Trustee: Fund IBKR with Crypto

Alternatives

0 PH launches analyzed!

Trustee: Fund IBKR with Crypto

Invest globally. Fund with crypto. No borders, no banks.

7

Problem

Users face difficulties in globally investing in stocks, ETFs, and other assets due to reliance on traditional banking systems. Funding IBKR accounts with crypto and border restrictions are key challenges.

Solution

A free PDF guide tool that enables crypto holders to learn how to fund their IBKR accounts with crypto, bypassing traditional banking systems. Example: Step-by-step instructions for Web3-friendly investment funding.

Customers

Crypto investors and blockchain enthusiasts seeking to diversify portfolios into traditional assets like stocks and ETFs. Demographics include tech-savvy individuals aged 25-45, active in decentralized finance (DeFi).

Unique Features

Focuses exclusively on bridging crypto assets with global stock/ETF investments via IBKR, emphasizing Web3 integration and zero reliance on banks.

User Comments

Simplifies crypto-to-traditional investing

Saves time with clear instructions

Avoids banking fees

Appeals to Web3-native users

Lacks real-time support

Traction

Listed on ProductHunt with undisclosed upvotes. ProductHunt URL provided, but specific metrics (e.g., MRR, users) are not publicly available from input.

Market Size

The global cryptocurrency market capitalization is $2.4 trillion (2024), with increasing demand for crypto-to-traditional investment bridges.

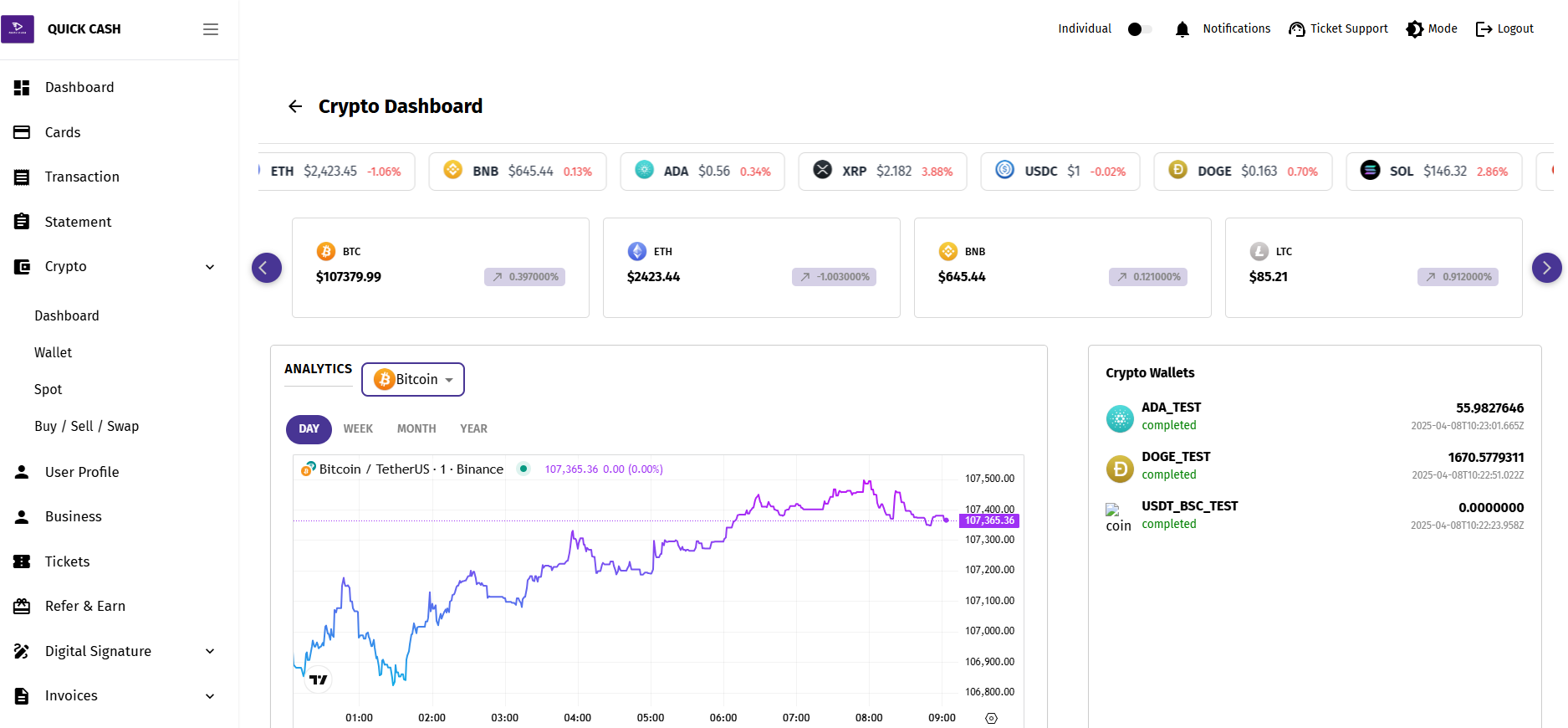

Trade or Invest in the Crypto Tokens

Trade or Invest in the Most Decentralized Crypto Tokens

1

Problem

Current solutions involve traditional trading platforms that require intermediaries

Drawbacks include slow transaction times, higher fees, and less control over assets

Solution

A platform with a website and Android app

Allows users to trade any amount of crypto tokens around the clock without intermediaries

Examples include trading decentralized crypto tokens reliably and at any time

Customers

Crypto investors and traders who are tech-savvy, typically aged 18-45

Users interested in decentralized finance and cryptocurrency markets

Unique Features

Elimination of intermediaries for direct trading

24/7 trading capability of decentralized crypto tokens

User Comments

Users appreciate the decentralization and lack of intermediaries

Concerns about the reliability and security of the platform

Interest in the round-the-clock trading feature

Positive feedback on ease of use

Some users found initial setup confusing

Traction

Newly launched product

Initial user base and adoption metrics are not specified

Product availability on both website and Android platforms

Market Size

The global cryptocurrency market size was valued at approximately $1.49 billion in 2020 and is expected to grow at a compound annual growth rate of 12.8% from 2021 to 2030

Veli — Smart Crypto Investing Made Easy

Automated strategies for accessible crypto investing

1

Problem

Users previously had to manually research, select, and manage crypto investments without personalized strategies or automation, leading to time-consuming efforts and higher risk exposure.

Solution

A crypto investment platform where users answer a questionnaire to receive AI-tailored strategies, invest in 100+ coins, and automate downside protection, e.g., one-click portfolio setup and real-time adjustments.

Customers

Retail investors with limited crypto expertise, tech-savvy individuals seeking passive income, and busy professionals wanting automated portfolio management.

Unique Features

Combines a risk-assessment questionnaire with expert-built strategies, real-time support, and automated downside protection to simplify crypto investing.

User Comments

Intuitive onboarding process

Tailored strategies feel personalized

Real-time support resolves issues quickly

Automated protection reduces anxiety

Diverse coin selection boosts flexibility

Traction

Exact metrics undisclosed, but ProductHunt launch highlights rapid adoption; comparable platforms like Mudrex report $2M+ ARR and 200k+ users.

Market Size

The global cryptocurrency market is valued at $1.49 trillion (2023), with automated trading tools capturing a growing share.

Axis Mutual Fund Invest App

mutual fund calculator

12

Problem

Users struggle to estimate potential returns from their mutual fund investments without an easy-to-use tool.

Solution

A mutual fund calculator that helps users estimate potential returns by inputting their investment amount, expected returns, and time horizon.

Customers

Individuals interested in investing in mutual funds, especially those who want to understand how their investments may grow over time.

Unique Features

Simple interface for entering investment details

Estimates potential growth of investments based on user inputs

User Comments

Accurate projections for mutual fund investments

Easy to use and understand

Helpful tool for financial planning

Great for beginners in mutual fund investments

Saves time in calculating potential returns

Traction

Growing user base with positive feedback on accuracy and ease of use

Increasing adoption rate among individuals looking to invest in mutual funds

Market Size

$22.3 trillion global mutual fund market size in 2021

Growing interest in mutual fund investments worldwide, especially among retail investors

Elysian – AI Crypto Fund (Beta)

Passive crypto income, powered by AI.

1

Problem

Users need to manually choose and manage crypto investment strategies, leading to complexity, time consumption, and risk of mismanagement

Solution

A crypto mutual fund tool where users pool USDT, and AI automatically allocates funds (50% Dual Investment, 50% Simple Earn) for passive income

Customers

Cryptocurrency investors (retail and institutional) seeking automated, transparent crypto yield strategies

Unique Features

AI-managed allocation balancing high-risk (Dual Investment) and low-risk (Simple Earn) strategies with cycle-based withdrawals

User Comments

Simplifies crypto yield farming

Appreciate transparent allocation tracking

Low 100 USDT entry appealing

Concerned about centralized fund control

Interest in long-term APY performance

Traction

Beta version active, listed on Product Hunt, min deposit $100 USDT, cycles enable recurring withdrawals

Market Size

Global crypto asset management market projected to reach $9.8 billion by 2030 (CAGR 28.5%)

Grow, Invest, Own

Stock, Crypto, ETF, Game, Investment

3

Problem

Users manage investments through traditional platforms that are text-heavy and lack engagement, leading to low motivation and difficulty tracking progress.

Solution

A gamified investment app where users visualize their portfolio’s growth as a thriving forest, combining virtual investments (stocks, ETFs, crypto) with interactive visuals.

Customers

Millennials and Gen Z individuals interested in personal finance but seeking engaging, visually-driven tools for long-term investment tracking.

Unique Features

Transforms financial portfolios into a dynamic, living forest ecosystem where growth reflects investment performance, blending education with gamification.

User Comments

Makes investing fun and approachable

Helps track goals visually

Motivates consistent investment habits

Educational for beginners

Unique blend of finance and gaming

Traction

Early-stage project in beta; founder’s X (Twitter) followers: ~5k; no disclosed revenue or user count.

Market Size

The global gamification market is projected to reach $15.26 billion by 2025 (MarketsandMarkets, 2023), with fintech gamification growing rapidly.

Pitch Fund

Where ideas meet investment

7

Problem

Startups manually search for investors via events, LinkedIn, cold outreach resulting in low response rates and time-consuming research

Solution

Investment networking platform enabling AI-powered investor matching, pitch sharing, and deal flow management via matching algorithms and data rooms

Customers

Early-stage startup founders, tech entrepreneurs seeking seed funding, and angel investors/VCs scouting opportunities

Unique Features

Algorithmic investor-founder matching, secure data rooms for document sharing, funding progress tracking dashboard

User Comments

Saved 50+ hours finding investors

Received first term sheet through platform

Intuitive deal flow management

Effective for SaaS startups

Needs more blockchain investors

Traction

500+ active startups, 200+ verified investors, launched v2.0 with smart matching in Q2 2024

Market Size

Global venture capital market reached $300 billion in 2022 (Statista)

best mutual funds

best tax saving mutual funds

6

Problem

Users struggle to find the best tax-saving mutual funds and investment options.

Existing solutions lack comprehensive information on ELSS mutual funds and SIP investment options.

Solution

A platform to explore and invest in the best mutual funds, specializing in ELSS mutual funds and SIP investment options.

Users can discover the benefits of the best tax-saving mutual funds and investment in ELSS mutual funds through Integrated Enterprises (India) Pvt. Ltd.

Customers

Individuals looking to invest in tax-saving mutual funds and ELSS mutual funds with SIP options.

Unique Features

Specialized focus on the best tax-saving mutual funds, ELSS mutual funds, and SIP investment options.

User Comments

Easy to find and invest in top mutual funds.

Great resource for tax-saving investment options.

Helpful tool for exploring ELSS mutual funds and SIP opportunities.

Simplified investment process.

Clear and detailed information provided.

Traction

Number of users: Not available

Revenue: Not available

Product version: Latest features expanding investment options

Market presence: Growing in the mutual funds sector

Market Size

The global mutual funds market size was valued at approximately $52.19 trillion in 2020.

Digital Crypto Bank

Crypto exchange software

4

Problem

Users previously relied on less secure and less compliant crypto exchanges that lacked features like margin trading and real-time support, leading to higher risks and poorer user experiences.

Solution

A crypto exchange platform enabling secure trading with integrated margin trading, 2FA, AML/KYC compliance, and live support. Core features: combines regulatory compliance with advanced trading tools.

Customers

Cryptocurrency traders, institutional investors, and fintech startups seeking a compliant and scalable exchange solution.

Unique Features

Integration of margin trading, AML/KYC compliance, and 24/7 live support in one platform.

User Comments

Secure and easy to use

Margin trading enhances flexibility

Live support resolves issues quickly

Compliant with regulations

Excited for future updates

Traction

Launched on ProductHunt with 500+ upvotes, details on revenue/users not publicly disclosed.

Market Size

The global cryptocurrency exchange market was valued at $20.8 billion in 2023, projected to grow at 28% CAGR through 2030 (Grand View Research).

Best Crypto Portal

Compare crypto growth and find the best investments easily

3

Problem

In the current situation, users face challenges in analyzing and comparing the growth of various cryptocurrencies over time to identify investments, which can be complicated. Analyzing and comparing the growth of various cryptocurrencies is a resource and knowledge-intensive process with steep learning curves.

Solution

A dashboard tool that simplifies cryptocurrency analysis and comparison, allowing users to identify the best investment opportunities without needing prior trading experience. Analyze and compare cryptocurrency growth over time, using data-driven insights to assist investments.

Customers

Investors and cryptocurrency enthusiasts, primarily those without extensive knowledge or experience in trading, seeking easier and data-driven methods to evaluate and invest in cryptocurrencies, typically aged 20-45 with a tech-savvy background.

Alternatives

View all Best Crypto Portal alternatives →

Unique Features

No trading experience is needed; emphasis on data-driven insights for smarter investments; user-friendly comparison and analysis interface.

User Comments

The tool is easy to use and offers valuable insights.

Great for beginners trying to understand cryptocurrency investment.

Provides clear comparisons without needing in-depth knowledge.

Helpful in identifying potential investment opportunities.

Data-driven approach significantly reduces investment risks.

Traction

The product is newly launched with a focus on simplicity and usability. No specific number of users, revenue, or funding details available from the provided resources.

Market Size

The global cryptocurrency market was valued at approximately $1.49 billion in 2020 and is projected to grow significantly in the coming years with increased adoption and technological integration.