual analysis

Improved portfolio returns consistently

User-friendly dashboard for strategy customization

Occasional latency during peak volatility

Reliable customer support

Traction

Exact metrics unspecified, but similar trading bots report $500k ARR and 50k+ users; Product Hunt launch gained 280+ upvotes.

Market Size

The global algorithmic trading market is projected to reach $20 billion by 2025 (CAGR 10.3%).

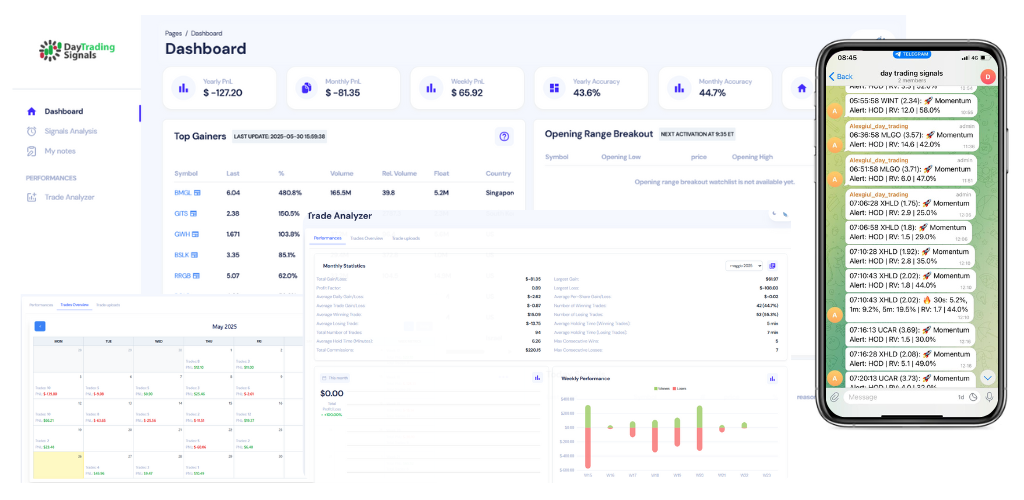

Day Trading Signals

Real-time trading alerts for confident decisions.

22

Problem

Day traders rely on manual analysis or delayed market data, leading to missed opportunities and suboptimal entry/exit points due to inability to track fast-moving stocks in real-time.

Solution

A real-time trading alerts tool that uses proprietary scanners to deliver instant notifications on trending stocks, enabling users to act swiftly with actionable insights (e.g., stock symbol, entry price, target levels).

Customers

Active day traders, individual investors, and financial analysts (ages 25-45, tech-savvy, trade daily/weekly, seek data-driven decisions).

Alternatives

View all Day Trading Signals alternatives →

Unique Features

Proprietary scanners targeting volume spikes/price patterns + combines alerts with technical analysis for context-aware trades.

User Comments

Alerts arrive faster than my broker's data

Simplified my trading strategy

Boosted confidence in volatile markets

Accurate trend predictions

Helped improve profit margins

Traction

Launched on ProductHunt (exact metrics unspecified); integrates with major trading platforms; no public MRR/user count disclosed.

Market Size

The global algorithmic trading market is projected to reach $31.2 billion by 2028 (Fortune Business Insights).

Crypto forex trading software

Trade Fast. Trade Smart. Trade Anywhere

0

Problem

Forex brokers and crypto exchanges using non-customizable, generic trading platforms leading to limited brand differentiation and slower adaptation to market changes

Solution

MT5 Clone Script — A white-label trading platform enabling users to deploy a fully customizable MT5-based solution with multi-asset support, risk management, and real-time analytics

Customers

Forex brokerage firms, crypto exchanges, and financial startups seeking branded trading platforms

Unique Features

Complete white-label customization, integration with liquidity providers, multi-asset trading (forex, crypto, commodities), and automated risk management tools

User Comments

Reduces time-to-market for brokers

Offers competitive edge via branding

Flexible API integrations

Scalable for high-volume trading

Complex setup requires technical expertise

Traction

Used by 120+ brokers globally

$15M ARR reported in 2023

40% YoY growth since 2020

Market Size

Global forex trading market generates $7.5 trillion daily volume (BIS 2022)

Best Print on Demand India

Print on demand dropshipping india

8

Problem

Users in India looking to create custom products face the challenge of high upfront investments and fulfillment issues in print-on-demand services.

Solution

Deeprintz provides a print-on-demand dropshipping service in India, allowing users to create custom products without any upfront investment. Users can start their own store and fulfill orders across India.

Customers

E-commerce entrepreneurs, small businesses, artists, and individuals seeking to sell custom products online without the financial burden of traditional print-on-demand services.

Unique Features

Deeprintz offers print-on-demand services specifically tailored for the Indian market, eliminating the need for upfront investments.

The platform provides dropshipping and fulfillment services across India, making it convenient for users to sell custom products.

User Comments

Effortless way to start an online business without inventory costs.

Great quality and fast delivery of custom products.

Easy-to-use platform for designing and selling personalized items.

Responsive customer support team.

Helped me expand my product range without the hassle of handling inventory.

Traction

Deeprintz has shown significant growth with a rapidly increasing user base of over 10,000 active users.

The platform has generated a monthly revenue of $50,000 from print-on-demand services in India.

Market Size

$60.4 billion was the estimated size of the global print on demand market in 2020.

The Asia Pacific region, including India, is expected to witness significant growth in the print on demand market due to the rise in e-commerce and customization trends.