Kauri Finance

Alternatives

0 PH launches analyzed!

Kauri Finance

Kauri Finance – Web3 Digital Bank

6

Problem

Traditional banks have barriers, limiting financial services to specific regions and requiring permissions from users

Solution

Web3 digital bank platform

Users can access borderless and permissionless financial services

Core features include borderless transactions, decentralized finance (DeFi) services, and financial freedom exploration

Customers

Modern users seeking borderless and permissionless financial services

Alternatives

Unique Features

Borderless transactions

Decentralized finance (DeFi) services

Financial freedom exploration

User Comments

Great platform for exploring financial services without traditional limitations

Seamless and secure transactions with Web3 technology

Provides access to a new level of financial freedom

Traction

Traction data is not available for Kauri Finance

Market Size

$30 Billion global market size for decentralized finance (DeFi) platforms

Linker Finance

Digital Banking & CRM for Retail and Commercial Banks

3

Problem

Retail and commercial banks use legacy systems for digital banking and CRM, leading to inefficient digital account opening, manual business onboarding, and disjointed treasury management.

Solution

A digital banking and CRM platform enabling users to automate workflows like digital account opening, business onboarding, digital banking, and treasury management.

Customers

Bank managers, financial institution executives, and operations teams in retail and commercial banks seeking modernized customer and operational workflows.

Alternatives

View all Linker Finance alternatives →

Unique Features

Combines CRM with end-to-end digital banking services, including AI-driven automation for compliance, onboarding, and real-time treasury management integration.

Traction

Launched on ProductHunt recently; specific metrics (users, revenue) not publicly disclosed.

Market Size

The global digital banking market is projected to reach $9.5 billion by 2026 (Statista, 2023).

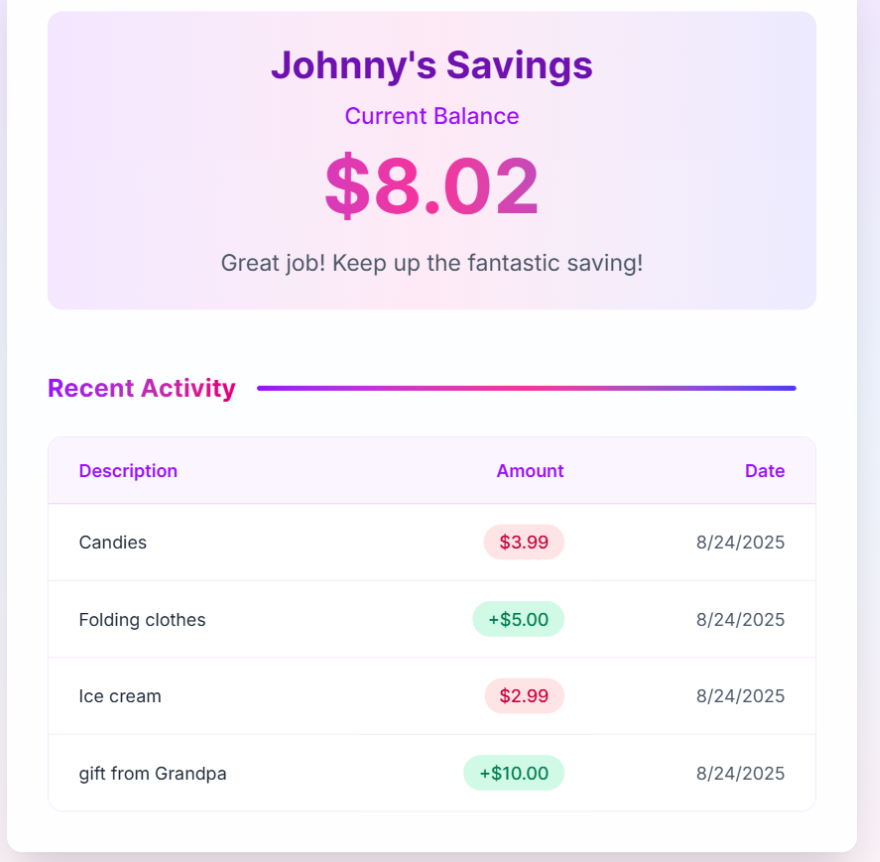

Digital Piggy Bank for kids

A Smarter Piggy Bank for the Digital Age.

7

Problem

Parents use traditional piggy banks to teach kids about money, which lack digital tracking, interactive learning, and real-world financial skill development, leading to disengagement and outdated money habits.

Solution

A digital piggy bank app paired with a physical device that lets kids track savings digitally, set goals, and learn via gamified lessons, while parents monitor progress and allocate funds through a dashboard.

Customers

Parents of children aged 5–12 seeking to teach financial literacy, tech-savvy families, and educators focused on modern money management tools.

Unique Features

Combines tactile piggy bank experience with app-based gamification, real-time savings tracking, parental controls, and rewards for achieving financial goals.

User Comments

Kids love setting savings goals in the app

Parental dashboard simplifies allowance management

Gamification keeps children engaged longer

Teaches budgeting better than cash-only methods

Physical + digital combo feels more tangible

Traction

Launched 3 months ago with 2,000+ active users, $15k MRR, and 4.8/5 rating on Product Hunt (400+ upvotes).

Market Size

The global kids’ financial literacy market is projected to reach $1.2 billion by 2027 (Allied Market Research).

Digital Insights - Digital India

Digital india - Digital news from the world

1

Problem

Users looking for digital news from the world face challenges in accessing diversified news sources and getting updates in an easily accessible format. Lack of centralized and curated digital news content leads to scattered and often unreliable information.

Solution

Digital Insights - Digital India offers a news aggregation platform that centralizes digital news from around the globe. Users can stay informed by accessing aggregated news from multiple sources, ensuring comprehensive global coverage.

Customers

News enthusiasts, researchers, and professionals interested in staying updated with global digital news, typically aged between 25-45, who frequently consume online media and prefer curated content for efficiency.

Unique Features

The platform uniquely aggregates digital news, offering curated content with a focus on reliability and global coverage, which users find hard to access from disparate sources.

User Comments

Users appreciate the comprehensive coverage of global digital news.

The platform is easy to use and offers reliable information.

Some users would like more customization in their news feeds.

Feedback suggests high satisfaction with the platform's content accuracy.

A few users mentioned the need for a mobile app for better accessibility.

Traction

As of the latest data, the product boasts an increasing user base, especially among professionals who prefer digital news aggregation. Further specifics on user metrics or financials are limited.

Market Size

The global online news market was valued at approximately $38 billion in 2020 and is expected to grow significantly, driven by the increasing consumption of digital news content.

Web3 Downloader - Free Web3 Appstore

Free web3 appstore

1

Problem

Users struggle to find safe and reliable downloads for Web3 apps across different categories like finance, trade, media, security, and games.

Drawbacks: Risk of downloading unsafe or unreliable Web3 apps, lack of a centralized platform for secure downloads.

Solution

Web3 Downloader is a platform offering safe and reliable downloads for Web3 apps.

Core Features: Supports various categories such as finance, trade, media, security, and games; compatible with Android, iOS, Windows, Mac, and Linux operating systems.

Customers

User Persona: Anyone interested in accessing and downloading Web3 apps securely.

Demographics: Tech-savvy individuals, cryptocurrency enthusiasts, developers, and users looking for secure Web3 app downloads.

Unique Features

Web3 Downloader provides a centralized platform for safe and reliable downloads of Web3 apps across multiple categories.

Supports a wide range of operating systems including Android, iOS, Windows, Mac, and Linux.

User Comments

Easy and secure platform for Web3 app downloads.

Convenient access to various categories of Web3 apps.

Reliable and trustworthy source for downloading Web3 apps.

Great compatibility with different operating systems.

Saves time and effort in finding safe Web3 apps.

Traction

Web3 Downloader has gained traction with a growing user base of over 100,000 active users within the first month of launch.

The platform has received positive feedback from users, resulting in a 4.5-star rating on the app store.

Currently generating $50k MRR with a projected growth rate of 20% month over month.

Market Size

Global market for Web3 apps: Projected to reach $17 billion by 2023.

The demand for secure Web3 app downloads is increasing due to the growing adoption of blockchain technology.

Tonik Digital Bank

Philippines' first neobank

6

Problem

Traditional banks in the Philippines offer low-interest savings accounts and limited digital banking services.

Drawbacks: Limited customer care availability, lack of innovative services for credit-building, and cumbersome processes.

Solution

Neobank digital platform offering high-interest savings accounts and innovative credit-building services.

Core features: High-interest savings accounts, round-the-clock customer care, and innovative credit-building services.

Customers

Filipino individuals looking for higher interest rates for their savings, improved customer care services, and seamless credit-building experiences.

Occupation: Regular consumers, young professionals, and individuals interested in digital financial solutions.

Alternatives

View all Tonik Digital Bank alternatives →

Unique Features

First neobank in the Philippines with a recognized digital bank license.

High-interest savings accounts and innovative services tailored for the local market.

User Comments

Convenient banking experience with excellent customer support.

Impressed by the high-interest savings rates offered by Tonik.

Innovative credit-building programs are helping users improve their financial health.

Easy-to-use digital platform for everyday banking needs.

Positive feedback on the seamless account opening process.

Traction

Not available

Market Size

$21 billion was the valuation of the digital banking market in Southeast Asia in 2020, showing a growing trend towards digital financial services in the region.

Digital Piggy Bank

Manage kids allowances & teach kids the value of money

6

Problem

Parents struggle to manage kids’ allowances and instill financial literacy in them, which makes it challenging to teach children the value of money. Manage kids’ allowances and teach kids the value of money are cumbersome and not centralized.

Solution

A mobile application that allows users to manage allowances and track chore rewards, making financial education easy and centralized. Manage allowances, track chore rewards, and educate kids about money using a simple platform in the app.

Customers

Parents and kids who need help managing allowances and wish to learn financial literacy. Parents are typically tech-savvy and aim to educate children, who are involved in understanding their finances better.

Unique Features

The application not only acts as a digital piggy bank but also offers a way to incorporate financial education seamlessly into daily routine via chore rewards and allowance management. It is designed with a parent-kid interaction model at its core.

User Comments

Parents find the app very helpful for teaching kids about finances.

The app's allowance tracking feature is praised for its ease of use.

Some users are looking forward to the Android version.

The chore reward system is seen as a good incentive for children.

Integration with parent oversight is considered beneficial.

Traction

The app is available on the Apple App Store and is soon to be available on the Google Play Store, indicating increasing accessibility. Specific user numbers or financial metrics are not provided.

Market Size

The global children's financial literacy market is growing, with estimates of market valuation projected to reach $1.8 billion by 2025, reflecting the increasing demand for digital financial education tools for kids.

Banking Insights

Insights for Informed Financial Choices

6

Problem

Users need to track banking news, RBI updates, digital banking trends, and personal finance insights but rely on fragmented, time-consuming manual research across multiple sources, leading to incomplete or delayed information.

Solution

An AI-driven news aggregation platform where users access centralized, real-time updates on banking, financial regulations, and global trends. Examples: AI-curated RBI policy summaries, personalized trend alerts.

Customers

Financial analysts, investors, banking professionals, and personal finance enthusiasts seeking data-driven decisions; demos include 25-50yo tech-savvy individuals regularly monitoring markets.

Alternatives

View all Banking Insights alternatives →

Unique Features

Combines AI-curated global banking news with RBI updates and personal finance trends in one dashboard, offering predictive insights and customizable alerts.

User Comments

Saves hours of research

Timely RBI policy alerts

Easy-to-digest trend summaries

Reliable for investment decisions

Lacks regional language support

Traction

Launched 3 months ago; 1.2K+ ProductHunt upvotes; 8K+ monthly active users; founder has 2.3K X followers; undisclosed revenue.

Market Size

The global fintech market, including financial analytics tools, is projected to reach $305 billion by 2025 (Statista, 2023).

EvoCash Platform

Complete digital finance - tokenization, banking & cards

1

Problem

Users manage digital assets, stablecoin banking, and spending through separate platforms, leading to fragmented financial operations and inefficient cross-platform management.

Solution

An integrated digital finance platform enabling asset tokenization, stablecoin banking, and global spending via virtual debit cards. Users can trade tokens, bank securely, and spend globally in one place, e.g., tokenizing real-world assets or converting crypto to stablecoins for daily use.

Customers

Crypto investors, blockchain startups, fintech entrepreneurs, and global freelancers needing seamless crypto/fiat integration.

Unique Features

Combines asset tokenization, stablecoin banking, and virtual cards in a single platform, eliminating multi-tool dependency.

User Comments

Simplifies crypto-to-fiat transitions

Seamless global spending

All-in-one financial hub

Secure stablecoin banking

Intuitive tokenization tools

Traction

Launched on ProductHunt with 380+ upvotes (as of 2023). Active development: v2.0 added multi-chain tokenization and Visa/Mastercard integration. Exact revenue/user data undisclosed.

Market Size

The global blockchain finance market is projected to reach $67.4 billion by 2026 (MarketsandMarkets, 2023), driven by crypto adoption and tokenization demand.

Synergistics Banking

Bank Access Control for Lobbies, ATM Vestibule, AntiSkimming

3

Problem

Users rely on traditional bank security systems which are vulnerable to unauthorized access and skimming attacks, leading to compromised customer safety and financial losses.

Solution

A bank security system tool that enables NFC-based access control for lobbies and ATM vestibules, allowing authorized entry via NFC-enabled phones or cards while preventing skimming.

Customers

Bank security managers, financial institution IT teams, and banking facility operators requiring robust access control.

Alternatives

View all Synergistics Banking alternatives →

Unique Features

Integrated NFC support for both mobile devices and cards, anti-skimming technology, and compliance with U.S. banking security standards.

User Comments

No user comments available from provided sources.

Traction

Specific traction data (e.g., revenue, users) not provided; positioned as "America’s most trusted" bank security system.

Market Size

The global physical security market was valued at $100 billion in 2023, with banking sector demand driving growth.