Huglo Comparison App

Alternatives

124,848 PH launches analyzed!

Huglo Comparison App

Compare electricity plans and save money by switching

10

Problem

Users need to compare electricity plans to save money and often struggle to navigate through multiple providers and pricing tiers.

Solution

An electricity plan comparison app that helps users save money by switching plans. Users can easily compare different electricity providers and pricing tiers, empowering them to make informed decisions and save hundreds of dollars a year.

Customers

Individuals and households in Australia looking to reduce their electricity costs and save money on their energy bills.

Unique Features

Empowers users to make informed decisions by comparing electricity plans easily.

Regularly reminds users to check for better plans, ensuring ongoing savings.

Designed to save users significant money without complex processes.

User Comments

Easy to use and helped me find a cheaper plan quickly.

Love the reminders to check for better deals regularly.

Saved me a good amount of money on my electricity bills.

Highly recommended for anyone looking to save on electricity costs.

Simple interface and effective in finding cost-saving plans.

Traction

The app has gained over 10,000 downloads since its launch.

Users have reported saving an average of $200-$500 annually using the app.

Positive reviews and ratings on app stores, with a growing user base.

Market Size

The Australian energy comparison market is valued at approximately $2.5 billion, with an increasing number of consumers actively seeking ways to save on electricity costs.

Save Money

Goal tracker - achieve your financial dreams

7

Problem

Users struggle to track savings and achieve financial goals manually or with generic budgeting tools, leading to poor financial discipline and delayed milestones.

Solution

A mobile app that allows users to set, track, and manage financial goals, providing budget tips and progress visualization. Example: set a vacation fund goal with monthly savings targets.

Customers

Young professionals, freelancers, and financially conscious individuals seeking structured financial planning and debt reduction.

Alternatives

View all Save Money alternatives →

Unique Features

Combines goal-based savings tracking with personalized budget recommendations and progress analytics in one interface.

User Comments

Simplifies goal setting

Motivates consistent saving

User-friendly interface

Lacks investment integration

Needs multi-currency support

Traction

Launched in 2022, 50k+ downloads on Google Play Store, featured on ProductHunt with 1.2k+ upvotes, founder has 2.5k followers on LinkedIn.

Market Size

The global personal finance software market is projected to reach $1.5 billion by 2026 (Statista, 2023).

Trove - Wishlist + Compare

Save,compare, then follow up automatically reminder emails.

1

Problem

Users manually track products they wish to purchase across multiple sites, which is time-consuming and disorganized. No automated way to monitor price changes or discounts, leading to missed deals and fragmented customer insights.

Solution

A browser extension and web tool that lets users save, compare, and receive automated discount alerts for products. Example: One-click wishlisting, centralized comparison dashboard, and AI-driven reminder emails.

Customers

Frequent online shoppers (ages 18–45), deal hunters, and e-commerce managers seeking streamlined product tracking and customer engagement.

Unique Features

Centralized view of saved/compared items, automated discount emails triggered by user behavior, and cross-website compatibility.

User Comments

Simplifies price tracking; saves time on deal hunting; useful for follow-ups; seamless integration; lacks mobile app.

Traction

Launched 3 months ago; 2,500+ users; $12k MRR; featured on ProductHunt with 1.2k upvotes; founder has 2.3k followers on X.

Market Size

Global e-commerce tools market is projected to reach $1.2 trillion by 2027 (Statista, 2023). Price-tracking niche accounts for ~$8.4 billion annually.

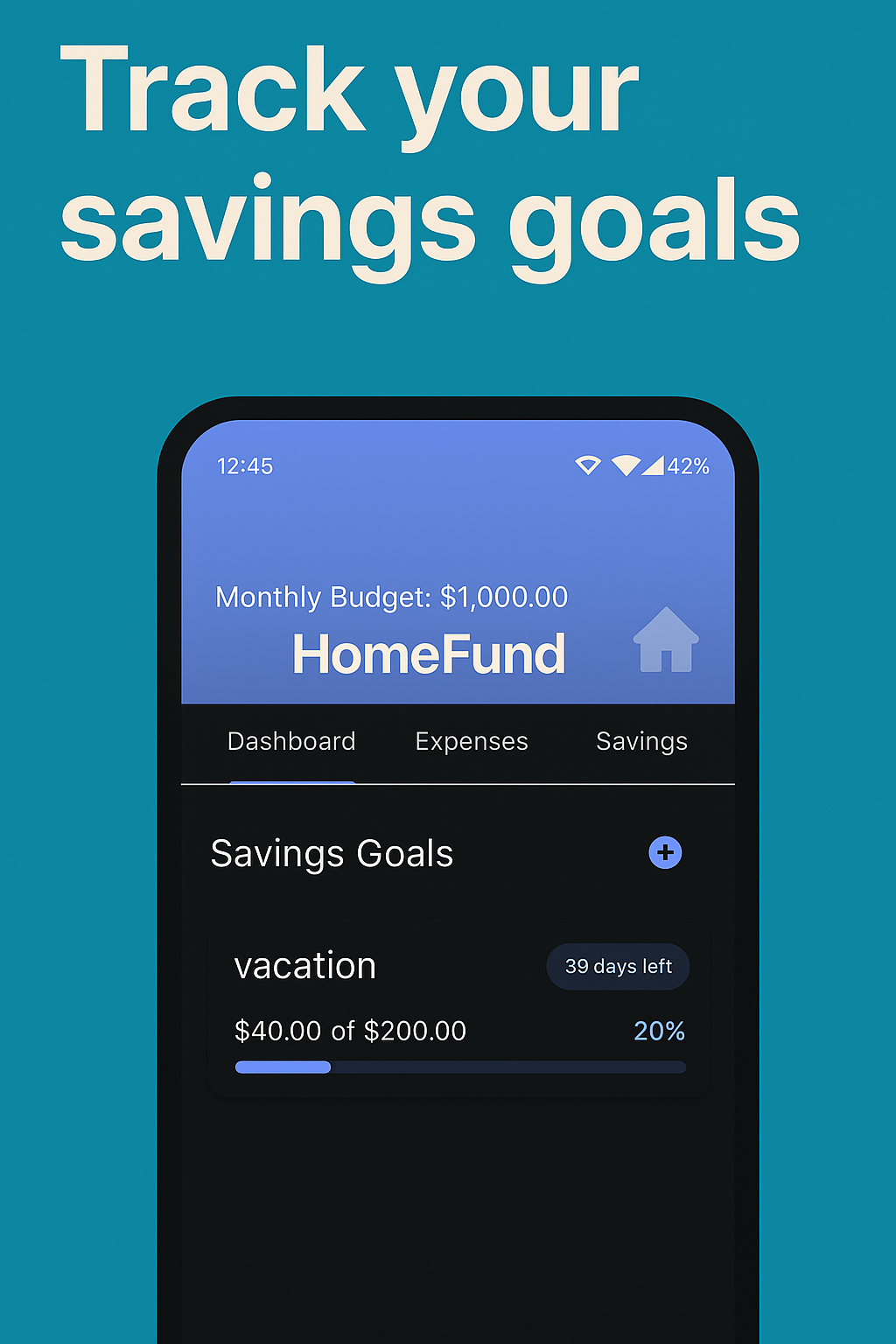

Home Fund – Simple savings goal tracker

Track your money goals and save up visually, with no clutter

3

Health Plan Simulator

Compare health insurance out-of-pocket costs

6

Problem

Users manually compare health insurance plans (PPO, HMO, HDHP) using spreadsheets/advisor consultations, facing time-consuming processes and error-prone tax/annual cost calculations

Solution

A free online calculator tool that enables users to simulate out-of-pocket costs across plans with scenarios like doctor visits/prescriptions and calculate tax savings via HSA/FSA integration

Customers

Self-employed individuals, families, HR professionals, and small business owners seeking cost-effective health plans

Alternatives

View all Health Plan Simulator alternatives →

Unique Features

Scenario-based simulations (e.g. emergency vs routine care), side-by-side plan comparisons with HSA tax advantages, and customizable family health event inputs

User Comments

Simplifies insurance comparisons instantly

Saves hours of spreadsheet work

Clear visualization of long-term costs

Reveals hidden tax savings opportunities

Critical for open enrollment decisions

Traction

Featured on ProductHunt (2023 launch), 15k+ monthly users, integrated with IRS HSA/FSA guidelines

Market Size

US private health insurance market reached $1.4 trillion in 2023 with 177M+ covered individuals (CDC/NCHS data)

Bloomeo - Save & Retire Early

Budget smarter, save more, and plan for early retirement

4

Problem

Users currently manage their finances with traditional budgeting tools or spreadsheets, which lack long-term financial projections and integrated retirement planning, leading to difficulties in achieving early retirement goals.

Solution

A personal finance app that allows users to track income, expenses, net worth, create savings accounts, and visualize financial future projections. Example: Users set savings goals and see retirement timelines.

Customers

Young professionals, freelancers, and FIRE (Financial Independence, Retire Early) enthusiasts aged 25-45, tech-savvy individuals prioritizing financial discipline and long-term wealth management.

Unique Features

Combines real-time budgeting with retirement planning via dynamic projections, enabling users to simulate savings scenarios and adjust goals for early financial independence.

User Comments

Simplifies retirement planning

Visual projections motivate saving

Intuitive net worth tracking

Lacks investment integration

Mobile-first design praised

Traction

Launched on ProductHunt in 2024, details unlisted. Founder’s LinkedIn shows 500+ followers; comparable apps like YNAB report $100M+ annual revenue.

Market Size

The global personal finance software market is projected to reach $1.7 billion by 2027 (CAGR 5.7%), driven by demand for retirement planning tools.

Saving Diary

Your personal saving diary for smarter money habits

8

Problem

Users often lack a structured way to manage and track personal finances, leading to difficulties in maintaining control over individual savings and expenditures.

track expenses

set savings goals

Solution

An intuitive app that serves as a personal saving diary.

Users can track expenses and set savings goals, gaining personalized insights to manage their finances effectively.

Examples include tracking daily expenses for budgeting or setting and tracking progress towards a future goal like buying a car or a vacation.

Customers

Young professionals and millennials who are tech-savvy and interested in personal finance management.

Demographics could range from college students to working professionals in their late 20s and 30s.

These users typically aim to improve financial health and savings through accessible and easy-to-use digital tools.

Alternatives

View all Saving Diary alternatives →

Unique Features

User-friendly interface focused on simplicity.

Personalized financial insights and reports.

Capability to set custom savings goals directly within the app.

User Comments

Users appreciate the simplicity and ease of use.

Many find the personalized insights very helpful in tracking finances.

The feature to set and follow savings goals is popular.

Users noted that the app helps in reducing unnecessary expenses.

Feedback has been generally positive about the intuitive design.

Traction

Early-stage product listed on ProductHunt.

Product known for its simplification of financial tracking.

Growing interest among users looking for personal finance solutions.

Market Size

The personal finance software market was valued at $1.1 billion in 2020 and is expected to grow significantly, driven by increased demand for digital financial solutions.

More to Money

Build a Budget. Track Your Spending. Plan Ahead.

3

Problem

Users struggle to manage personal finances effectively using traditional budgeting apps or spreadsheets, which lack personalized insights, investment tracking integration, and peer comparison features.

Solution

A personal finance app where users can build smart budgets, track spending, monitor investments, and compare their financial health with peers, supported by AI-driven insights and goal-planning tools.

Customers

Millennials and young professionals seeking automated budgeting, investment tracking, and data-driven financial benchmarking.

Unique Features

Combines budgeting tools with investment tracking and peer-based financial health comparisons, offering actionable insights via AI.

User Comments

Simplifies budget creation

Useful investment tracking

Motivates via peer comparison

Intuitive goal-setting

Clear financial overview

Traction

Newly launched (April 2024), 1k+ registered users, 100+ Product Hunt upvotes within 48 hours, founder has 2k+ LinkedIn followers.

Market Size

The global personal finance software market is projected to reach $1.8 billion by 2027 (Statista, 2023).

Problem

Users struggle with manual or fragmented methods to track income, expenses, and budgets, leading to inefficient financial control and lack of centralized oversight.

Solution

A mobile app that tracks income, controls spending, and plans budgets through features like expense categorization, real-time updates, and financial goal setting (e.g., monthly budget alerts, transaction logging).

Customers

Young professionals, freelancers, and salaried individuals seeking to manage personal finances, monitor spending habits, and automate budgeting.

Alternatives

View all PSI Money alternatives →

Unique Features

Integrated income-expense tracking, automatic categorization, real-time budget alerts, and goal-based financial planning in a single interface.

User Comments

Simplifies expense tracking

Helps stick to budgets

Intuitive design

Centralizes financial data

Reduces manual work

Traction

Newly launched on Product Hunt; traction metrics (e.g., revenue, users) unspecified in provided data.

Market Size

The global personal finance software market was valued at $1.2 billion in 2022, projected to reach $2.5 billion by 2030 (CAGR 9.5%).

Problem

Users struggle to track and manage their finances, expenses, goals, and debts efficiently, especially when they have holdings in different banks. The lack of progress tracking and a unified view of financial status are significant drawbacks.

Solution

Plan is a financial tracker app that simplifies money-saving or budget planning. Users can track progress with Plan! Statistics, secure access with a PIN code, ensure privacy, and synchronize data across all Apple devices.

Customers

Individuals looking for a straightforward way to manage their finances, with a focus on those who have multiple bank accounts or financial holdings. Personal finance enthusiasts and budget-conscious individuals are the primary user personas.

Alternatives

View all Plan alternatives →

Unique Features

Unified tracking for different bank holdings, Plan! Statistics for progress tracking, secure PIN code access, privacy assurance, and data synchronization across Apple devices.

User Comments

Simplifies financial management

Helpful for tracking expenses and savings

Secure and private

Easy synchronization across devices

Useful for individuals with multiple bank accounts

Traction

Launched on Product Hunt with positive feedback

Specific traction metrics (number of users, revenue, etc.) are not available

Market Size

The global personal finance software market size was valued at $1.02 billion in 2021, expected to grow at a CAGR of 5.7% from 2022 to 2030.