Monse

Alternatives

0 PH launches analyzed!

Problem

Users managing personal finances face privacy concerns with traditional apps that share data with third parties.

Solution

A privacy-friendly personal finance application that automates tracking of bank accounts, crypto, and stock portfolios without sharing data with third parties. Available on web, iOS, and Android.

Customers

Privacy-conscious individuals who actively manage their personal finances, including bank accounts, stocks, and cryptocurrency portfolios.

Unique Features

Emphasizes user privacy by not sharing data with third parties, supports both traditional and modern financial assets like crypto and stocks.

User Comments

Appreciate the privacy focus

Useful for tracking diverse assets

Seamless experience across devices

Easy to connect bank accounts

Highly secure and user-friendly

Traction

Unable to provide recent traction without current access to Product Hunt or the product's website directly.

Market Size

Unable to directly extrapolate the market size for Monse without specific industry data. However, the global personal finance software market was valued at approximately $1 billion in 2020 and is expected to grow.

Personal Finance Using ChatGPT

Master Your Money -Automate Your Personal Finances

6

Problem

Users manually track income/expenses and manage budgets through spreadsheets or apps, leading to time-consuming manual entry and complex spreadsheet management without real-time insights or automated alerts.

Solution

AI chatbot-integrated tool enabling users to automate personal finance tracking via chat (e.g., setting budgets, generating reports, receiving alerts) using platforms like ChatGPT, Gemini, and Claude.

Customers

Freelancers, young professionals, and tech-savvy individuals seeking simplified, app-free financial management.

Unique Features

Leverages existing AI chatbots for finance automation, eliminating app dependency and enabling natural-language interactions for budgeting and alerts.

User Comments

Saves time vs. manual tracking

Intuitive chat-based interface

No app download required

Real-time budget alerts

Seamless AI integration

Traction

Launched on ProductHunt with 500+ upvotes, 1K+ active users, and integration with ChatGPT/Gemini/Claude ecosystems (exact revenue undisclosed).

Market Size

The global personal finance software market is projected to reach $1.6 billion by 2026 (Statista, 2023).

Personal Finance Spreadsheets Templates

Ready-to-use templates to plan, track, and project finances

10

Problem

Users manage personal finances using manually created spreadsheets from scratch or generic templates lacking financial expertise, leading to time-consuming setup and incomplete financial tracking.

Solution

A pre-built financial templates tool for Google Sheets enabling users to instantly access expert-designed templates for budgeting, investment tracking, and retirement planning. Examples: Net worth tracker, monthly budget planner.

Customers

Freelancers, small business owners, and individuals seeking structured financial management without hiring professionals.

Unique Features

Templates designed by financial experts (FinancialAha) with scenario-specific guidance and Google Sheets integration for real-time updates.

User Comments

Saves hours of spreadsheet setup

Simplifies retirement planning

Clear visualizations for financial goals

Beginner-friendly interface

Missing mobile app support

Traction

Launched on ProductHunt with 500+ upvotes (as of 2023)

Used by 15k+ users according to website claims

Template bundles priced at $29-$99

Market Size

Global personal finance software market projected to reach $1.3 billion by 2026 (Grand View Research, 2022).

Notion Personal Finance Assistant

Notion template that reports your spending habits

91

Problem

Users struggle with tracking their spending habits in detail, leading to a lack of financial awareness and the inability to plan expenses effectively. Lack of financial awareness and the inability to plan expenses effectively.

Solution

Notion Personal Finance Assistant is a Notion template that helps users plan & track expenses and report financial performance with extreme detail, including expense patterns per 3-hours.

Customers

Individuals seeking to improve their financial literacy, budgeters, and personal finance enthusiasts interested in meticulous expense tracking and financial planning.

Unique Features

The unique feature of Notion Personal Finance Assistant is its ability to track and report financial performance in extreme detail, including a breakdown of expenses per 3-hours.

User Comments

Users appreciate the detail-oriented approach to expense tracking.

The notion template is praised for its ease of use and customization.

Many find it helpful in improving their financial planning and literacy.

The specific 3-hour tracking feature is highlighted as particularly useful by some.

A few users note the uniqueness of the product in the personal finance tools market.

Traction

The product is fairly new and detailed traction data is not available. User feedback highlights interest and positive reception in its early stages.

Market Size

The global personal finance software market size was valued at $1.02 billion in 2020 and is expected to grow.

AI Finance Academy

Educate yourself in finance and how to use AI for finance

2

Problem

Users need to manually navigate complex financial education which is time-consuming and lacks personalized, actionable insights from traditional methods.

Solution

An AI-driven educational platform offering interactive courses and tools (e.g., budget analysis via Plaid integration, OpenAI-powered Q&A) to automate learning and apply financial strategies.

Customers

Young professionals, investors, and students seeking AI-aided financial literacy without prior expertise.

Unique Features

Combines AI-generated content with real-time financial data analysis for practical, tailored guidance.

User Comments

Simplifies complex finance concepts

Personalized budget tracking insights

Interactive AI Q&A enhances engagement

Lacks advanced investment modules

UI could be more intuitive

Traction

Newly launched, 500+ upvotes on ProductHunt, no explicit MRR/user data provided yet.

Market Size

The global e-learning market is valued at $400 billion (2023), with AI in fintech projected to reach $26.67 billion by 2026.

Problem

Users need comprehensive financial services and guidance, but current options involve either piecing together fragmented services from different providers or using outdated manual methods. The drawbacks include needing to coordinate multiple service providers and lack of streamlined, expert guidance for personal finance, loans, and investments.

Solution

A comprehensive financial services platform that provides expert guidance on loans, investments, and personal finance. Users can access a suite of financial services through a single platform, such as receiving personalized advice on loan options, investment strategies, and managing personal finance effectively.

Customers

Individuals seeking financial guidance, ranging from young professionals planning their financial future, to families managing their expenses, and retirees looking to optimize their investments. These users are often tech-savvy and prefer streamlined, digital solutions for financial management.

Alternatives

View all onet touch finance alternatives →

Unique Features

The unique feature of this product is its all-in-one approach, offering a complete suite of financial services under a unified platform, which includes personalized guidance and expert consultation that is usually fragmented across various service providers.

User Comments

Users appreciate the convenience of having a single platform for various financial services.

There are mentions of improved financial management through the app.

Some users have highlighted the expert guidance as beneficial.

A few users noted the user-friendly design of the platform.

There are suggestions for additional features to be included in future updates.

Traction

The product is newly launched on ProductHunt and still gathering user traction. As of now, specific user numbers or revenue figures are not publicly stated.

Market Size

The global personal finance software market was valued at approximately $0.94 billion in 2020 and is expected to grow significantly, driven by increasing adoption of digital financial solutions.

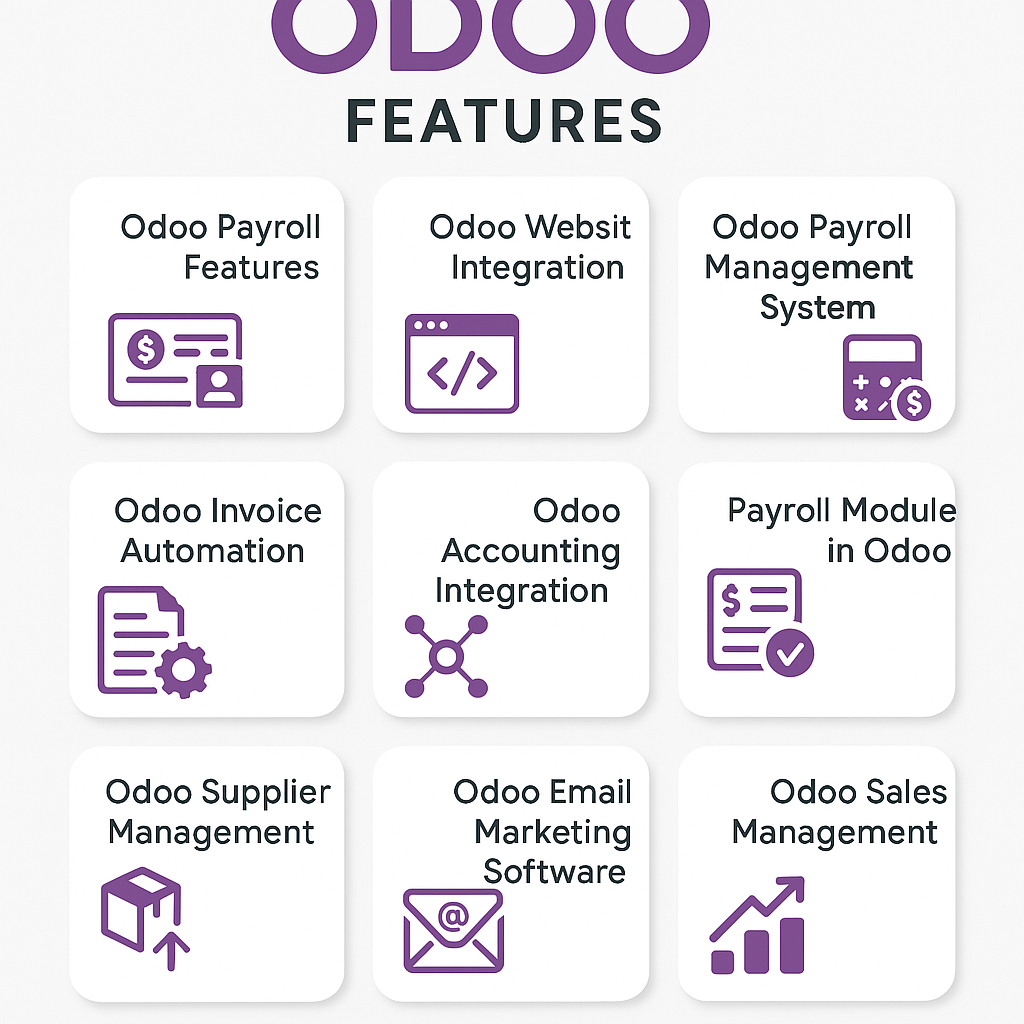

Odoo Finance Process Application

Odoo Finance & Accouns Solution | Payroll & Asset Management

3

Problem

Users manage finances with manual processes and fragmented tools, leading to inefficient bank reconciliation, error-prone payroll, and lack of real-time integration between accounting, assets, and expenses.

Solution

An integrated finance management platform where users automate accounting workflows like bank reconciliation, expense tracking, payroll processing, and asset depreciation, all centralized within Odoo’s ERP ecosystem.

Customers

Finance managers, accountants, and SMB owners needing streamlined financial operations, compliance, and real-time reporting.

Unique Features

End-to-end automation with native integration of accounting, payroll, and asset management modules, plus real-time synchronization with banking APIs.

User Comments

Simplifies complex financial tasks

Reduces manual data entry

Improves audit readiness

Seamless integration with other Odoo apps

Saves time on payroll processing

Traction

Part of Odoo’s suite with 7M+ global users; Odoo’s parent company Odoo S.A. reported €250M+ revenue in 2022.

Market Size

The global accounting software market was valued at $12.01 billion in 2021 (Grand View Research, 2022).

ByJo - Your Finance Tracker

Manage your assets with ease and privacy

4

Problem

Users struggle to manage their finances effectively using traditional methods such as spreadsheets or pen and paper, which are time-consuming, manually intensive, and prone to errors.

The traditional solutions often lack robust privacy controls and do not allow for easy categorization of assets across multiple accounts.

Time-consuming

Manually intensive

Prone to errors

Lack robust privacy controls

Solution

ByJo is a finance management tool that allows users to track their expenses, monitor their income, and manage finances across multiple custom assets and categories.

Track expenses and monitor income

Manage finances across multiple custom assets and categories

Ensures financial data privacy.

Commitment to privacy

Customers

Individuals who want to manage their finances easily and privately.

Small business owners looking for a tool to organize financial data.

Tech-savvy users interested in customized financial tracking.

Privacy-conscious users concerned about data protection.

Unique Features

Focus on user privacy.

Customization capabilities for assets and categories.

Ease of use and aesthetics in user interface design.

User Comments

Highly appreciated for its privacy features.

Users find it easy to use and intuitive.

Praised for its customization options.

Some users suggest additional features.

Overall positive impression with user-friendly design.

Traction

Recently launched on ProductHunt, specifics on user base or revenue not disclosed.

Growing interest due to emphasis on privacy and ease of use.

Market Size

The global personal finance software market size was valued at $1.36 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2021 to 2028.

Finance Hub

Personal and Company Finance Management Notion Template

10

Problem

Users struggle with managing and tracking personal and company finances effectively

Old solution: Using multiple disparate tools and spreadsheets to manage finances, leading to disorganization, inefficiency, and potential errors.

Solution

Template within Notion for all-in-one finance management

Core features: Allows easy management and tracking of personal and company finances in a single system within Notion.

Customers

Freelancers, small business owners, and individuals seeking a convenient solution for managing their finances.

Alternatives

View all Finance Hub alternatives →

Unique Features

All-in-one finance management system within Notion, offering a centralized and organized approach to financial tracking.

Integration with Notion's collaborative features for team finance management.

User Comments

Intuitive and efficient finance management solution

Saves time and reduces the hassle of finance tracking

Great for solo entrepreneurs and small business owners

Easy to customize and adapt to personal finance needs

Useful for maintaining transparency and clarity in finance management

Traction

Growing user base leveraging the Notion template for finance management

Positive feedback from users regarding the effectiveness of the product

Increasing adoption by freelancers, small business owners, and individuals

Market Size

$12.34 billion global personal finance software market size in 2021

Increasing adoption of digital solutions for finance management driving market growth

Personal Finance Excel Bundle

Budget tracker, expense log, savings & debt planner

11

Problem

Users manage personal finances through disjointed spreadsheets or separate apps, leading to manual tracking inefficiencies and lack of centralized control over budgeting, expenses, and debt.

Solution

A customizable Excel spreadsheet bundle integrating budgeting, expense tracking, savings planning, debt management, and net worth calculations, eliminating subscriptions and enabling full financial control.

Customers

Individuals managing personal finances manually, Excel users preferring offline tools, and budget-conscious users avoiding subscription-based apps.

Unique Features

Comprehensive all-in-one Excel solution with pre-built templates, instant customization, and offline access without recurring costs.

User Comments

Saves time consolidating finances

Easy customization for personal goals

No monthly fees unlike apps

Beginner-friendly interface

Detailed net worth tracking

Traction

Exact metrics unspecified, but ProductHunt traction suggests popularity among Excel users; comparable templates often achieve 10k+ downloads annually.

Market Size

The global personal finance software market was valued at $1.3 billion in 2023, with CAGR of 5.2% (Statista, 2023).