StockAlgos.com Insiders Tool

Alternatives

0 PH launches analyzed!

StockAlgos.com Insiders Tool

Analyze insider trading to make strategic investments

221

Problem

Investors often struggle to make informed decisions due to a lack of access to insider trading data and patterns. The drawbacks of this old situation include limited visibility on insider sentiments and potential missed opportunities for strategic investments.

Solution

The product is a data analytics tool that enables users to analyze insider trading data to make strategic investments. It filters and sorts through various data to match search criteria, allowing investors to see insider trading and selling patterns.

Customers

The primary users are likely to be retail investors, financial analysts, and hedge funds who are seeking advanced tools to gain insights into insider trading activities for better investment decisions.

Unique Features

The unique feature of this solution is its ability to provide access to comprehensive insider trading data and patterns, which are not readily available to the general public. It offers a competitive edge in strategic investment planning.

User Comments

Users appreciate the insight into insider trading data.

Highly valued for making informed investment decisions.

Simplifies the process of identifying strategic investment opportunities.

Positive feedback on the usability and functionality of the tool.

Some users wish for more advanced filtering options.

Traction

Due to restrictions on accessing ProductHunt and the product's website, specific traction metrics such as user count, MRR/ARR, or financing details are not available.

Market Size

The global financial analytics market is expected to reach $11.4 billion by 2023, reflecting the demand for advanced analytical tools in financial decision-making.

Trade or Invest in the Crypto Tokens

Trade or Invest in the Most Decentralized Crypto Tokens

1

Problem

Current solutions involve traditional trading platforms that require intermediaries

Drawbacks include slow transaction times, higher fees, and less control over assets

Solution

A platform with a website and Android app

Allows users to trade any amount of crypto tokens around the clock without intermediaries

Examples include trading decentralized crypto tokens reliably and at any time

Customers

Crypto investors and traders who are tech-savvy, typically aged 18-45

Users interested in decentralized finance and cryptocurrency markets

Unique Features

Elimination of intermediaries for direct trading

24/7 trading capability of decentralized crypto tokens

User Comments

Users appreciate the decentralization and lack of intermediaries

Concerns about the reliability and security of the platform

Interest in the round-the-clock trading feature

Positive feedback on ease of use

Some users found initial setup confusing

Traction

Newly launched product

Initial user base and adoption metrics are not specified

Product availability on both website and Android platforms

Market Size

The global cryptocurrency market size was valued at approximately $1.49 billion in 2020 and is expected to grow at a compound annual growth rate of 12.8% from 2021 to 2030

Lets Value Invest

Learn, analyze, invest: your value investing toolkit

7

Problem

Users lack resources to learn value investing principles and struggle with analyzing investments for long-term benefits.

Solution

A platform offering value investing analysis and learning tools to help users learn principles, analyze investments, invest smarter for long-term gains, and achieve compounding benefits.

Features: Learn value investing principles, analyze investments, invest smartly with a long-term perspective.

Customers

Individuals interested in learning value investing principles, analyzing investments, and seeking long-term compounding benefits.

Alternatives

View all Lets Value Invest alternatives →

Unique Features

Focus on value investing principles and long-term gains, educational platform, investment analysis tools.

User Comments

Great platform for learning value investing principles and analyzing investment opportunities.

Helped me understand the importance of long-term investing and compounding benefits.

Easy to use tools for analyzing investments and making informed decisions.

Traction

Growing user base with positive feedback, increasing engagement, and active user participation.

Market Size

$62.4 billion market size for financial education and investment tools globally in 2021.

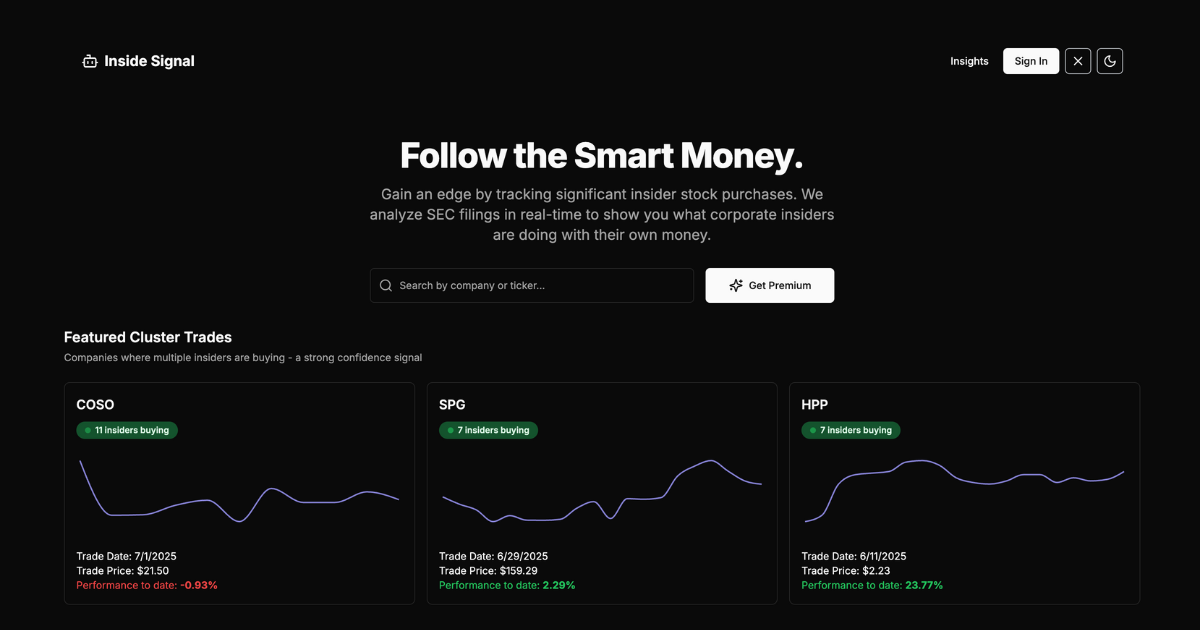

Insider Signal AI

AI-driven platform analyzing insider trading

3

Problem

Users manually track SEC filings to follow insider trades, which is time-consuming and inefficient. Analysis is often delayed or lacks real-time insights.

Solution

AI-driven platform that analyzes SEC filings in real-time, enabling users to track significant insider stock purchases through automated alerts and dashboards.

Customers

Individual investors, financial analysts, and stock traders seeking data-driven investment strategies (demographics: 25–50 years old, tech-savvy professionals).

Alternatives

View all Insider Signal AI alternatives →

Unique Features

Real-time SEC filing analysis, prioritization of high-impact trades via AI, customizable alerts, and portfolio integration tools.

User Comments

Saves hours of manual research

Timely alerts improve trade decisions

User-friendly interface for non-experts

Accurate filtering of meaningful trades

Enhances portfolio performance

Traction

Launched in 2023, 1,000+ active users (estimated via Product Hunt engagement), founder has 2,200+ followers on X (per linked profile).

Market Size

The global stock trading platform market reached $8.6 billion in 2022 (Statista 2023), with AI-driven analytics growing at 24% CAGR.

Investing.one

Unlimited commission-free investing

6

Problem

Users face commission fees and lack of fractional shares or insider insights with traditional brokerage platforms, limiting accessibility and informed decision-making.

Solution

A commission-free investing platform enabling users to trade stocks/ETFs without fees, buy fractional shares, and access insider trading data (e.g., real-time SEC filings).

Customers

Retail investors, particularly millennials, Gen Z, and new investors seeking low-cost, accessible tools to build portfolios.

Alternatives

View all Investing.one alternatives →

Unique Features

Combines zero-commission trades, fractional shares, and curated insider trading signals in one interface.

User Comments

Saves on fees for small trades

Easy fractional investing

Useful insider data

Beginner-friendly UI

No account minimums

Traction

1k+ Product Hunt upvotes (2023 launch), 4.8/5 average rating, claims $1M+ user assets under management

Market Size

The $15.8B global online brokerage market (2023) is projected to grow at 8.1% CAGR through 2030 (Grand View Research).

AI Crypto Trading Bot

Launch your own AI Trading Bot for Crypto Trading

7

Problem

In the current situation, users involved in crypto trading manually have to constantly monitor market trends and make decisions on when to buy or sell, which can be time-consuming and exhausting. It requires continuous attention and understanding of complex market dynamics, leading to potential human error.

Manual monitoring of market trends

Time-consuming and exhausting process

Potential for human error

Solution

An AI crypto trading bot that automates trades using advanced algorithms. Users can have the bot analyze market trends and make optimal buy/sell decisions on their behalf, which enhances efficiency and minimizes risks. For example, a user can launch their own AI trading bot, allowing it to operate and make trading decisions based on real-time market data.

Customers

Crypto investors and traders, particularly those who are active in cryptocurrency markets and might be seeking ways to optimize their trading strategies. This can include both individual investors looking to maximize their profits and institutional investors seeking automated solutions to trading.

Demographics include tech-savvy individuals, aged 25 to 45, with a keen interest in cryptocurrency and investment. User behaviors include frequent use of trading platforms, engagement in crypto communities, and a desire to leverage advanced technological tools.

Alternatives

View all AI Crypto Trading Bot alternatives →

Unique Features

The AI trading bot's capability to analyze market trends and make autonomous trading decisions sets it apart. It leverages advanced algorithms to enhance trading efficiency, minimize risks, and maximize profits, providing a seamless and profitable trading experience for investors.

User Comments

Users find the AI trading bot highly efficient in automating trades.

Many appreciate the minimization of trading risks.

Users see an increase in profitability.

Some users highlight the ease of launching and managing the bot.

A few users mention concerns about initial setup complexity.

Traction

The product has been featured on Product Hunt, showcasing its relevance in the market. Specific quantitative data on users or financing is not provided in the initial information.

Market Size

The global algorithmic trading market was valued at $10.5 billion in 2020 and is expected to grow significantly, with increased adoption of AI technologies by traders across various geographies.

Insider Alert

Get insider trade alerts the moment they come out

13

Problem

Users need to manually track SEC filings or rely on delayed data to monitor insider trades, leading to time-consuming manual tracking and missed opportunities due to delayed information.

Solution

A real-time notification platform that provides instant alerts via email/SMS when SEC Form 4 filings are submitted, enabling users to act promptly on insider trading activity.

Customers

Investors, day traders, and financial analysts seeking timely insights into corporate insider transactions.

Alternatives

View all Insider Alert alternatives →

Unique Features

Direct integration with SEC filings for real-time alerts, bypassing delays in public data dissemination.

User Comments

Saves hours of manual tracking

Alerts are faster than competitors

Crucial for trading decisions

Simple setup process

Reliable notifications

Traction

Launched on Product Hunt with 500+ upvotes and 120+ reviews within 24 hours

Market Size

The global algorithmic trading market, which relies on real-time data, is valued at $14.9 billion (2023) and growing at 10.3% CAGR.

SGB Analyzer

Compare & Analyze Sovereign Gold Bonds (sgbs)

5

Problem

Investors manually compare Sovereign Gold Bond (SGB) prices and track market trends, which is time-consuming and inefficient, potentially leading to missed investment opportunities.

Solution

A data analysis tool enabling users to compare SGB prices, identify discounted bonds, and track market trends for informed decisions (e.g., filtering bonds by discount rates, maturity dates).

Customers

Individual investors, financial advisors, and institutional investors in countries like India, aged 25-55, actively managing gold-based portfolios.

Unique Features

Specialized focus on SGBs with features like real-time discounted bond identification, historical performance tracking, and yield comparison tools.

User Comments

Simplifies SGB analysis

Identifies undervalued bonds quickly

Saves research time

Improves investment decision clarity

User-friendly interface

Traction

Launched on ProductHunt (specific upvotes/revenue data unavailable). Sovereign Gold Bonds issued in India exceeded $5 billion in 2023, indicating a sizable target market.

Market Size

India’s Sovereign Gold Bond market reached $5 billion in annual issuances (2023), with over 40 million ounces of gold held in SGBs as of 2024.

Plancana AI Trading Journal

Track & analyze your trades to level up your day trading

28

Problem

Traders often struggle with effectively tracking and analyzing their trades manually, which can lead to inefficient trading practices and suboptimal performance. The drawbacks of this old situation include difficulties in managing a comprehensive and accurate trading log and planning personalized trading strategies.

Solution

A sleek app that serves as an AI-powered trading journal, offering capabilities to sync with popular trading platforms, provide personalized trading plans, performance tracking, and management of trading psychology.

Customers

Day traders and financial analysts who require tools for detailed trade analysis and performance improvement.

Unique Features

AI-driven personalized trading plans and comprehensive trading psychology management features.

Market Size

The global trading software market was valued at approximately $5.5 billion in 2020 and is expected to grow at a CAGR of 8.1% from 2021 to 2028.

VortexTJ - Trading Journal

Your Ultimate Crypto Trading Journal. Track Analyze Improve.

4

Problem

Crypto traders currently rely on traditional trading journals or spreadsheets to log their trades and analyze performance, which are often manual and cumbersome, leading to potentially inaccurate tracking and lack of real-time insights.

Solution

A crypto trading journal that enables users to log trades and gain key insights with advanced analytics, refining strategies to maximize profitability. Features include performance tracking, trade analysis, and strategy optimization.

Customers

Crypto traders looking to improve their trading performance and profitability. These users are likely to be tech-savvy, predominantly male, aged 25-45, actively engaged in the cryptocurrency market, and seeking advanced tools to aid in decision-making.

Unique Features

Advanced analytics to gain key insights

Capability to refine and optimize trading strategies

Comprehensive logging and tracking functionalities

User Comments

Users appreciate the detailed analytics provided.

The tool is recognized for enhancing strategic trade decisions.

Some users mentioned ease of log entries.

A few expressed interest in additional integrations.

Overall satisfaction with the product's usability.

Traction

The product is newly launched and continuously developing.

Active on ProductHunt with ongoing user acquisition.

Efforts towards building a user base and enhancing features.

Market Size

The global cryptocurrency trading market size was valued at $1.49 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2028.