What is Hedge Trading Bot Development?

Create a smart hedge trading bot to streamline trades, reduce risks, and maximise profits using advanced AI and machine learning.

Problem

Users manually manage trades or use basic automated tools, facing inefficient trade execution, higher risk exposure, and missed profit opportunities due to lack of real-time adaptability and advanced risk mitigation.

Solution

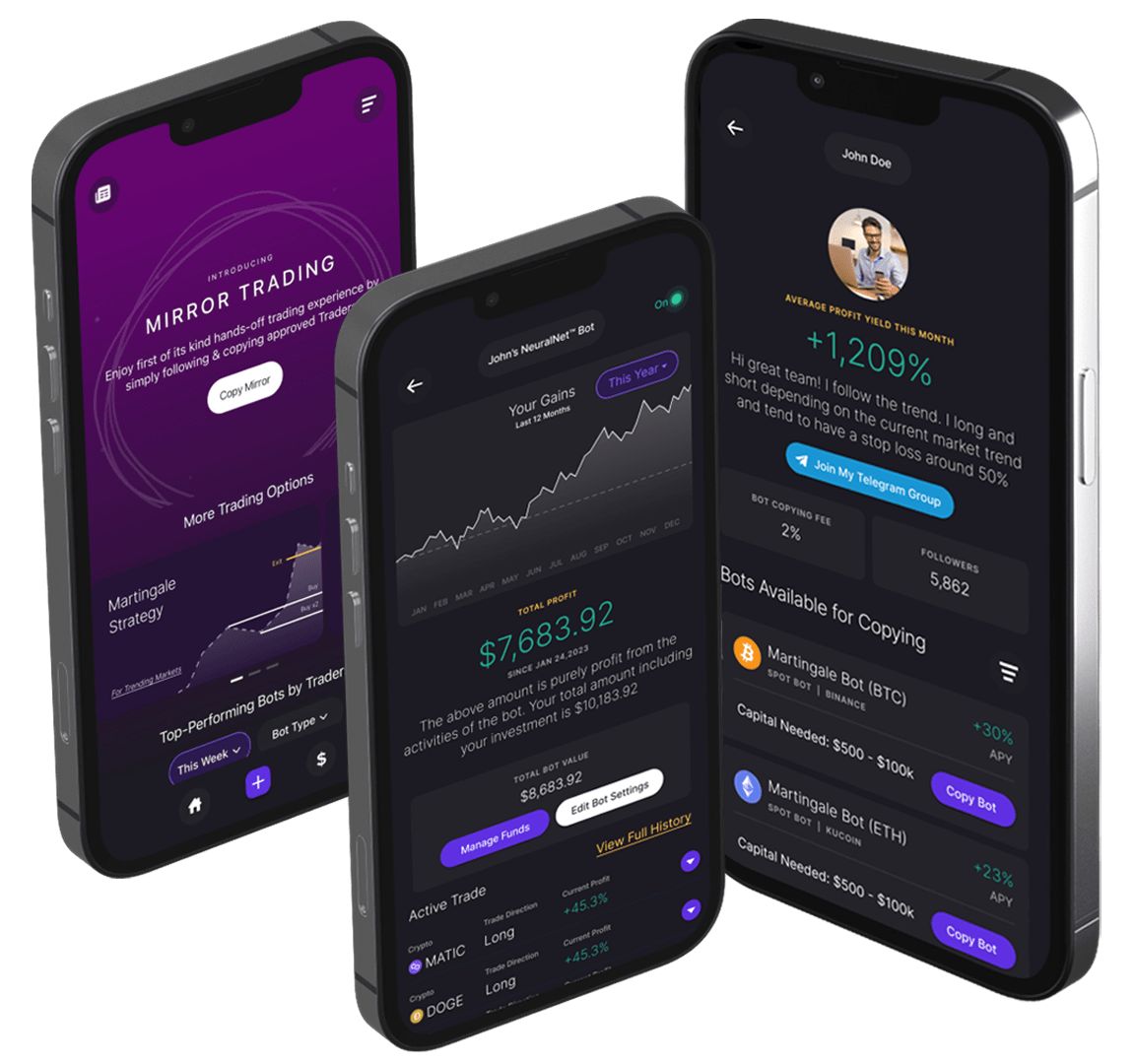

A hedge trading bot development tool leveraging AI/ML to automate trades, optimize strategies, and dynamically manage risks. Example: Users input trading parameters, and the bot executes hedged positions across markets to balance risks and profits.

Customers

Hedge fund managers, algorithmic traders, and cryptocurrency investors seeking automated, data-driven trading solutions to minimize losses and enhance portfolio performance.

Unique Features

Real-time risk management, multi-exchange hedging, adaptive AI strategies that learn from market volatility, and backtesting capabilities for strategy optimization.

User Comments

Saves time on manual trading

Reduces portfolio volatility

Boosts profitability in bear markets

User-friendly interface for non-coders

Requires initial setup expertise

Traction

Launched recently on ProductHunt; specific metrics (MRR, users) undisclosed. Founder’s LinkedIn/X followers not publicly listed.

Market Size

The global algorithmic trading market was valued at $14.18 billion in 2021, projected to reach $18.8 billion by 2028 (CAGR of 6.5%).