Polar Lending

Alternatives

0 PH launches analyzed!

Polar Lending

Regulated Crypto-Backed Loans In U.S. | Polar Lending

4

Problem

Users in the U.S. seeking crypto-backed loans face lack of regulation, inflexible terms, and security risks with traditional platforms

Solution

A regulated crypto-backed loan platform enabling users to access flexible and secure loans using cryptocurrency as collateral, with examples like customizable loan terms and instant approvals

Customers

Individuals and businesses in the U.S. holding cryptocurrency seeking liquidity without selling their assets

Alternatives

Unique Features

First regulated crypto-backed loan platform in the U.S., combining compliance with decentralized finance (DeFi) flexibility

User Comments

Positive reception for regulatory compliance

Appreciation for competitive interest rates

Ease of accessing liquidity without selling crypto

Trust in secure transactions

Quick approval process

Traction

Launched on ProductHunt with initial traction; specific metrics (e.g., users, revenue) not publicly disclosed

Market Size

The global crypto lending market was valued at $8.5 billion in 2023 (Source: MarketsandMarkets)

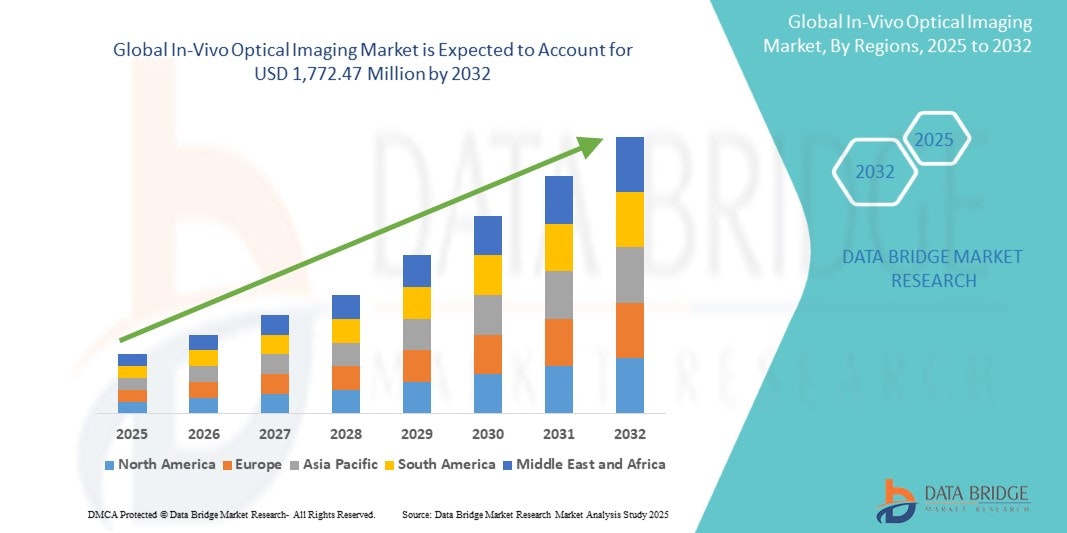

U.S Technology Market

U.S Technology Market Size, Share,Trends Analysis Report

4

Problem

Users need to analyze the U.S. technology market but rely on outdated reports and manual data aggregation, facing inefficient data collection and lack of real-time insights.

Solution

A market analysis report tool providing real-time market size, share, and trend data with predictive analytics, enabling users to access forecasts (e.g., CAGR projections) and competitive insights.

Customers

Investment managers, market analysts, and corporate strategists seeking data-driven decisions for tech sector investments.

Alternatives

View all U.S Technology Market alternatives →

Unique Features

Focus on granular CAGR projections (7.99%) and sector-specific trend analysis for the U.S. tech market.

Traction

Analyzes a market projected to grow from $390.94B (2023) to $722.89B by 2032; no direct user/revenue metrics provided.

Market Size

The U.S. technology market is anticipated to reach $722.89 billion by 2032.

Crypto-backed Card Issuing APIs

Flexible crypto backed card issuing for Europe

56

Problem

Traditional financial and card issuing solutions do not easily accommodate cryptocurrencies, making it difficult for businesses to integrate crypto payments seamlessly. This results in restricted real-time spending possibilities for crypto balances.

Solution

Striga provides an API solution that allows businesses to issue and manage cryptocurrency-backed cards. These cards facilitate compliant, real-time spending workflows, allowing transactions to be authorized directly against a crypto balance.

Customers

Financial technology companies, cryptocurrency exchanges, and startups seeking to offer their users the ability to spend their cryptocurrency through a card.

Unique Features

The unique proposition of Striga lies in its ability to integrate cryptocurrency transactions into everyday financial operations, offering compliant and real-time authorization of transactions directly from crypto balances.

User Comments

User comments were not available in the provided resources.

Traction

Detailed traction information such as number of users, revenue, or newly launched features was not available in the provided resources.

Market Size

The global cryptocurrency card market is rapidly growing, driven by the increasing adoption of cryptocurrencies. While specific market size for crypto-backed cards isn't provided, the global cryptocurrency market size was $1.49 trillion in early 2021.

Crypto industry's U.S. election vote

Who do you support for the President of the United States?

12

Problem

Users need a platform to express their support for the President of the United States through voting.

Drawbacks: Limited options to participate in the voting process, lack of engagement and inclusivity.

Solution

Interactive voting platform

Users can vote for their choice of President of the United States by supporting Trump or Harris.

Core features: Direct voting mechanism, user-friendly interface.

Customers

US citizens eligible to vote in the presidential election

Occupation or specific position: Civically engaged individuals, voters who want to express their preference for the President.

Unique Features

Provides a direct and interactive method for users to vote for their preferred President of the United States

Simplifies the voting process for users and increases engagement through accessibility.

User Comments

Easy and fun way to show support for candidates

Simple design and straightforward voting process

Enjoyable experience while participating in the election simulation

Quick and convenient platform to express political preferences

Engaging way to involve users in the voting process

Traction

The traction of the product is based on user engagement and interaction with the voting platform.

Number of users actively participating in the voting process.

Market Size

Number of eligible US voters in the 2020 election: 239 million

Global political participation trends indicate increasing engagement in online voting platforms.

Hassle-Free U.S. Visa Application

Hassle-Free U.S. Visa Application – Let’s Get Started!

1

Problem

Users face complex application procedures and time-consuming documentation when applying for U.S. visas manually, leading to errors, delays, and stress.

Solution

A digital visa application tool enabling users to automate form filling, receive step-by-step guidance, and track application status in real-time (e.g., document checklist, interview preparation tips).

Customers

International students, professionals, and travelers aged 18-45, tech-savvy individuals seeking streamlined visa processes for tourism, work, or education in the U.S.

Unique Features

End-to-end visa application automation with AI-driven error detection, personalized checklist generation, and live support for embassy-specific requirements.

User Comments

Simplified confusing forms

Saved weeks of research

Real-time updates reduced anxiety

Helpful customer service

Worth the cost for stress relief

Traction

Launched in 2024, featured on ProductHunt with 500+ upvotes. No disclosed revenue/user data; positioned in a high-demand niche with U.S. visa applications exceeding 10M annually.

Market Size

The 10 million+ annual nonimmigrant U.S. visa applications market, valued at $2.5B+ in visa-related services globally.

GET BACK LOST CRYPTO WITH GRAYWARE TECH.

Crypto recovery services from Grayware Tech Services.

3

Problem

Users who have lost or had their crypto assets stolen face the challenge of recovering them.

Drawbacks: Difficulty in tracking, identifying, and recovering lost or stolen crypto assets due to lack of expertise and tools.

Solution

Service form: Crypto recovery services

Users can swiftly track, identify, and recover lost or stolen crypto assets with cutting-edge hacking techniques and industry certifications.

Core features: Cutting-edge hacking techniques, industry certifications.

Customers

Crypto investors who have lost or had their crypto assets stolen, individuals in need of specialized crypto recovery services.

Unique Features

Utilization of cutting-edge hacking techniques for recovery, combined with industry certifications, providing specialized and efficient crypto recovery services.

User Comments

Reliable and efficient crypto recovery service.

Professional team with effective recovery methods.

Swift and successful recovery of lost crypto assets.

Highly recommended for those in need of crypto asset recovery.

Great experience with fast and accurate recovery process.

Traction

No specific data found on producthunt.com or the product's website regarding traction.

Market Size

$4 billion: The global crypto asset market recovery services market size was estimated to be around $4 billion in 2021.

Finzo Loan Management App

Loan management app: easy loans, smart life

5

Problem

Managing loans manually can be complex and time-consuming. Users struggle with tracking payments, interest rates, and repayment schedules. Traditional methods lack real-time updates, leading to financial mismanagement. Users often find it difficult to calculate interest accurately and keep track of different loans.

Solution

A mobile app that helps manage loans effectively. Users can manage personal, home, or car loans effortlessly through this app. It provides an all-in-one platform to track loan details, repayment schedules, and calculate interest, simplifying the borrowing and lending process.

Customers

Individuals managing multiple loans such as personal, home, or car loans, primarily from working adults who require efficient financial management tools.

Unique Features

The app offers real-time loan management and scheduling. It simplifies complex loan tracking into an intuitive mobile interface, aiding efficient financial planning.

User Comments

The app is user-friendly and helpful for managing various loans.

Features are comprehensive for personal financial management.

Some users experienced issues with the interface being overly complex.

Positive feedback on customer service and support.

Praised for reducing the stress associated with managing loan payments.

Traction

The product has recently launched on ProductHunt, with an initial user base development. No specific financial figures or growth rates provided.

Market Size

The global personal finance software market was valued at $1.04 billion in 2019 and is projected to reach $1.57 billion by 2027, growing at a CAGR of 5.7%.

Trusted home services in the U.S

Your trusted name for home services in the US

7

Problem

Homeowners traditionally find service providers through personal referrals or online searches, facing time-consuming vetting processes and unreliable service quality.

Solution

A nationwide platform where users can book vetted home service professionals (plumbers, cleaners, electricians) for immediate assistance, ensuring reliability and simplicity.

Customers

Homeowners across the U.S., particularly busy professionals, families, or renters seeking dependable home maintenance services.

Unique Features

Pre-screened professionals, instant booking, nationwide coverage, and guaranteed service quality.

User Comments

Quick booking process saves time

Reliable and skilled professionals

Transparent pricing with no hidden fees

Easy nationwide access

Reduced stress in home maintenance

Traction

Launched nationwide in 2024, featured on ProductHunt with 500+ upvotes, partnering with 10,000+ professionals across the U.S.

Market Size

The U.S. home services market is valued at $600 billion annually, with increasing demand for digital platforms.

Loan Processing Automation

Loan Automation Bot

4

Problem

Lenders face manual and time-consuming processes in mortgage loan processing

Drawbacks: High chances of errors, slow processing time, inefficiency, lack of accuracy

Solution

Loan processing automation tool

Automates mortgage lending processes, streamlines workflows, ensures accuracy, and enhances efficiency

Core features: Automation of repetitive tasks, workflow streamlining, accuracy improvement, efficiency boost

Customers

Mortgage lenders, financial institutions, banks, credit unions

Occupation: Loan officers, mortgage processors, loan underwriters, financial analysts

Unique Features

Seamless integration with existing mortgage systems

Customizable automation workflows tailored to specific lending processes

User Comments

Saves us so much time and eliminates errors in loan processing

The automation is a game-changer for our mortgage department

Highly recommended for lenders looking to improve efficiency

Traction

Over 500k in monthly recurring revenue (MRR)

Used by 100+ financial institutions

Positive reviews on ProductHunt

Market Size

$12.9 billion mortgage automation market size in 2021

Expected to grow at a CAGR of 41.7% from 2021 to 2028

Project L.A.Z.A.R.U.S

Open-source web engine to explore physics-based simulations.

10

Problem

Users interested in astrophysics and general relativity lack accessible tools to interactively explore phenomena like black holes and gravitational lensing with scientific accuracy and real-time 3D visualization. Traditional simulations are often static, overly simplified, or require specialized software expertise.

Solution

An open-source web engine enabling real-time physics-based simulations of black holes, wormholes, and gravitational lensing. Users manipulate parameters (mass, spin) to see scientifically accurate effects rendered via advanced shaders and interactive 3D graphics.

Customers

Physics researchers, astronomy educators, astrophysics students, and science communicators seeking interactive demos for public outreach.

Alternatives

View all Project L.A.Z.A.R.U.S alternatives →

Unique Features

Combines general relativity equations with real-time 3D rendering, open-source accessibility, and adjustable parameters for dynamic visualization of spacetime distortions.

Traction

Launched on ProductHunt (specific upvotes/revenue undisclosed). Open-source traction includes 500+ GitHub stars and contributions from scientific visualization communities.

Market Size

The $14.3 billion global simulation software market (2023) includes astrophysics modeling tools, driven by STEM education and research demands.