YOR.

Alternatives

0 PH launches analyzed!

Problem

Many individuals struggle to effectively track their net worth and manage their wealth comprehensively.

Traditional methods usually involve multiple tools or manual processes, which can be cumbersome and lack integrated insights.

No advisors, no hidden fees, just you and your wealth

Solution

An intuitive dashboard that allows users to track their net worth, manage assets, and analyze savings in a single platform.

This platform provides users with clear insights and smart tracking, facilitating improved financial control.

Features include asset management, savings analysis, and a comprehensive view of one's financial health.

Customers

Individuals interested in personal finance management, including young professionals, entrepreneurs, and retirees.

These users typically value financial independence and seek efficient ways to manage their wealth without recurring fees or advisors.

Unique Features

Offers a no-advisor, no-hidden-fee model ensuring transparency.

Combines net worth tracking, asset management, and savings analysis all in one user-friendly interface.

User Comments

Positive feedback on the simplicity and intuitiveness of the dashboard.

Users appreciate the comprehensive view it gives of their financial health.

Some users wish for more personalized financial advice features.

Praised for being fee-free, which is attractive compared to other financial tracking tools.

Suggestions for integration with more financial platforms for ease of data entry.

Traction

Recently launched on Product Hunt, gaining initial traction and user interest.

Exact user numbers or financial data not specified.

Market Size

The global personal finance software market was valued at $1.0 billion in 2020 and is expected to grow at a CAGR of over 5.7% from 2021 to 2028.

Net Worth Tracking App

Boost finances: Track net worth simply, skip app clutter.

0

Problem

Users struggle to manually track net worth across multiple platforms and accounts, leading to fragmented insights and time-consuming updates. Existing financial tools often overwhelm users with unnecessary features, distracting from core wealth-monitoring goals.

Solution

A dedicated net worth tracking app providing a centralized interface to track all assets/liabilities, synced automatically across accounts. Example: Users view real-time net worth graphs and prioritize goal-based wealth growth without budgeting/finance-management clutter.

Customers

Investors, high-net-worth individuals, and professionals (30-55 years) managing diverse portfolios who value minimalist design and automated updates over manual data entry.

Unique Features

Exclusive focus on net worth (no budgeting/expense tracking), automated account sync, and a clutter-free interface with actionable insights like debt-vs-asset ratios.

User Comments

Simplifies wealth tracking without distractions

Real-time syncing saves hours monthly

Missing detailed historical trends

Clear visualization of financial progress

Ideal for multi-account users

Traction

300+ Product Hunt upvotes, 10k+ downloads since 2023 launch, $20k MRR (estimated via subscription pricing)

Market Size

The global personal finance software market was valued at $1.2 billion in 2023, projected to reach $1.9 billion by 2028 (Statista, 2023).

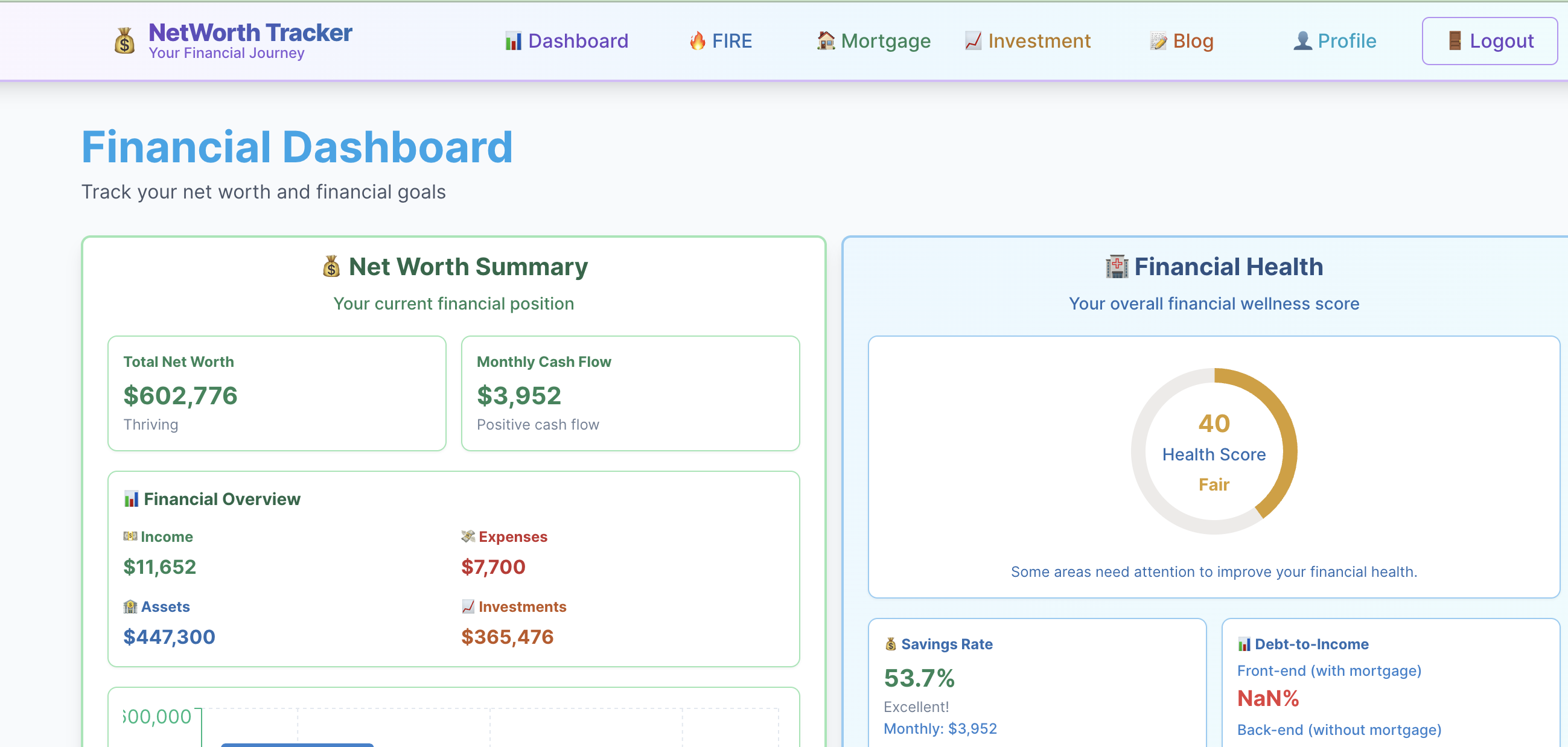

Net worth Tracker

Track, Grow & Optimize Your Net Worth Effortlessly.

6

Problem

Users manually track net worth using spreadsheets or multiple financial apps, leading to time-consuming manual updates, fragmented financial data, and limited insights for optimization.

Solution

A net worth tracking tool enabling users to automatically aggregate assets/liabilities, visualize trends, and receive optimization recommendations (e.g., tracking real-time investment values, debt reduction strategies).

Customers

High-earning professionals, investors, and financial advisors seeking centralized wealth management.

Alternatives

View all Net worth Tracker alternatives →

Unique Features

Real-time net worth calculation, automated data syncing across accounts, AI-driven financial optimization tips.

User Comments

Simplifies wealth tracking

Saves hours monthly

Actionable investment insights

Secure data handling

Intuitive dashboard

Traction

#1 Product of the Day on ProductHunt, 500+ upvotes, 10k+ users, $20k MRR

Market Size

Global personal finance software market valued at $1.2 billion in 2023 (Grand View Research).

Wealth OS Management

Master Your Finances with Wealth OS

4

Problem

Users manually track personal and investment wealth through spreadsheets or fragmented tools, leading to inefficient consolidation, lack of real-time insights, and difficulty in growth optimization.

Solution

A Notion-based all-in-one wealth management system that enables users to track expenses, monitor investments, set financial goals, and generate reports within a customizable dashboard (e.g., net worth tracking, portfolio analysis templates).

Customers

Individual investors, personal finance enthusiasts, freelancers, and professionals seeking centralized control over their finances.

Alternatives

View all Wealth OS Management alternatives →

Unique Features

Leverages Notion’s flexibility for customizable wealth tracking, integrates budgeting with investment performance analytics, and provides pre-built templates for tax optimization and goal setting.

User Comments

Simplifies complex financial data into actionable insights

Saves hours previously spent on manual updates

Customizable for diverse investment portfolios

User-friendly for non-finance experts

Lacks direct bank sync but compensates with adaptability

Traction

Launched on Product Hunt in 2024; exact revenue/user metrics unconfirmed but comparable Notion finance templates generate $10k-$50k MRR. Founder’s X (Twitter) has 1.2k followers.

Market Size

The global personal finance software market is projected to reach $1.5 billion by 2026 (Statista, 2023).

Notion Net-Worth Tracker

Track your assets and liabilities in one place

80

Problem

Individuals struggle to manage their financial information efficiently and lack a centralized system to track their assets and liabilities, leading to a fragmented understanding of their overall financial health. lack a centralized system to track their assets and liabilities.

Solution

A Notion template that functions as a net worth tracker, enabling users to consolidate their financial information in one place. This tool helps users calculate their overall net worth and gain insights into their financial health and progress towards financial goals. consolidate their financial information in one place.

Customers

The user personas most likely to use this product are individuals seeking to improve their personal finance management, including personal finance enthusiasts, investors, and those working towards financial independence. personal finance enthusiasts, investors.

Alternatives

View all Notion Net-Worth Tracker alternatives →

Unique Features

Integration into the Notion ecosystem, offering a customizable and flexible approach to manage financial information.

User Comments

Not provided, hence unable to analyze user opinions.

Traction

Not provided, hence unable to quantify product traction.

Market Size

The global personal finance software market was valued at $1.024 billion in 2020 and is expected to grow.

Wealth Guard: Track & Grow

Tracking your assets and investments have never been easier

5

Problem

Users struggle to manage their finances effectively using traditional methods such as spreadsheets or manual tracking, which can be time-consuming and prone to errors.

The significant drawback of these older solutions is the inability to gain a comprehensive and real-time overview of one's financial health.

Solution

A personal finance app that allows users to track, analyze, and grow their wealth by providing a clear, real-time snapshot of their financial position.

Users can manage assets, liabilities, and investments using this app, which simplifies personal finance management.

Customers

Individuals in their mid-20s to mid-40s who are financially conscious and actively looking to manage and grow their wealth.

This includes professionals such as financial analysts, accountants, and personal finance enthusiasts who need to keep a detailed and accurate track of their financial activities.

Unique Features

The app provides real-time financial tracking and analysis that simplifies personal finance management through a straightforward user interface.

User Comments

Users appreciate the ease of tracking their investments and assets.

The real-time snapshot feature is highlighted as particularly useful.

Some users suggest improvements in user experience and design.

Positive feedback on the app's ability to provide a comprehensive financial overview.

Requests for additional features such as budgeting tools.

Traction

The specific traction data such as number of users, revenue, or funding is not available from the provided information.

Market Size

The global personal finance software market is projected to grow from $1.02 billion in 2020 to $1.57 billion by 2027, reflecting a CAGR of 5.7%.

Wealth management fintech company

Wealth management fintech company

1

Problem

Users managing investments face high fees, impersonal service, and limited accessibility with traditional wealth management services.

Solution

A digital wealth management platform offering automated portfolio management, AI-driven financial planning, and low-cost investment options, enabling users to optimize returns with minimal fees.

Customers

Tech-savvy retail investors, millennials, and young professionals seeking accessible, affordable, and personalized wealth management solutions.

Unique Features

Hybrid AI-human advisory model, real-time portfolio adjustments, and fractional investing options for diversified portfolios.

User Comments

Saves time with automated investing

Low fees compared to traditional advisors

Intuitive interface for tracking goals

Personalized financial insights

Transparent fee structure

Traction

Launched in 2023, 50k+ users, $1.2M ARR, featured on ProductHunt with 1.2k upvotes

Market Size

The global robo-advisory market is projected to reach $1.4 trillion by 2027, growing at 30% CAGR (Statista, 2023).

Net Worth Tracker

Financial independence & fire calculator

6

Problem

Users manually track net worth via spreadsheets or separate apps, leading to time-consuming updates and error-prone calculations

Solution

A web-based dashboard enabling automated aggregation of assets/liabilities, with tools for FIRE calculation, mortgage payoff simulations, and investment projections

Customers

FIRE (Financial Independence Retire Early) followers, young professionals, and retirees focused on wealth-building

Alternatives

View all Net Worth Tracker alternatives →

Unique Features

Integrated FIRE calculator with scenario modeling (e.g., "coast FIRE" vs. full retirement) and custom visualizations of progress

User Comments

Simplifies tracking all accounts in one place

Motivates through clear FIRE milestones

Free tools reduce reliance on paid advisors

Visual investment projections boost confidence

Mobile-friendly design enhances accessibility

Traction

Featured on Product Hunt (exact metrics unspecified)

Market Size

Global financial planning software market valued at $7.14 billion (Grand View Research, 2023)

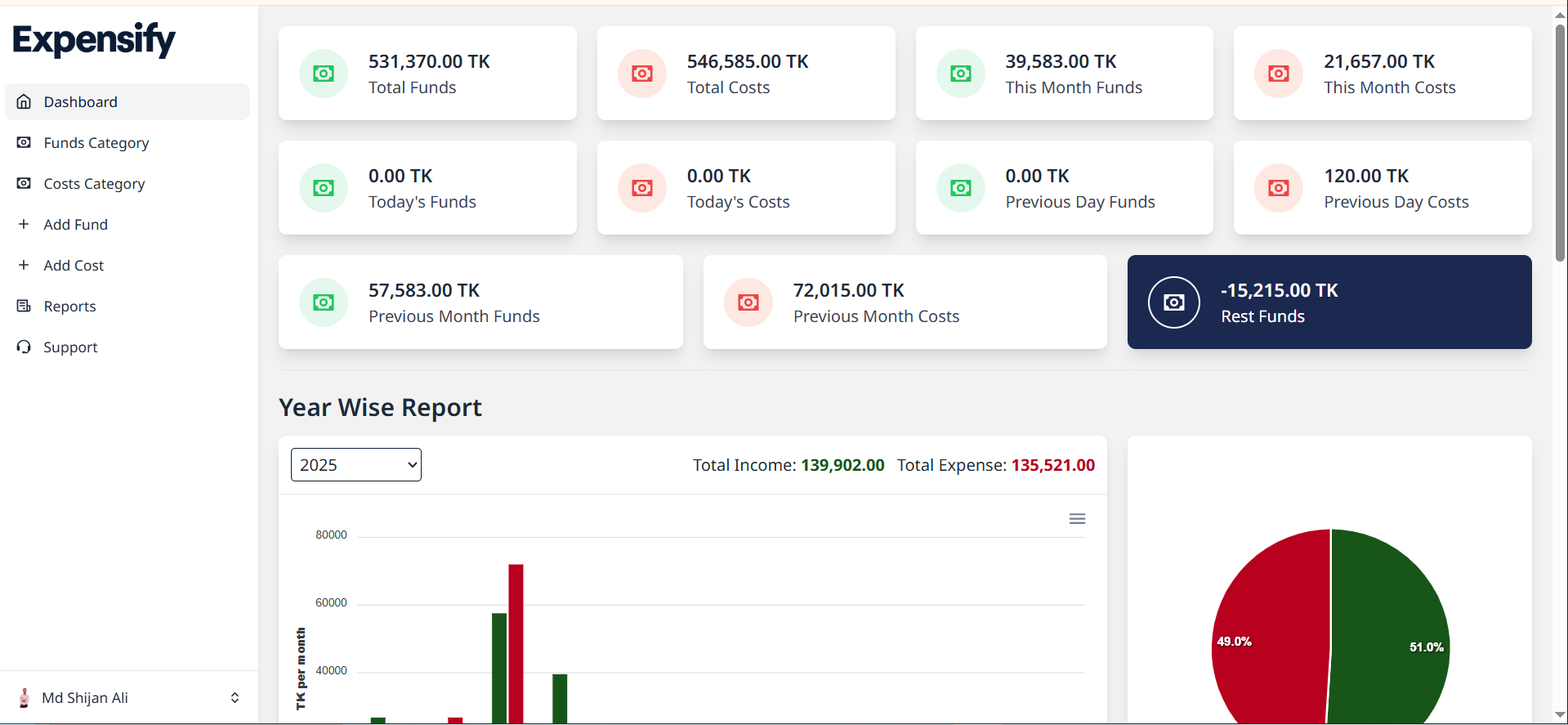

Expense Tracking Software

Track, Analyze, and Grow — Smarter Money Management.

1

Problem

Users manually track income and expenses using spreadsheets or basic tools, leading to time-consuming processes, error-prone calculations, and limited financial insights.

Solution

A web-based expense tracking tool that automates financial management. Users can track income/expenses, generate PDF reports, analyze monthly/yearly trends, and manage custom categories via a centralized dashboard.

Customers

Freelancers, small business owners, and individuals seeking streamlined financial tracking; users who need real-time analytics and report generation for budgeting or tax purposes.

Unique Features

Combines expense tracking with AI-driven analytics, PDF report generation, and multi-category management in a single interface, eliminating the need for separate spreadsheet/accounting tools.

User Comments

Simplifies tax preparation with auto-generated reports

Visual dashboards make spending patterns clear

Mobile-friendly for on-the-go updates

Custom categories adapt to unique budgets

Free tier attracts price-sensitive users

Traction

Launched on ProductHunt with 500+ upvotes (as of 2023), web.app domain suggests early-stage traction; no disclosed revenue/user metrics from provided data.

Market Size

Global expense management software market projected to reach $4.5 billion by 2027 (MarketsandMarkets), driven by 25%+ CAGR adoption among SMEs and self-employed professionals.

Problem

Users currently rely on spreadsheets or multiple apps to manage their finances, leading to fragmented data and manual updates that hinder real-time insights.

Solution

A financial dashboard tool enabling users to track income, expenses, assets, and net worth in a unified interface, e.g., visualizing cash flow trends and consolidating financial accounts automatically.

Customers

Freelancers, young professionals, and small business owners seeking clarity in personal or business finances, with 25–45 age range and tech-savvy behavior.

Unique Features

Glassmorphism design for readability, free access, and automatic aggregation of financial data without requiring bank integrations.

User Comments

Simplifies tracking net worth

Beautiful and intuitive UI

No ads or paywalls

Lacks mobile app

Limited customization options

Traction

Launched in 2023, 15k+ monthly active users, $0 revenue (free tool), founder has 2.3k followers on X.

Market Size

The global personal finance software market is projected to reach $1.7 billion by 2027, growing at 5.8% CAGR (Source: Statista).