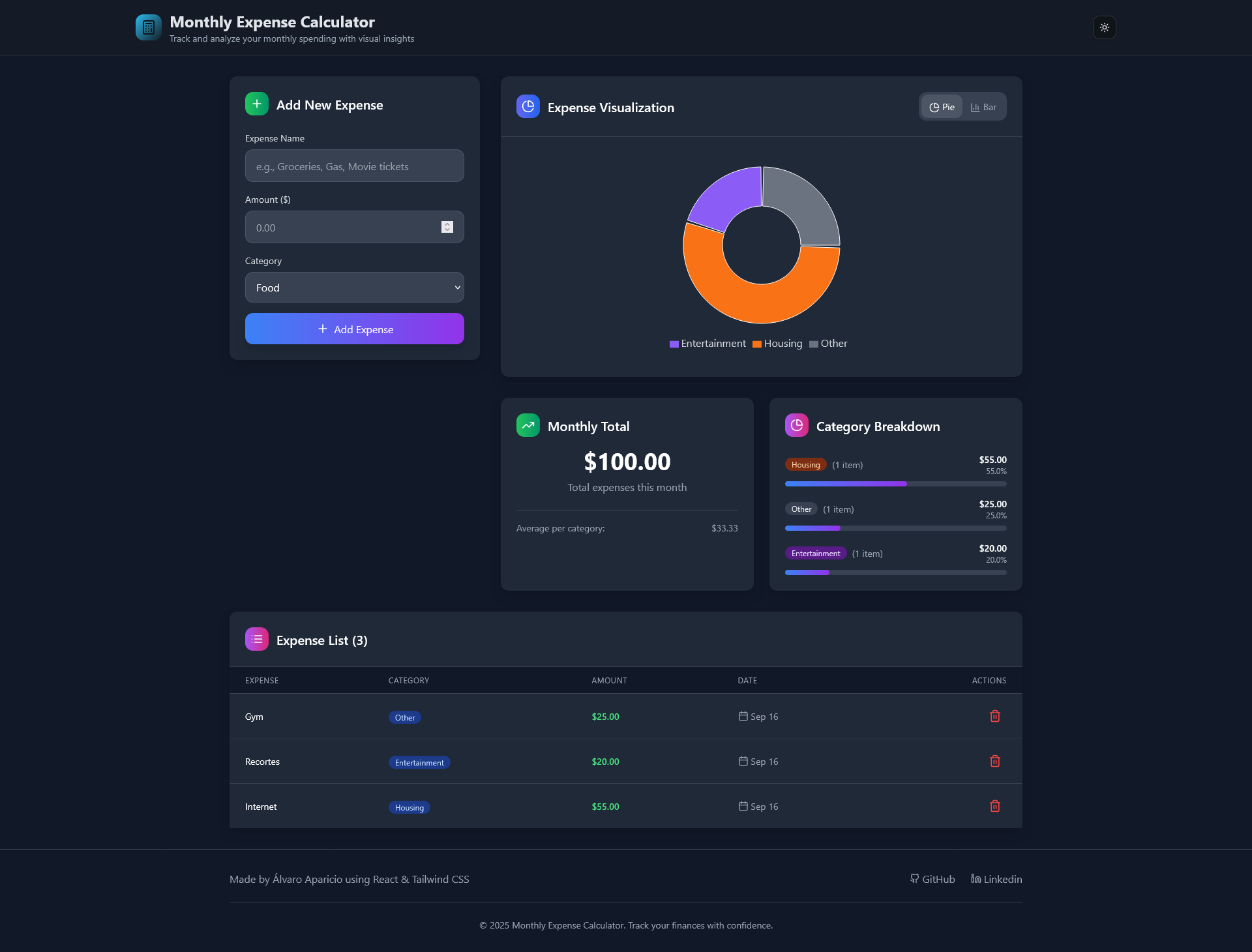

What is Work from Home Expenses Tax Calculator?

Use our Home Expenses Tax Calculator to determine your potential deductions. Designed for freelancers and remote workers, our calculator provides a quick and easy way to estimate home expense deductions for tax purposes.

Problem

Freelancers and remote workers struggle to accurately calculate their work-from-home expense deductions for tax purposes

Solution

A web-based Home Expenses Tax Calculator specifically designed for freelancers and remote workers to easily estimate their potential deductions for tax purposes

Features: Provides a quick and easy way to calculate home expense deductions, tailored for tax purposes

Customers

Freelancers, remote workers, independent contractors, and self-employed individuals

Unique Features

Tailored specifically for freelancers and remote workers

Streamlined and user-friendly interface for quick and easy estimation of deductions

User Comments

Saves time and hassle of manually calculating deductions

Accurate estimation of tax deductions

Great tool for freelancers and remote workers

Traction

Number of users and financial traction data unavailable

Market Size

$23.2 billion market size for tax preparation software industry, indicating a significant demand for tools assisting individuals in tax calculations