70/20/10 Budget Spreadsheet Template

Alternatives

0 PH launches analyzed!

70/20/10 Budget Spreadsheet Template

Master your money with the 70/20/10 budget rule template

6

Problem

Users struggle to manage their finances effectively and allocate their income to needs, savings, and wants according to the 70/20/10 rule.

Drawbacks: Lack of a structured budgeting tool leads to difficulty in tracking expenses, balancing financial priorities, and achieving financial goals.

Solution

Budget spreadsheet template for Excel & Google Sheets

Helps users effortlessly manage finances by allocating 70% to needs, 20% to savings, and 10% to wants.

Core features: Track expenses, achieve financial balance, and adhere to the 70/20/10 budget rule.

Customers

Individuals looking to efficiently manage their finances

Occupation: Finance professionals, budgeting enthusiasts, individuals seeking financial stability

Unique Features

Provides a structured budget template following the popular 70/20/10 rule

Offers simplicity in allocating income to different financial aspects

Helps users in tracking expenses effectively and achieving financial goals effortlessly

User Comments

Simple and effective budgeting tool

Great way to manage finances and track expenses

Easy to use and practical for financial planning

Helped me prioritize my spending and savings effectively

Highly recommend for anyone wanting to improve their financial management

Traction

The product has gained popularity on ProductHunt with positive reviews

It has generated significant user engagement and interest in budgeting tools

Market Size

$28.6 billion was the global personal finance software market size in 2020

The market is expected to grow further due to increased demand for efficient financial management tools

70/20/10 Budget Spreadsheet Template

Excel & Google Sheets

4

Problem

Users manage their finances manually without structured guidance which results in poor financial planning.

structured guidance

Solution

Spreadsheet template

A budgeting tool that helps users allocate their finances according to a 70/20/10 rule using either Excel or Google Sheets

allocate their finances according to a 70/20/10 rule using either Excel or Google Sheets

Customers

Personal finance enthusiasts, budget-conscious individuals, and young professionals

25-45 years old

Tech-savvy and prefer using digital tools

Interested in personal finance optimization

Unique Features

Simple structure allowing clear financial categorization

Compatibility with both Excel and Google Sheets for flexibility

Automated calculations for easy financial tracking

User Comments

Easy to use and effective in organizing finances

Highly compatible with popular spreadsheet software

Offers a clear and simple way to manage money

The breakdown of percentages is very helpful for beginners

Some users wish for more customization options

Traction

Recently launched

Targeting budget-conscious users

Gaining attention on ProductHunt

Market Size

The personal finance software market is projected to reach a value of $1.57 billion by 2025

60/20/20 Budget Planner Template Excel

Effortless 60/20/20 budgeting for smarter money management

3

Problem

Users struggle to effectively plan, track, and manage their finances, resulting in poor allocation of funds for needs, savings, and wants.

Solution

A budget planner template for Excel & Google Sheets that facilitates effortless 60/20/20 budgeting, ensuring optimal allocation of 60% to needs, 20% to savings, and 20% to wants.

Customers

Individuals looking to achieve financial balance through a structured budgeting approach.

Unique Features

Optimal allocation template: The template is designed for 60/20/20 budgeting, simplifying financial planning for users.

User Comments

Easy-to-use budget template

Helped me organize my finances better

Great tool for budgeting

Traction

Growing user base on ProductHunt platform

Market Size

Personal finance management software market was valued at approximately $1.4 billion in 2020.

50/30/20 Rule Notion Template

Save more with the 50/30/20 budgeting Notion template

7

Problem

Users struggle to manage their finances effectively using traditional budgeting methods

Users find it challenging to divide their income into essential expenses, wants, and savings

Traditional budgeting methods lack simplicity and user-friendliness, leading to difficulties in tracking and managing finances efficiently

Solution

Notion template

Helps users divide their income into "Essentials," "Wants," and "Savings" for easy budgeting

Core features include simplifying the 50/30/20 budgeting method, beginner-friendly design, and sync support for seamless financial management

Customers

Individuals looking to effectively manage and budget their finances

Students, young professionals, and individuals new to budgeting

Unique Features

Simplifies the 50/30/20 budgeting method for easy understanding and implementation

Beginner-friendly design for users new to budgeting

User Comments

Easy-to-use budgeting tool

Saves time and effort in managing finances

Helps in setting and achieving financial goals

Great for beginners in budgeting

Improves financial awareness and discipline

Traction

Reached the top rank for "Budget App"

Significant downloads and positive user feedback

Market Size

The global personal finance software market was valued at approximately $1.05 billion in 2020 and is projected to reach $1.57 billion by 2025, with a CAGR of 8.4%

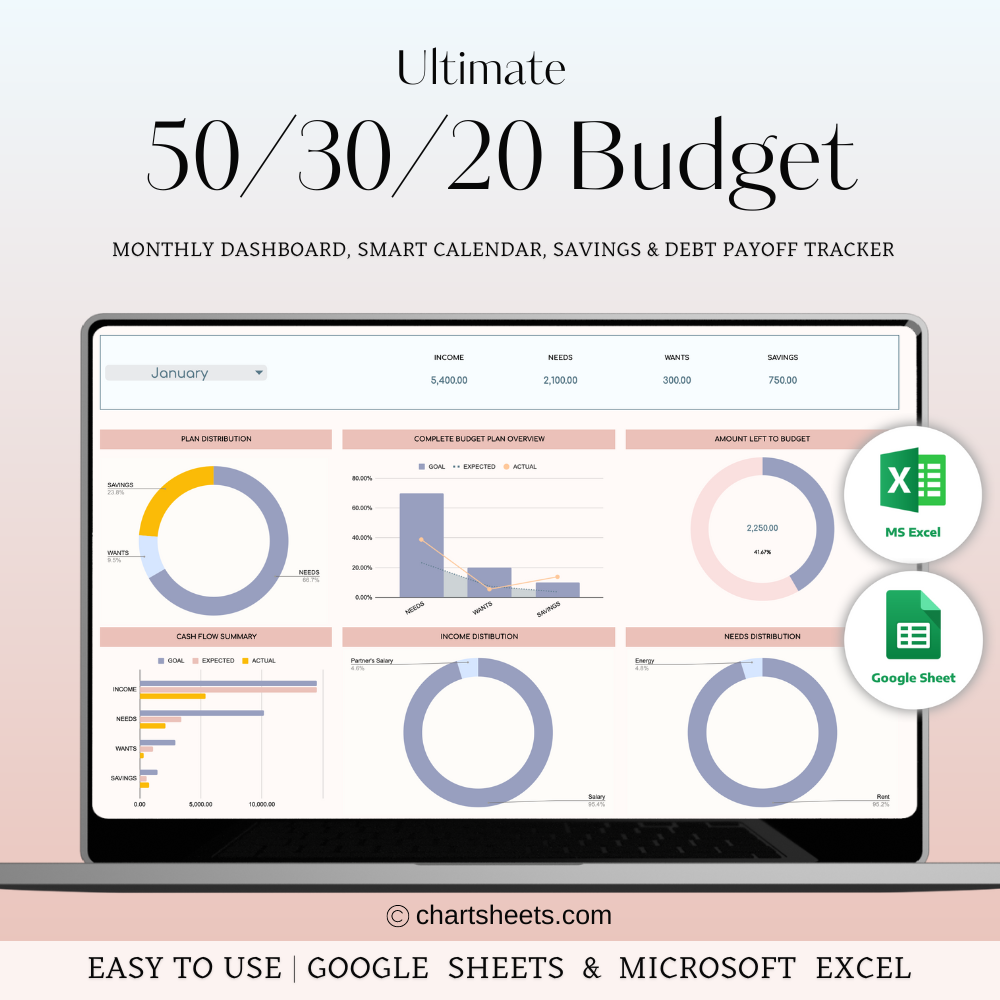

50/30/20 Budget Spreadsheet Template

Simple budget tracker based on the 50/30/20 rule

6

Problem

Users struggle to effectively track and manage their finances, leading to disorganized expenses, undefined savings goals, and poor budget management.

Solution

A budget spreadsheet template for Excel and Google Sheets based on the 50/30/20 rule that helps users effortlessly track finances, organize expenses, set savings goals, and manage budgets effectively.

Customers

Individuals looking to improve their financial management, individuals seeking to organize their expenses, set savings targets, and effectively manage their budgets.

Unique Features

Utilizes the 50/30/20 rule to categorize expenses into needs, wants, and savings, making budget tracking and financial management more straightforward and effective.

Market Size

Personal finance software market was valued at approximately $1.9 billion in 2020 and is projected to reach $4.5 billion by 2026, with a CAGR of over 12%.

80/10/10 Budget Spreadsheet Template

Excel & Google Sheets

4

Problem

Users are trying to manage their finances manually or through simple templates, which may not provide an efficient breakdown of budget allocation. The drawbacks of this old situation include lacking a structured approach to distribute income efficiently, potentially leading to financial mismanagement.

Solution

An Excel & Google Sheets budget tool that allows users to allocate 80% of their income to living expenses, 10% for savings, and 10% for investments, ensuring a sustainable financial plan. Users can use this template to precisely plan and monitor their budget.

Customers

Individuals, especially young professionals and financially-conscious people who are seeking to improve their financial management habits, including specific roles like financial advisors and personal finance educators.

Unique Features

The 80/10/10 allocation model is simple yet comprehensive, allowing for straightforward implementation of financial discipline and long-term financial planning.

User Comments

Users find the template useful for maintaining financial discipline.

The 80/10/10 model is appreciated for its simplicity.

The template is praised for ease of use in Excel and Google Sheets.

Some users wish for integration with other financial tools.

Customizability of the template is a highlight for users.

Traction

The template has been featured on ProductHunt and is available for download for Excel and Google Sheets users, indicating a targeted user base interested in structured financial planning.

Market Size

The personal finance software market is projected to reach approximately $1.57 billion by 2027, indicating a growing demand for budgeting and financial planning tools.

70/15/10/5 Budget Spreadsheet Template

Excel & Google Sheets

1

Problem

The user currently manages their finances using traditional methods which lack structure and guidelines.

Lack of clear budgeting plans and categorization

Difficulties allocating income effectively

Solution

A budgeting spreadsheet template available for Excel & Google Sheets

Allows users to allocate 70% of income to essentials, 15% to savings, 10% to wants, and 5% to investments

Facilitates structured financial planning and prioritization of financial security

Customers

Individuals looking to gain control over their finances

Ages 25-45

Primarily those who are new to professional life or seeking financial stability

Users who prefer structured budgeting

Unique Features

Simple and clear categorization

Stable budgeting system emphasizing financial security

Compatibility with both Excel and Google Sheets

User Comments

Easy to use and helpful for budgeting

Clear categorization makes financial planning simpler

Useful for tracking expenses and savings

Appreciated for its simplicity

Excel and Google Sheets compatibility is beneficial

Traction

Featured listing on ProductHunt

Available for both Excel & Google Sheets

Part of trending budget tools in financial management

Market Size

Global personal financial management tools market is expected to reach $1.57 billion by 2025

60/20/20 Budget Spreadsheet Template

Excel & Google Sheets

4

Problem

Users are trying to manage their personal finances manually, which can often lead to errors and inefficiencies.

Allocate their income appropriately might be difficult for them, leading to potential overspending or insufficient savings.

Solution

A spreadsheet template designed for both Excel and Google Sheets.

Users can allocate 60% to essentials, 20% to savings, and 20% to lifestyle easily, ensuring a balanced financial plan.

Customers

Individuals who aim to manage their personal finances more effectively

Mostly adults with disposable income and an interest in personal financial planning.

Those who are familiar with using Excel or Google Sheets for data management.

Unique Features

The specific 60/20/20 budgeting method that defines clear allocation of finances.

Compatibility with both Excel and Google Sheets, enabling flexibility and accessibility.

User Comments

Users find the template easy to use and helpful for financial planning.

Many appreciate the clear allocation strategy that the template offers.

Some find the template enhances their financial discipline.

There are positive remarks on the product being available in both Excel and Google Sheets.

A few users have mentioned slight improvements that could be made.

Traction

The product is newly launched and specific metric data are not provided.

It's gaining visibility on platforms like ProductHunt.

Market Size

The personal finance software market was valued at $1.5 billion in 2020 and is expected to grow.

Annual 50/30/20 Budget Spreadsheet

Plan Your Finances with the 50/30/20 Budget Template!

4

Problem

Users struggle to track and manage their income, needs, wants, and savings effectively throughout the year using traditional methods.

Drawbacks: Manual budget tracking can be time-consuming, prone to errors, and lacks a comprehensive overview.

Solution

A comprehensive budget spreadsheet template for Google Sheets & Excel.

Core Features: Helps users track income, needs, wants, and savings all year, simplifying budgeting and enabling users to achieve their financial goals.

Examples: Easy-to-use template for monthly or yearly budget tracking with clear categorization.

Customers

Individuals looking to improve their financial management skills and achieve their financial goals.

Occupation: Finance enthusiasts, individuals on a budget planning journey, students, professionals, and families.

Unique Features

Provides a structured and user-friendly approach to managing finances throughout the year.

Caters to different financial needs by categorizing income, needs, wants, and savings effectively.

User Comments

Easy to understand and great for beginners in budgeting.

Helped me organize my finances efficiently and set savings goals.

Simple yet powerful tool for tracking expenses and ensuring financial stability.

Highly customizable to fit individual budgeting preferences.

Saved me time and effort in managing my finances effectively.

Traction

Over 500k downloads across Google Sheets & Excel platforms.

Featured on ProductHunt with positive user feedback and reviews.

Market Size

$12.1 billion: Personal finance software market size in 2021.

Increasing demand for budgeting tools due to rising personal financial management awareness.

65/25/10 Budget Spreadsheet Template

Excel & Google Sheets

5

Problem

Traditional budgeting methods often involve manual calculations and generic categories that users struggle to customize for their real-life financial scenarios.

Users face difficulty in managing and allocating funds effectively when using outdated budgeting techniques that do not provide clear guidance on spending and saving priorities.

manual calculations and generic categories

Solution

A budget spreadsheet template for Excel & Google Sheets

Users can allocate funds into specific categories such as essential expenses, savings, and investments to track financial stability and future preparedness.

allocate funds into specific categories such as essential expenses, savings, and investments

Customers

Individuals interested in personal finance management, particularly those between the ages of 25-45 who are actively seeking to improve their budgeting and saving habits.

Individuals

Unique Features

The simplicity and customization for users to easily allocate their income into the structured 65/25/10 budgeting method, seamlessly integrated with popular spreadsheet software like Excel and Google Sheets.

User Comments

Users appreciate the clarity the template brings to their financial planning.

It's praised for being easy to use and highly customizable.

Some users find it helpful in achieving their savings goals.

A few users noted that the method encourages proactive financial habits.

Some mention it as a good introductory tool for new budgeters.

Traction

Recently launched on Product Hunt.

Significant user interest observed, as indicated by current engagements on the platform.

Positioned as a tool compatible with both Excel and Google Sheets for a broad user base.

Market Size

The global personal finance software market was valued at $1.1 billion in 2020 and is expected to expand significantly driven by increasing demand for financial planning and management solutions.