Sammy

Alternatives

0 PH launches analyzed!

Problem

Global digital workers struggle to get paid from the US due to the requirement of a Social Security Number (SSN) or being a US resident, leading to slow payment processes and the inability to save or spend in dollars requirement of a Social Security Number (SSN) or being a US resident.

Solution

Sammy is a fintech platform that partners with a US bank to offer an account for global workers without the need of a SSN or being a US resident, enabling them to get paid faster from the US, save money in dollars, and spend with an international debit card.

Customers

Global digital freelancers, remote workers, and international entrepreneurs who receive payments from the US are the digital freelancers, remote workers, and international entrepreneurs.

Unique Features

The ability to open a US bank account without a Social Security Number or US residency.

User Comments

Simplifies payment process for international workers

Finally, no SSN requirement to get a US account

Makes it easier to manage earnings in USD

International debit card feature is highly appreciated

Great solution for freelancers working with US clients

Traction

Unable to determine specific traction data from the provided resources.

Market Size

The global digital payment market size is expected to reach $236.10 billion by 2028.

Problem

Users face difficulty accessing and managing US-based banking services internationally. They previously relied on traditional banks with geographic restrictions and inefficient cross-border transactions.

Solution

A digital banking platform that provides a virtual US bank account for saving in stablecoins, sending/receiving funds across 50+ countries, and future Visa card integration for global spending.

Customers

Expats, freelancers, remote workers, or international students requiring cross-border financial solutions without physical presence in the US.

Unique Features

Combines virtual US banking with stablecoin savings, supports transactions in 50+ countries, and integrates crypto with traditional banking via an upcoming Visa card.

Traction

Newly launched, expanding to Visa card functionality; supports transactions across 50+ countries.

Market Size

The global cross-border payment market was valued at $190 trillion in 2023, with neobanks projected to reach $2.05 trillion by 2030.

Digits AI Accounting

Make confident decisions with smart accounting

526

Problem

Many founders struggle with managing finances and bookkeeping, which takes time away from building their core products.

managing finances and bookkeeping

Solution

AI accounting platform that offers real-time insights, 24/7 AI-driven accounting, and seamless bill pay and invoicing.

Users can automate their accounting processes, receive real-time insights, and manage transactions more efficiently.

Customers

Business founders, especially those in startups looking to efficiently manage their finances with less effort.

Unique Features

Digits provides an end-to-end solution that combines traditional accounting functionality with AI to provide real-time insights and automation.

User Comments

Users appreciate the ease of use and automation features.

Real-time insights are highly valued.

Some users see it as a significant time saver.

Automation helps reduce human error.

The platform is praised for its modern design.

Traction

Digits launched as an AI-driven accounting platform focusing on real-time insights.

It is recognized as a product of the AI era offering innovative solutions.

Market Size

The global accounting software market was valued at $11.9 billion in 2020 and is projected to reach $20.4 billion by 2026, growing at a CAGR of 8.5%.

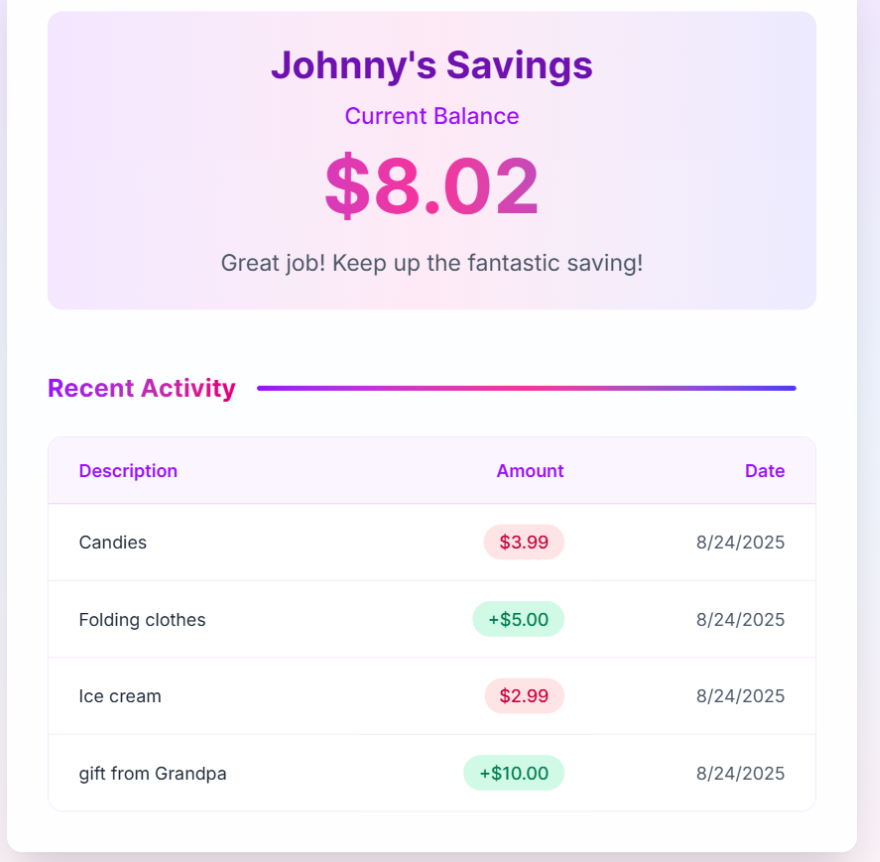

Digital Piggy Bank for kids

A Smarter Piggy Bank for the Digital Age.

7

Problem

Parents use traditional piggy banks to teach kids about money, which lack digital tracking, interactive learning, and real-world financial skill development, leading to disengagement and outdated money habits.

Solution

A digital piggy bank app paired with a physical device that lets kids track savings digitally, set goals, and learn via gamified lessons, while parents monitor progress and allocate funds through a dashboard.

Customers

Parents of children aged 5–12 seeking to teach financial literacy, tech-savvy families, and educators focused on modern money management tools.

Unique Features

Combines tactile piggy bank experience with app-based gamification, real-time savings tracking, parental controls, and rewards for achieving financial goals.

User Comments

Kids love setting savings goals in the app

Parental dashboard simplifies allowance management

Gamification keeps children engaged longer

Teaches budgeting better than cash-only methods

Physical + digital combo feels more tangible

Traction

Launched 3 months ago with 2,000+ active users, $15k MRR, and 4.8/5 rating on Product Hunt (400+ upvotes).

Market Size

The global kids’ financial literacy market is projected to reach $1.2 billion by 2027 (Allied Market Research).

Virtual USD Bank Accounts by Wind

Turn USD into Crypto (USDC) with dedicated virtual accounts.

153

Problem

Users struggle with traditional currency exchange methods, facing high fees, slow transaction times, and limited currency support.

Solution

Platform with dedicated virtual bank accounts, enabling users to convert USD to USDC seamlessly.

Features: Complete KYC, get a dedicated virtual bank account, send USD to the account, and receive USDC in the Wind Wallet instantly.

Customers

Demographics: International travelers, digital nomads, crypto enthusiasts.

User behaviors: Frequently exchange currencies, desire quick and low-cost conversions.

Unique Features

Seamless exchange between USD and USDC in various currencies and tokens.

Support for 38+ currencies and 200+ tokens enhances versatility.

User Comments

Fast and convenient currency exchange process.

Wide range of supported currencies and tokens is impressive.

Great for travelers who need to manage both traditional and crypto finances.

Saves on fees compared to traditional exchange methods.

Smooth user experience with the Wind Wallet.

Traction

Growing user base with positive feedback on the seamless Fiat-Crypto-Fiat journey.

Increased transactions and user adoption globally.

Market Size

$7.2 trillion global remittance market value, with a significant share requiring currency exchange services.

Increasing adoption of cryptocurrencies drives demand for solutions like virtual USD bank accounts.

Buy Chime Bank Account

Physical card active & huge transactions @Usaelitesmm

1

Problem

Users are looking to buy Chime Bank Accounts without fees for digital banking.

Solution

Website platform for buying Chime Bank Accounts with fee-free digital banking services.

Buy Chime Bank Accounts with fee-free digital banking services.

Customers

Individuals seeking Chime Bank Accounts for fee-free digital banking services.

Alternatives

View all Buy Chime Bank Account alternatives →

Unique Features

Fee-free digital banking services for Chime Bank Accounts.

User Comments

Fast and easy account setup process.

Great customer service and support.

Hassle-free transactions with no fees.

Secure and reliable platform for purchasing bank accounts.

Convenient WhatsApp, Telegram, and Skype contact options for assistance.

Traction

Specific traction data not available. Contact options provided for customer inquiries.

Market Size

Market size of the Chime Bank Account sales industry is undisclosed and may vary based on demand for digital banking services.

Digital Insights - Digital India

Digital india - Digital news from the world

1

Problem

Users looking for digital news from the world face challenges in accessing diversified news sources and getting updates in an easily accessible format. Lack of centralized and curated digital news content leads to scattered and often unreliable information.

Solution

Digital Insights - Digital India offers a news aggregation platform that centralizes digital news from around the globe. Users can stay informed by accessing aggregated news from multiple sources, ensuring comprehensive global coverage.

Customers

News enthusiasts, researchers, and professionals interested in staying updated with global digital news, typically aged between 25-45, who frequently consume online media and prefer curated content for efficiency.

Unique Features

The platform uniquely aggregates digital news, offering curated content with a focus on reliability and global coverage, which users find hard to access from disparate sources.

User Comments

Users appreciate the comprehensive coverage of global digital news.

The platform is easy to use and offers reliable information.

Some users would like more customization in their news feeds.

Feedback suggests high satisfaction with the platform's content accuracy.

A few users mentioned the need for a mobile app for better accessibility.

Traction

As of the latest data, the product boasts an increasing user base, especially among professionals who prefer digital news aggregation. Further specifics on user metrics or financials are limited.

Market Size

The global online news market was valued at approximately $38 billion in 2020 and is expected to grow significantly, driven by the increasing consumption of digital news content.

Verified Coinbase-bank Accounts bank

Unleash the World of Cryptocurrency with Your Coinbase Acc..

1

Problem

Users struggle to access reliable and pre-verified cryptocurrency accounts, which leads to potential difficulties in entering the digital finance world

Solution

A platform that provides access to verified Coinbase accounts, which allows users to easily engage in cryptocurrency transactions and investments

Customers

Cryptocurrency investors, both seasoned and beginners, looking to explore and expand their digital finance activities

Unique Features

The platform offers pre-verified accounts that streamline the process of engaging with cryptocurrency without the hassle of initial account verification steps

User Comments

Users appreciate the ease of accessing verified accounts

Many find the service useful for entering the cryptocurrency world

The verification process is trusted by the community

Some users worry about security implications

Satisfactory experience with customer support

Traction

Product recently launched on ProductHunt

Currently being discovered by users interested in cryptocurrency

Market Size

The global cryptocurrency market size was valued at approximately $1.6 trillion in 2021

Linker Finance

Digital Banking & CRM for Retail and Commercial Banks

3

Problem

Retail and commercial banks use legacy systems for digital banking and CRM, leading to inefficient digital account opening, manual business onboarding, and disjointed treasury management.

Solution

A digital banking and CRM platform enabling users to automate workflows like digital account opening, business onboarding, digital banking, and treasury management.

Customers

Bank managers, financial institution executives, and operations teams in retail and commercial banks seeking modernized customer and operational workflows.

Alternatives

View all Linker Finance alternatives →

Unique Features

Combines CRM with end-to-end digital banking services, including AI-driven automation for compliance, onboarding, and real-time treasury management integration.

Traction

Launched on ProductHunt recently; specific metrics (users, revenue) not publicly disclosed.

Market Size

The global digital banking market is projected to reach $9.5 billion by 2026 (Statista, 2023).

US Global Mail

Turn every envelope into actionable intelligence

136

Problem

Users manually process physical mail, leading to time-consuming sorting, missed urgent documents, and inefficient check deposits.

Solution

A mail management tool using AI to read, summarize, and route mail, auto-deposit checks, and flag urgent documents securely (SOC2 & HIPAA compliant).

Customers

Remote-first companies, executives, freelancers, and healthcare providers handling high volumes of physical mail.

Alternatives

View all US Global Mail alternatives →

Unique Features

SOC2/HIPAA compliance, AI-driven mail prioritization, automatic check deposits, and real-time alerts for urgent items.

User Comments

Saves hours weekly on mail sorting

Instant check deposits are a game-changer

Secure handling of sensitive documents

Never miss urgent mail

Streamlines remote operations

Traction

Featured on ProductHunt, SOC2/HIPAA certified, details on user numbers/revenue unspecified from provided data.

Market Size

Global digital mailroom market valued at $1.2 billion in 2022 (Grand View Research).