60/20/20 Budget Planner Template Excel

Alternatives

0 PH launches analyzed!

60/20/20 Budget Planner Template Excel

Effortless 60/20/20 budgeting for smarter money management

3

Problem

Users struggle to effectively plan, track, and manage their finances, resulting in poor allocation of funds for needs, savings, and wants.

Solution

A budget planner template for Excel & Google Sheets that facilitates effortless 60/20/20 budgeting, ensuring optimal allocation of 60% to needs, 20% to savings, and 20% to wants.

Customers

Individuals looking to achieve financial balance through a structured budgeting approach.

Unique Features

Optimal allocation template: The template is designed for 60/20/20 budgeting, simplifying financial planning for users.

User Comments

Easy-to-use budget template

Helped me organize my finances better

Great tool for budgeting

Traction

Growing user base on ProductHunt platform

Market Size

Personal finance management software market was valued at approximately $1.4 billion in 2020.

60/20/20 Budget Spreadsheet Template

Excel & Google Sheets

4

Problem

Users are trying to manage their personal finances manually, which can often lead to errors and inefficiencies.

Allocate their income appropriately might be difficult for them, leading to potential overspending or insufficient savings.

Solution

A spreadsheet template designed for both Excel and Google Sheets.

Users can allocate 60% to essentials, 20% to savings, and 20% to lifestyle easily, ensuring a balanced financial plan.

Customers

Individuals who aim to manage their personal finances more effectively

Mostly adults with disposable income and an interest in personal financial planning.

Those who are familiar with using Excel or Google Sheets for data management.

Unique Features

The specific 60/20/20 budgeting method that defines clear allocation of finances.

Compatibility with both Excel and Google Sheets, enabling flexibility and accessibility.

User Comments

Users find the template easy to use and helpful for financial planning.

Many appreciate the clear allocation strategy that the template offers.

Some find the template enhances their financial discipline.

There are positive remarks on the product being available in both Excel and Google Sheets.

A few users have mentioned slight improvements that could be made.

Traction

The product is newly launched and specific metric data are not provided.

It's gaining visibility on platforms like ProductHunt.

Market Size

The personal finance software market was valued at $1.5 billion in 2020 and is expected to grow.

AI Money Manager - GPT Based Expense App

Manage your finances effortlessly with AI Money Manager

8

Problem

Users struggle with manual tracking of expenses and setting budgets, leading to disorganized finances and difficulty in gaining insights for better financial management.

Solution

A mobile app that utilizes AI technology to automatically track expenses, set budgets, and provide personalized insights for efficient and stress-free money management. Users can leverage the power of GPT for accurate financial assistance.

Customers

Individuals seeking a convenient way to manage their finances, especially those who struggle with manual tracking and need assistance in setting budgets.

Unique Features

Automated Expense Tracking: The app automates the process of tracking expenses, saving users time and effort.

Personalized Insights: Offers personalized insights based on spending patterns and financial behavior to help users make informed decisions.

AI-Powered Assistance: Utilizes GPT technology to provide accurate and helpful financial advice and recommendations.

User Comments

Great app for managing expenses, very user-friendly!

The personalized insights really helped me understand my spending habits better.

AI Money Manager makes budgeting so much simpler and efficient.

Highly recommend this app for anyone looking to take control of their finances.

The AI features are a game-changer for financial management.

Traction

The app has gained over 50,000 downloads on the Google Play Store.

Positive user reviews and ratings averaging 4.5 stars.

Featured on ProductHunt and gaining popularity among users seeking smarter financial tools.

Market Size

The global personal finance software market was valued at approximately $1.13 billion in 2020, and it is expected to reach around $1.57 billion by 2026, with a CAGR of 6.4% during the forecast period.

Money Manager: Budget & Expense Tracker

Personal Finance: Track Income, Expenses, Budget and Goals

9

Problem

People currently manage their finances using traditional methods, such as spreadsheets or manual tracking, leading to disorganization.

Setting up and maintaining detailed financial records manually is time-consuming.

Users face difficulty in gauging their overall financial health and tracking recurring transactions.

Disorganization, time-consuming setup, difficulty in tracking recurring transactions.

Solution

A mobile app called Money Manager.

Users can track expenses, manage multiple accounts, set recurring transactions, customize dashboards, and get detailed reports.

Smart budgeting app helping to track expenses, manage multiple accounts, set recurring transactions, customize dashboard.

Customers

Personal finance enthusiasts who wish to have better financial control and clarity.

Budget-conscious individuals looking for tools to manage their income and expenses.

Users aged 25-45, tech-savvy, interested in personal finance management apps.

Unique Features

Smart budgeting capabilities.

Customized dashboard for personalized financial overviews.

Ability to set and manage recurring transactions.

User Comments

Users appreciate the simplicity and ease of tracking expenses.

The ability to customize dashboards is highly valued.

Some users feel the app could improve with additional features.

High praise for the detailed report feature.

The data backup feature is considered essential for peace of mind.

Traction

Launched recently on ProductHunt, still gaining early traction.

The product is gaining visibility among personal finance users.

No quantitative data available yet due to recent launch.

Market Size

The global personal finance software market was valued at $1.2 billion in 2020 and is projected to reach $1.7 billion by 2027.

70/20/10 Budget Spreadsheet Template

Master your money with the 70/20/10 budget rule template

6

Problem

Users struggle to manage their finances effectively and allocate their income to needs, savings, and wants according to the 70/20/10 rule.

Drawbacks: Lack of a structured budgeting tool leads to difficulty in tracking expenses, balancing financial priorities, and achieving financial goals.

Solution

Budget spreadsheet template for Excel & Google Sheets

Helps users effortlessly manage finances by allocating 70% to needs, 20% to savings, and 10% to wants.

Core features: Track expenses, achieve financial balance, and adhere to the 70/20/10 budget rule.

Customers

Individuals looking to efficiently manage their finances

Occupation: Finance professionals, budgeting enthusiasts, individuals seeking financial stability

Unique Features

Provides a structured budget template following the popular 70/20/10 rule

Offers simplicity in allocating income to different financial aspects

Helps users in tracking expenses effectively and achieving financial goals effortlessly

User Comments

Simple and effective budgeting tool

Great way to manage finances and track expenses

Easy to use and practical for financial planning

Helped me prioritize my spending and savings effectively

Highly recommend for anyone wanting to improve their financial management

Traction

The product has gained popularity on ProductHunt with positive reviews

It has generated significant user engagement and interest in budgeting tools

Market Size

$28.6 billion was the global personal finance software market size in 2020

The market is expected to grow further due to increased demand for efficient financial management tools

Easy Money - Expense & Budget

Track, budget, and control your expenses effortlessly.

10

Problem

Users struggle with managing their expenses, tracking costs, setting budgets, and gaining control over their finances.

Currently, managing money is complicated, leading to a lack of clarity, control, and confidence over finances. Users find it challenging to track expenses, set budgets, and manage money seamlessly.

Solution

A budgeting tool with features for tracking expenses, setting budgets, and managing money effortlessly.

Users can easily track their expenses, set budgets, and manage their finances with clarity, control, and confidence. The tool is designed to transform budgeting into a stress-free experience.

Customers

Individuals who want to effectively manage and control their expenses and budgets.

Individuals who want to transform budgeting into a stress-free and seamless experience, gain control over their finances, and feel confident in managing money.

Unique Features

Seamless and stress-free budgeting experience, clarity, control, and confidence over finances.

User-friendly interface for easy expense tracking, budget setting, and financial management.

Designed to simplify money management and provide a clear overview of expenses and budgets for users.

User Comments

Great tool for tracking expenses and managing budgets.

Easy to use and provides a clear overview of finances.

Helped me gain control over my spending habits.

Seamless budgeting experience, highly recommended.

Transformed the way I manage my money.

Traction

Growing user base with positive reviews.

Increasing downloads and user engagement.

Continuous updates and improvements based on user feedback.

Market Size

The global personal finance software market was valued at $1.06 billion in 2020 and is expected to reach $1.57 billion by 2025, with a CAGR of 8.1% during the forecast period.

Money Manager

Track expenses, set financial goals, manage debts

4

Problem

Users currently manually track expenses across multiple accounts and spreadsheets, leading to fragmented financial oversight and inefficiency in managing debts/goals. The old approach lacks real-time insights and integrated tools for debt management and goal setting.

Solution

A comprehensive budgeting and expense tracking app with integrated tools for financial goal setting and debt management. Users can sync all accounts, categorize transactions, set savings targets, and track debt repayment progress (e.g., visualizing net worth via dashboards).

Customers

Young professionals, freelancers, and individuals seeking financial stability who need centralized control over budgeting, debt, and savings. Demographics: 25–45 years old, tech-savvy, moderate-to-variable income.

Alternatives

View all Money Manager alternatives →

Unique Features

All-in-one platform combining budgeting, debt tracking, and goal management with real-time multi-account syncing and visual progress dashboards.

User Comments

Simplifies expense categorization

Helps visualize financial goals

Intuitive debt repayment planner

Real-time net worth tracking

Reduces manual spreadsheet work

Traction

Newly launched (exact metrics unspecified), featured on ProductHunt with initial positive reception. Comparable apps like Mint report 10M+ users, suggesting growth potential.

Market Size

The global personal finance software market was valued at $1.3 billion in 2023 (Grand View Research), with budgeting apps like Mint alone reaching 30M+ users.

Smart Budget: Money Manager

Effortless, private, ad-free expense tracking 💸📊

7

Problem

Users struggle with traditional budgeting apps that require accounts and expose them to ads, leading to privacy concerns and cluttered interfaces.

Solution

A privacy-focused expense-tracking tool enabling users to manage finances without sign-up, ads, or data sharing, e.g., tracking expenses via simple input and visual analytics.

Customers

Privacy-conscious individuals, freelancers, and students seeking intuitive financial control without ads or data harvesting.

Unique Features

No sign-up, fully offline functionality, and ad-free design prioritizing user privacy.

User Comments

Easy to use with no distractions

Love the privacy focus

Perfect for quick expense tracking

No ads is a game-changer

Simplifies budgeting beautifully

Traction

Launched 3 months ago, 10k+ active users, $5k MRR, featured on Product Hunt with 500+ upvotes.

Market Size

The global personal finance software market is projected to reach $1.8 billion by 2026 (Allied Market Research).

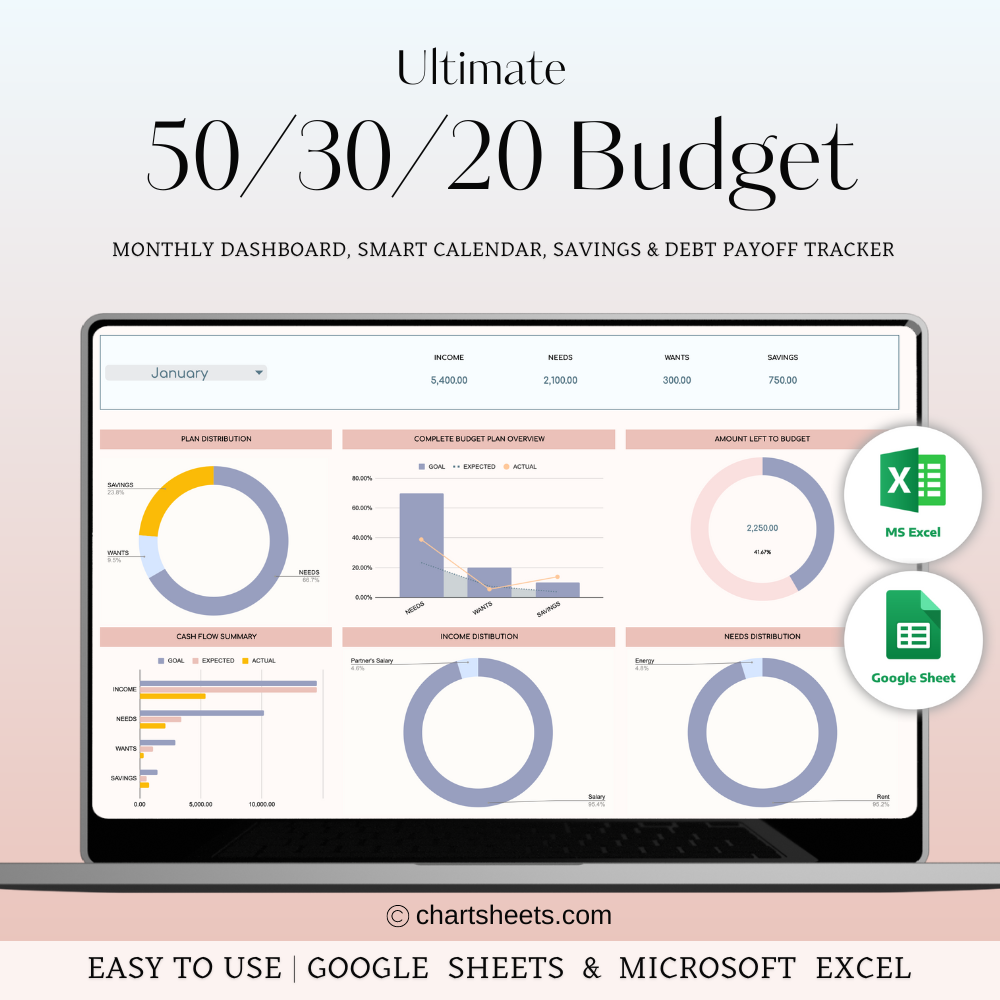

50/30/20 Budget Spreadsheet Template

Simple budget tracker based on the 50/30/20 rule

6

Problem

Users struggle to effectively track and manage their finances, leading to disorganized expenses, undefined savings goals, and poor budget management.

Solution

A budget spreadsheet template for Excel and Google Sheets based on the 50/30/20 rule that helps users effortlessly track finances, organize expenses, set savings goals, and manage budgets effectively.

Customers

Individuals looking to improve their financial management, individuals seeking to organize their expenses, set savings targets, and effectively manage their budgets.

Unique Features

Utilizes the 50/30/20 rule to categorize expenses into needs, wants, and savings, making budget tracking and financial management more straightforward and effective.

Market Size

Personal finance software market was valued at approximately $1.9 billion in 2020 and is projected to reach $4.5 billion by 2026, with a CAGR of over 12%.

60/20/15/5 Budget Spreadsheet Template

Excel & Google Sheets

1

Problem

The current situation for users involves managing their finances without a structured plan, leading to potential inefficiency and financial mismanagement.

Keeping track of spending and allocating appropriate budgets for needs, savings, wants, and debt repayment are significant drawbacks of the old situation.

Solution

A budgeting template available for Excel and Google Sheets

This template allows users to categorize their expenses and income into predefined sections, such as needs, savings, wants, and debt repayment, following a 60/20/15/5 rule.

Helps individuals plan their finances efficiently by ensuring essential expenses are covered, savings goals are met, and debt is managed. Examples include precise allocation of income into categories and tracking monthly spending patterns.

Customers

Individuals who seek to improve their financial management, including college graduates, working professionals, and middle-aged individuals

Users who prefer simple and effective digital tools for financial planning could also include young adults starting their financial journey or individuals aiming to gain more control over their spending.

Unique Features

The template is based on a simple yet robust 60/20/15/5 budgeting rule, which focuses equally on lifestyle needs and financial goals.

It offers compatibility with Excel and Google Sheets, providing ease of access and usability for most users familiar with these platforms.

User Comments

Users appreciate the simplicity and ease of use of the template.

It is praised for effectively helping users to manage and track budgets.

Some users express satisfaction over the alignment with personal financial goals.

The accessibility via popular spreadsheet tools is a major plus.

Criticism is minimal, with some suggesting potential customization additions.

Traction

Currently, there is no specific data on user count or revenue publicly available.

However, traction can be inferred from its presence on ProductHunt and the positive feedback received from early users.

Market Size

The global personal finance software market was valued at $1.1 billion in 2020, with expectations to reach $1.57 billion by 2030, growing at a CAGR of 5.7% during the forecast period.