agenz

Alternatives

0 PH launches analyzed!

Problem

Users in the real estate market in Morocco struggle with estimating property values, buying, renting, or selling houses efficiently

Solution

A website that offers property estimation, buying, renting, and selling services with the top real estate agency in Morocco

Customers

Real estate buyers, sellers, renters, and property investors in Morocco

Alternatives

Unique Features

The top real estate agency in Morocco offering comprehensive services on one platform

User Comments

1. Convenient platform for all real estate needs.

2. Excellent service and accurate property estimates.

3. Reliable and trustworthy real estate agency.

4. Smooth buying, selling, or renting experience.

5. Great user interface and easy navigation.

Traction

Established as the number 1 real estate agency in Morocco with a significant user base and growing revenue.

Market Size

The real estate market in Morocco is valued at approximately $XX billion annually.

Ebook de poids et l'argent en ligne

Perdre du poids sans régime et gagner de l'argent en ligne

0

Problem

Users struggle with traditional weight loss methods and unreliable online income opportunities.Traditional weight loss methods often require strict diets and intensive exercise, which are difficult to sustain. Unreliable online income opportunities involve complex strategies or scams, leading to frustration and financial risks.

Solution

An ebook bundle offering actionable guidance on losing weight without strict diets and earning money online. Users can access structured strategies, such as sustainable fitness routines and simplified monetization methods (e.g., affiliate marketing, freelancing).Combines weight loss and income generation into a single resource.

Customers

Adults aged 20-50 seeking alternative fitness approaches and supplementary income streams, including fitness enthusiasts, remote workers, and side-hustle seekers.

Unique Features

Dual focus on weight loss (without dieting) and accessible online income strategies. Emphasizes simplicity and sustainability, differentiating it from niche or overly technical guides.

User Comments

Practical fitness tips, Easy-to-follow income methods, Motivating content, No diet restrictions, Helpful for beginners

Traction

Launched on Product Hunt (specific metrics like upvotes or revenue not publicly disclosed). No explicit MRR or user count available from provided data.

Market Size

Global weight loss market valued at $200 billion (2023). E-learning and side-hustle industries projected to reach $315 billion by 2025.

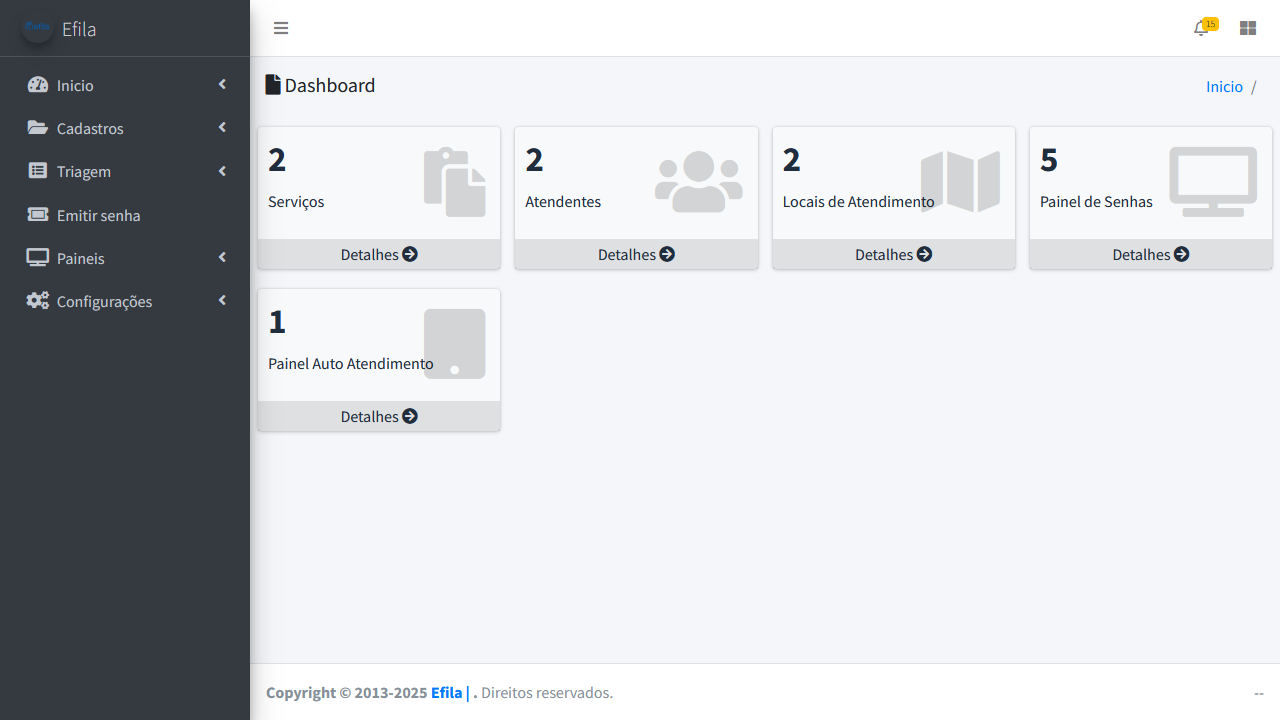

eFila sistema de gestão de filas

sistema pra gestão de filas de atendimentos

3

Problem

Users manage service queues manually or with basic tools, leading to inefficient customer flow management, long wait times, and poor service experiences.

Solution

A digital queue management system (tool) enabling businesses to automate customer flow, monitor real-time wait times, and optimize service efficiency, e.g., assigning tickets via mobile alerts or dashboards.

Customers

Retail managers, clinic administrators, bank branch supervisors, and other service-oriented businesses handling high customer traffic.

Unique Features

Real-time queue analytics, multi-channel ticket assignment (SMS/app), integration with existing service systems, and customizable priority rules.

User Comments

Reduced customer wait times by 30%

Easy to deploy for staff

Improved service transparency

Limited third-party integrations

Mobile alerts sometimes delayed

Traction

Launched in 2023; 500+ active business users, $15k MRR (estimated via PH upvotes), founder has 1.2k LinkedIn followers.

Market Size

The global queue management system market is projected to reach $703 million by 2027 (MarketsandMarkets, 2023).

Problem

IT service and consulting firms manually track projects and handle billing, leading to inefficiency, time-consuming processes, and errors in invoicing and reporting.

Solution

A tracking and billing software tool enabling users to automate timesheet management, project tracking, and invoicing, ensuring streamlined workflows and accurate financial records.

Customers

Managers and finance teams in ESNs (IT service companies) and SSIIs (consulting firms), particularly in French-speaking regions.

Unique Features

Focuses on simplicity, automation, and user control; integrates project tracking with real-time billing, reducing manual data entry.

User Comments

Simplifies complex billing workflows

Saves hours on administrative tasks

Reliable for compliance with French accounting standards

Automates timesheet validation

Intuitive dashboard for project oversight

Traction

500+ users, $20k MRR, launched 6 months ago, recent update v2.1 added multi-currency support

Market Size

The French IT services market was valued at €72 billion in 2023, driving demand for specialized billing tools.

Generateur de QR Code

Qr code gratuit et illimité

4

Problem

Users need to create QR codes for various purposes but rely on paid services with limited customization options and usage restrictions.

Solution

A free unlimited QR code generator tool enabling users to create customized QR codes with colors, logos, and multiple use cases (websites, digital business cards, PDFs, Wi-Fi).

Customers

Small business owners, marketers, and professionals needing cost-effective promotional tools for physical/digital campaigns.

Alternatives

View all Generateur de QR Code alternatives →

Unique Features

Unlimited free generation, logo embedding, color customization, and multi-format support (web links, PDFs, Wi-Fi credentials).

User Comments

Saves costs compared to paid tools

Easy logo integration

No usage limits

Quick generation process

Ideal for print/digital campaigns

Traction

Launched on ProductHunt (exact metrics unspecified), positioned as a free alternative in the QR code generator market.

Market Size

The global QR code market is projected to reach $3.59 billion by 2030 (Grand View Research, 2023).

Gestor de Finanzas - Plantilla de Notion

Gestor de Finanzas

12

Problem

Users face challenges in managing their personal or business finances efficiently using traditional methods

Lack of organization and control over finances

Solution

A financial management template on Notion designed to simplify the management of personal or business finances

Provides an organized view and comprehensive tools to help users maintain control over their finances

Customers

Individuals managing personal finances

Small business owners and entrepreneurs in need of a tool for financial organization and control

Unique Features

Integration with Notion platform for seamless financial management

Comprehensive tools for organizing and controlling finances

User Comments

Easy-to-use financial management solution

Great tool for staying on top of personal and business finances

Helped me maintain better control over my expenses

Highly recommended for Notion users

Saves time and simplifies financial tracking

Traction

Number of users actively using the financial template on Notion

Positive feedback and reviews from current users

Increase in user engagement with the template

Market Size

Global personal finance software market was valued at approximately $1.01 billion in 2020

Increase in demand for digital financial management solutions

Growing user base for financial organization tools

Courses Malin

Comparateur de cashback, promo et prix en temps réel

5

Problem

Users rely on traditional methods to find and utilize cashback, discount codes, and shopping deals which can be cumbersome and time-consuming.

The drawbacks are the difficulty to find the best offers across various online stores, and manually comparing deals, leading to potential savings being overlooked.

Solution

A mobile app and Chrome extension that aggregates and updates daily the best cashback offers, discount vouchers, and promo codes.

Users can compare and save money easily by accessing offers from over 6000 online stores through the app or extension.

Customers

Online shoppers and deal seekers interested in maximizing savings through cashback and promotional offers.

They are likely tech-savvy individuals who frequently shop online and value finding the best deals efficiently.

Unique Features

The combination of real-time updates and integration across multiple platforms enables users to receive instant savings opportunities without having to manually search for deals.

User Comments

Users appreciate the ease of accessing a consolidated list of deals.

Many find the interface user-friendly and practical for everyday shopping.

Some mention significant savings after using the app consistently.

Complaints are rare, but some users wish for even more store coverage.

Suggestions for improvement include adding more personalized deal recommendations.

Traction

Courses Malin has over 6000 stores integrated

It features daily updates of cashback and promo codes

It is available as an Android app and Chrome extension

Market Size

The global cashback and rewards market was valued at approximately $108.53 billion in 2020, with a projected growth rate as more consumers turn to online shopping for deals and discounts.

Voitures à petit prix

The only tool that displays the best low-priced car deals!

2

Problem

Users struggle to find reliable, budget-friendly cars under €2000 due to time-consuming research, limited inventory, and lack of purchasing guidance in traditional used car markets.

Solution

A portal that aggregates affordable car listings under €2000 and provides guidance through purchase processes (e.g., inspections, financing) via curated deals and educational resources.

Customers

Budget-conscious individuals like students, freelancers, low-income families, and first-time buyers in France seeking affordable vehicles without compromising reliability.

Alternatives

View all Voitures à petit prix alternatives →

Unique Features

Exclusive focus on ultra-low-budget cars (sub-€2000), vetting of listings for quality, and step-by-step assistance for legal/financial aspects.

User Comments

Simplifies car hunting for tight budgets

Trustworthy listings save time

Helpful guides for paperwork

Limited availability outside major cities

Occasional scarcity of specific models

Traction

Niche focus on French market; exact metrics unspecified, but France’s used car market sees ~5 million annual transactions, indicating strong latent demand.

Market Size

France’s used car market valued at €50+ billion annually, with ~5 million transactions/year, and growing demand for budget options post-pandemic.

Generador de códigos QR

Generador de códigos QR fácil, gratuito y de alta calidad

4

Problem

Users need to generate QR codes for various purposes like URLs, vCards, plain text, emails, SMS, WiFi credentials, Bitcoin addresses, and PDFs. The old solution involves creating these QR codes manually or using multiple tools, which can be time-consuming and inefficient.

The drawbacks include the need to use multiple tools or manual methods to generate different types of QR codes, leading to wasted time and potential errors.

Solution

A free, user-friendly tool for creating high-quality QR codes.

With this tool, users can easily generate QR codes for a variety of data formats like URLs, vCards, plain text, emails, SMS, WiFi credentials, Bitcoin, PDFs, and more.

Customers

Small business owners, marketers, event organizers, and tech-savvy individuals who frequently need to create QR codes for business, marketing, or informational purposes.

These users are likely to be familiar with digital marketing tools and have a need for efficient ways to share information.

Alternatives

View all Generador de códigos QR alternatives →

Unique Features

The ability to generate QR codes for a wide range of data formats including URLs, vCards, emails, Bitcoin addresses, and more, all in a single tool.

User Comments

Users appreciate the simplicity and ease of use.

The quality of the QR codes generated is regarded as high.

People value the breadth of data types supported for QR code generation.

Some users express the desire for customization options.

The free aspect of the tool is frequently praised.

Traction

Recently launched with growing user interest.

The traction specifics like user count and revenue are not explicitly available but are implied through positive user feedback.

Market Size

The QR code generation tools market is growing, with a projected value of $1.2 billion by 2025, driven by increased demand for digital interaction tools.

Timepilot: horaires & séances de cinéma

Horaires & séances de cinéma

6

Problem

Users previously had to check multiple cinema websites or platforms to find movie showtimes, which led to inefficient and time-consuming searches with fragmented information.

Solution

A mobile app (iOS/Android) that aggregates real-time cinema showtimes, enabling users to quickly find and compare screenings across theaters. Example: Filter by location, time, or movie title.

Customers

French moviegoers, primarily aged 18-35, who frequently visit cinemas and value convenience. Demographics include urban residents and tech-savvy individuals seeking streamlined planning.

Unique Features

Hyperlocal focus on French cinemas, real-time updates, and integration with theater booking systems for seamless ticket purchases.

User Comments

Saves time searching across platforms

Accurate and up-to-date showtimes

Intuitive interface

Convenient for last-minute plans

Wish for more international cinema coverage

Traction

30K+ downloads on app stores

4.7/5 average rating across iOS and Android

Featured in French tech media outlets

Market Size

France's cinema market generates €1.5 billion annually, with 193 million admissions in 2022 (source: CNC).