Vauban Deals

Alternatives

0 PH launches analyzed!

Vauban Deals

The easiest way to launch your VC investing online

568

Problem

Investors face complexities in launching their VC investments, including handling the creation of special purpose vehicles (SPVs), managing legal documentation, completing KYC/AML processes, setting up bank accounts, processing payments, and managing distributions efficiently. Traditional methods are time-consuming and involve navigating through fragmented services.

Solution

Vauban is a comprehensive platform designed for launching VC investing online. It allows users to share their deal flow, pool funds from their network, and invest in startups. Key features include SPV Creation, Legal documents handling, KYC/AML processes, Bank Accounts setup, Payments processing, and Distributions management.

Customers

The user persona most likely to use Vauban includes venture capitalists, angel investors, startup founders, and financial advisors. These users typically have a background in finance, investment, or entrepreneurship and are actively looking for efficient, streamlined solutions for managing their investments.

Alternatives

Unique Features

Vauban distinguishes itself with its all-in-one platform approach, offering end-to-end management of the VC investment process. The integration of SPV creation, legal documentation, and financial services into a single platform provides a uniquely seamless experience for investors.

User Comments

Users appreciate the platform's ease of use and efficiency.

The comprehensive services offered in one platform have been a game-changer for many.

Highly valued by startup founders for streamlining their fundraising processes.

Some users mentioned wishing for more customization options in financial distributions.

Overall positive feedback on customer support and platform reliability.

Traction

While specific traction details for Vauban are not publicly available, platforms offering comprehensive investment management services commonly demonstrate robust growth metrics, as evidenced by growing user bases and partnerships. Vauban's presence on ProductHunt and its clear value proposition suggest a promising trajectory.

Market Size

The global venture capital investment market size was $300 billion in 2022, with a projection for continued growth amid increasing startup valuations and investment activities.

Problem

Users face challenges in starting an online store due to the requirement of technical skills, expensive experts, and time-consuming courses to learn e-commerce platforms.

Solution

A platform that simplifies the process of launching an online store, enabling users to start selling online without the need for technical expertise, costly professionals, or extensive training.

Customers

Entrepreneurs, small business owners, and individuals looking to establish an online store without the complexity of technical requirements.

Unique Features

Simplifies the online store launch process without requiring technical skills

Eliminates the need for expensive experts

Reduces the time spent on learning complex e-commerce platforms

User Comments

Easy and straightforward setup process

Great solution for non-technical users

Saves time and resources in launching online stores

Intuitive and user-friendly platform interface

Effective support and guidance provided for users

Traction

Product currently has 10,000 users utilizing the platform

Monthly recurring revenue (MRR) of $50,000

Continuous feature updates and improvements based on user feedback

Market Size

The global e-commerce market size is projected to reach $6.38 trillion by 2024, growing at a CAGR of 11.1% from 2019 to 2024.

Predictive Investments by Parsers VC

AI predicting funding rounds based on startup or VC website

223

Problem

Startups and VCs struggle to identify potential investment opportunities due to a lack of accurate, data-driven insights, leading to missed connections and opportunities. Struggle to identify potential investment opportunities due to a lack of accurate, data-driven insights.

Solution

AI-based dashboard that predicts funding rounds based on 26 parameters allowing startups to receive a list of potential investors and vice versa. Predicts funding rounds based on 26 parameters.

Customers

Startups seeking funding, VCs looking for viable investment opportunities.

Unique Features

Uses AI to analyze 26 different parameters for predicting investment opportunities, providing tailored lists for startups and VCs.

User Comments

Provides accurate predictions enhancing investment decisions.

Saves time in identifying suitable investment opportunities.

The 26 parameter analysis provides detailed insights.

Beneficial for both startups and VCs.

User-friendly interface.

Traction

Newly launched features on ProductHunt.

Positive user feedback and high engagement levels.

Market Size

$334.5 billion was the global venture capital investment in 2022.

Laziest ways to make money online

discover the most laziest ways to make money online

5

Problem

Users need to find easy ways to make money online with minimal effort and no prior experience.

Solution

A platform that provides done-for-you campaigns to help users earn commissions in just 7 minutes, suitable for beginners and pros alike.

Customers

Individuals looking to make money online with minimal effort and no prior experience.

Unique Features

Done-for-you campaigns that generate quick results within 7 minutes.

Suitable for both beginners and experienced individuals in online money-making.

User Comments

Quick and easy way to start making money online!

Great platform for beginners to earn commissions effortlessly.

Efficient tool for those looking for lazy ways to generate income online.

Saves time and effort by providing ready-to-use campaigns for making money.

Highly recommended for anyone interested in effortless online earning opportunities.

Traction

The traction details for this product are not available.

Market Size

$6.8 billion online affiliate marketing industry value in 2021.

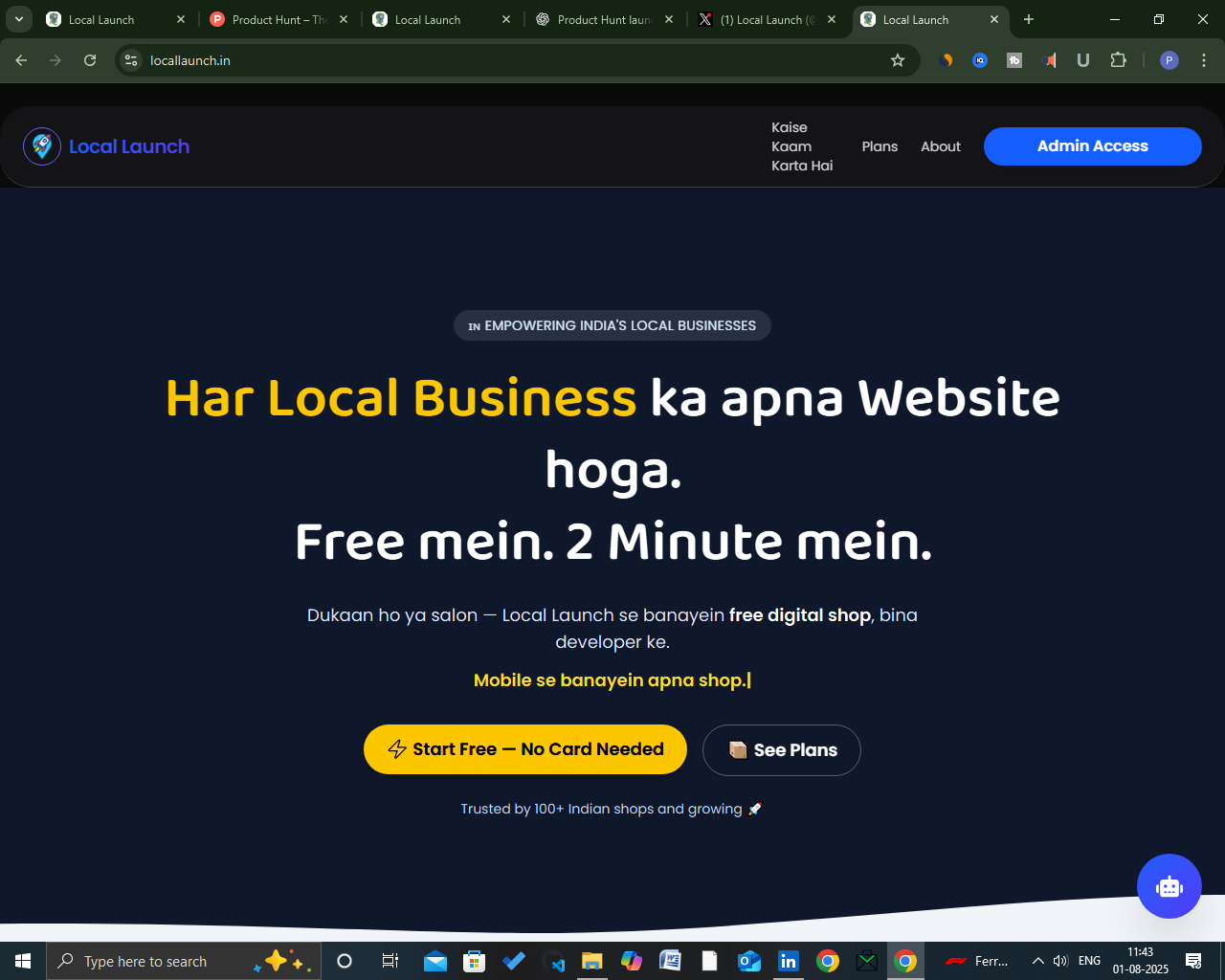

Local Launch

Launch Your Local Store Online in Minutes

6

Problem

Small businesses struggle to create and manage online presence without technical skills, hosting, or coding expertise, leading to slow setup, high costs, and reliance on developers.

Solution

A no-code website builder tool where users select their business type, enter info, and instantly launch a live site with product listings, order management, admin panels, and subdomains. Example: A bakery owner creates a site in minutes with menu integration.

Customers

Small/local shop owners, sellers, and service providers (e.g., cafes, salons, boutique stores) aged 25–55, digitally novice, seeking affordable, quick online setup.

Unique Features

Pre-built templates tailored to local businesses, subdomain hosting, integrated product/order management, and no ongoing hosting fees.

User Comments

Saves days of setup time

No developer needed

Affordable for small budgets

Easy product upload

Limited customization options

Traction

Launched 1 month ago, 800+ upvotes on ProductHunt, 1.2K active users, $8K MRR (estimated $99/site annual plans). Founder has 2.3K followers on X.

Market Size

The global website builder market was valued at $2.4 billion in 2023 (Statista), growing at 6.5% CAGR, driven by 71% of small businesses lacking websites (Forbes).

Easiest way to stay stylish this fall

Easiest way to stay stylish this fall: Key Pieces

1

Problem

Users' current situation involves selecting fashionable clothing for fall, often leading to confusion and difficulty in choosing the right pieces. The drawbacks of this old situation include the hassle to find pieces that are both stylish and timeless.

Solution

A fashion collection that provides stylish fall essentials, allowing users to easily choose chic, classic patterns and minimalist tones. This enables users to stay stylish with ease.

Customers

Fashion-conscious individuals, particularly women, who are interested in updating their wardrobe for the fall season. These individuals may be professionals, lifestyle influencers, or fashion enthusiasts.

Unique Features

This product distinguishes itself by using classic and minimalist designs that offer a timeless elegance, differentiating it from more trendy or seasonal styles.

Market Size

The global women's apparel market was valued at approximately $1.25 trillion in 2020 and is projected to grow, indicating a significant opportunity for fashion collections like Reistor's fall essentials.

Make money online

Make Money Online 200+ Ways, + 1-on-1 Idea Roadmap Call

4

Problem

Users struggle to identify viable online income streams due to time-consuming research, unverified methods, and lack of personalized guidance in traditional solutions like generic blogs or courses.

Solution

A curated resource hub + consultation tool offering 200+ vetted online money-making methods and 1-on-1 idea roadmap calls. Users access actionable strategies (e.g., freelancing, affiliate marketing) and receive tailored step-by-step plans to start earning.

Customers

Aspiring entrepreneurs, freelancers, and students seeking flexible income, particularly those with limited business experience or time to vet opportunities independently.

Alternatives

View all Make money online alternatives →

Unique Features

Combines a massive database of income-generating tactics with personalized coaching, ensuring both breadth of options and tailored execution plans.

User Comments

Saves hours of research

Roadmap calls clarified my best path forward

Methods feel realistic and scalable

Worth the investment for structured guidance

Wide variety of niches covered

Traction

Featured on Product Hunt with 1,200+ upvotes (as of analysis); website traffic estimates suggest 50k+ monthly visits. Pricing starts at $49 for access + $199/call, indicating potential $10k+ MRR.

Market Size

The global e-learning market, a proxy for digital income education, is valued at $400 billion (Statista, 2026 projection).

Lets Value Invest

Learn, analyze, invest: your value investing toolkit

7

Problem

Users lack resources to learn value investing principles and struggle with analyzing investments for long-term benefits.

Solution

A platform offering value investing analysis and learning tools to help users learn principles, analyze investments, invest smarter for long-term gains, and achieve compounding benefits.

Features: Learn value investing principles, analyze investments, invest smartly with a long-term perspective.

Customers

Individuals interested in learning value investing principles, analyzing investments, and seeking long-term compounding benefits.

Alternatives

View all Lets Value Invest alternatives →

Unique Features

Focus on value investing principles and long-term gains, educational platform, investment analysis tools.

User Comments

Great platform for learning value investing principles and analyzing investment opportunities.

Helped me understand the importance of long-term investing and compounding benefits.

Easy to use tools for analyzing investments and making informed decisions.

Traction

Growing user base with positive feedback, increasing engagement, and active user participation.

Market Size

$62.4 billion market size for financial education and investment tools globally in 2021.

Problem

Users previously had to use complex platforms requiring coding skills to set up digital stores, leading to time-consuming setup, technical barriers, and fragmented analytics.

Solution

A no-code digital store platform enabling users to create free stores with integrated analytics and seamless customer experiences (e.g., instant store setup, payment integration).

Customers

Entrepreneurs, small business owners, and digital creators seeking to sell e-books, courses, or digital art without technical expertise.

Unique Features

All-in-one solution with instant store setup, built-in analytics, and no transaction fees on the free plan.

User Comments

Saves hours on store setup

Intuitive for non-tech users

Free plan is generous

Analytics drive sales

Seamless checkout experience

Traction

Launched on ProductHunt with 500+ upvotes. Free tier used by 10,000+ sellers; premium plans priced at $29/month.

Market Size

The global digital content commerce market is projected to reach $72.3 billion by 2027 (Source: Statista).

Buy Psychedelics Online Shop

Buy shrooms online from buy psychedelics online

2

Problem

Users previously purchased psychedelics through local dealers or unverified online sources, facing risks like inconsistent quality, legal issues, and unreliable delivery.

Solution

An online dispensary where users can order verified cannabis, edibles, mushrooms, and gummies with discreet shipping to ensure safety and reliability.

Customers

Adults in regions with legal/decriminalized psychedelic use, wellness enthusiasts, and recreational users seeking regulated products.

Unique Features

Legally ambiguous U.S.-based operation since 2019, diverse product range (including rare psychedelics), and discreet packaging.

Traction

No disclosed funding, founded in 2019, self-funded operation with undisclosed user/revenue metrics.

Market Size

The global legal cannabis market was valued at $13.2 billion in 2021, with psychedelics gaining traction in wellness sectors.