What is Sophistia.ai?

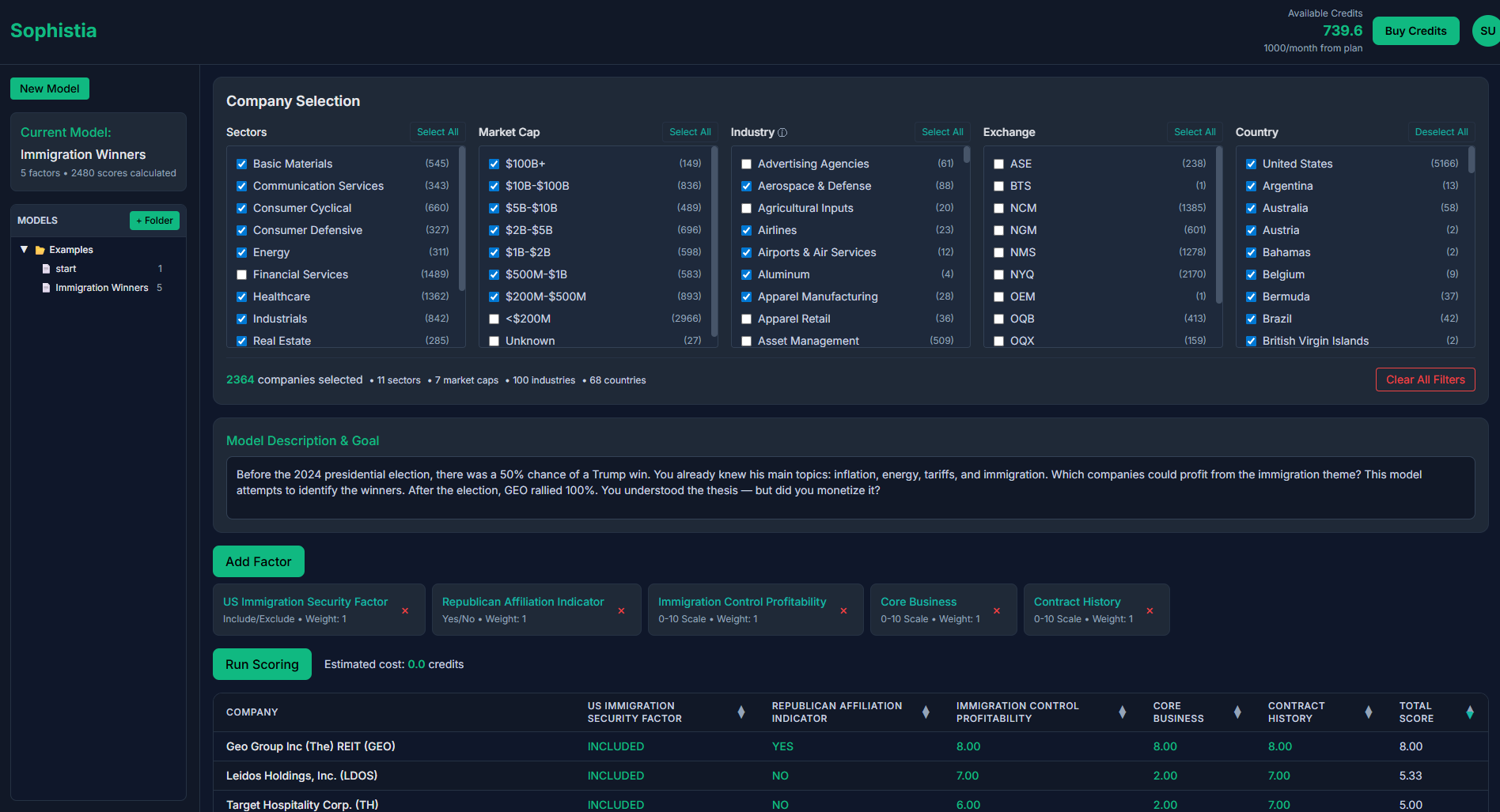

Sophistia is an AI stock screener that lets you define your own factors in plain English. Type any theme or business characteristic - like AI datacenter exposure, tariff sensitivity, high switching costs, recurring-revenue strength, mission-critical supplier, etc. Sophistia scores thousands of companies 0–10 on each factor and surfaces the best-fit stocks you’d never find through ratios and financials alone.

Problem

Users struggle to find stocks based on qualitative factors or custom themes using traditional screeners that rely solely on financial ratios and predefined metrics, limiting their ability to uncover nuanced investment opportunities.

Solution

A stock screening tool powered by AI factor models that lets users define custom investment themes in plain English (e.g., "AI datacenter exposure" or "tariff sensitivity"), automatically scoring thousands of companies 0–10 on these factors to surface relevant stocks.

Customers

Investment analysts, portfolio managers, and individual investors seeking thematic or factor-based opportunities, particularly those focused on niche business characteristics beyond standard financial metrics.

Unique Features

Natural language processing to convert plain English themes into quantitative scoring models; coverage of non-traditional factors like "mission-critical supplier" or "recurring-revenue strength".

User Comments

Saves hours of manual research for thematic investing

Identifies stocks overlooked by traditional screeners

Intuitive interface for non-technical users

Helpful for AI-related investment strategies

Improves diversification with unconventional metrics

Traction

Launched May 2024 on ProductHunt; no explicit revenue/user metrics disclosed yet

Market Size

The global algorithmic trading market, which includes quantitative investment tools, was valued at $18.8 billion in 2022 (Grand View Research).