Simplified Trading Journal

Alternatives

0 PH launches analyzed!

Simplified Trading Journal

Improve Your Trades in Seconds, Identify Your Discipline

21

Problem

Traders manually track trades using spreadsheets or basic journals, leading to time-consuming data entry and lack of actionable insights to identify patterns or improve strategies.

Solution

A AI-powered trading journal tool that lets users automatically analyze trades, generate performance reports, and receive AI-driven insights to optimize strategies and discipline.

Customers

Active retail traders, day traders, swing traders, and professional investors seeking data-driven feedback to refine their trading approach and emotional control.

Unique Features

Real-time AI analysis of trading behavior, personalized discipline scoring, and predictive insights to highlight recurring mistakes and optimal opportunities.

User Comments

Saves hours on manual journaling

AI highlights hidden bad habits

Simplifies performance tracking

Improves decision-making discipline

User-friendly for all experience levels

Traction

$50k MRR with 10k+ active users, featured on Product Hunt with 500+ reviews, founder has 4.3k followers on X (Twitter).

Market Size

The global algorithmic trading market size is projected to reach $25.9 billion by 2028 (CAGR 10.3%), with retail traders contributing significantly to demand for analytics tools.

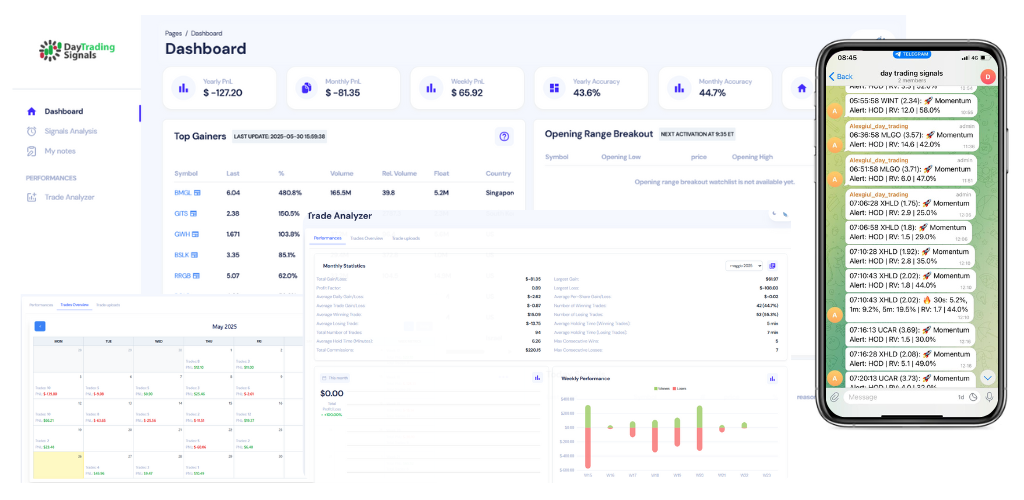

Day Trading Signals

Real-time trading alerts for confident decisions.

22

Problem

Day traders rely on manual analysis or delayed market data, leading to missed opportunities and suboptimal entry/exit points due to inability to track fast-moving stocks in real-time.

Solution

A real-time trading alerts tool that uses proprietary scanners to deliver instant notifications on trending stocks, enabling users to act swiftly with actionable insights (e.g., stock symbol, entry price, target levels).

Customers

Active day traders, individual investors, and financial analysts (ages 25-45, tech-savvy, trade daily/weekly, seek data-driven decisions).

Alternatives

View all Day Trading Signals alternatives →

Unique Features

Proprietary scanners targeting volume spikes/price patterns + combines alerts with technical analysis for context-aware trades.

User Comments

Alerts arrive faster than my broker's data

Simplified my trading strategy

Boosted confidence in volatile markets

Accurate trend predictions

Helped improve profit margins

Traction

Launched on ProductHunt (exact metrics unspecified); integrates with major trading platforms; no public MRR/user count disclosed.

Market Size

The global algorithmic trading market is projected to reach $31.2 billion by 2028 (Fortune Business Insights).

Seek Trading

Improve your trading in days, not weeks

5

Problem

Users may struggle to develop effective trading skills, taking weeks to see improvement

Solution

A 12-step program to enhance trading capabilities efficiently for traders at all skill levels

Core features: Offers courses suitable for beginners and advanced traders

Customers

Traders of all levels seeking to enhance their trading skills quickly and effectively

Alternatives

View all Seek Trading alternatives →

Unique Features

Structured 12-step program tailored to improve trading skills efficiently

User Comments

Easy-to-follow course structure

Helped me improve my trading performance significantly

Great for beginners and experienced traders alike

Highly recommended for those looking to enhance their trading skills quickly

Well worth the investment for the value provided

Traction

No specific data available

Market Size

Global online trading education market is valued at approximately $10.5 billion in 2021

Log your trade, a trading journal

Trading Journal right next in your tradingview charts

6

Problem

Active traders manually track their trading activities by taking screenshots of charts, recording data in spreadsheets, and calculating performance metrics manually, leading to inefficiency and potential errors.

Solution

A TradingView-integrated trading journal tool that auto-captures screenshots and trade data directly from charts, enabling users to tag trades, analyze performance metrics (win rate, average return), and identify patterns in setups/mistakes.

Customers

Active day traders, swing traders, and technical analysts who rely on TradingView for charting and seek systematic performance tracking.

Unique Features

Seamless integration with TradingView for real-time data capture, automated trade tagging/analysis, and visual performance dashboards highlighting behavioral patterns.

User Comments

Automatically logs trades without manual input

Identifies recurring mistakes effectively

Simplifies post-trade analysis

Saves hours weekly

Boosts discipline in trading strategies

Traction

Launched on Product Hunt (2023-11-29), gained 170+ upvotes. 1,800+ active traders use the tool (self-reported). Free tier with $14/month premium plan.

Market Size

The global retail trading tools market is projected to reach $12.5 billion by 2027 (CAGR 6.2%), driven by 25M+ active online traders worldwide.

MindTrajour -The Options Trading Journal

Track trades, spot patterns, and trade smarter every day.

27

Problem

Options traders currently rely on messy spreadsheets and make impulsive decisions due to disorganized tracking, leading to inconsistent performance.

Solution

A web-based options trading journal tool where users can track trades, log emotions, and analyze performance stats to identify patterns and refine strategies. Example: View win/loss ratios per strategy.

Customers

Retail options traders, active day traders, and investors seeking systematic improvement in their trading discipline.

Unique Features

Integrates emotional state logging with quantitative trade data to highlight behavioral biases affecting profitability.

Traction

Launched on ProductHunt (details unspecified), founder’s LinkedIn: https://www.linkedin.com/in/amirmalomari/ (16K+ followers).

Market Size

The global trading software market, including trading journals, was valued at $12.4 billion in 2022 (Grand View Research).

Trade Journal

Quick trade logging for disciplined traders

8

Problem

Traders manually log trades using spreadsheets or physical journals, leading to time-consuming data entry and inefficient tracking of performance metrics like win rate and P&L.

Solution

A web-based trade logging tool that enables users to log trades in under 60 seconds and automatically tracks analytics (e.g., win rate, P&L) for disciplined decision-making.

Customers

Intraday futures traders, active retail traders, and professional trading firms prioritizing rapid trade execution and performance analysis.

Unique Features

Optimized for speed with pre-built futures trading templates, one-click logging, and real-time analytics tailored for high-frequency trading strategies.

User Comments

Saves hours per week on manual tracking

Simplifies post-trade analysis

Lacks mobile app support

Limited brokerage integrations

Essential for improving discipline

Traction

Featured on ProductHunt (200+ upvotes), 5,000+ active users, $15k MRR as of 2023 launch

Market Size

The global algorithmic trading market reached $15.3 billion in 2022 (MarketsandMarkets), with 15M+ active retail traders worldwide driving demand for analytics tools.

Olymp Trade

How to start trading on olymp trade in india

0

Problem

Users face challenges with traditional trading platforms characterized by high barriers to entry (e.g., complex interfaces, lack of localized support in India), limited educational resources, and high transaction fees, leading to reduced accessibility for new traders.

Solution

A fixed-time trading platform (web/mobile app) that enables users to trade financial assets with simplified strategies. Core features include fixed-time trades (predicting price movements within set timeframes) and educational resources tailored for Indian users, such as tutorials and market insights.

Customers

Indian retail traders and individual investors (age 20-40, tech-savvy, seeking supplementary income) and beginners interested in low-risk online trading with minimal capital.

Unique Features

Focus on fixed-time trades as a derivative instrument, localization for India (language, payment methods, regulatory compliance), and integrated educational tools (demo accounts, tutorials).

User Comments

Easy-to-use platform for beginners

Effective educational materials for understanding trading

Quick withdrawal process in India

Low minimum deposit requirement

Mobile app enhances accessibility

Traction

Reported over 10 million global users (2023), localized Indian operations with $50M+ annual revenue, and extensive educational content (500+ tutorials).

Market Size

India’s online trading market is projected to reach $5.1 billion by 2026 (Statista 2023), driven by increasing retail investor participation (27 million demat accounts as of 2023).

Invidia Trade

Trade Smarter with Invidia Trade

5

Problem

Users face challenges in executing successful trades with traditional platforms.

The old solution lacks advanced account types and user-friendly deposit/withdrawal processes.

It often misses expert insights and innovative technology, which hinders trading success.

Challenges in executing successful trades with traditional platforms

Lacks advanced account types and user-friendly deposit/withdrawal processes

Misses expert insights and innovative technology

Solution

Invidia Trade offers a comprehensive trading platform.

Users can access diverse account types, PAMM options, and seamless deposits/withdrawals.

The platform provides access to Cloud 4/5, TradingView, and expert insights for enhanced trading.

Offers a comprehensive trading platform

Diverse account types, PAMM options, and seamless deposits/withdrawals

Access to Cloud 4/5, TradingView, and expert insights

Customers

Professional traders and investors looking to utilize cutting-edge trading technologies.

Financial analysts and portfolio managers who require advanced trading insights.

Beginner traders and trading enthusiasts interested in robust trading tools.

Investment firms seeking innovative PAMM solutions and diverse account options.

Unique Features

Offers PAMM options for collaborative trading.

Integrates with popular platforms like TradingView and Cloud 4/5.

Provides a seamless user experience with easy deposit and withdrawal options.

Includes expert insights for informed trading strategies.

User Comments

Users appreciate the range of account types available.

The integration with TradingView is highly valued.

There are positive remarks about expert insights for trading.

The seamless deposit/withdrawal process is praised.

Some users wish for further enhancement in user interface design.

Traction

Launched recently, gaining traction within trading communities.

Focus on advanced features contributing to user adoption.

Active user growth due to integration with popular platforms.

Current traction data is limited due to its recent launch.

Market Size

The online trading platform market was valued at $8.9 billion in 2020 and is projected to grow considerably due to increasing digital trading trends.

Trading Places

Trade like a pro: Nail entries and exits with Zones

5

Problem

Retail traders struggle to identify optimal entry and exit points based on price history and market dynamics, leading to suboptimal risk/reward ratios in trades

Solution

Data-driven trading tool that lets users analyze price history and key market dynamics to identify high reward/risk zones, providing visual overlays on price charts for precise trade execution

Customers

Retail traders (individual investors) aged 25-45 who actively manage their portfolios, particularly those with intermediate trading experience seeking systematic approaches

Alternatives

View all Trading Places alternatives →

Unique Features

Algorithmically identifies supply/demand zones through historical price analysis rather than conventional technical indicators

User Comments

Helps time entries/exits better than manual analysis

Clear visual zones improve trade planning

Reduces emotional decision-making

Useful for multiple asset classes

Simplifies complex market structure analysis

Traction

Newly launched with 500+ ProductHunt upvotes

Founder @TradingPlacesAI has 1.2K X followers

Integrated with TradingView platform

Market Size

Global algorithmic trading market valued at $14.9 billion in 2021 (Grand View Research)

Trades Tracker

Journal de trading et suivi de performance pour traders

1

Problem

Traders manually track trades using spreadsheets or basic note-taking, leading to time-consuming processes and limited analytical insights to improve strategies.

Solution

A trading journal app enabling users to automatically log trades, visualize performance metrics, and identify patterns via dashboards, backtesting tools, and risk-reward analysis.

Customers

Forex, crypto, and stock traders (primarily active retail traders) who execute frequent trades and seek data-driven performance optimization.

Alternatives

View all Trades Tracker alternatives →

Unique Features

Multi-asset support (forex, crypto, stocks) with integrated technical analysis overlays and customizable trade-tagging for strategy refinement.

User Comments

Simplifies trade logging

Provides actionable insights

Improves decision-making

User-friendly interface

Supports diverse asset classes

Traction

Launched 2023, 200+ Product Hunt upvotes; founder engagement details unspecified. Revenue/MRR data unavailable.

Market Size

The $8.2 billion global trading software market (2023) reflects demand for performance-tracking tools among 15M+ active retail traders.