Bill Split - Money Splitting App

Alternatives

121,440 PH launches analyzed!

Bill Split - Money Splitting App

Share Bills & Track Expenses

3

Problem

Users manually track and split expenses using spreadsheets or mental math, which is time-consuming, error-prone, and inconvenient for group coordination.

Solution

A mobile app that lets users split bills fairly, track shared expenses in real-time, and settle payments instantly. Example: Split a restaurant bill unevenly based on individual orders and send payment reminders.

Customers

Travelers, roommates, friends dining out, and event organizers who frequently share costs. Demographics: 18-40 age group, tech-savvy, urban dwellers.

Alternatives

Unique Features

One-click bill splitting with customizable ratios, multi-currency support, debt tracking, and integration with payment platforms for instant settlements.

User Comments

Simplifies group expenses during trips

No more awkward money conversations

Saves hours of manual calculations

Intuitive interface for non-tech users

Free with no hidden fees

Traction

1,000+ upvotes on Product Hunt, 50,000+ downloads, $15k MRR (estimated from in-app purchases and premium features).

Market Size

The global digital payment market, including expense-sharing apps, is projected to reach $9.5 trillion by 2027 (Statista, 2023).

Expense — Effortless Expense Tracking

Track, manage, and control your expenses — effortlessly.

3

Problem

Users manually track expenses via spreadsheets or basic apps, which is time-consuming, error-prone, and lacks real-time insights, leading to poor financial visibility and management inefficiencies.

Solution

A mobile/web-based expense tracking tool that automates categorization, syncs transactions across cash, mobile payments, and banks, and provides smart AI-driven insights, multi-currency support, and offline functionality.

Customers

Freelancers, small business owners, and frequent travelers needing streamlined expense management, plus individuals prioritizing budgeting and financial control.

Unique Features

Offline-first design, AI-powered auto-categorization, real-time multi-currency conversion, and instant spend analytics without bank integrations.

User Comments

Saves hours on manual entry

Intuitive interface for global expenses

Offline mode works flawlessly

AI categories are surprisingly accurate

Perfect for small business budgets

Traction

Launched 2 months ago with 2,500+ Product Hunt upvotes, $20k MRR, 50k+ active users, and featured on 10+ finance blogs. Founder has 2.3k LinkedIn followers.

Market Size

The global $5.8 billion expense management software market (Statista, 2023), growing at 12% CAGR due to SME digitization and remote work trends.

Bill Split

Share expenses simply with your friends in seconds

4

Problem

Individuals are currently using manual methods or generic apps for splitting bills which can be cumbersome and lead to inaccuracies.

Manual methods or generic apps for splitting bills

Solution

Easy bill splitting app for friends and roommates

App to track and share expenses among friends and roommates such as splitting rent, utilities, and shared purchases

Customers

Individuals who share living expenses like roommates, college students, young professionals

Unique Features

Simple and quick bill splitting process tailored specifically for friends and roommates

User Comments

Users appreciate its simplicity

Helpful in avoiding conflicts over shared expenses

Smooth user interface

Improved coordination among roommates

Many find it faster than typical splitting methods

Traction

Specific traction data not available; it's a newly introduced product on Product Hunt

Market Size

The market size for peer-to-peer payment apps, which includes bill splitting, was valued at approximately $1.93 billion in 2019, expected to grow significantly.

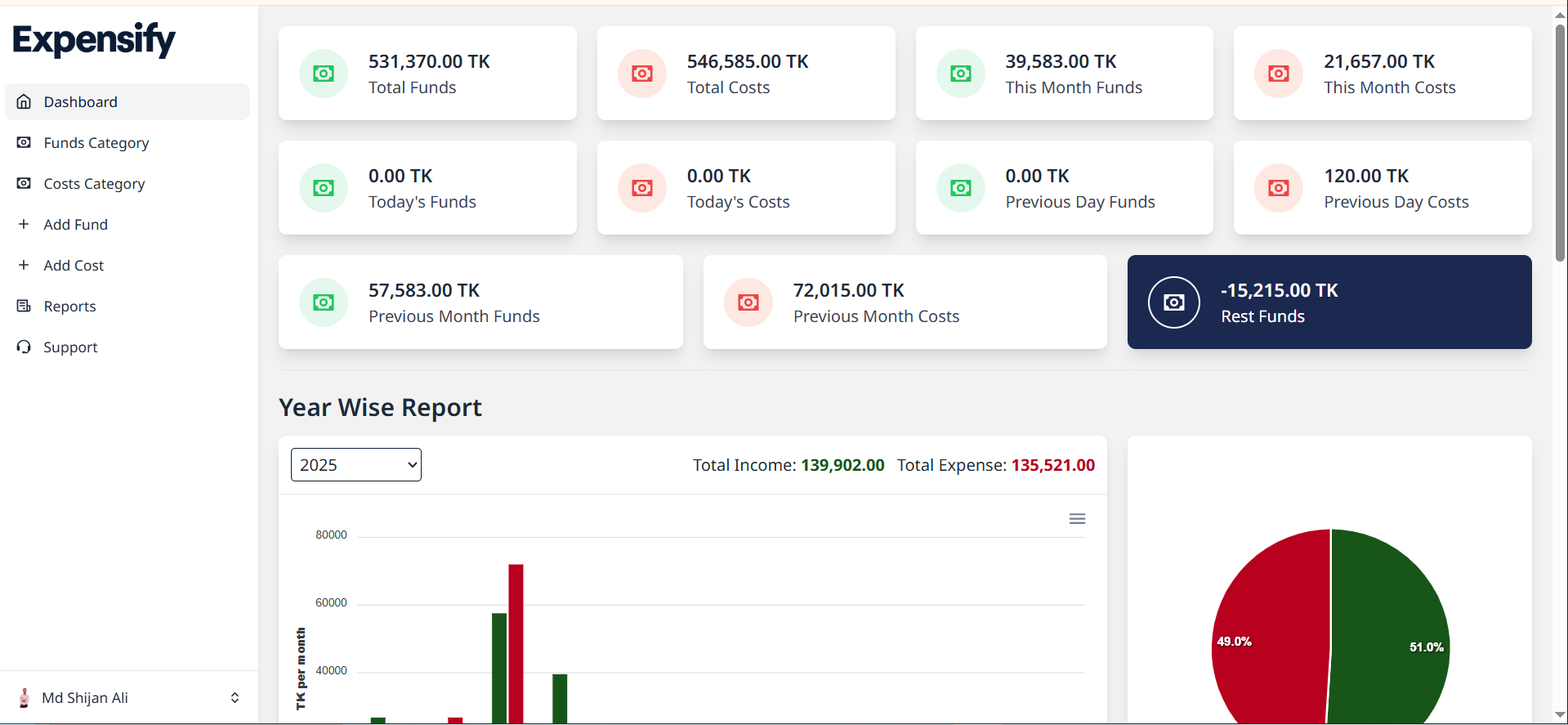

Expense Tracking Software

Track, Analyze, and Grow — Smarter Money Management.

1

Problem

Users manually track income and expenses using spreadsheets or basic tools, leading to time-consuming processes, error-prone calculations, and limited financial insights.

Solution

A web-based expense tracking tool that automates financial management. Users can track income/expenses, generate PDF reports, analyze monthly/yearly trends, and manage custom categories via a centralized dashboard.

Customers

Freelancers, small business owners, and individuals seeking streamlined financial tracking; users who need real-time analytics and report generation for budgeting or tax purposes.

Unique Features

Combines expense tracking with AI-driven analytics, PDF report generation, and multi-category management in a single interface, eliminating the need for separate spreadsheet/accounting tools.

User Comments

Simplifies tax preparation with auto-generated reports

Visual dashboards make spending patterns clear

Mobile-friendly for on-the-go updates

Custom categories adapt to unique budgets

Free tier attracts price-sensitive users

Traction

Launched on ProductHunt with 500+ upvotes (as of 2023), web.app domain suggests early-stage traction; no disclosed revenue/user metrics from provided data.

Market Size

Global expense management software market projected to reach $4.5 billion by 2027 (MarketsandMarkets), driven by 25%+ CAGR adoption among SMEs and self-employed professionals.

Finance:Budget Expense Tracker

Track expenses, budget, manage bills, and save money.

82

Problem

Users often struggle to efficiently track expenses, manage their budgets, handle bills, and overall safeguard their financial health. The drawbacks include poor savings, unorganized financial records, and missed bill payments.

Solution

A comprehensive finance management app that allows users to track expenses, manage budgets, monitor bills, and enhance their savings. It centralizes all financial matters in one platform.

Customers

Individuals keen on improving their personal finance, such as budget-conscious individuals, financially responsible adults, and those who need an organized method to monitor their financial status.

Unique Features

Combining expense tracking, budget management, bill monitoring, and savings enhancement - all in one application.

User Comments

Many find it user-friendly and effective in managing personal finances.

Users appreciate the ability to see all finances in one place.

Helps users stay on top of bills and avoid late payments.

Effective in budget planning and expense tracking.

Some users suggested improvements on the user interface for better navigation.

Traction

Launched on ProductHunt, currently gaining visibility and user feedback. User numbers and financial metrics haven't been disclosed yet.

Market Size

The global personal finance software market was valued at $1 billion in 2021

Cashinator - Split Group Expenses Easily

Who owes what? Easily track and split shared expenses.

3

Problem

Users manually track shared expenses via spreadsheets or basic apps, leading to confusion, errors, and inefficiency in settling group balances.

Solution

A mobile/web app enabling users to split group expenses, track costs, optimize payments, and settle balances automatically for trips, households, or friend groups.

Customers

Roommates, travelers, and friends managing shared costs; demographics include millennials/Gen Z, budget-conscious groups, and households splitting recurring bills.

Unique Features

Smart payment optimization to minimize transactions, real-time balance tracking, and automated reminders for settlements.

User Comments

Simplifies group expense splitting

Intuitive interface for quick tracking

Saves time during trips

Affordable alternative to pricier apps

Reduces payment disputes

Traction

Featured in press as a top alternative to Splitwise; exact user/MRR data unavailable but comparable apps like Splid report 500k+ users and $50k+ MRR.

Market Size

Global expense management software market was valued at $3.2 billion in 2023, with 8.5% CAGR projected through 2030 (Grand View Research).

Budget Ally

Simple Shared Expense Tracking

7

Problem

Users currently manage shared expenses through manual methods or simple spreadsheets.

Manually track shared expenses can lead to errors, confusion, and conflicts over payment balances.

Solution

A mobile app that offers simple shared expense tracking.

Users can create shared pockets for different activities such as trips, households, or any collaborative expenses.

Examples include couples tracking their household expenses together or friends managing costs during a trip.

Customers

Couples, families, and groups of friends.

Individuals who frequently share expenses or engage in group activities necessitating pooled budgeting.

Unique Features

Focused on simplicity and ease of sharing expense tracking among groups.

Specifically caters to versatile scenarios like trips, households, and other shared financial engagements.

User Comments

Users appreciate the simplicity and ease of use.

The app is effective for managing various types of shared expenses.

Many find it particularly useful for trips and couples managing joint finances.

Some users have mentioned that it alleviates the confusion of who owes what.

There's positive feedback on its effectiveness in promoting financial transparency among groups.

Traction

Recently launched.

Primary traction channels are Product Hunt and direct website visits.

No specific quantitative data on user base or revenue growth yet.

Market Size

The personal finance software market is projected to grow at a CAGR of 5.4% from 2021 to 2028.

Increased use of mobile apps for managing individual and shared expenses reflects this upward trend.

ExpenShare Expense Tracking Made Easy

Manage your Money Expenses, Track Costs, Stay Budget

5

Problem

Individuals and groups currently manage financial records using outdated methods like spreadsheets or manual bookkeeping, which are prone to errors

error-prone and time-consuming processes

Solution

An innovative expense tracker app

manage expenses and generate reports

Customers

Individuals and groups who prioritize managing their finances effectively, including budget-conscious individuals, family households, and small collaborative teams

Typically tech-savvy, aged 18-45, looking for easy-to-use digital solutions

Unique Features

Centralized expense management platform

Generates detailed financial reports

Based in Singapore, indicating a focus on providing solutions tailored to the local market

Market Size

The global expense management software market was valued at $2.3 billion in 2021, showcasing a growing demand for efficient financial management solutions

SplitVors - Bill Splitter App

Split Bills, Stress Free. Share Smarter with SplitVors

1

Problem

Users manually split bills and track group expenses, leading to cumbersome tracking of costs, inefficient settlements, and security risks with shared payments.

Solution

A mobile app where users can split bills, track group expenses, invite guests, and settle instantly using smart features and secure logins, e.g., splitting restaurant bills or shared trip costs.

Customers

Frequent travelers, roommates sharing living expenses, and friends managing group activities, aged 18-35, tech-savvy, and active in shared financial scenarios.

Unique Features

Combines expense splitting with secure instant payments, guest invitations, and granular cost-tracking in one platform.

User Comments

Simplifies group payments

No more manual calculations

Secure and quick settlements

Perfect for trips with friends

Reduces payment disputes

Traction

Launched on ProductHunt, exact traction data (users, revenue) unspecified from provided info.

Market Size

The global digital payment market, including bill-splitting apps, is projected to reach $19.89 trillion by 2026 (Statista, 2023).

Problem

Users manually track shared expenses using spreadsheets, notes, or manual splitting, which is time-consuming, error-prone, and lacks multi-currency support.

Solution

A mobile/web app that allows users to track shared expenses, split bills automatically, and handle multi-currency transactions. Example: Groups can input expenses, assign shares, and get instant splits with currency conversion.

Customers

Friends, roommates, travel groups, and professionals who regularly split costs, particularly millennials and Gen Z seeking digital solutions.

Unique Features

Multi-currency support and offline functionality, enabling seamless tracking without internet access or currency barriers.

User Comments

Simplifies group expense tracking

Multi-currency feature is a game-changer

Intuitive interface for quick splits

Offline mode useful during travel

Fair and transparent calculations

Traction

10K+ downloads, 4.8/5 rating on app stores, founder with 2K+ X followers

Market Size

The global expense management software market is valued at $1.2 billion in 2023 (Grand View Research).