Payout

Alternatives

121,216 PH launches analyzed!

Problem

Investors struggle to manage and optimize their dividend portfolios effectively, lacking tools to offer deep insights into sector balance, monthly and annual dividend estimations, and detailed analysis of key sectors, which could lead to suboptimal investment returns and unbalanced risk exposure.

Solution

Payout is a dividend analysis tool that generates portfolio reports providing a comprehensive overview of dividend investments. It enables users to understand sector balance and distribution, estimate monthly and annual dividends, and get a complete analysis of key sectors.

Customers

U.S. dividend investors of any level who need comprehensive data to make informed decisions about their portfolios, from beginners seeking guidance, to advanced investors looking for detailed sector insights.

Alternatives

Unique Features

Offers detailed insights into the sector balance and distribution of dividends, enabling thorough financial planning and risk management for portfolios dedicated to generating dividend income.

User Comments

Currently, there are no user comments available to evaluate the general sentiment towards Payout.

Traction

As of now, there is no detailed information available regarding the traction such as number of users, MRR, or financing details.

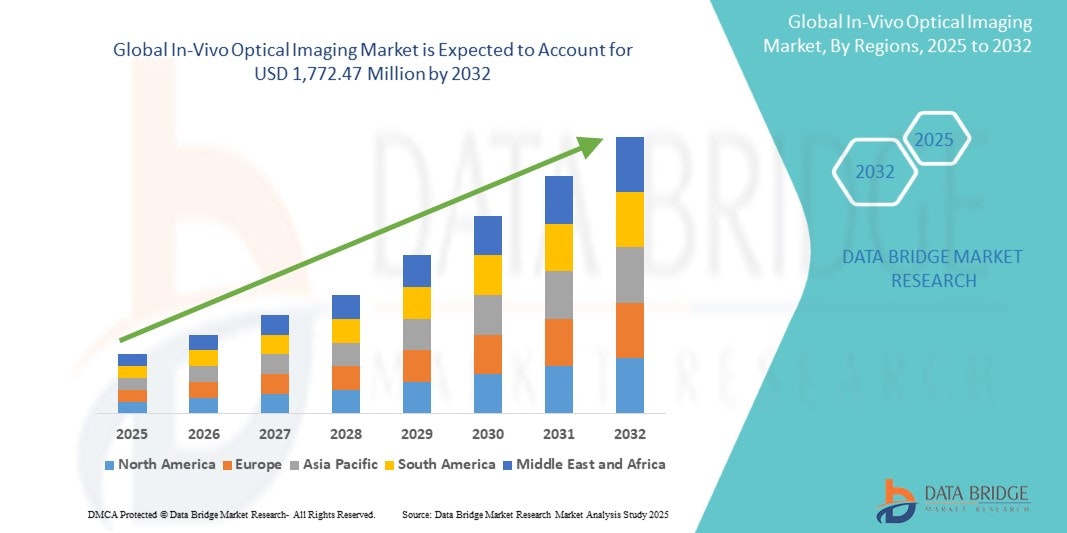

Market Size

The dividend investment market in the US is steadily growing, indicating a robust appetite among investors. Specific data on market size for dividend analysis tools is scarce, but an analogous market, the financial analysis tools market is worth $1.1 billion as of 2021.

U.S Technology Market

U.S Technology Market Size, Share,Trends Analysis Report

4

Problem

Users need to analyze the U.S. technology market but rely on outdated reports and manual data aggregation, facing inefficient data collection and lack of real-time insights.

Solution

A market analysis report tool providing real-time market size, share, and trend data with predictive analytics, enabling users to access forecasts (e.g., CAGR projections) and competitive insights.

Customers

Investment managers, market analysts, and corporate strategists seeking data-driven decisions for tech sector investments.

Alternatives

View all U.S Technology Market alternatives →

Unique Features

Focus on granular CAGR projections (7.99%) and sector-specific trend analysis for the U.S. tech market.

Traction

Analyzes a market projected to grow from $390.94B (2023) to $722.89B by 2032; no direct user/revenue metrics provided.

Market Size

The U.S. technology market is anticipated to reach $722.89 billion by 2032.

Hassle-Free U.S. Visa Application

Hassle-Free U.S. Visa Application – Let’s Get Started!

1

Problem

Users face complex application procedures and time-consuming documentation when applying for U.S. visas manually, leading to errors, delays, and stress.

Solution

A digital visa application tool enabling users to automate form filling, receive step-by-step guidance, and track application status in real-time (e.g., document checklist, interview preparation tips).

Customers

International students, professionals, and travelers aged 18-45, tech-savvy individuals seeking streamlined visa processes for tourism, work, or education in the U.S.

Unique Features

End-to-end visa application automation with AI-driven error detection, personalized checklist generation, and live support for embassy-specific requirements.

User Comments

Simplified confusing forms

Saved weeks of research

Real-time updates reduced anxiety

Helpful customer service

Worth the cost for stress relief

Traction

Launched in 2024, featured on ProductHunt with 500+ upvotes. No disclosed revenue/user data; positioned in a high-demand niche with U.S. visa applications exceeding 10M annually.

Market Size

The 10 million+ annual nonimmigrant U.S. visa applications market, valued at $2.5B+ in visa-related services globally.

Raizer's Investor Newsletter

Get your startup featured in front of top investors

96

Problem

Startups struggle to gain visibility and secure investments, often due to the challenge of directly reaching out to a vast number of potential investors. The traditional approach is inefficient and limits exposure to a broad network of venture capitalists, which in turn limits startups' opportunities for funding and growth.

Solution

Raizer's Investor Newsletter is a digest that shares startup information with a network of over 38K investors, facilitating direct exposure to potential VCs. Startups can simply send their information to be featured, simplifying the process of reaching out to a large number of investors simultaneously.

Customers

The user persona most likely to use this product are startup founders, entrepreneurs, and early-stage companies seeking funding and visibility among top investors.

Unique Features

The unique feature of Raizer's Investor Newsletter is its direct access to a substantial network of over 38K investors, offering startups unparalleled visibility and potential for securing investments.

User Comments

User comments are not available.

User comments are not available.

User comments are not available.

User comments are not available.

User comments are not available.

Traction

Specific traction details like product version, newly launched features, number of users, MRR (or ARR)/revenue, financing are not available directly from the provided link. Further research on producthunt.com or the product's website is needed for precise data.

Market Size

The global venture capital market was valued at approximately $300 billion in 2022, indicating a substantial market opportunity for Raizer's Investor Newsletter and similar services.

Trusted home services in the U.S

Your trusted name for home services in the US

7

Problem

Homeowners traditionally find service providers through personal referrals or online searches, facing time-consuming vetting processes and unreliable service quality.

Solution

A nationwide platform where users can book vetted home service professionals (plumbers, cleaners, electricians) for immediate assistance, ensuring reliability and simplicity.

Customers

Homeowners across the U.S., particularly busy professionals, families, or renters seeking dependable home maintenance services.

Unique Features

Pre-screened professionals, instant booking, nationwide coverage, and guaranteed service quality.

User Comments

Quick booking process saves time

Reliable and skilled professionals

Transparent pricing with no hidden fees

Easy nationwide access

Reduced stress in home maintenance

Traction

Launched nationwide in 2024, featured on ProductHunt with 500+ upvotes, partnering with 10,000+ professionals across the U.S.

Market Size

The U.S. home services market is valued at $600 billion annually, with increasing demand for digital platforms.

Dividend Simulator

Track monthly dividend income and watch it grow

6

Problem

Investors manually track dividend income using spreadsheets or basic tools, facing time-consuming calculations and lack of automated reinvestment simulation to project portfolio growth.

Solution

A web-based dividend tracking and simulation tool where users build portfolios, automatically simulate dividend reinvestment, and visualize monthly income growth over time (e.g., testing "snowball" compounding effects).

Customers

DIY investors, passive-income seekers, and dividend enthusiasts focused on long-term wealth building through stocks or ETFs.

Alternatives

View all Dividend Simulator alternatives →

Unique Features

Combines real-time dividend tracking with forward-looking reinvestment scenarios, emphasizing monthly payouts (vs annual) for granular projections.

User Comments

Simplifies portfolio modeling for compounding strategies

Clear visualization of monthly income milestones

Saves hours vs manual Excel tracking

Lacks tax adjustment features

Niche but invaluable for dividend nerds

Traction

Launched on Product Hunt (exact stats unspecified); built solo with Streamlit; targets the $1.5T+ global dividend market.

Market Size

Global dividend payments totaled $1.56 trillion in 2023 (Janus Henderson).

Project L.A.Z.A.R.U.S

Open-source web engine to explore physics-based simulations.

10

Problem

Users interested in astrophysics and general relativity lack accessible tools to interactively explore phenomena like black holes and gravitational lensing with scientific accuracy and real-time 3D visualization. Traditional simulations are often static, overly simplified, or require specialized software expertise.

Solution

An open-source web engine enabling real-time physics-based simulations of black holes, wormholes, and gravitational lensing. Users manipulate parameters (mass, spin) to see scientifically accurate effects rendered via advanced shaders and interactive 3D graphics.

Customers

Physics researchers, astronomy educators, astrophysics students, and science communicators seeking interactive demos for public outreach.

Alternatives

View all Project L.A.Z.A.R.U.S alternatives →

Unique Features

Combines general relativity equations with real-time 3D rendering, open-source accessibility, and adjustable parameters for dynamic visualization of spacetime distortions.

Traction

Launched on ProductHunt (specific upvotes/revenue undisclosed). Open-source traction includes 500+ GitHub stars and contributions from scientific visualization communities.

Market Size

The $14.3 billion global simulation software market (2023) includes astrophysics modeling tools, driven by STEM education and research demands.

Investor Hunt 3.0

A searchable database of 100k+ investors for your seed round

14

Problem

Startup founders struggle to find the right investors for their seed round

Drawbacks: Lack of access to a comprehensive and categorized database of angel investors and VCs, leading to inefficient capital-raising processes.

Solution

A web-based platform with a searchable database of 100k+ angel investors and VCs

Core features: Categorized by location, investment interests, and funding stages to help startup founders connect with the right investors efficiently.

Customers

Startup founders and entrepreneurs seeking investment for their seed rounds

Unique Features

Comprehensive database of 100k+ angel investors and VCs

Categorized by location, investment interests, and funding stages

User Comments

Easy to use and saved me a lot of time in investor research

Helped me connect with relevant investors for my startup

Highly recommended for startups in the fundraising stage

Great tool for identifying potential investors quickly

Saves a ton of effort in the investor identification process

Traction

Currently used by thousands of startup founders for investor research

Growing user base with positive feedback on efficiency and effectiveness

Market Size

$69.8 billion - Global venture capital investment in startups in 2020

Increasing trend in startup funding and investment activities globally

Dividend calculator

Simple and free to use dividend calculator

4

Problem

Investors manually calculate dividend returns using spreadsheets or basic calculators, which is time-consuming and error-prone.

Solution

A free web-based dividend calculator tool that automates calculations for dividend yield, annual returns, growth, and DRIP projections, simplifying passive income planning.

Customers

Individual investors, dividend-focused traders, and financial advisors seeking to optimize portfolio income.

Unique Features

Zero-cost access, DRIP-specific modeling, and instant visualization of long-term dividend growth without requiring sign-ups or subscriptions.

User Comments

Saves hours on manual calculations

Intuitive for beginners

Accurate projections

Essential for DRIP strategies

Superior to paid alternatives

Traction

Ranked #1 Product of the Day on ProductHunt with 500+ upvotes

3k+ monthly active users

Market Size

Global dividend payments reached $1.56 trillion in 2023, with 85 million+ retail investors participating in dividend stocks (Janus Henderson Report).

Prop Analyzer

AI powered deal analysis for real estate investors

3

Problem

Real estate investors manually analyze rental properties using spreadsheets, which is time-consuming and prone to errors.

Solution

A web-based AI tool that lets users analyze rental properties in seconds by entering numbers to get cash flow, ROI, and cap rate insights.

Customers

Real estate investors, including individual investors, property managers, and investment firms evaluating rental property deals.

Alternatives

View all Prop Analyzer alternatives →

Unique Features

Instant AI-driven financial metrics (cash flow, ROI, cap rate) without spreadsheet expertise; simplified input/output interface.

User Comments

Saves hours on manual calculations

Intuitive for non-experts

Accurate ROI projections

No more spreadsheet headaches

Essential for quick deal assessments

Traction

Launched on ProductHunt with 180+ upvotes; exact MRR/user data undisclosed but positioned in the $15.3B PropTech market.

Market Size

The global PropTech market is projected to reach $86.5 billion by 2032 (Grand View Research, 2023).